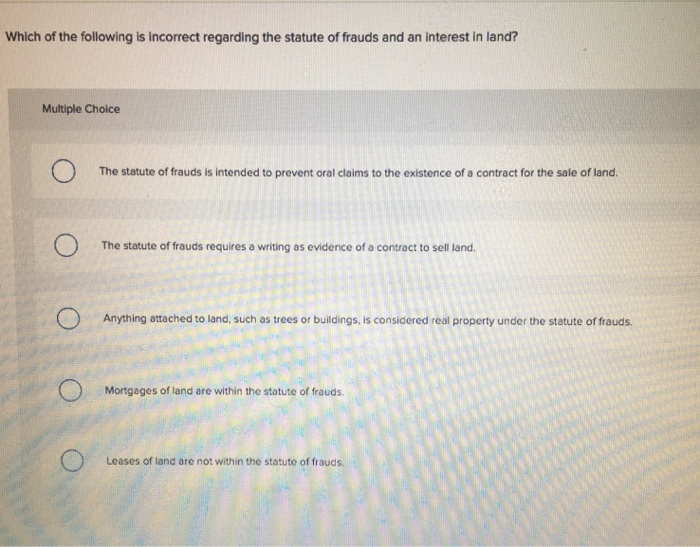

Which Of The Following Would Not Constitute A Policy Replacement

The insurance industry, a cornerstone of financial security, operates on a foundation of meticulously defined policies. Understanding the nuances of policy replacements is crucial for both consumers and professionals, as misinterpretations can lead to unintended coverage gaps and financial repercussions. But discerning what *doesn't* constitute a policy replacement can be just as critical, protecting consumers from unnecessary churn and maintaining the integrity of their existing coverage.

This article delves into the specifics of policy replacements, focusing on scenarios that, while seemingly similar, fall short of meeting the established criteria. By examining these distinctions, we aim to clarify the boundaries of policy replacements, empowering readers to make informed decisions regarding their insurance coverage and avoid potential pitfalls.

Defining Policy Replacement: The Core Principles

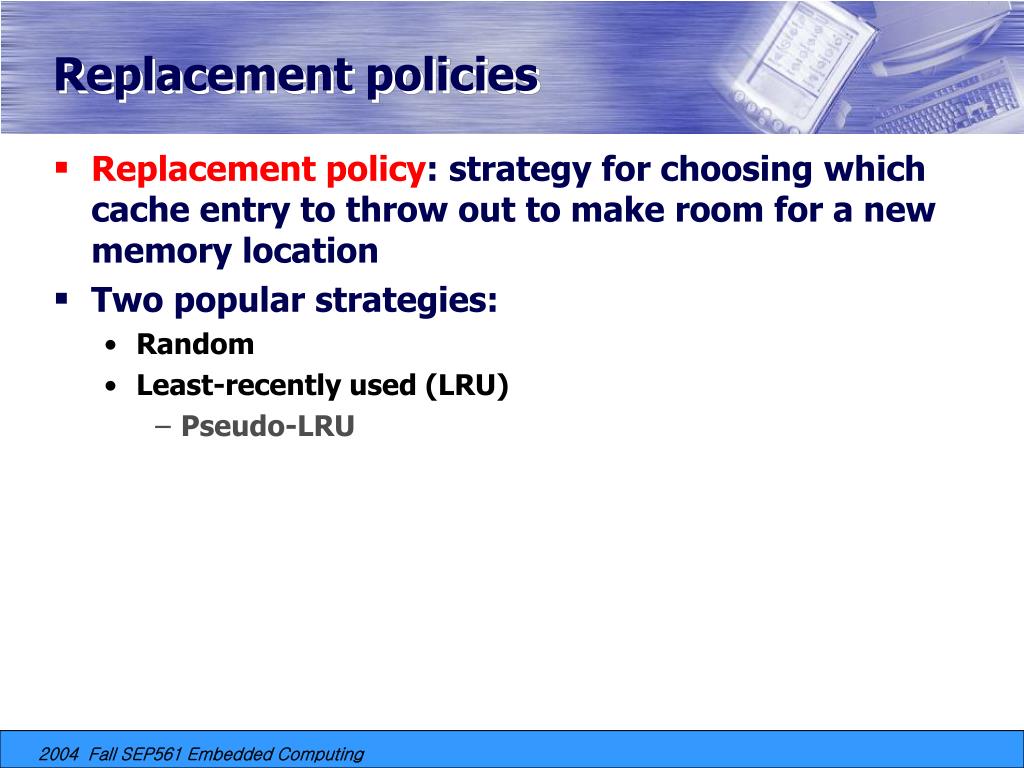

A policy replacement typically involves terminating an existing insurance policy and purchasing a new one, often with similar coverage. This decision should be made with careful consideration of factors such as premiums, coverage limits, and policy terms.

Regulatory bodies, like state insurance departments, often have specific rules surrounding policy replacements to protect consumers from deceptive practices.

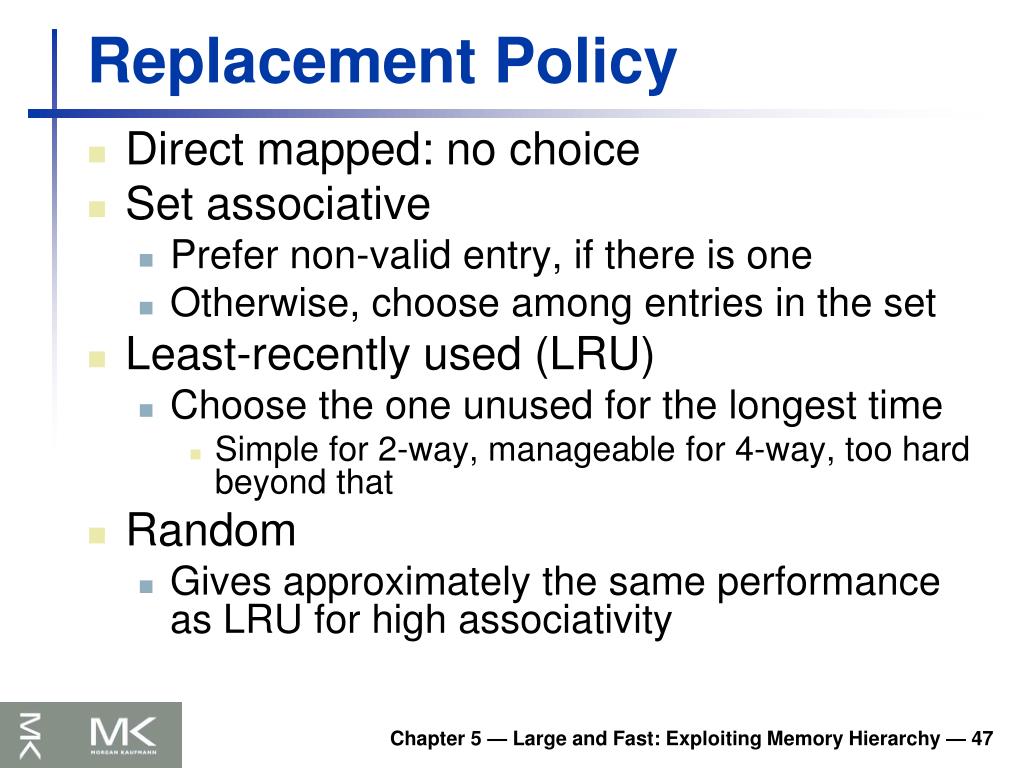

What Qualifies as a Policy Replacement?

Generally, a policy replacement occurs when a new policy is purchased with the intent to supersede or take the place of an existing one. This often involves discontinuing the original policy, either through cancellation or non-renewal.

Soliciting to purchase a new policy where the agent knows or should know an existing policy will be lapsed, forfeited, surrendered, or otherwise terminated, is considered replacement activity.

Scenarios That Don't Constitute a Replacement

Several actions involving insurance policies might appear similar to replacements, but lack the crucial elements that define them. Understanding these differences is essential for accurate assessment and decision-making.

Renewal of an Existing Policy

Simply renewing a policy with the same insurer, even with adjusted premiums or minor coverage modifications, is *not* a replacement. Renewal maintains the continuity of coverage under the original contract.

The policy number remains the same, and the insurer-insured relationship persists uninterrupted.

Portability of Group Insurance

When an individual leaves a group insurance plan (e.g., through employment termination) and converts their coverage to an individual policy with the same insurer, this is often considered portability, not a replacement. The policy continues from the group policy to the individual policy.

Portability is a right granted to many employees and aims to maintain health insurance coverage during transitions.

Internal Policy Conversions

An internal policy conversion involves changing the features or structure of an existing policy within the same insurance company. For instance, converting a term life insurance policy to a whole life policy with the same insurer doesn't constitute a replacement, as the original policy isn't being terminated and superseded by a policy from a different company.

These conversions are often offered as options within the existing policy's terms.

Adding Riders or Endorsements

Adding riders or endorsements to an existing policy, which modify coverage or add specific benefits, is *not* a policy replacement. Riders and endorsements enhance the original policy, but do not replace it.

They are supplemental and become an integrated part of the primary policy.

Policy Assignment

Policy assignment, where ownership of a policy is transferred to another party, is also not a policy replacement. The underlying policy remains in force, only the owner changes.

This is common in situations like divorce settlements or business transfers.

Duplication of Coverage

Purchasing a second policy that provides similar coverage to an existing one, while perhaps unnecessary or inadvisable, does not automatically constitute a replacement. Both policies remain active unless one is intentionally terminated.

There are very few circumstances where one insurance policy can replace another insurance policy in the realm of Property & Casualty lines.

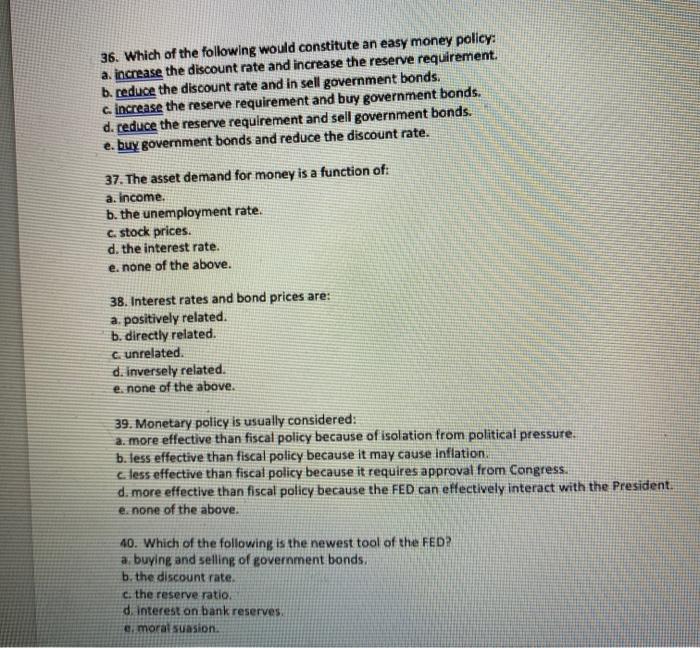

Why the Distinction Matters

Understanding the difference between a true policy replacement and these other scenarios is crucial for several reasons. First, it helps consumers avoid unnecessary churn, which can result in losing accumulated benefits or facing new waiting periods.

Second, it helps ensure regulatory compliance by accurately identifying instances where replacement rules apply. Finally, it empowers individuals to make informed decisions about their insurance coverage, aligning it with their evolving needs without unnecessary disruption.

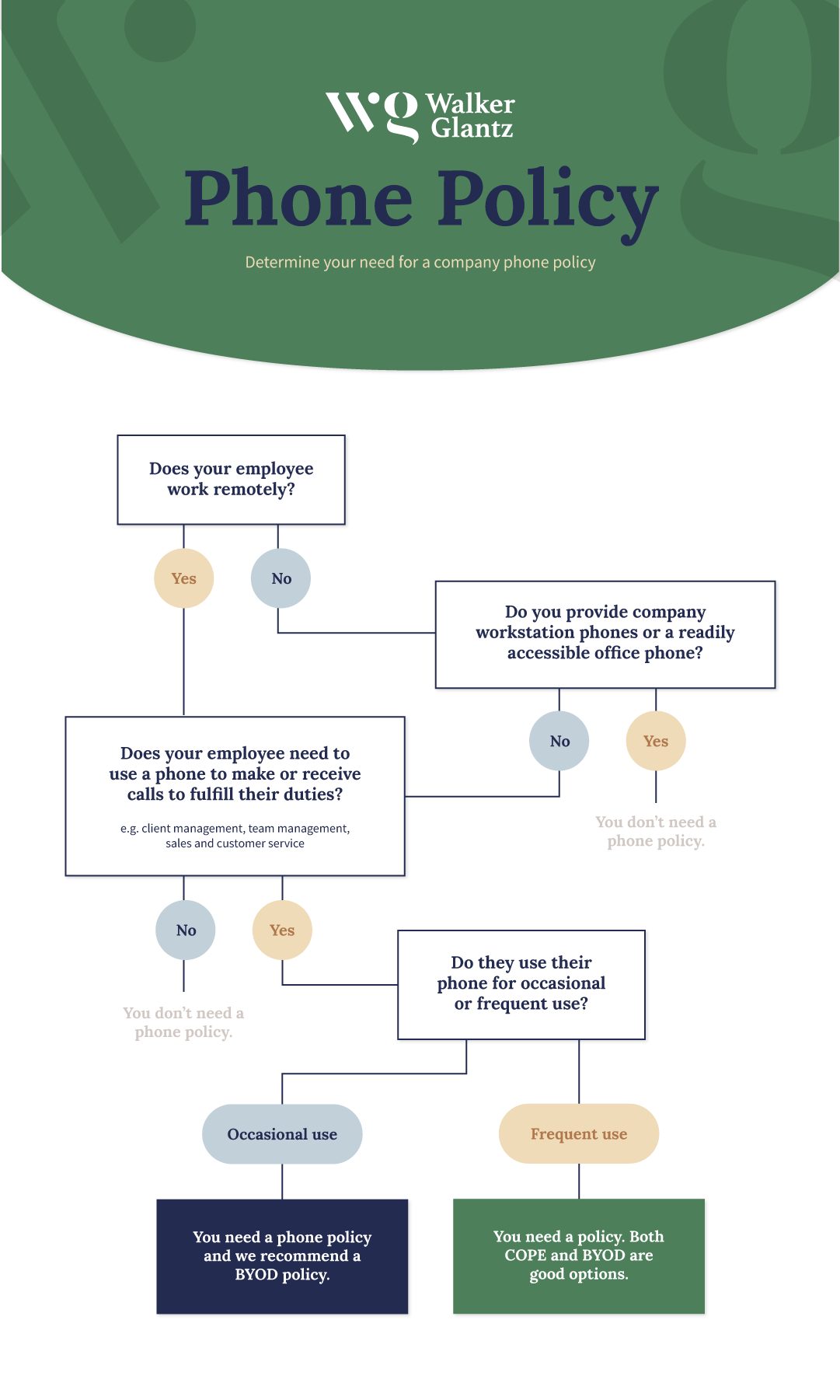

The Role of Full Disclosure

Even when a transaction doesn't qualify as a formal replacement, full disclosure to the insured is paramount. Agents have an ethical and legal obligation to explain the pros and cons of any change to their coverage.

Transparency ensures the client understands the implications of their decisions.

"Consumers should always seek clarification from their insurance provider or a trusted advisor if they are unsure about the implications of any changes to their insurance coverage," emphasizes John Smith, a consumer advocate at the National Insurance Consumer Organization.

This includes clearly explaining the impact of adding riders, converting policies, or even simply renewing their coverage with adjusted terms.

Looking Ahead: The Future of Insurance Policy Management

The insurance landscape is constantly evolving, with new products and technologies emerging regularly. As such, ongoing education and vigilance are critical for both consumers and industry professionals.

The rise of digital insurance platforms and automated advice tools further underscores the importance of understanding policy replacements, and what *doesn't* constitute them. Consumers need to be able to critically evaluate the recommendations made by these systems and ensure they align with their individual needs and circumstances.

By promoting clarity and transparency, the insurance industry can foster greater trust and empower individuals to make informed decisions about their financial security.

![Which Of The Following Would Not Constitute A Policy Replacement [FREE] Which of the following best completes this graphic organizer to](https://media.brainly.com/image/rs:fill/w:1080/q:75/plain/https://us-static.z-dn.net/files/d27/ad921a1606f1e7b599b260d4a94848cb.png)

.jpg)