Will Microsoft Increase Its Dividend

Microsoft shareholders are keenly awaiting the company's upcoming announcements, particularly regarding a potential dividend increase. The technology giant has a history of consistently raising its dividend payouts, leading investors to speculate whether this trend will continue in the near future.

At the heart of this anticipation is the question: Will Microsoft increase its dividend? This question is not just relevant to shareholders, but also to the broader market as it can influence investor confidence and market dynamics.

Dividend History and Financial Performance

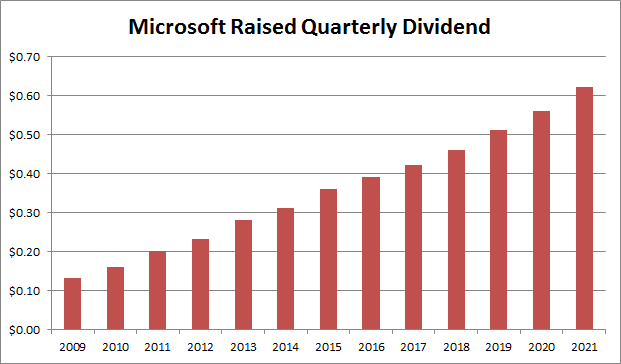

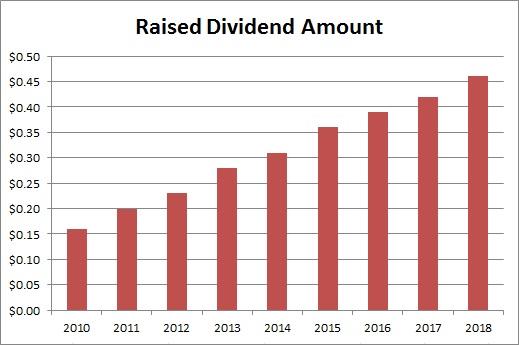

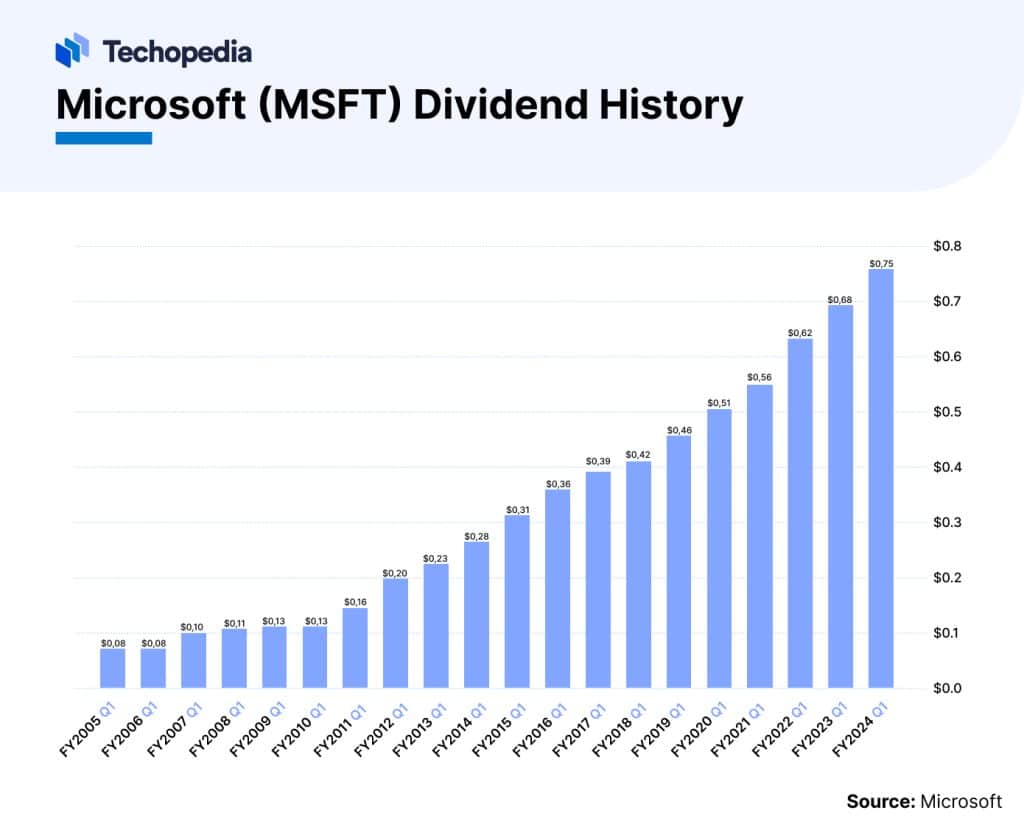

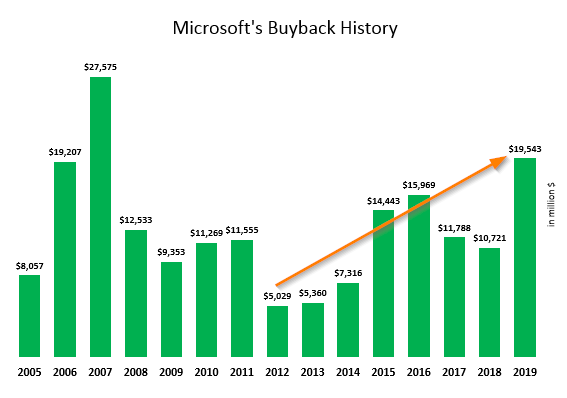

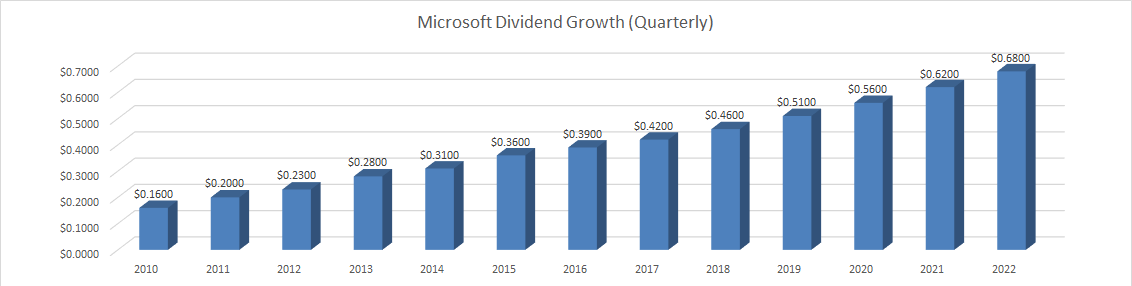

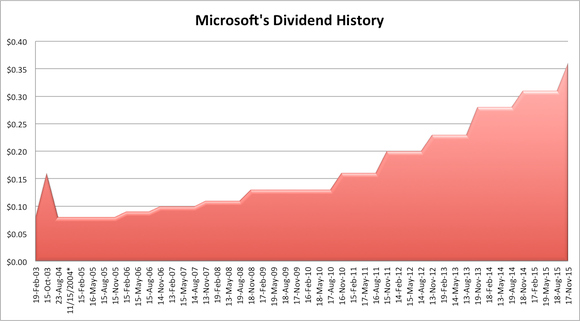

Microsoft has a long track record of returning value to shareholders through dividends and share repurchases. Its last dividend increase was announced in September 2023, a 10% rise from $0.68 to $0.75 per share on a quarterly basis, reflecting the company's strong financial health and commitment to shareholder returns.

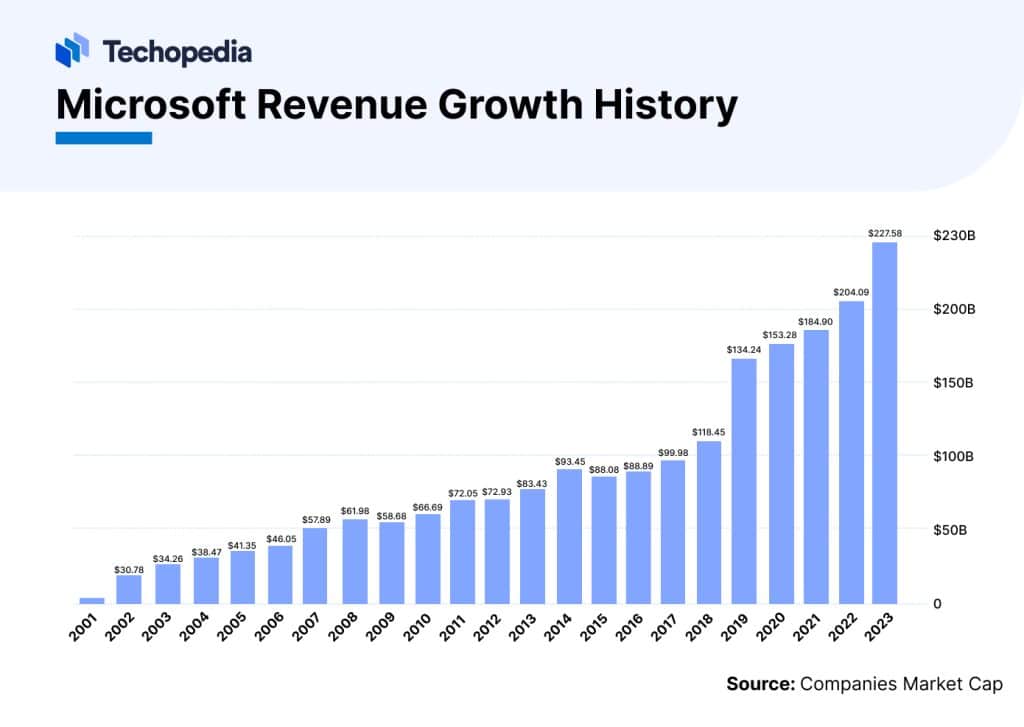

The company's strong financial performance in recent years has bolstered expectations for continued dividend growth. Microsoft reported impressive earnings in its most recent quarterly reports, driven by growth in its cloud computing segment, Azure, and its productivity software suite, Microsoft 365.

Such strong financial performance is generally viewed as a positive sign for future dividend increases.

Analysts' Expectations and Market Sentiment

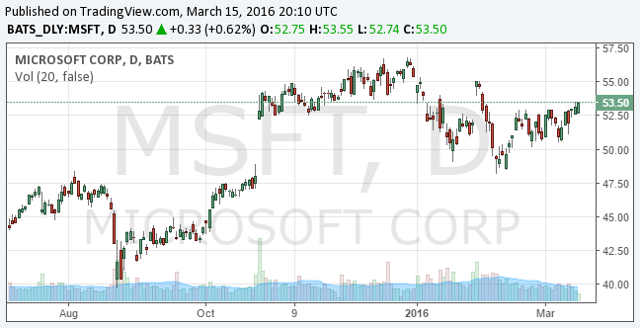

Financial analysts are closely monitoring Microsoft's financial performance and statements to gauge the likelihood of a dividend hike. Several analysts have issued reports suggesting that an increase is probable, citing the company's robust cash flow and strong balance sheet.

Market sentiment also plays a significant role in shaping expectations. A general consensus among investors is that Microsoft will likely continue its dividend growth trajectory.

This expectation is based on the company's history and its proven ability to generate consistent profits, even in challenging economic environments.

Potential Impact of a Dividend Increase

A dividend increase by Microsoft would have several potential impacts on investors and the market. Firstly, it would directly benefit shareholders by increasing their income from owning the stock.

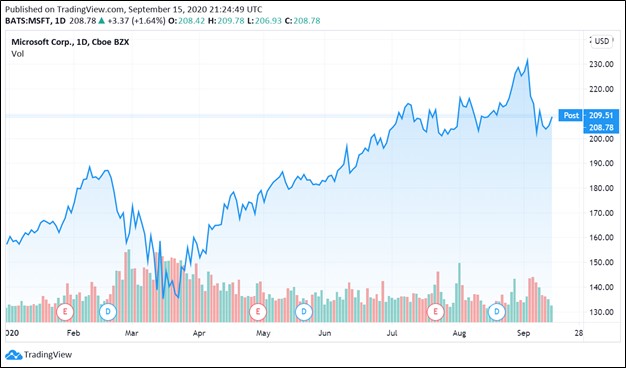

This is particularly important for income-focused investors, such as retirees, who rely on dividends to supplement their income. Secondly, a dividend increase could boost investor confidence in Microsoft, potentially driving up the stock price.

This could also have a ripple effect, positively impacting the broader market by signaling the strength and stability of a major player in the technology sector.

"A dividend increase sends a strong signal to the market about the company's financial health and its commitment to rewarding shareholders,"said one analyst at a leading investment firm.

Factors Influencing the Decision

Several factors will likely influence Microsoft's decision regarding a dividend increase. These include the company's overall financial performance, future growth prospects, and capital allocation priorities.

Microsoft will also consider the broader economic environment and potential risks to its business. Additionally, the company's management team will assess the impact of a dividend increase on its long-term financial sustainability.

Decisions on significant investment and acquisitions would also be considered.

Looking Ahead

Investors are advised to closely monitor Microsoft's upcoming earnings releases and investor calls for any indications of a potential dividend increase. The company's official announcements will provide the most accurate and up-to-date information on its dividend policy.

Regardless of whether a dividend increase is announced, Microsoft remains a solid investment option for many. Its strong financial performance, innovative products, and commitment to shareholder returns make it an attractive choice for long-term investors.

Ultimately, the decision to increase dividends rests with Microsoft's board of directors.