Xrp Bullish Breakout Predicts Surge To $4.40

The cryptocurrency market is abuzz with speculation as XRP, the digital asset associated with Ripple Labs, has recently exhibited a bullish breakout pattern, igniting fervent predictions of a substantial price surge. Some analysts are projecting a rise to as high as $4.40, a level not seen since the peak of the 2018 crypto boom. This potential rally comes amidst ongoing legal battles and regulatory uncertainty, making the forecast a point of intense debate within the digital asset community.

The projected surge to $4.40 hinges on the continuation of the recent bullish momentum, which has been fueled by positive developments in the ongoing lawsuit between Ripple and the Securities and Exchange Commission (SEC). This legal battle has cast a long shadow over XRP's price for several years. Key technical indicators, such as moving averages and relative strength index (RSI), are also pointing towards a potential upward trend.

Technical Analysis Fuels Optimism

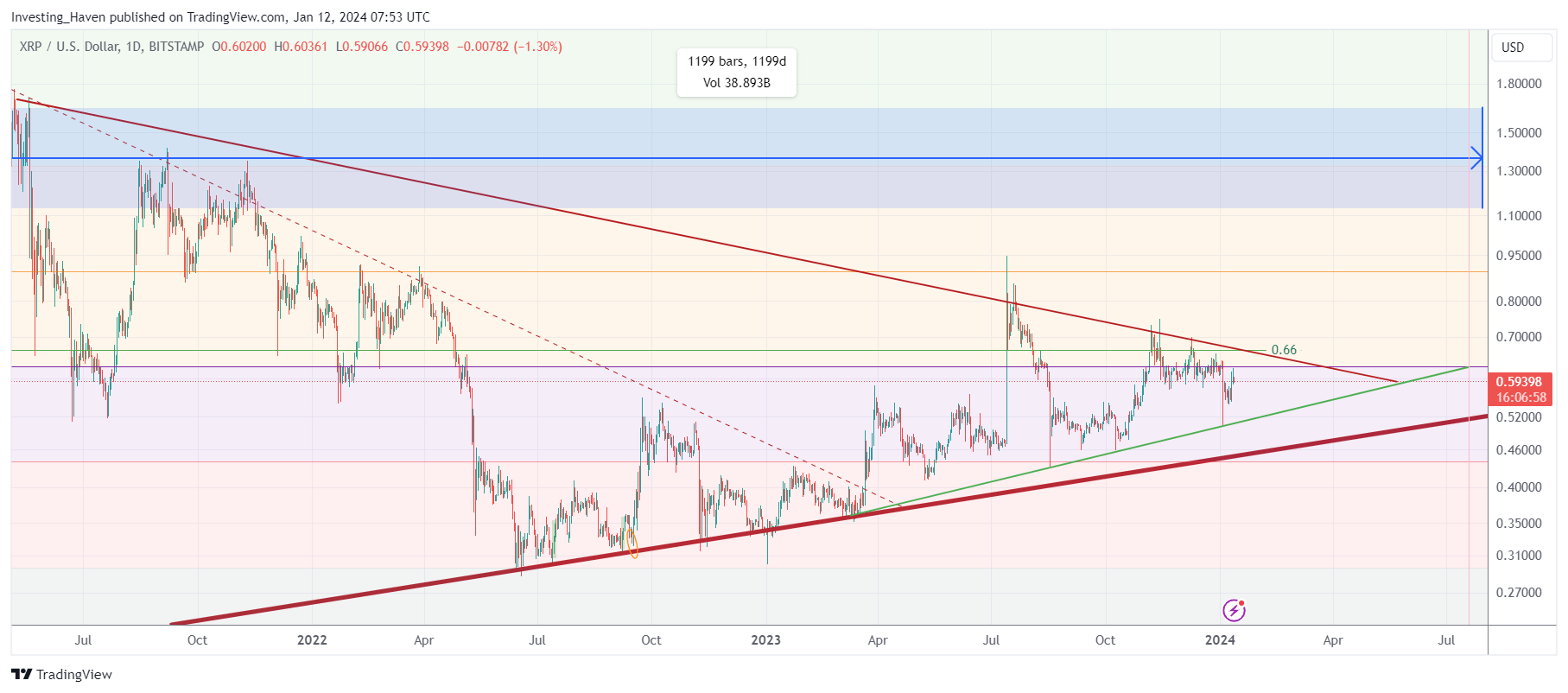

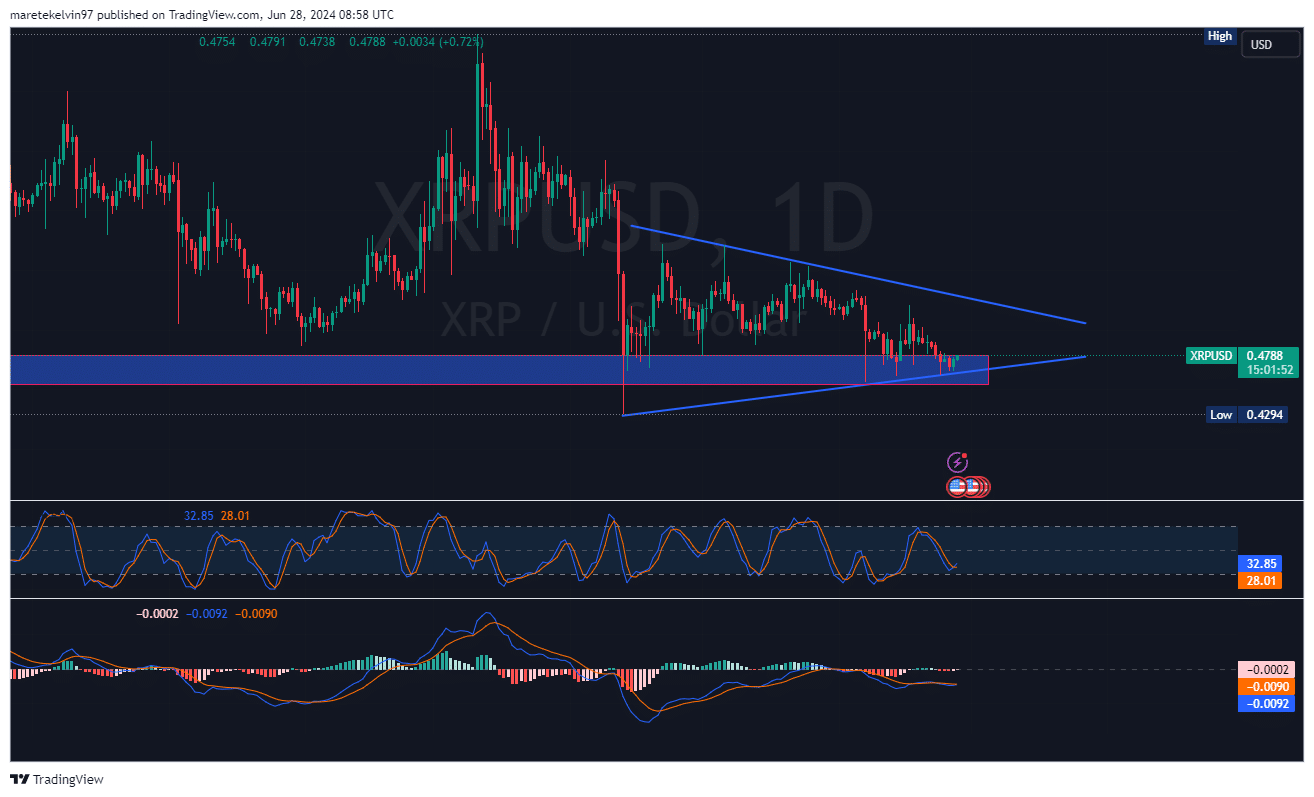

Several technical analysts have identified a bullish breakout pattern on XRP's price charts, suggesting a strong likelihood of further gains. This pattern, characterized by a break above a key resistance level, indicates increased buying pressure and investor confidence.

One popular crypto analyst, @CryptoBull2023 on Twitter, stated, "XRP is poised for a massive move. The breakout is confirmed, and $4.40 is the target." This prediction, while optimistic, highlights the prevailing sentiment among some technical traders.

However, other analysts urge caution. They believe that while the technical indicators are promising, the ongoing legal uncertainty surrounding Ripple could still impact XRP's price negatively.

The Importance of Resistance Levels

The immediate resistance level for XRP lies around $0.80. A decisive break above this level would further solidify the bullish outlook, potentially paving the way for a move towards $1.00 and beyond.

Conversely, failure to hold above critical support levels could invalidate the bullish scenario. Such a failure would trigger a price correction and potentially dampen investor enthusiasm.

The Ripple vs. SEC Lawsuit: A Key Factor

The ongoing lawsuit between Ripple and the SEC remains a significant driver of XRP's price volatility. The SEC alleges that Ripple's sale of XRP constituted an unregistered securities offering.

Positive developments in the case, such as favorable rulings for Ripple, tend to boost XRP's price. Conversely, negative news or unfavorable rulings can trigger sharp declines.

Ripple CEO Brad Garlinghouse has repeatedly expressed optimism about the outcome of the lawsuit. He stated, "We are confident that we will prevail in this case, and XRP will continue to thrive."

Potential Outcomes and Market Reactions

A favorable outcome for Ripple could lead to a significant surge in XRP's price, potentially exceeding the $4.40 target. A negative outcome, however, could have devastating consequences, potentially pushing the price back to near zero.

Legal experts believe that a settlement between Ripple and the SEC is also a possibility. Such a settlement could remove the regulatory uncertainty surrounding XRP and allow it to resume its normal trajectory.

Market Sentiment and Investor Behavior

Market sentiment towards XRP is currently bullish, driven by the positive technical indicators and the anticipation of a favorable outcome in the lawsuit. This positive sentiment has attracted new investors to the market.

However, it is essential to note that market sentiment can change rapidly. Unexpected events, such as regulatory crackdowns or negative news about Ripple, could quickly reverse the current bullish trend.

Investors should exercise caution and conduct their due diligence before investing in XRP or any other cryptocurrency. Understanding the risks involved is critical.

Alternative Perspectives and Cautions

While many analysts are optimistic about XRP's prospects, some experts caution against excessive exuberance. They argue that the cryptocurrency market is inherently volatile and unpredictable.

"Investing in cryptocurrencies is highly risky, and investors should only invest what they can afford to lose," warned Professor Emily Carter, a financial analyst at Harvard University.

Moreover, some critics argue that XRP's utility is limited compared to other cryptocurrencies. They believe that its primary purpose is to facilitate cross-border payments, a niche market that may not justify its current market capitalization.

Conclusion: A Risky Bet with High Potential Reward

The prediction of XRP surging to $4.40 is a bold one, driven by technical analysis, market sentiment, and optimism surrounding the Ripple vs. SEC lawsuit. While the potential reward is substantial, the risks are equally significant.

Investors should carefully weigh the potential benefits against the potential downsides before making any investment decisions. Remaining informed and exercising caution are crucial in the volatile world of cryptocurrency.

Ultimately, the future of XRP depends on a combination of factors, including the outcome of the lawsuit, market sentiment, and the broader macroeconomic environment. Only time will tell whether it reaches the ambitious target of $4.40.