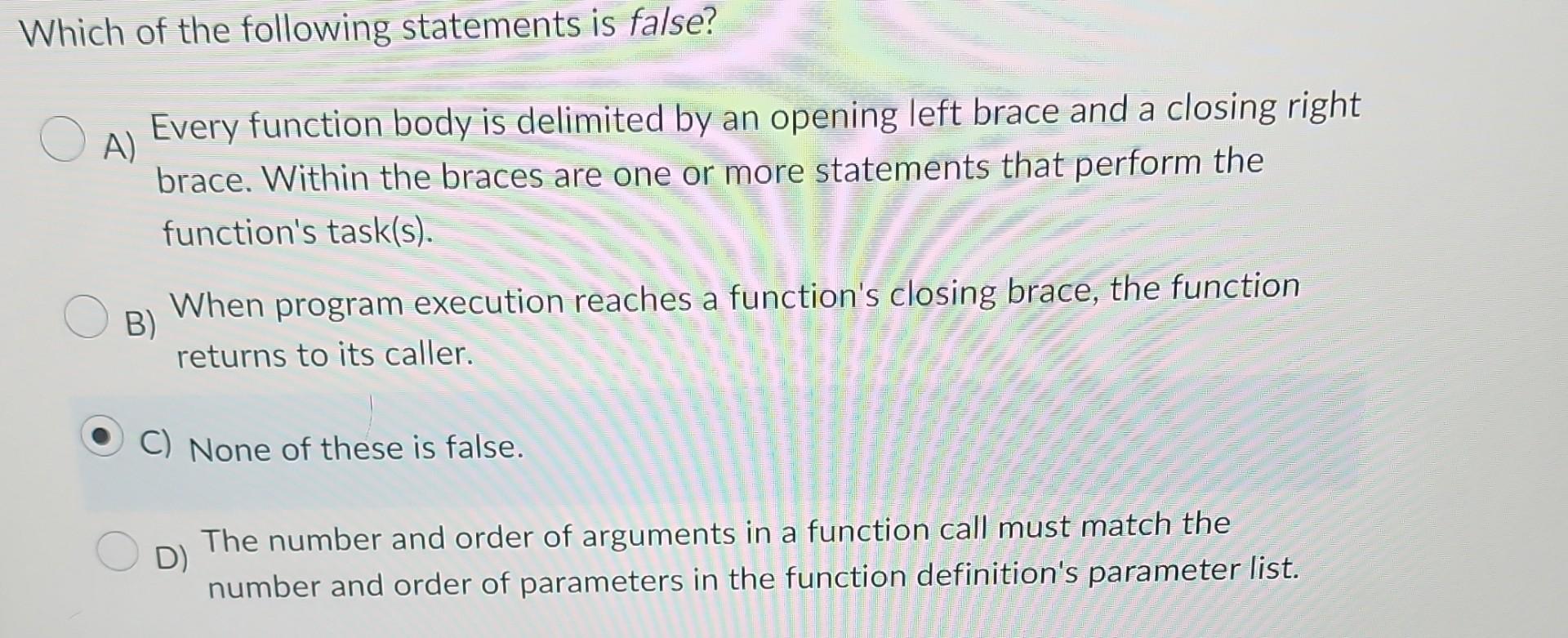

Which Of These Statements Regarding Insurance Is False

Imagine Sarah, a bright-eyed recent graduate, staring at a stack of insurance brochures. Health, auto, renters – the jargon swam before her eyes, each promise and caveat a potential pitfall. She wasn't alone; millions grapple with similar confusion, unsure which claims about insurance are true and which are cleverly disguised myths.

Navigating the world of insurance can feel like traversing a minefield of misinformation. This article aims to debunk common misconceptions about insurance, clarifying the truth behind frequently encountered statements. We’ll explore the nuances of various insurance types, helping you become a more informed and confident consumer.

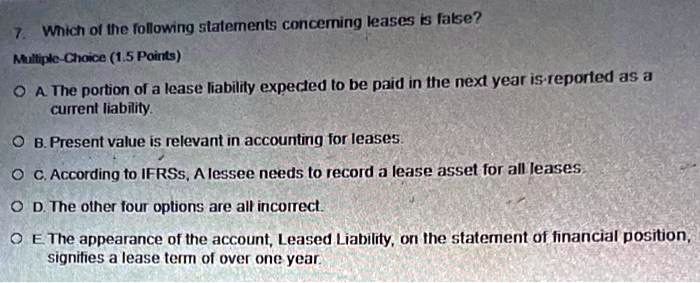

The Labyrinth of Insurance: Separating Fact from Fiction

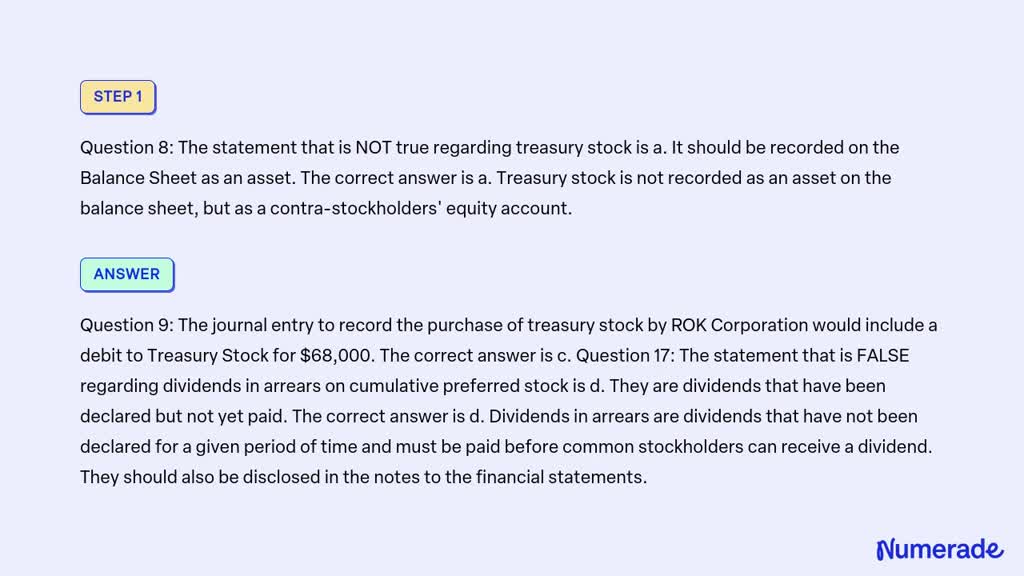

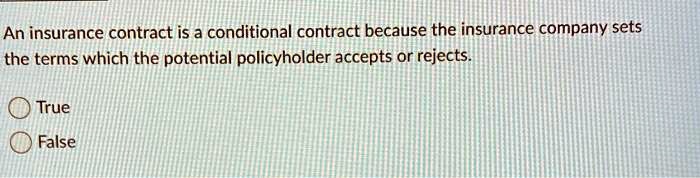

Insurance, at its core, is a contract. It protects you from financial losses due to unforeseen events. Understanding the basics is crucial to making informed decisions and avoiding costly mistakes.

Myth 1: "My Credit Score Doesn't Affect My Insurance Rates"

This is often false, especially for auto and homeowners insurance. In many states, insurance companies use credit-based insurance scores to assess risk. A lower credit score can translate to higher premiums.

Data from organizations like the Consumer Federation of America has consistently shown a correlation between credit scores and insurance rates. The higher the credit score the lower the insurance rates.

"Credit scoring is used to predict how likely someone is to file a claim," explains James Jones, a senior analyst at a leading insurance research firm. "Statistically, people with lower credit scores tend to file more claims."

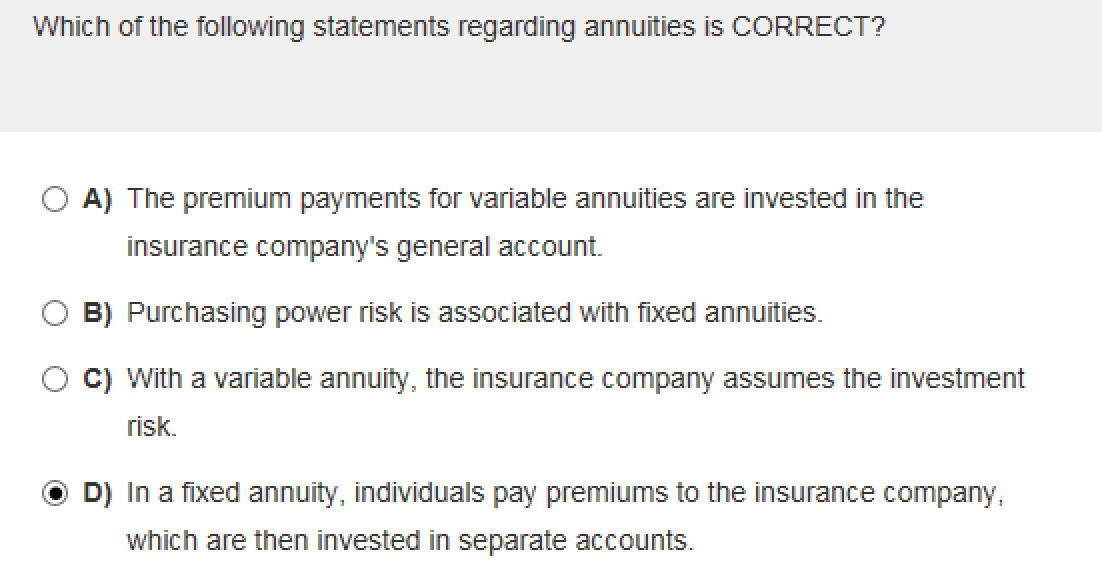

Myth 2: "All Insurance Policies Are the Same"

Absolutely not! Policy details vary widely between insurance providers. Even seemingly identical policies can have crucial differences in coverage limits, deductibles, and exclusions.

Take homeowners insurance, for example. One policy might cover water damage from burst pipes, while another may exclude it or have specific limitations. Reading the fine print is essential.

Myth 3: "Once I Have Insurance, I Don't Need to Review It"

Life changes, and your insurance needs should too. Major life events like marriage, a new home, or the birth of a child all warrant a review of your policies.

For example, adding a teenager to your auto insurance policy will significantly increase your premiums. Similarly, remodeling your home increases its value, requiring adjustments to your homeowner's coverage.

Myth 4: "Renters Don't Need Insurance"

This is a dangerous misconception. Landlord's insurance covers the building itself, but not your personal belongings.

Renters insurance protects your possessions from theft, fire, and other covered perils. It also provides liability coverage if someone is injured in your apartment.

Myth 5: "Filing a Claim Will Always Increase My Premiums"

While this is often true, it's not always the case. Small claims might not impact your rates, especially if you have a good driving record or claim-free history.

However, repeated claims or claims for significant amounts are likely to lead to higher premiums. It's a balancing act between using your insurance and maintaining a good risk profile.

Myth 6: "Pre-existing Conditions Aren't Covered by Health Insurance"

Thanks to the Affordable Care Act (ACA), this is generally false for most health insurance plans. The ACA prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions.

However, some grandfathered plans (those that existed before the ACA) might still have restrictions. Understanding your specific plan's details is vital.

Myth 7: "My Car Insurance Covers Me No Matter Who is Driving"

While your policy typically covers permissive drivers (those you give permission to drive your car), it may not cover everyone. Certain exclusions might apply, such as drivers specifically excluded from the policy or those driving without a valid license.

It's important to know who is covered under your policy and the potential consequences of allowing an uninsured or excluded driver to operate your vehicle. If someone isn't on your policy and gets into an accident, it can get very messy very quickly!

Myth 8: "The Cheaper the Insurance Policy, the Better"

Price is important, but it shouldn't be the sole deciding factor. A cheap policy might have inadequate coverage or high deductibles, leaving you vulnerable in the event of a claim.

Focus on finding a balance between affordability and adequate protection. Comparing quotes from multiple insurers and carefully reviewing the policy details is crucial.

Becoming an Informed Insurance Consumer

Understanding insurance requires proactive research and critical thinking. Don't rely solely on advertisements or anecdotal evidence. Consult reliable sources, compare policies, and ask questions.

The National Association of Insurance Commissioners (NAIC) offers a wealth of information and resources for consumers. State insurance departments can also provide assistance and resolve disputes.

Speaking with an independent insurance agent can be beneficial. They can assess your individual needs and recommend policies that fit your specific circumstances.

Conclusion: Empowered by Knowledge

The world of insurance can seem daunting, but with knowledge comes empowerment. By debunking these common myths, you can approach insurance decisions with confidence and clarity.

Remember Sarah, overwhelmed by those brochures? Now, armed with facts, she can navigate the insurance landscape with greater assurance, securing the protection she needs and deserves.

Ultimately, insurance is about peace of mind. Taking the time to understand your options and choose the right coverage can protect you from financial hardship and allow you to face the future with greater security. Don’t be afraid to ask questions and do your research, the peace of mind is worth it.

![Which Of These Statements Regarding Insurance Is False [ANSWERED] Which of the following statements is false regarding - Kunduz](https://media.kunduz.com/media/sug-question/raw/42569999-1658236051.1177423.jpeg?h=512)

+Which+of+the+following+statements+regarding+medications+is+FALSE.jpg)