Why Are Refinance Rates Lower Than Purchase Rates

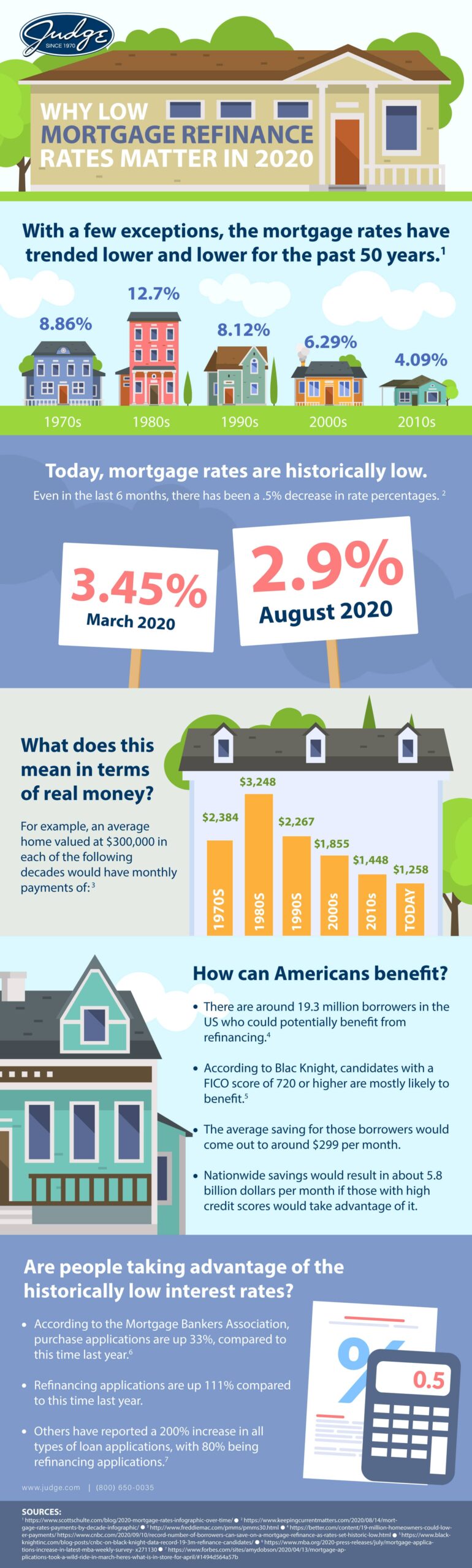

Imagine strolling through a sun-drenched neighborhood, admiring the freshly painted houses and meticulously manicured lawns. The air is filled with the promise of new beginnings, a sentiment echoed in the real estate market, where interest rates often dictate whether dreams take flight or remain grounded. Yet, a curious anomaly has emerged: refinance rates are, in many cases, lower than purchase rates.

This disparity, while seemingly counterintuitive, is rooted in a complex interplay of risk assessment, market dynamics, and the strategies lenders employ to navigate the ever-shifting economic landscape. Understanding why refinance rates are often lower than purchase rates involves delving into the intricacies of mortgage-backed securities, lender appetite, and the perceived security associated with existing homeowners.

To grasp the current situation, we must first understand the fundamental differences between a purchase and a refinance. A purchase loan is used to buy a new property. A refinance loan, on the other hand, replaces an existing mortgage with a new one, ideally with better terms.

The Role of Risk Assessment

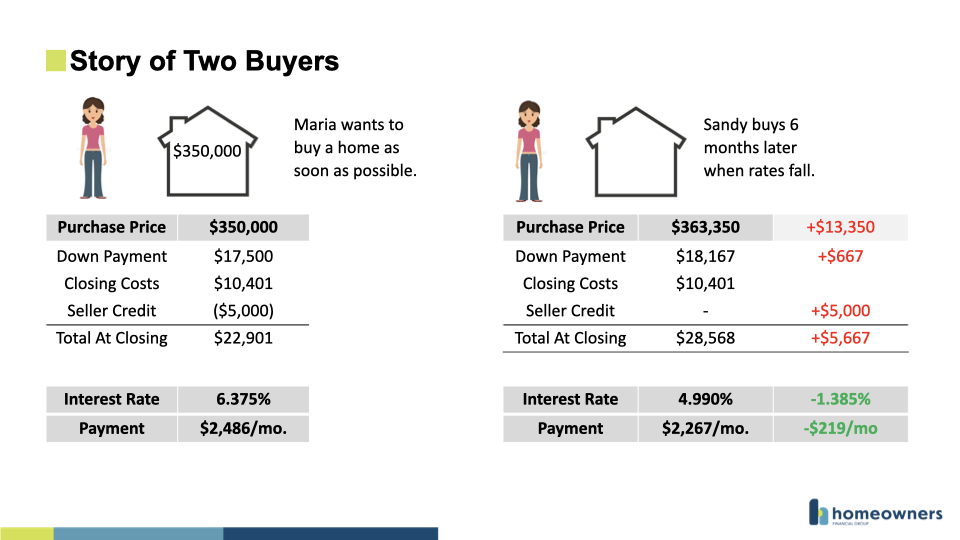

Lenders meticulously evaluate risk when extending credit. With purchase loans, the lender faces the uncertainty of a new borrower and a potentially unproven property.

Consider the scenario of a first-time homebuyer with limited credit history; they represent a higher risk compared to an existing homeowner who has consistently made mortgage payments. According to data from the Mortgage Bankers Association (MBA), foreclosure rates are significantly lower for borrowers with established payment histories.

Pre-Existing Relationships and Data

Refinance applicants are already in a lending relationship. Lenders have a track record to assess the borrower's payment behavior.

This existing data provides a more transparent risk profile, allowing lenders to offer potentially lower rates. The lender already knows how the borrower handles debt.

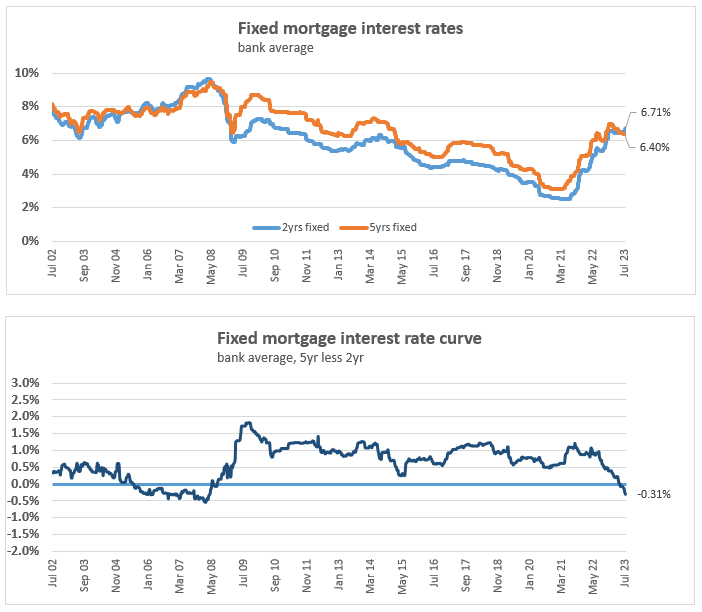

Market Dynamics and Competition

The mortgage market is a highly competitive arena. Lenders are constantly vying for business.

Often, lenders will offer lower refinance rates to retain existing customers, preventing them from jumping ship to a competitor. This is particularly true when interest rates are fluctuating, creating opportunities for homeowners to seek better deals elsewhere.

Mortgage-Backed Securities (MBS)

Mortgage-backed securities play a significant role in shaping interest rates. These securities are bundles of mortgages sold to investors.

Demand for MBS influences the rates lenders can offer.

"The pricing of MBS can vary based on the characteristics of the underlying mortgages, with refinances sometimes being perceived as less risky,"explains Dr. Jane Thompson, a leading economist specializing in housing finance.

The Psychology of Homeownership

Homeowners seeking to refinance often have a vested interest in maintaining their property's value and creditworthiness. They’ve already invested time and money into their homes.

This psychological commitment translates to a lower perceived risk for lenders. They are more likely to prioritize on-time payments to protect their investment.

The Long-Term View

Lenders consider the long-term implications of their lending decisions. A borrower who has already weathered economic storms and consistently met their financial obligations is seen as a more stable bet.

This stability allows lenders to offer more favorable terms. They know a little more about you and how responsible you are with your mortgage payments.

In conclusion, the lower refinance rates are a reflection of the nuanced risk assessment, competitive market forces, and the inherent stability associated with existing homeowners. While the real estate market remains dynamic, understanding these underlying factors empowers borrowers to make informed decisions and navigate the path to homeownership with confidence. The sun continues to shine on those who seize opportunities, armed with knowledge and a clear understanding of the landscape.