Why Is Modern Currency Accepted As A Medium Of Exchange

Trust in modern currency hinges on a complex interplay of government backing, societal agreement, and practical utility. This system, while often taken for granted, requires continuous maintenance to avoid economic instability.

At its core, the acceptance of fiat currency – money not backed by a physical commodity like gold – rests on a collective belief. The enduring question is: why do we all agree to accept these pieces of paper (or digital entries) as valuable? The answer lies in a multi-faceted system built on legal tender status, governmental oversight, and the convenience it offers in facilitating complex transactions.

The Foundation: Government Mandate and Legal Tender

The bedrock of any modern currency is its designation as legal tender by a sovereign government. This means that within a specific jurisdiction, the currency must be accepted as payment for debts, both public and private.

For example, the U.S. dollar's status as legal tender, enshrined in law, compels businesses and individuals within the United States to accept it. This creates a baseline demand, as people need dollars to pay taxes and conduct legally recognized transactions.

This legal framework, however, is not enough on its own. Government backing extends beyond legal tender laws, encompassing monetary policy and fiscal responsibility, essential in maintaining confidence.

The Role of Central Banks and Monetary Policy

Central banks, like the U.S. Federal Reserve or the European Central Bank, play a pivotal role in managing a nation's currency. They influence the money supply, set interest rates, and act as lenders of last resort to stabilize the financial system.

By controlling inflation and promoting economic growth, these institutions aim to maintain the purchasing power of the currency. According to the Bank for International Settlements (BIS), effective monetary policy is crucial for anchoring inflation expectations and ensuring the long-term stability of a currency.

Credible central bank policies enhance public trust, reassuring people that their money will retain its value over time. Lack of central bank independence, or perceived mismanagement of monetary policy, can rapidly erode this trust and lead to currency devaluation.

Trust and Social Convention

Beyond the legal and institutional frameworks, the acceptance of modern currency is deeply rooted in social convention. We accept money because we believe that others will also accept it.

This shared belief is self-reinforcing. The more widely a currency is accepted, the more valuable it becomes, creating a positive feedback loop.

Consider the widespread adoption of digital payment systems like Venmo or PayPal. Their acceptance depends on a network effect: the more users who adopt them, the more useful they become as a medium of exchange.

Practicality and Efficiency in Transactions

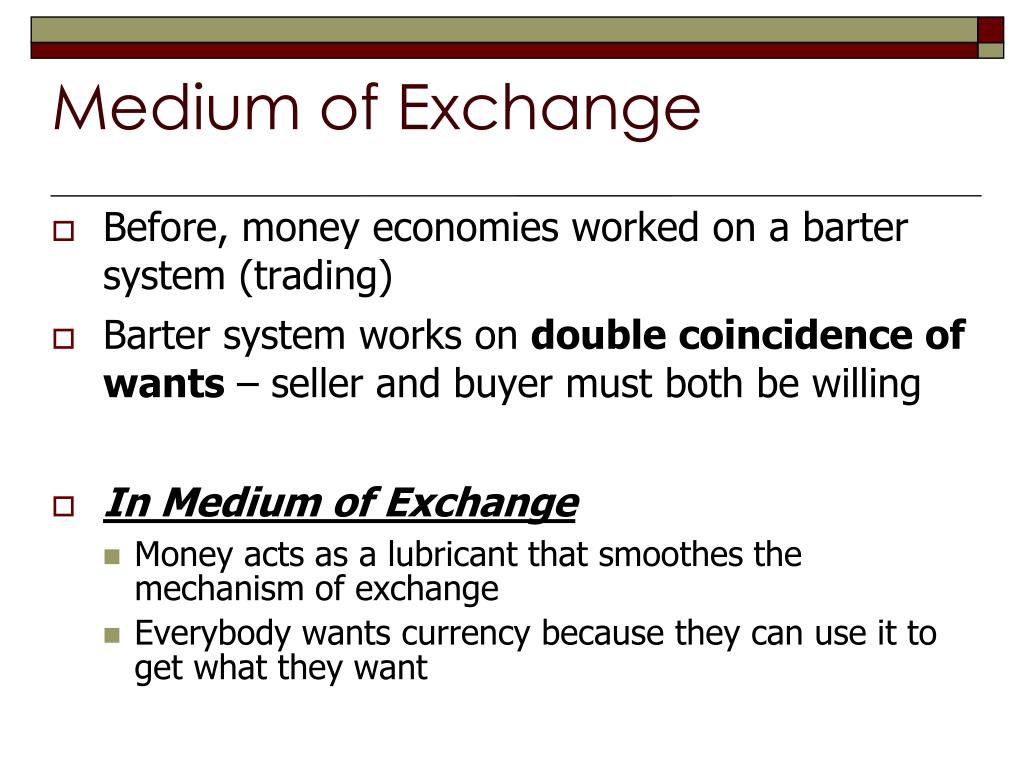

Modern currency offers unparalleled convenience and efficiency in facilitating transactions. Compared to barter systems or commodity-backed currencies, fiat money simplifies the process of buying and selling goods and services.

Its divisibility, portability, and standardized form allow for complex transactions across diverse markets. The rise of e-commerce, for example, wouldn't be possible without a universally accepted and easily transferable medium of exchange.

The efficiency gains from using money are substantial. According to a study by the National Bureau of Economic Research (NBER), countries with well-functioning monetary systems experience higher levels of economic growth and development.

The Risks: Inflation and Loss of Confidence

While modern currency offers many advantages, it also carries inherent risks. The biggest threat is inflation, which erodes the purchasing power of money.

Uncontrolled inflation can lead to hyperinflation, where prices rise rapidly and the currency becomes virtually worthless. This often stems from excessive government spending or mismanagement of monetary policy.

The loss of confidence in a currency can have devastating consequences, triggering capital flight, economic recession, and social unrest. Recent examples of countries struggling with currency instability include Venezuela and Zimbabwe.

Looking Ahead: Maintaining Trust in the Digital Age

The advent of cryptocurrencies and other digital assets poses both a challenge and an opportunity for modern currency systems. While cryptocurrencies aim to offer an alternative to traditional fiat money, their volatility and lack of regulation raise concerns about their stability and widespread acceptance.

Central banks are actively exploring the possibility of issuing Central Bank Digital Currencies (CBDCs), which would combine the security and stability of fiat money with the efficiency and innovation of digital technology. According to the International Monetary Fund (IMF), CBDCs could potentially improve financial inclusion and reduce transaction costs.

The future of modern currency will likely involve a combination of traditional fiat money, digital assets, and evolving regulatory frameworks. The key to maintaining trust and stability lies in responsible government policies, sound monetary management, and ongoing adaptation to technological advancements.

What's Next?

Continued monitoring of inflation rates and global economic conditions remains crucial. Governments and central banks must prioritize maintaining the value and stability of their currencies. Further developments in digital currency technologies, including potential CBDCs, will require careful evaluation and regulation.

The ongoing debate about the role of digital assets in the financial system will continue to shape the future of money.

![Why Is Modern Currency Accepted As A Medium Of Exchange [Sample Paper] “Money acts as a medium of exchange in transactions”](https://cdn.teachoo.com/8f0f6c32-c7e6-4746-8d8d-9c4b5b939679/money-acts-as-a-medium-of-exchange-in-transactions---teachoo-(2).png)

![Why Is Modern Currency Accepted As A Medium Of Exchange [Sample Paper] “Money acts as a medium of exchange in transactions”](https://d1avenlh0i1xmr.cloudfront.net/small/dcadd42f-4e81-4e26-9f36-518a169b0c76/money-acts-as-a-medium-of-exchange-in-transactions---teachoo.png)