Who Makes The Most Important Decisions In A Corporation

Corporate power structures remain opaque, leaving many in the dark about who truly steers the ship. Decision-making authority in corporations is distributed, but pinpointing the ultimate influence requires a closer look.

This article dissects the layers of corporate hierarchy, revealing the key players responsible for the most impactful decisions. We examine the roles of the board of directors, C-suite executives, and even significant shareholders, clarifying who wields the power to shape a company's future.

The Board of Directors: Guardians of Strategy

The board of directors holds the ultimate responsibility for a corporation's overall direction. They are elected by shareholders to represent their interests and oversee the company's management.

Their primary duties include setting strategic goals, approving major investments, and ensuring ethical and legal compliance. According to a 2023 report by the National Association of Corporate Directors (NACD), 74% of directors believe their most important role is overseeing strategy.

C-Suite Executives: Implementing the Vision

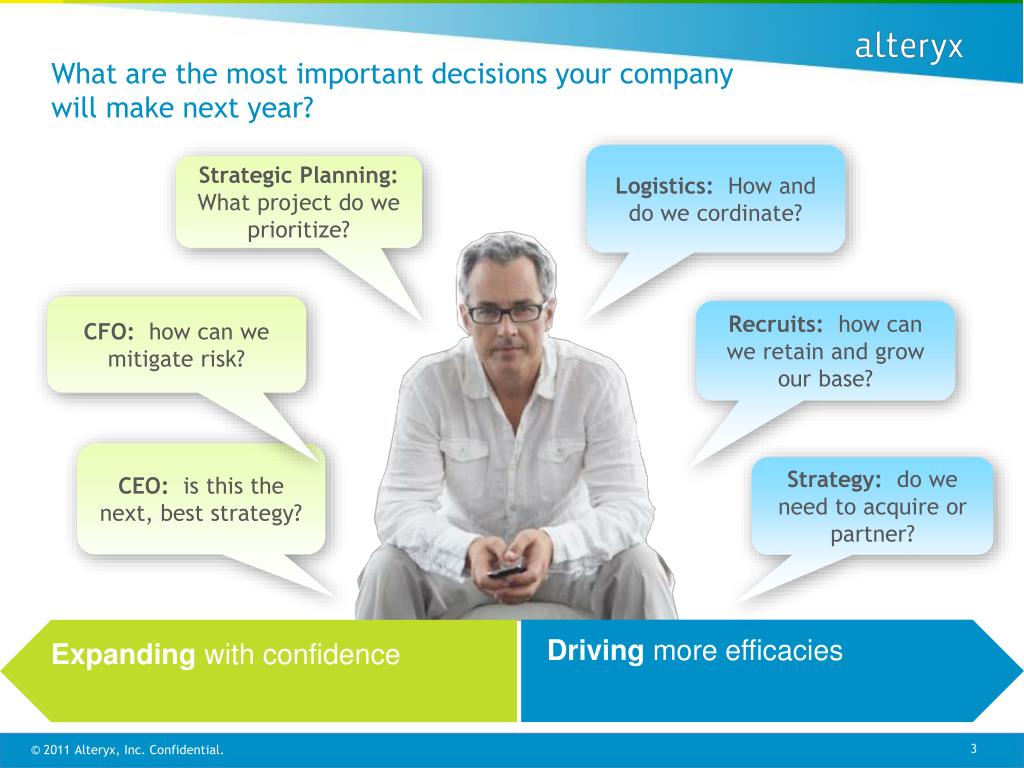

The C-suite, comprising the CEO, CFO, COO, and other top executives, are responsible for executing the board's strategic vision. The CEO, in particular, is the face of the company and leads the day-to-day operations.

These executives make critical decisions regarding resource allocation, operational efficiency, and market expansion. A recent study by Harvard Business Review found that CEO decisions account for up to 45% of a company's performance variability.

Shareholders: The Ultimate Owners

While not directly involved in daily operations, shareholders, particularly institutional investors, wield significant influence. They elect the board of directors and have the power to vote on major corporate actions, such as mergers and acquisitions.

Large institutional investors, like pension funds and mutual funds, can exert pressure on management through shareholder proposals and proxy votes. According to data from ISS Corporate Solutions, shareholder activism increased by 15% in 2023, demonstrating growing shareholder influence.

Decentralized Decision-Making: The Rise of Teams

In many modern corporations, decision-making is increasingly decentralized, with teams and committees playing a vital role. This approach aims to foster innovation and agility by empowering employees at different levels.

Project teams, cross-functional committees, and employee resource groups contribute to decisions related to product development, marketing, and diversity & inclusion. This allows for input from a wider range of perspectives and expertise.

Navigating the Corporate Labyrinth

Identifying the most influential decision-makers requires understanding the specific context of each corporation. The balance of power can shift depending on the company's size, industry, ownership structure, and corporate culture.

Smaller, privately held companies often have a more concentrated decision-making structure compared to large, publicly traded corporations. In family-owned businesses, for example, the founding family may retain significant control.

The Ongoing Debate

The debate over who makes the most important decisions in a corporation continues. Some argue that the board of directors and C-suite executives hold the ultimate power. Others emphasize the increasing influence of shareholders and decentralized teams.

Ultimately, the answer is complex and multifaceted, varying from company to company. Understanding the interplay of these different actors is crucial for anyone seeking to navigate the corporate world effectively.

Next Steps

Corporate governance structures are constantly evolving in response to changing market conditions and societal expectations. Investors, employees, and stakeholders should remain vigilant in monitoring corporate decision-making processes.

Increased transparency and accountability are essential for ensuring that corporations are making decisions that are in the best interests of all stakeholders. The ongoing debate about corporate power structures underscores the need for continued scrutiny and reform.