Which Statement About The Operation Of A Corporation Is Correct

The intricate world of corporate governance is a landscape riddled with complexities, where seemingly simple statements can mask profound implications. Understanding the fundamental truths about how a corporation operates is not just an academic exercise; it's crucial for investors, employees, regulators, and the public alike. A single misconstrued fact can lead to flawed decisions with far-reaching consequences.

This article delves into a central question often posed: "Which statement about the operation of a corporation is correct?" We will dissect the common misconceptions surrounding corporate structures, exploring the interplay between stakeholders, the role of the board, the concept of shareholder primacy, and the increasing importance of corporate social responsibility (CSR). The aim is to provide clarity on the principles that underpin successful and ethical corporate operations, drawing upon credible sources and expert analysis.

The Myth of Shareholder Primacy: An Evolving Perspective

For decades, the dominant view in corporate governance was shareholder primacy. This theory posited that the primary, if not sole, responsibility of a corporation was to maximize profits for its shareholders. This perspective, championed by economists like Milton Friedman, has significantly shaped corporate decision-making.

However, the modern corporate landscape is witnessing a shift away from this singular focus. The Business Roundtable, a group of chief executives from major US corporations, issued a statement in 2019 explicitly rejecting shareholder primacy. It broadened the purpose of a corporation to include commitments to employees, customers, suppliers, and communities.

This shift reflects a growing recognition that long-term value creation depends on a broader set of stakeholders. Ignoring the needs of employees, damaging the environment, or engaging in unethical practices can ultimately harm a corporation's reputation and profitability. Therefore, the statement emphasizing shareholder primacy as the *sole* objective is increasingly inaccurate in today's context.

The Role and Responsibilities of the Board of Directors

The board of directors sits at the apex of corporate governance, charged with overseeing the management of the corporation. They are elected by shareholders to represent their interests and ensure that the company is run in a responsible and sustainable manner. Their duties are typically defined by law and corporate charters, emphasizing oversight and accountability.

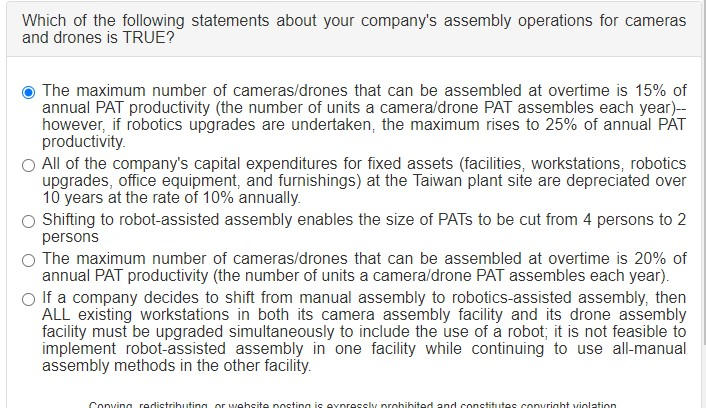

One common misconception is that the board is solely responsible for day-to-day operations. In reality, the board's role is primarily strategic. They set the overall direction of the company, approve major decisions (like mergers and acquisitions), and monitor the performance of senior management, including the CEO.

Another crucial function is risk management. The board must ensure that the corporation has adequate systems and controls in place to identify and mitigate potential risks, from financial risks to compliance risks to reputational risks. A board that is unaware or negligent in addressing these risks can face legal liability and severe reputational damage.

Stakeholder Theory: Balancing Competing Interests

Stakeholder theory offers a more nuanced perspective on corporate governance. This theory argues that corporations have responsibilities to all stakeholders who are affected by its actions, not just shareholders. These stakeholders include employees, customers, suppliers, communities, and the environment.

A correct statement about corporate operation acknowledges the importance of balancing these competing interests. For example, a decision to cut costs by laying off employees might increase short-term profits but could also damage employee morale, productivity, and the company's reputation in the long run. Stakeholder theory suggests carefully considering the consequences for all affected parties.

Navigating these competing demands requires careful judgment and a commitment to ethical decision-making. Some companies have adopted ESG (Environmental, Social, and Governance) frameworks to guide their strategies and operations. These frameworks provide a structure for considering the impact of corporate decisions on a broader range of stakeholders.

The Legal and Regulatory Framework

Corporate operations are heavily influenced by legal and regulatory frameworks. These frameworks vary across jurisdictions but generally aim to protect investors, employees, and the public from corporate malfeasance. Compliance with these laws is not optional; it is a fundamental obligation of the corporation.

The Sarbanes-Oxley Act (SOX) in the United States, for instance, was enacted in response to major accounting scandals like Enron and WorldCom. It imposed stricter requirements on corporate governance, financial reporting, and internal controls. Similarly, many countries have laws protecting whistleblowers who report corporate wrongdoing.

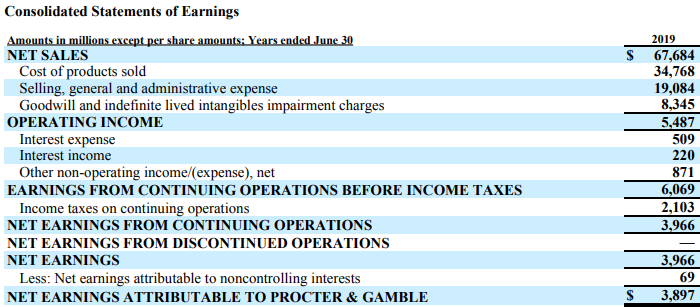

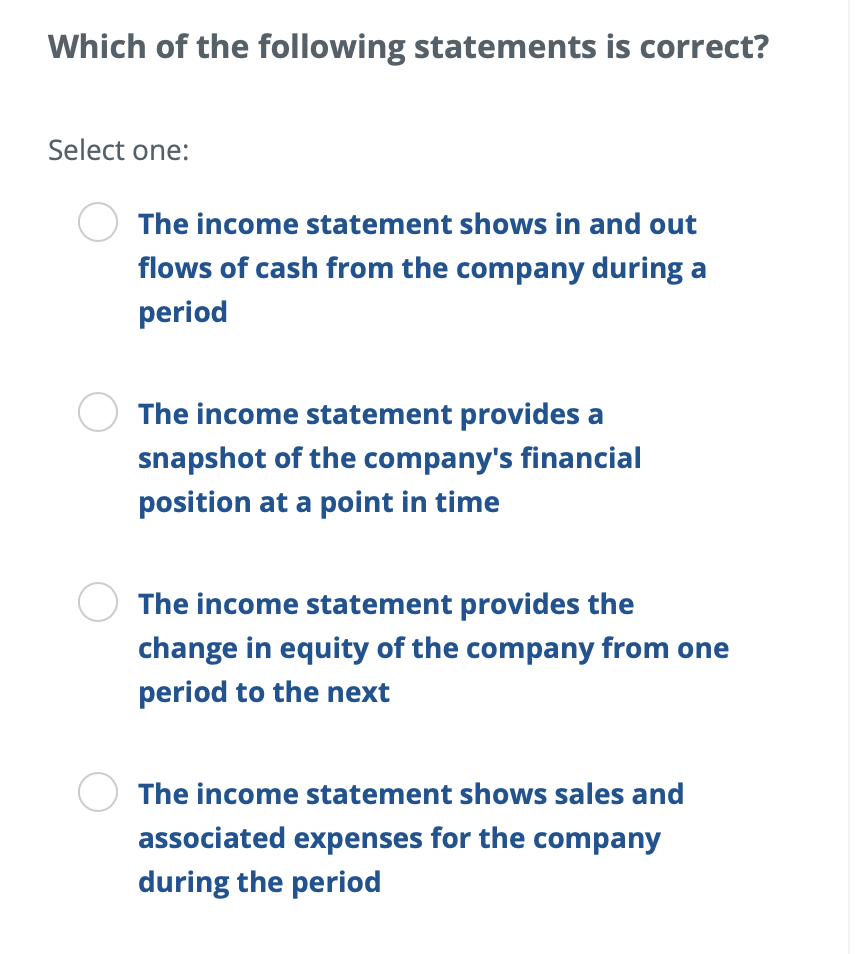

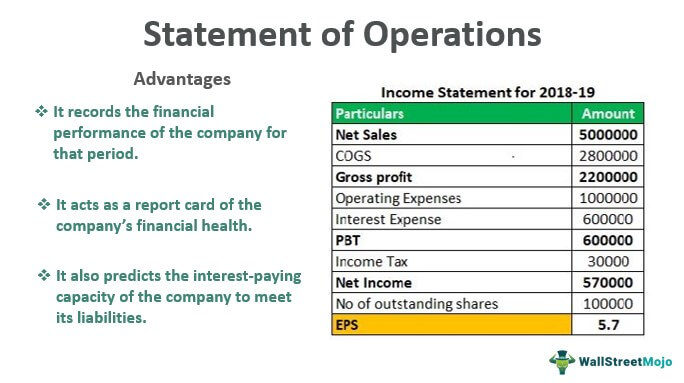

A key aspect of these frameworks is transparency and disclosure. Corporations are required to disclose financial information, executive compensation, and other material information to the public. This allows investors and other stakeholders to make informed decisions and hold management accountable.

Corporate Social Responsibility: Beyond Profit Maximization

Corporate social responsibility (CSR) has emerged as a crucial aspect of modern corporate operations. CSR encompasses a wide range of activities, from reducing environmental impact to promoting diversity and inclusion to supporting local communities. Companies are increasingly expected to go beyond simply complying with the law and to actively contribute to the well-being of society.

Some argue that CSR is simply a marketing ploy designed to improve a company's image. However, there is growing evidence that genuine CSR efforts can enhance a company's long-term value. It can improve employee morale, attract and retain customers, and build stronger relationships with communities.

The rise of impact investing also reflects the growing importance of CSR. Impact investors seek to invest in companies that generate positive social and environmental outcomes alongside financial returns. This creates a powerful incentive for corporations to prioritize social and environmental responsibility.

Looking Ahead: The Future of Corporate Governance

The debate over the correct statement about corporate operation is likely to continue. The evolving understanding of corporate purpose, the increasing focus on stakeholder value, and the growing importance of CSR all point towards a more nuanced and complex view of corporate governance.

The challenges facing corporations in the 21st century, such as climate change, income inequality, and technological disruption, require a more holistic and sustainable approach to corporate operations. Companies that prioritize short-term profits at the expense of long-term sustainability are likely to face increasing scrutiny and ultimately fail to thrive.

Ultimately, the correct statement acknowledges that corporations are powerful institutions with the potential to create both significant wealth and significant harm. The responsibility of corporate leaders is to harness this power in a way that benefits all stakeholders and contributes to a more just and sustainable world. This requires a commitment to ethical leadership, transparent governance, and a genuine understanding of the complex interplay between business and society.