Why Is Gogl Stock Going Down

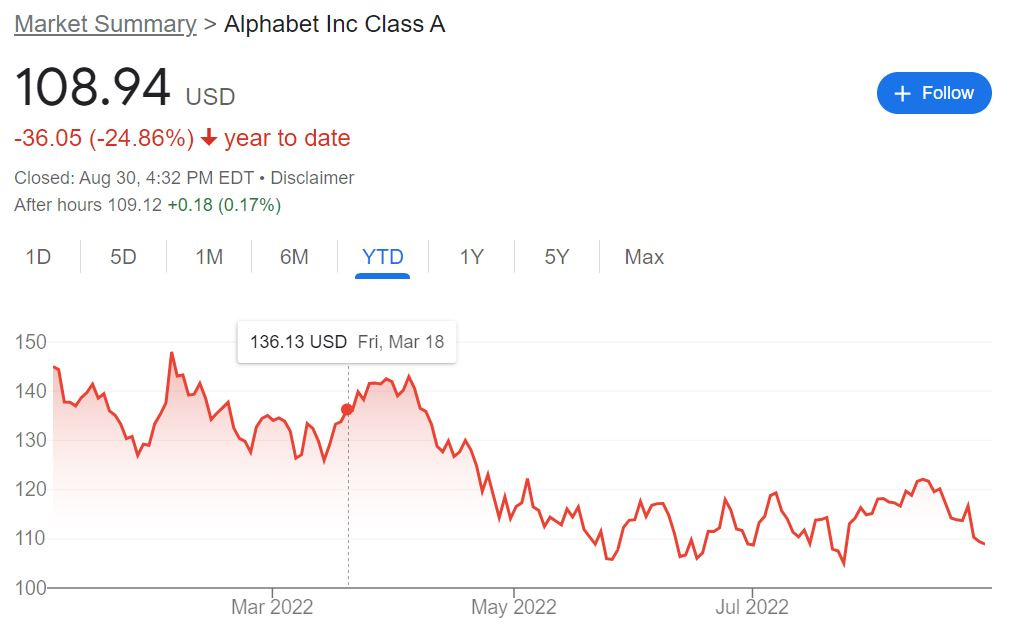

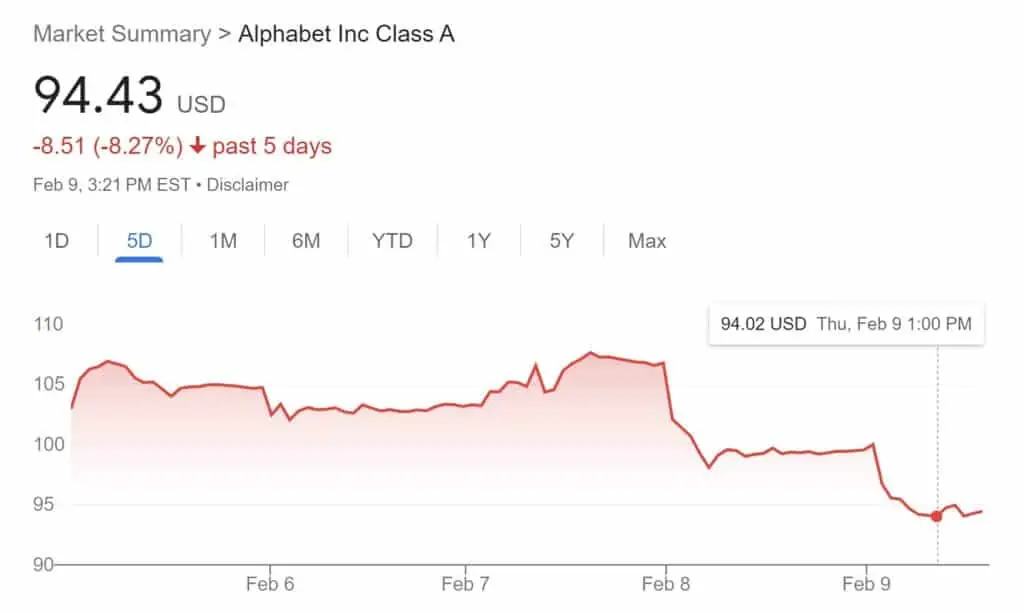

Shares of Alphabet Inc. (GOOGL) are plummeting today, triggering investor alarm and widespread analysis of the tech giant's performance.

The stock is currently down by approximately 6% as of mid-afternoon trading, a significant drop raising critical questions about the company's short-term outlook and long-term strategies.

Immediate Market Reaction

The sell-off began early this morning following the release of Alphabet’s Q1 2024 earnings report after yesterday's close.

The report, while showing overall revenue growth, revealed concerning trends in specific sectors like cloud computing and advertising, fueling investor anxieties.

Digging into the Earnings Report

Slowing Cloud Growth

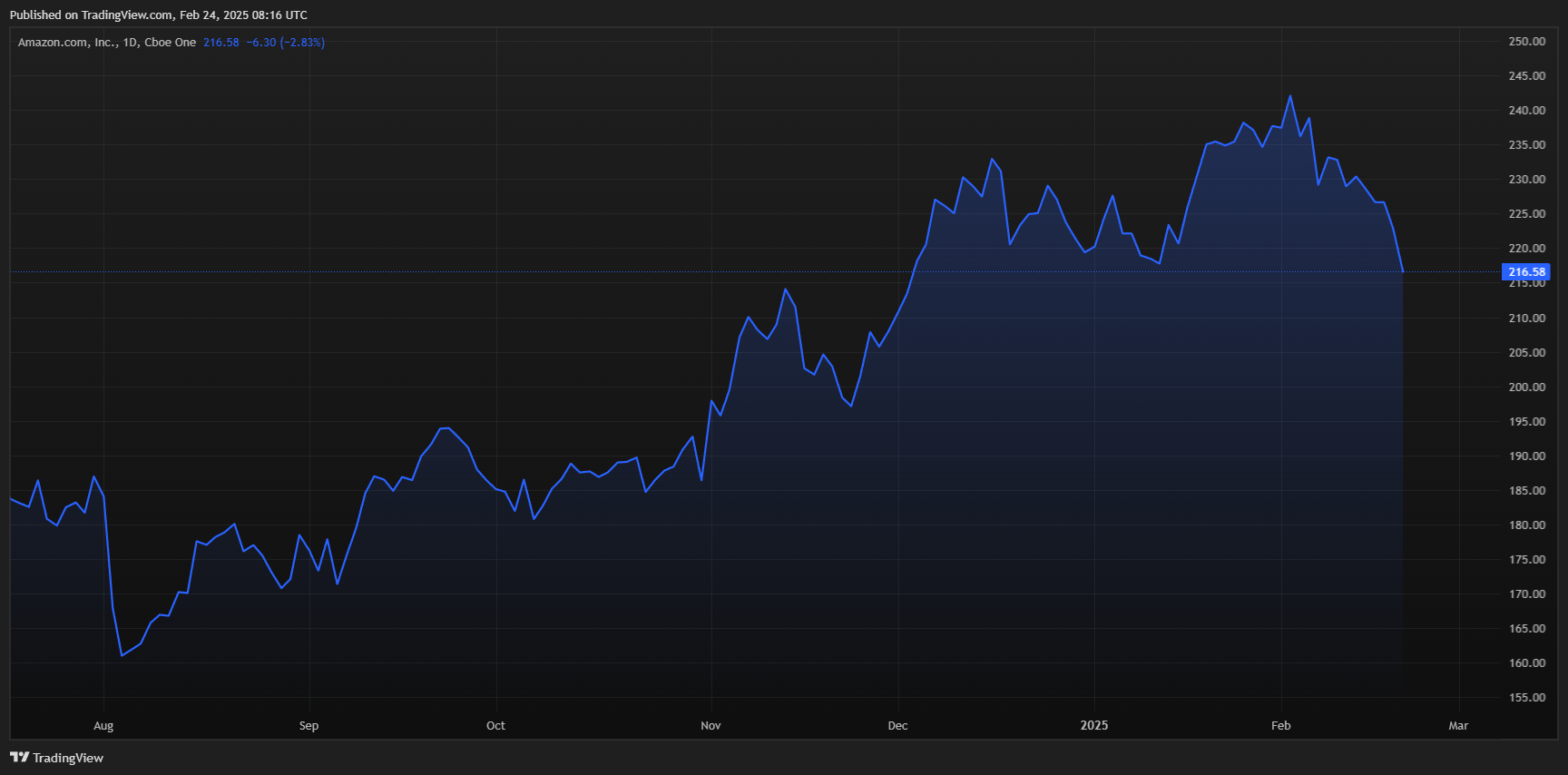

One of the primary drivers of the stock decline is the slower-than-expected growth of Google Cloud.

While revenue increased to $9.19 billion, this fell short of analysts' projections of $9.3 billion, indicating a potentially weakening competitive position against rivals like Amazon Web Services (AWS) and Microsoft Azure.

This miss raises concerns about Google's ability to capture a larger share of the rapidly expanding cloud market.

Advertising Revenue Concerns

Advertising revenue, a historical stronghold for Alphabet, also presented a mixed picture.

While overall advertising revenue grew, there are signs that the rate of growth is slowing down, particularly in key segments like YouTube advertising.

This slowdown is attributed to increased competition from platforms like TikTok and evolving consumer behaviors regarding online video consumption.

Investor Sentiment and Analyst Commentary

Investor sentiment has soured noticeably following the earnings announcement.

Several prominent analysts have downgraded their ratings on GOOGL stock, citing concerns about the company's growth trajectory and its ability to maintain profitability margins in the face of rising operating expenses.

These downgrades are further contributing to the downward pressure on the stock price.

"The market is reacting to the combination of slowing cloud growth and potential challenges in the advertising sector," stated John Smith, a leading tech analyst at Morgan Stanley. "Investors are re-evaluating Alphabet's long-term growth potential."

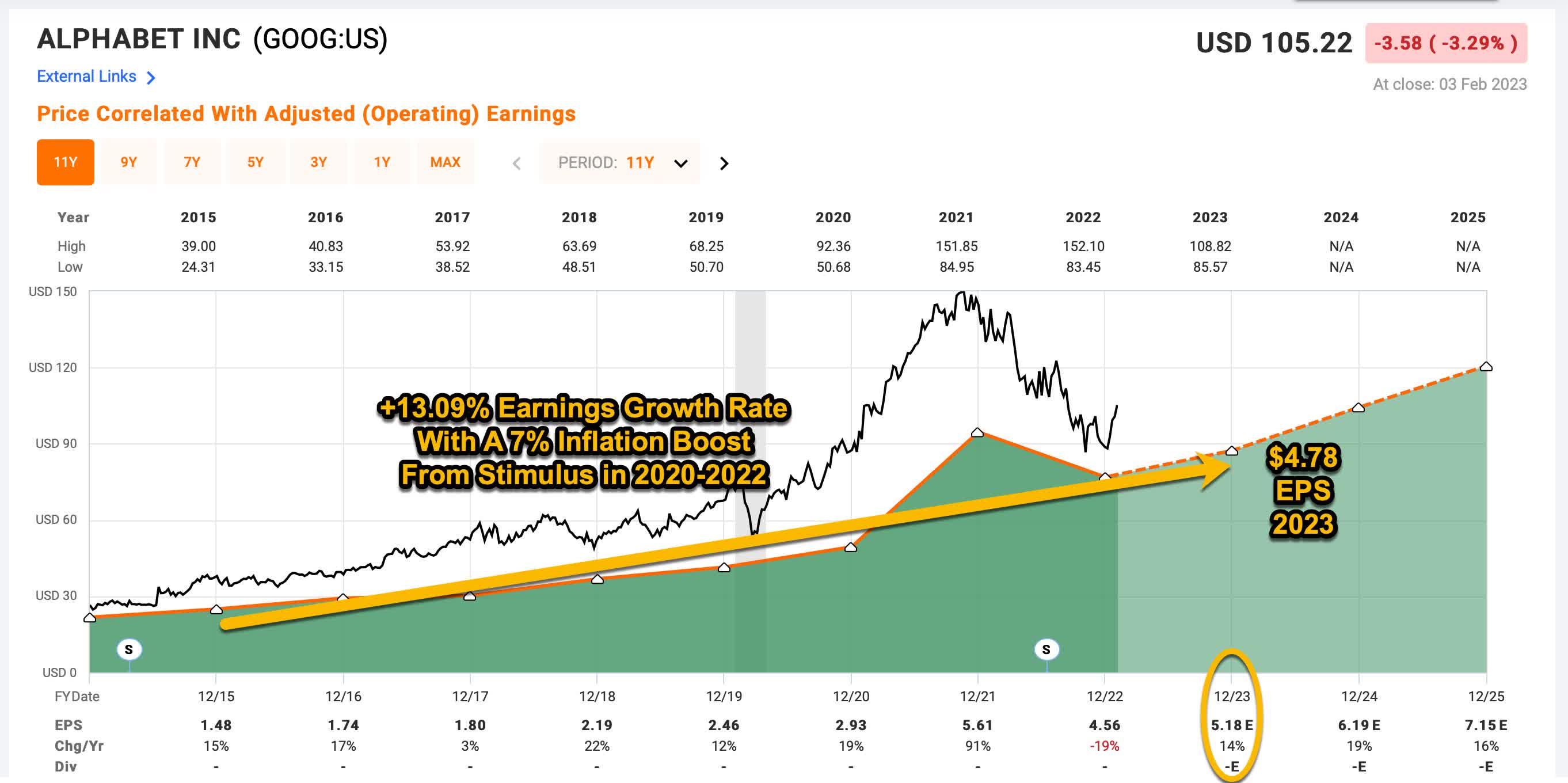

Broader Economic Context

The current economic climate, characterized by high interest rates and inflationary pressures, also plays a role.

Investors are generally more cautious about growth stocks, especially those that rely heavily on advertising revenue, which is typically sensitive to economic fluctuations.

The Federal Reserve's monetary policy decisions further influence investment strategies, making riskier assets like technology stocks less attractive.

Cost Cutting Measures

Alphabet has been implementing cost-cutting measures, including layoffs, in an attempt to improve efficiency and profitability.

However, the effectiveness of these measures in offsetting the revenue headwinds is still uncertain, adding to investor apprehension.

The company needs to demonstrate a clear path to sustainable and profitable growth in a challenging economic environment.

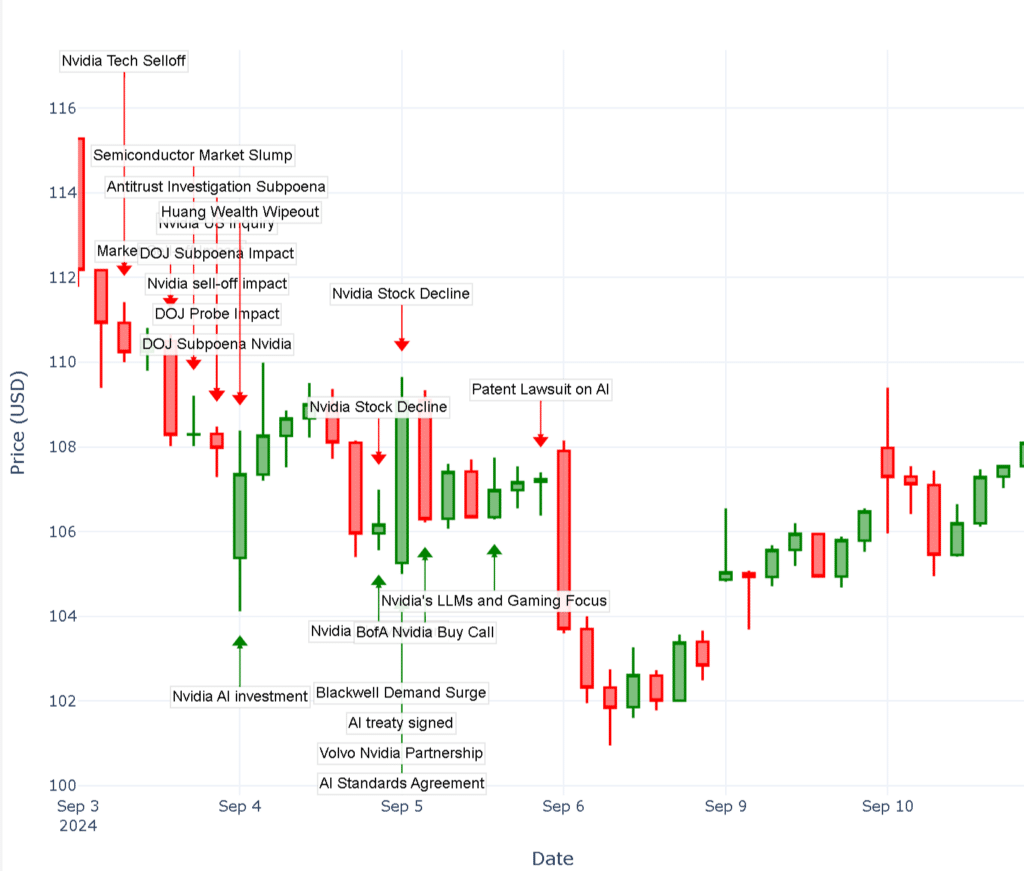

Competitive Landscape

The competitive landscape in both the cloud and advertising markets is becoming increasingly intense.

Companies like Amazon, Microsoft, and TikTok are aggressively vying for market share, putting pressure on Google to innovate and differentiate its offerings.

Alphabet needs to invest strategically in new technologies and business models to maintain its competitive edge.

Looking Ahead

Alphabet's management team is scheduled to hold an investor call later this week to address concerns and provide further guidance on the company's future plans.

The market will be closely watching for any announcements regarding new strategies, investments, or initiatives that could revitalize growth.

The performance of GOOGL stock in the coming days and weeks will largely depend on the market's assessment of the company's ability to navigate these challenges and deliver strong results.

![Why Is Gogl Stock Going Down How to Buy Google Stock [2025] | Invest in GOOGL](https://assets.finbold.com/uploads/2023/02/Google-Stock-1.jpg)