Xoom Exchange Rate Philippines Today

For millions of Filipinos relying on remittances from overseas workers, the daily Xoom exchange rate is a critical piece of financial information. Fluctuations, even slight ones, can significantly impact the amount of pesos their families receive. Today's rate is drawing particular attention amidst a complex global economic landscape, raising questions about purchasing power and household budgets.

Understanding the Xoom exchange rate to the Philippines today requires a multi-faceted approach. It involves examining not just the headline number, but also the underlying factors influencing its movement, its implications for beneficiaries, and expert predictions for the near future. This article delves into the current Xoom exchange rate, its driving forces, its effects on Filipino families, and what to expect in the coming days.

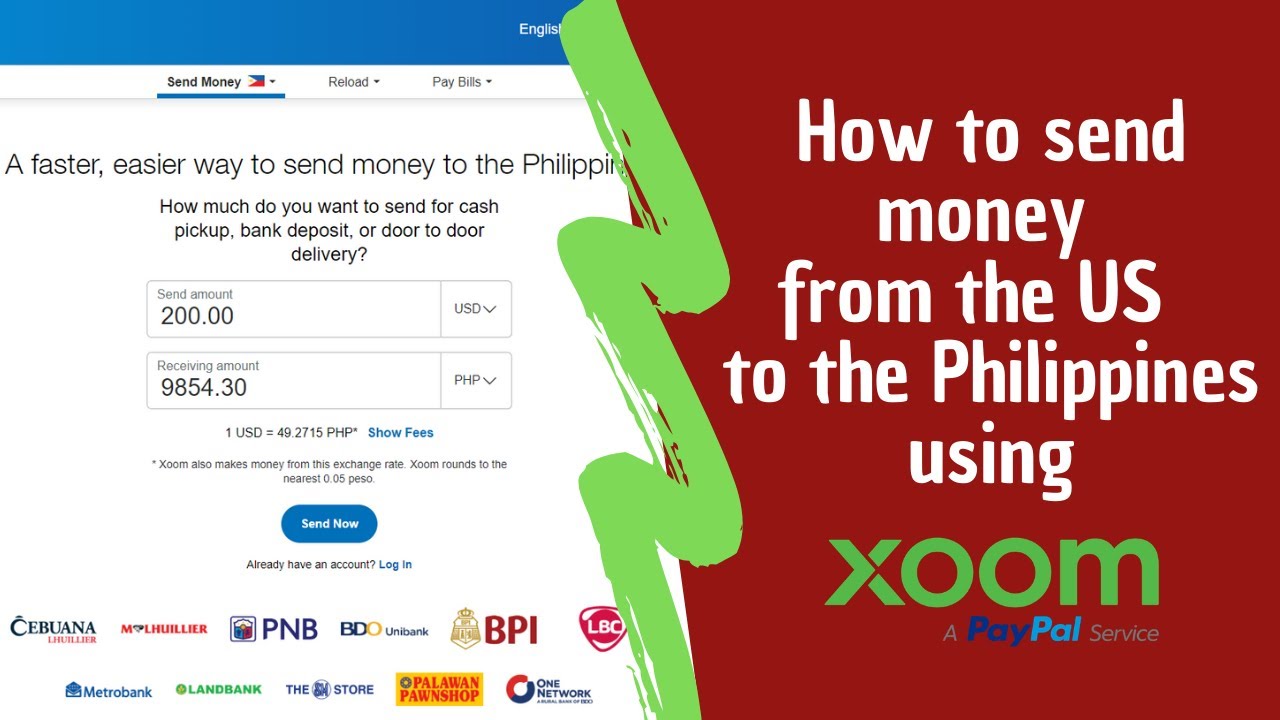

Current Xoom Exchange Rate and Influencing Factors

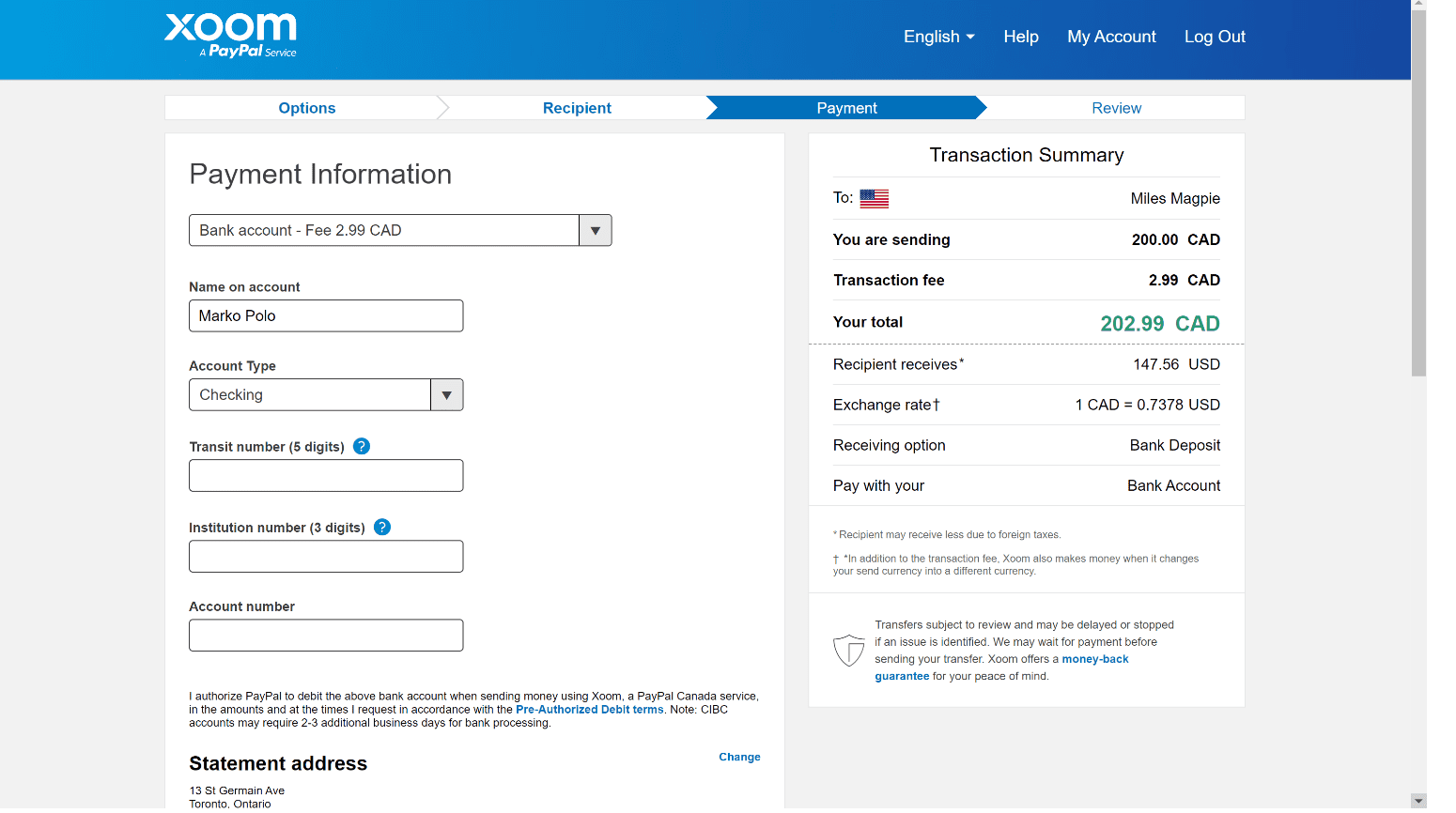

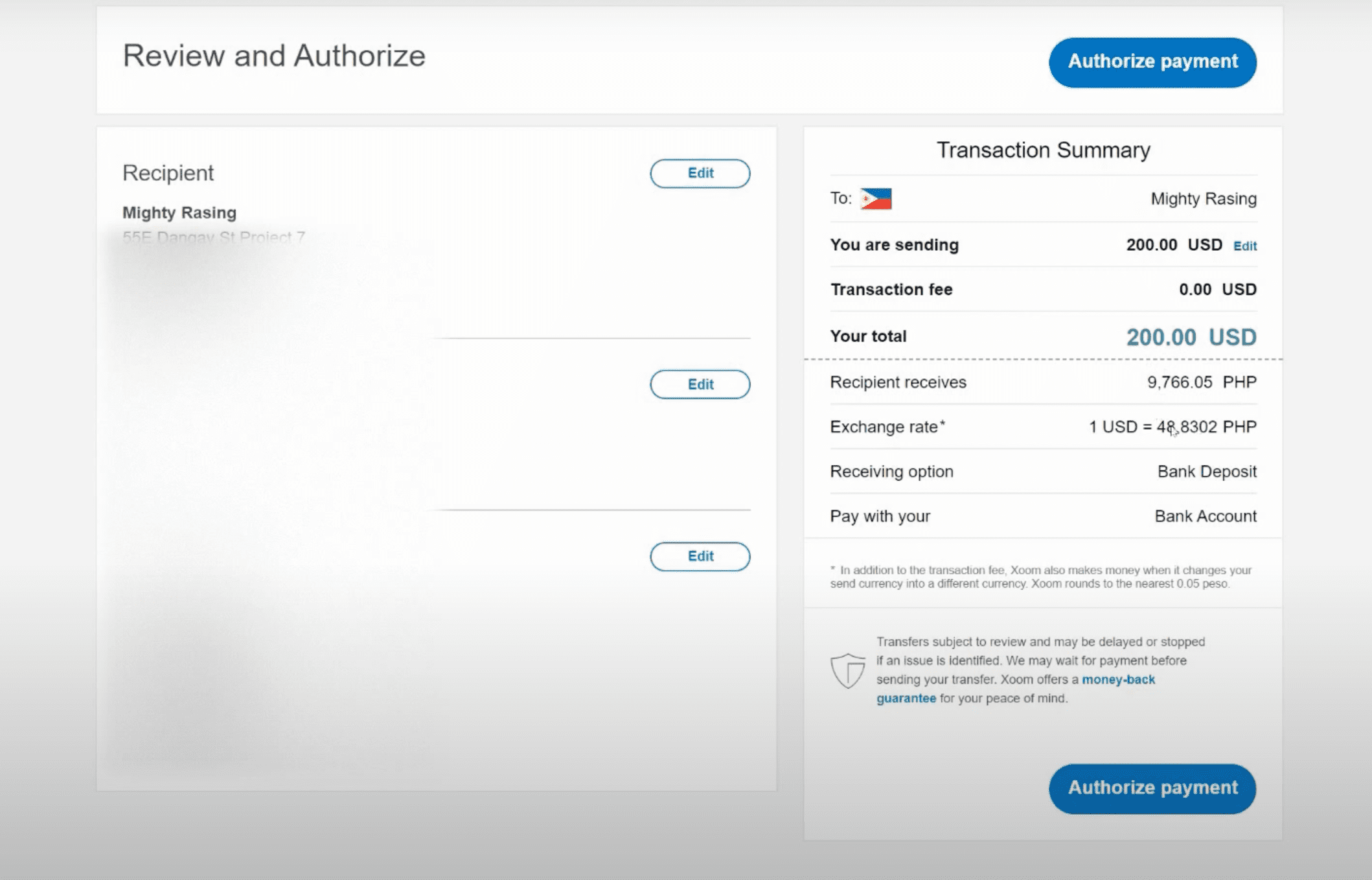

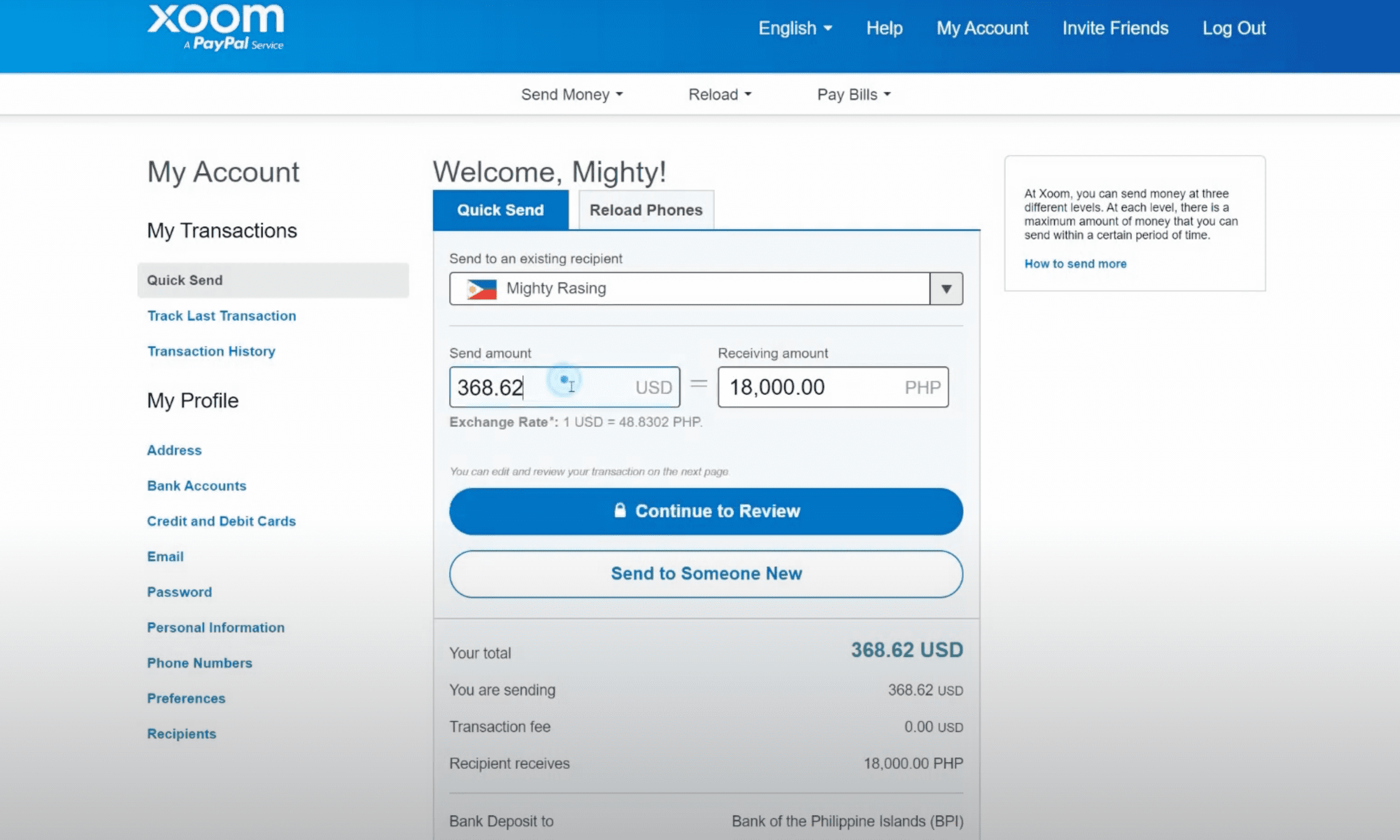

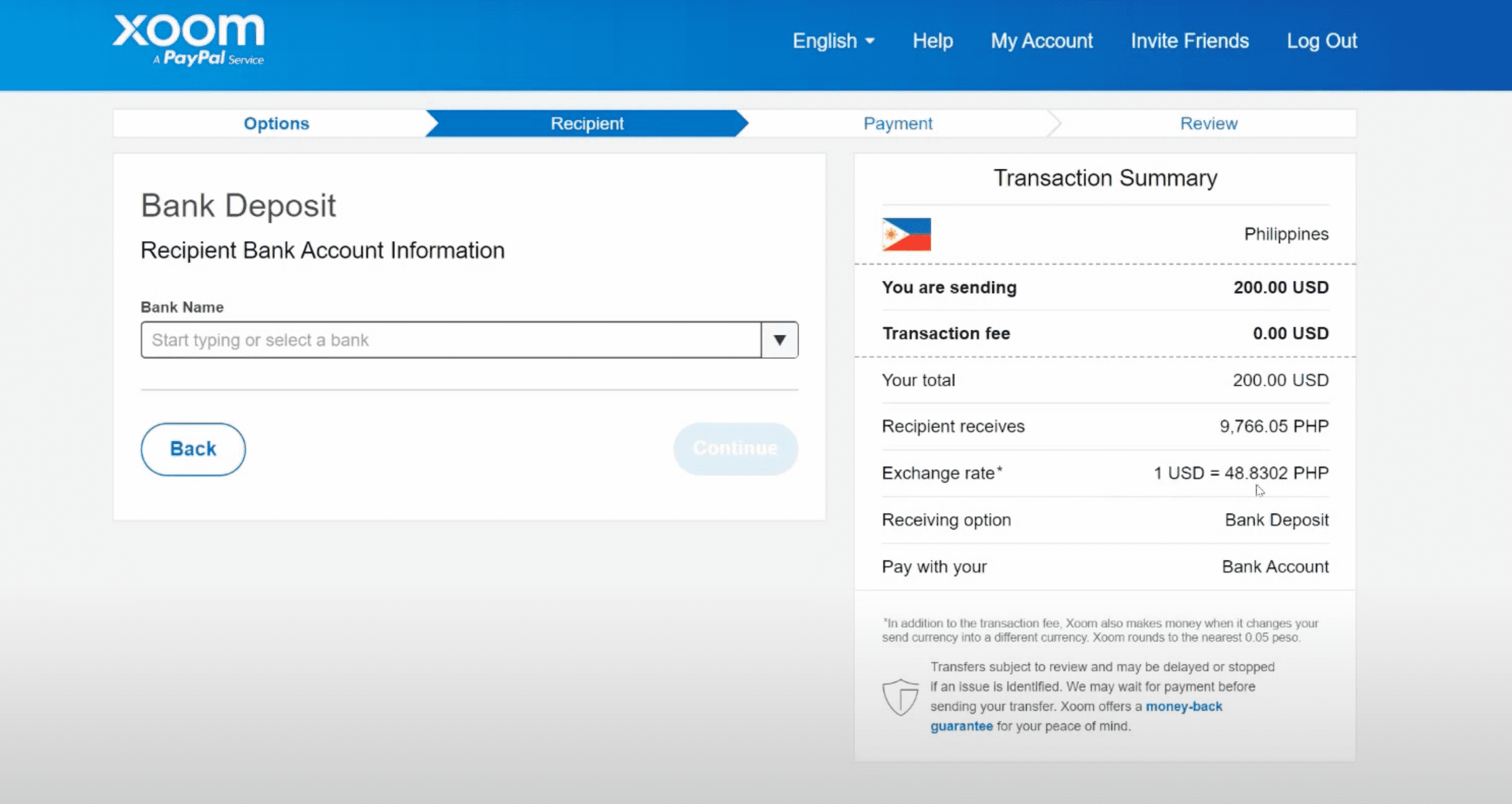

As of today, [Insert Specific Date Here], the Xoom exchange rate to the Philippine Peso (PHP) is hovering around [Insert Specific Rate Here] per US Dollar (USD). This figure is subject to change throughout the day due to market volatility. Several factors contribute to this fluctuation.

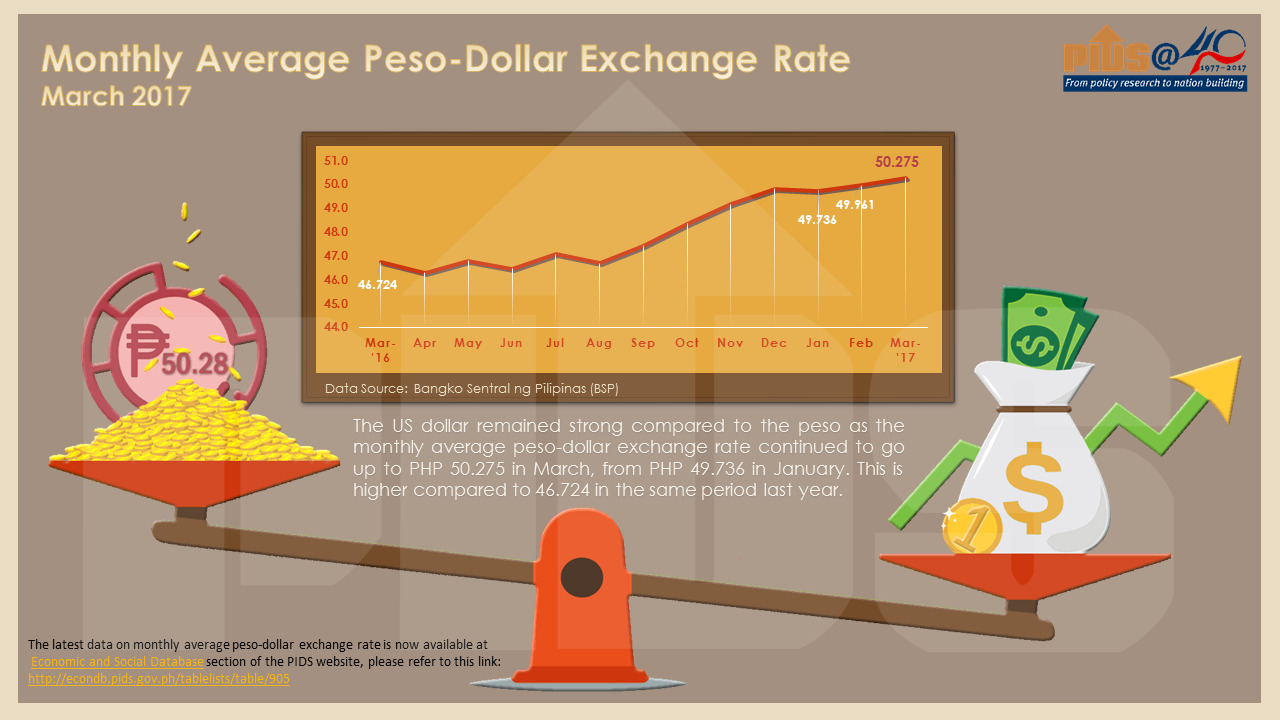

The strength of the US dollar plays a crucial role. Recent economic data from the United States, including inflation reports and employment figures, are impacting the dollar's value against other currencies. Furthermore, pronouncements from the US Federal Reserve regarding interest rate hikes or pauses significantly sway investor sentiment and currency valuations.

Philippine-specific factors also exert considerable influence. The performance of the Philippine economy, as measured by GDP growth, inflation rates, and balance of payments, affects the peso's value. Political stability and government policies concerning foreign exchange also play a role.

Central bank intervention, in this case by the Bangko Sentral ng Pilipinas (BSP), can stabilize the peso or prevent excessive volatility. The BSP's foreign exchange reserves and its willingness to use them to manage the currency market are closely watched by analysts.

Impact on Filipino Families Receiving Remittances

The Xoom exchange rate directly impacts the purchasing power of Filipino families who depend on remittances. A stronger peso means recipients receive fewer pesos per dollar remitted, potentially affecting their ability to cover essential expenses.

Conversely, a weaker peso translates to more pesos for every dollar, boosting household income. This increased income can be used for various purposes, including education, healthcare, and investments.

However, a weaker peso can also contribute to inflation. As imported goods become more expensive, the overall cost of living rises, potentially offsetting the benefits of increased remittance income. It is a delicate balancing act.

Perspectives from Recipients

"When the exchange rate is good, we can afford to buy more food and pay for our children's school fees," says Maria Santos, a recipient of remittances from her husband working in Saudi Arabia. "But when it's low, we have to tighten our belts."

"The fluctuations are stressful," adds Ricardo dela Cruz, whose daughter sends money from Canada. "It's hard to budget when you don't know how much you're going to receive each month."

Expert Analysis and Future Outlook

Economists offer varying perspectives on the future of the Xoom exchange rate. Some predict that the peso will remain relatively stable, while others foresee potential for further depreciation. Much depends on global economic trends and the BSP's policy decisions.

"We expect continued volatility in the currency market," says Dr. Elena Reyes, a professor of economics at the University of the Philippines. "The global economic outlook remains uncertain, and this will continue to put pressure on emerging market currencies like the peso."

The *World Bank* recently released a report suggesting that remittances to the Philippines will remain strong, but the impact on household income will depend on exchange rate movements and inflation levels. Investors are advised to monitor economic indicators closely and consider hedging strategies to mitigate currency risk.

Conclusion

The Xoom exchange rate remains a vital economic indicator for the Philippines. Its fluctuations have tangible consequences for millions of families relying on remittances. Understanding the complex interplay of factors influencing the rate, from global economic forces to local policy decisions, is crucial for individuals and policymakers alike. Moving forward, continuous monitoring of economic data and expert analysis is essential to navigate the ever-changing currency landscape and mitigate potential financial risks.