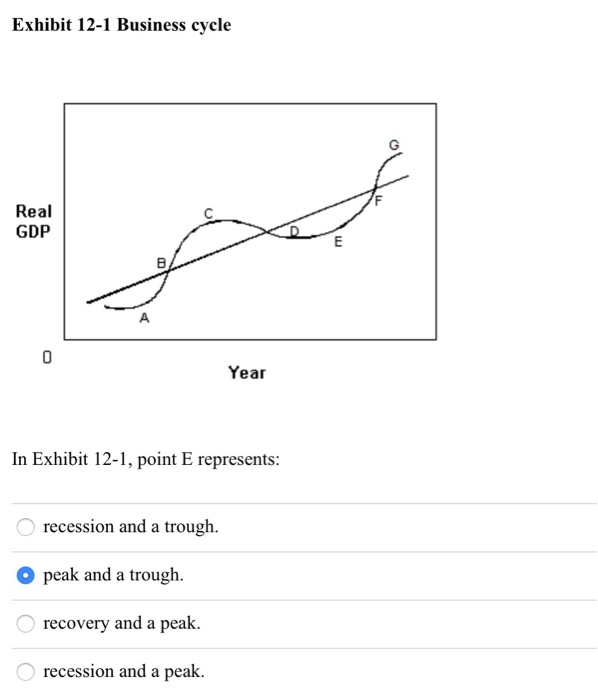

Which Point Of The Business Cycle Represents A Peak

Breaking News: Economic indicators suggest a potential peak in the current business cycle, demanding immediate assessment.

Experts are closely watching leading economic indicators for confirmation. This situation necessitates vigilance from investors and policymakers alike.

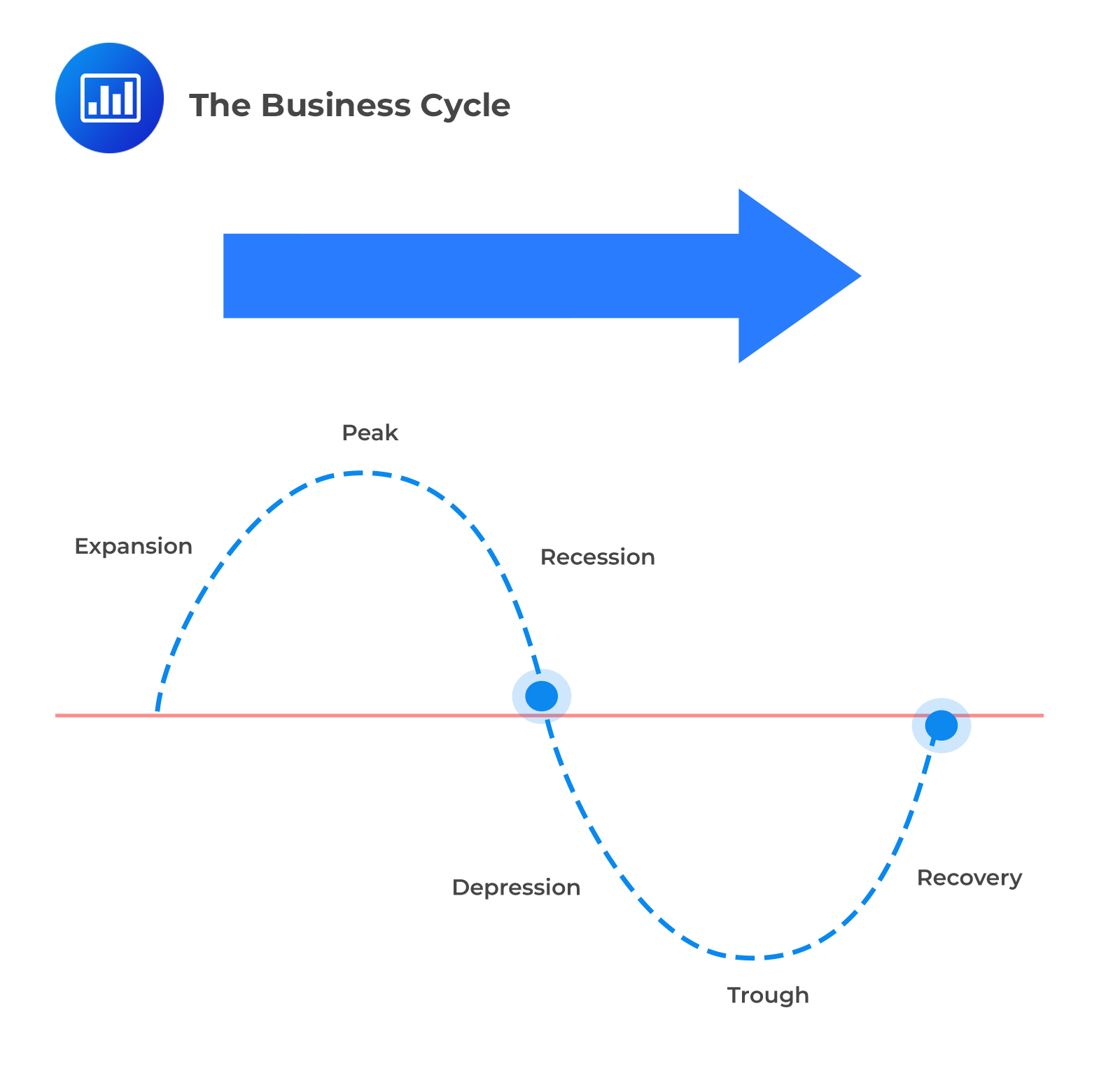

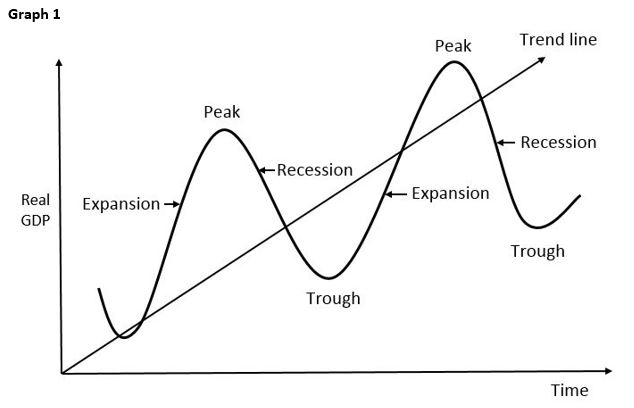

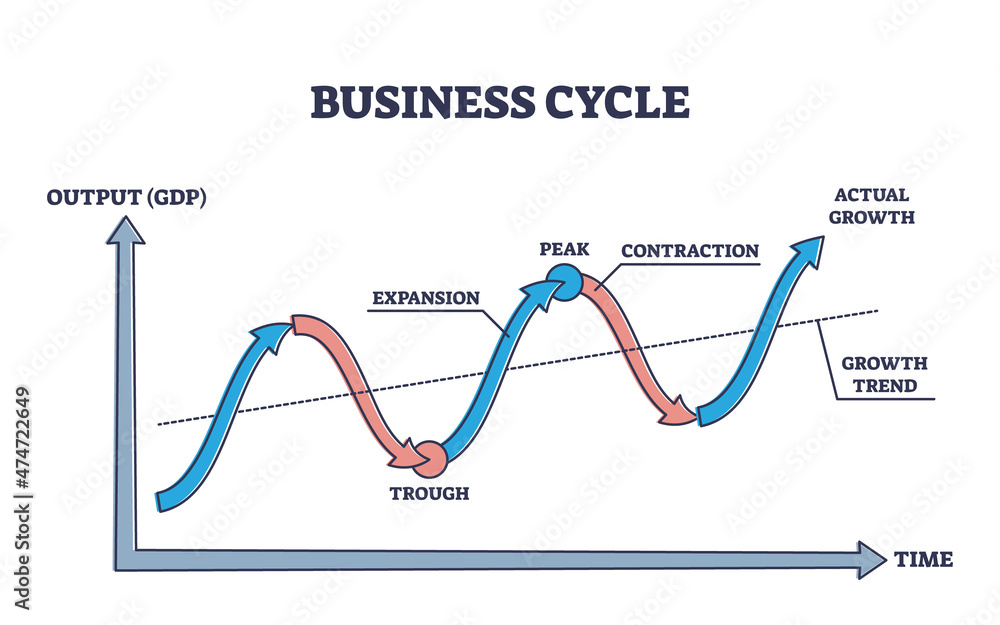

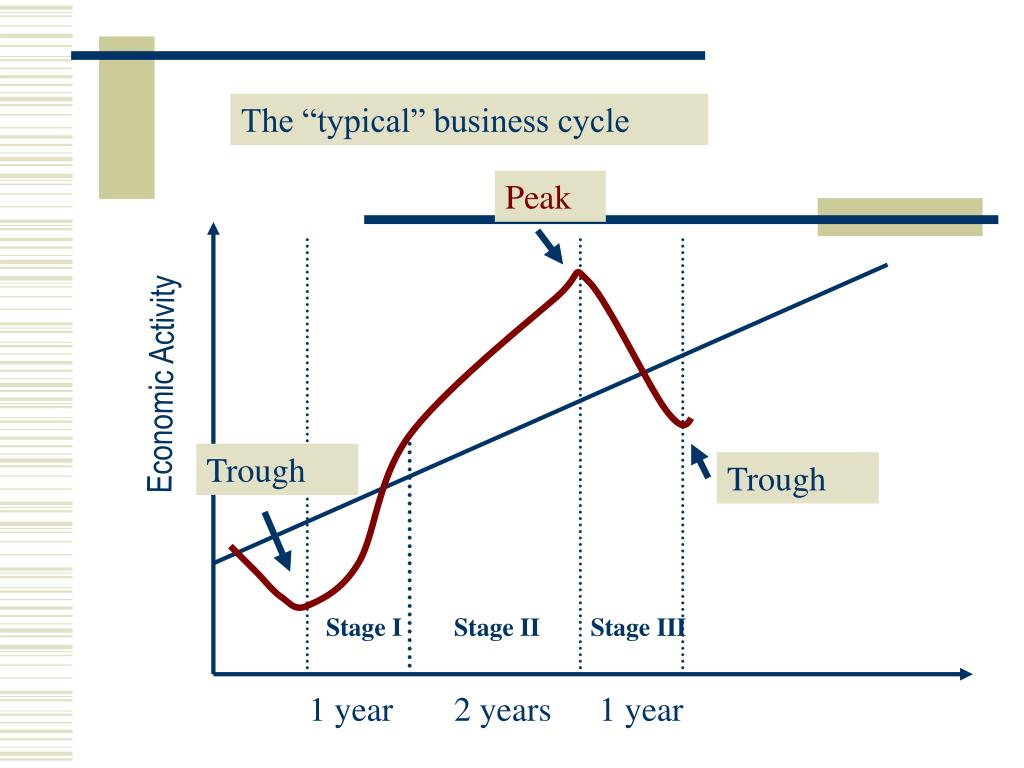

Defining the Peak

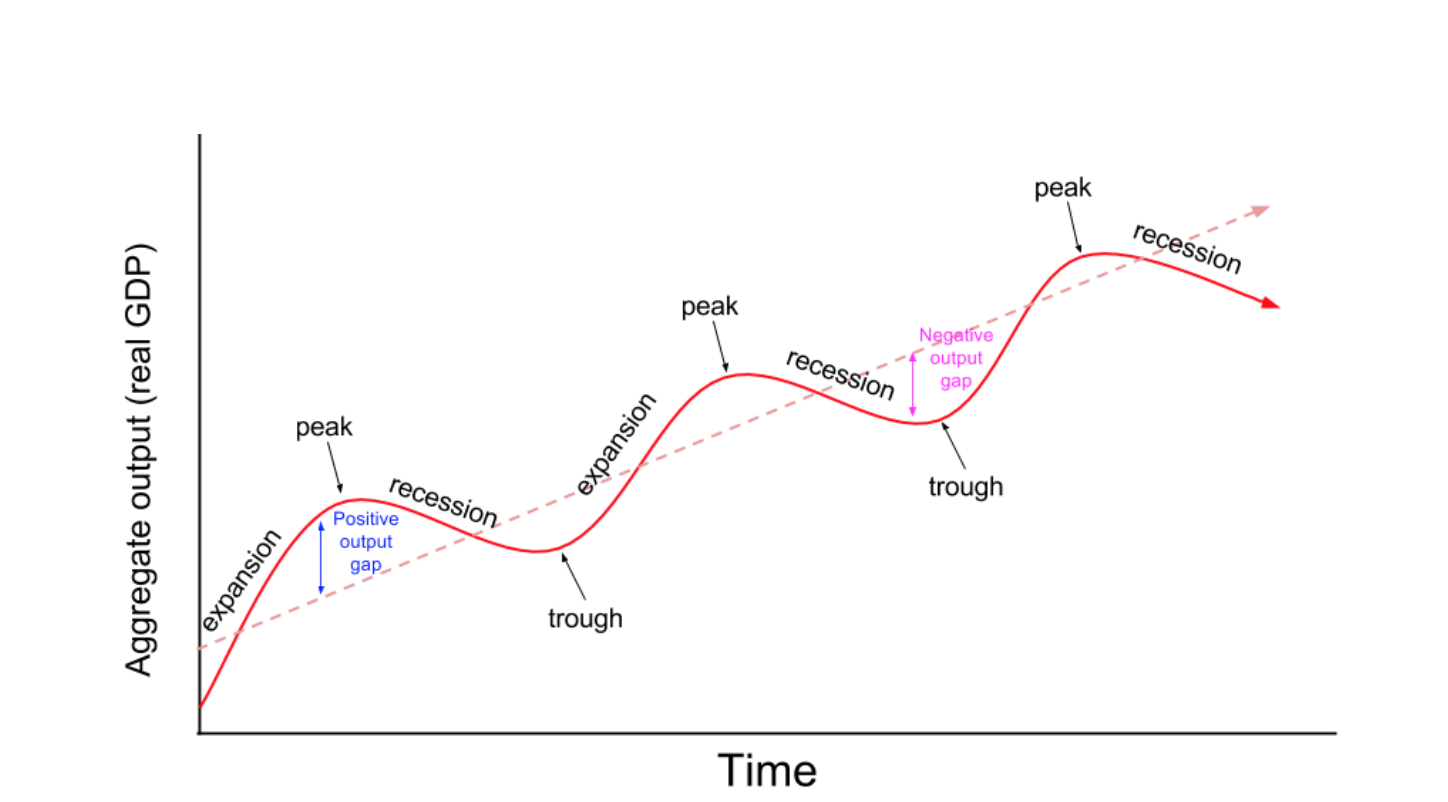

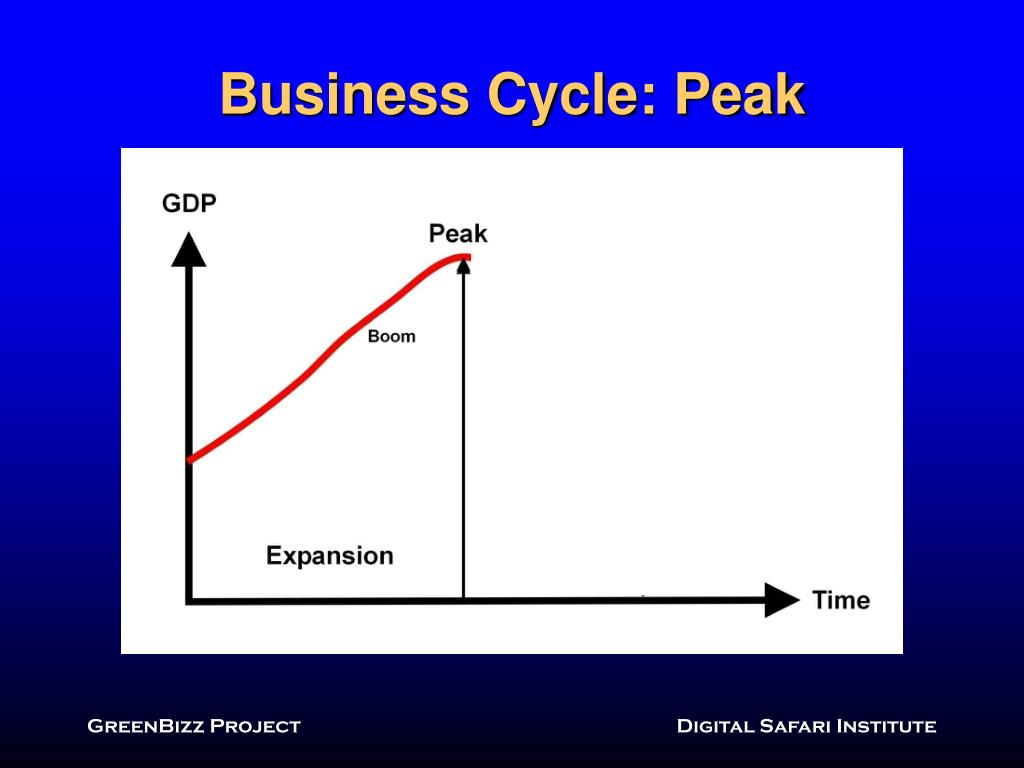

The peak of a business cycle represents the highest point of economic expansion before a contraction begins.

It is characterized by maximum output, employment, and often, inflationary pressures.

Identifying a peak accurately is crucial for anticipating economic downturns and adjusting fiscal strategies.

Key Indicators Under Scrutiny

Several indicators are signaling a possible peak, including slowing GDP growth.

Inflation remains stubbornly high, despite efforts to curb it through interest rate hikes.

Consumer spending, a major driver of economic activity, shows signs of weakening.

GDP Growth

Recent GDP reports reveal a slowing pace of expansion compared to the previous year.

Data from the Bureau of Economic Analysis (BEA) shows a quarterly growth rate that has declined in the last two quarters.

A sustained period of slow or negative growth is a hallmark of an approaching economic peak.

Inflation Trends

Inflation, as measured by the Consumer Price Index (CPI), remains above the Federal Reserve's target rate.

Persistent inflationary pressures can erode purchasing power and dampen consumer confidence.

The Federal Reserve's efforts to control inflation through interest rate hikes have yet to fully materialize in lowered price levels.

Consumer Spending

Retail sales data indicates a decrease in consumer spending on discretionary items.

High inflation and rising interest rates are impacting consumer budgets, leading to reduced spending.

A decline in consumer confidence, reflected in surveys, further supports this trend.

The Role of Interest Rates

The Federal Reserve has been actively raising interest rates to combat inflation.

Higher interest rates increase the cost of borrowing, which can slow down economic activity.

While intended to curb inflation, these measures can also contribute to an economic downturn.

Expert Opinions

Economists are divided on whether the economy has already reached its peak or is approaching it.

Some argue that the slowing growth and persistent inflation are clear signs of a peak.

Others believe that the economy remains resilient and can avoid a recession.

"The next few months will be critical in determining the trajectory of the economy," says Dr. Anya Sharma, a leading economist at the National Bureau of Economic Research (NBER). "We need to closely monitor these indicators to assess the potential for a recession."

Implications for Investors

The potential peak in the business cycle has significant implications for investors.

Investors may consider shifting their portfolios towards more conservative assets.

Careful risk management is essential during periods of economic uncertainty.

Policy Responses

Policymakers are closely monitoring the economic situation and considering appropriate responses.

Fiscal policy measures may be implemented to support economic growth.

The Federal Reserve will continue to adjust monetary policy based on economic data.

Next Steps

The Bureau of Economic Analysis (BEA) will release its next GDP report in [insert date - e.g., late July].

The Federal Reserve is scheduled to meet again in [insert date - e.g., early August] to discuss monetary policy.

These events will provide further insights into the state of the economy and the potential for a recession.

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

:max_bytes(150000):strip_icc()/UnderstandingTrough2-d597d31e8ba54dd5b4cdc0fbb18b0e3a.png)