Xrp Has Broken Out Of A Bullish Price Action Pattern.

Imagine a sun-drenched market, the air buzzing with anticipation. Traders lean forward, eyes glued to flickering screens, a collective breath held in anticipation. Charts paint a story, lines dancing like flames, and a palpable sense of something significant is about to unfold.

XRP, the digital asset often at the center of crypto conversations, has broken free from a well-established bullish price action pattern, signaling a potential shift in market sentiment. This breakout, observed by both seasoned analysts and retail investors, could mark the beginning of a new upward trajectory for XRP, though caution and thorough research remain paramount.

The Story So Far

To understand the significance of this breakout, we need to rewind and examine XRP's recent history. XRP, created by Ripple Labs, aims to facilitate faster and cheaper global payments.

It differs from traditional cryptocurrencies like Bitcoin and Ethereum in its consensus mechanism and intended use case. However, its journey has been far from smooth, facing regulatory hurdles and intense market scrutiny.

The most prominent challenge has been the ongoing legal battle with the U.S. Securities and Exchange Commission (SEC), which alleged that Ripple conducted an unregistered securities offering with XRP. This lawsuit has cast a long shadow over XRP's price and overall market perception, leading to periods of uncertainty and volatility.

Despite these legal headwinds, the XRP community has remained steadfast, believing in the technology and its potential. Ripple has continued to develop its payment solutions, partnering with financial institutions worldwide to improve cross-border transactions.

Throughout the legal proceedings, XRP's price action has been largely dictated by news and developments related to the case. Positive rulings or favorable comments from the judge have often triggered rallies, while negative news has led to price declines.

Decoding the Bullish Pattern

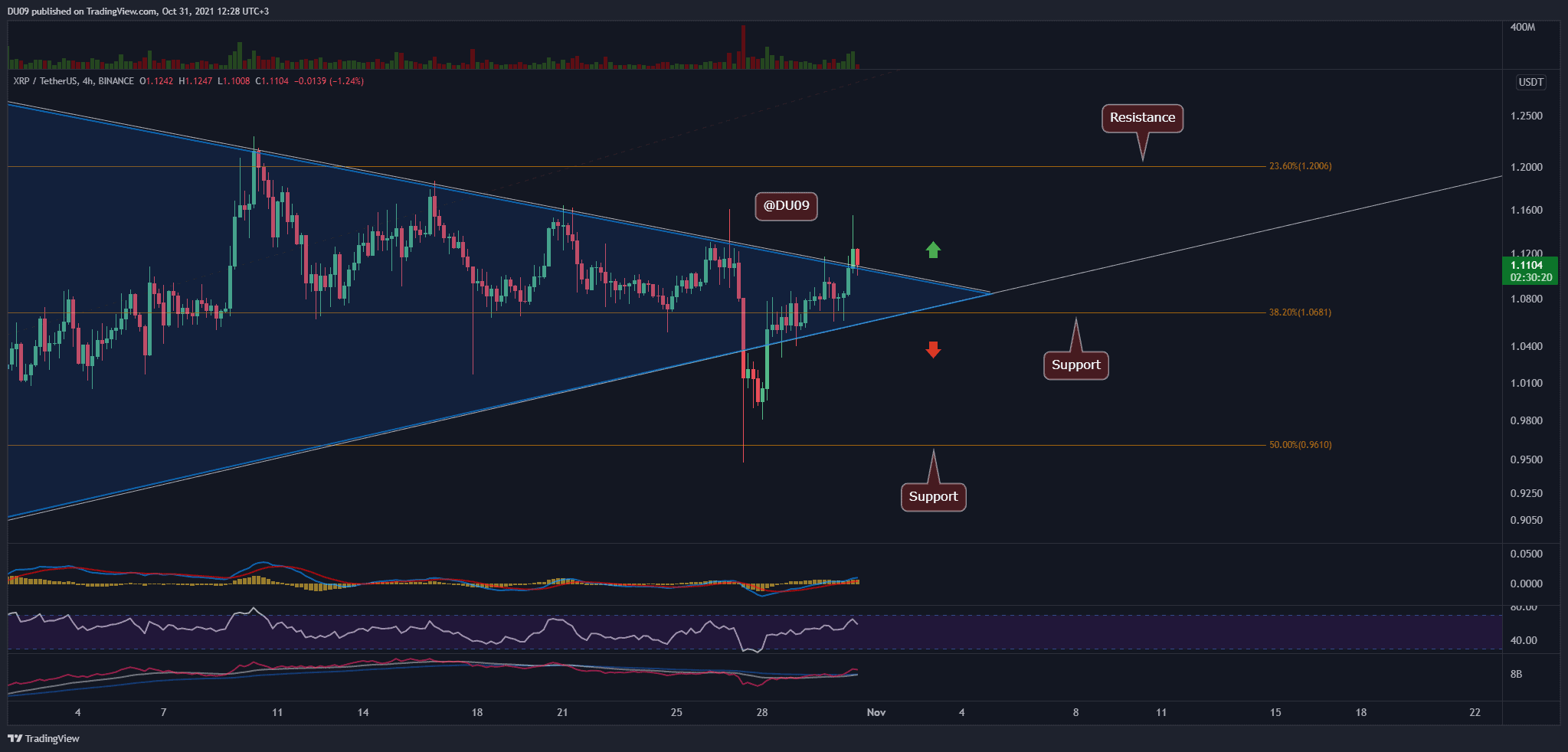

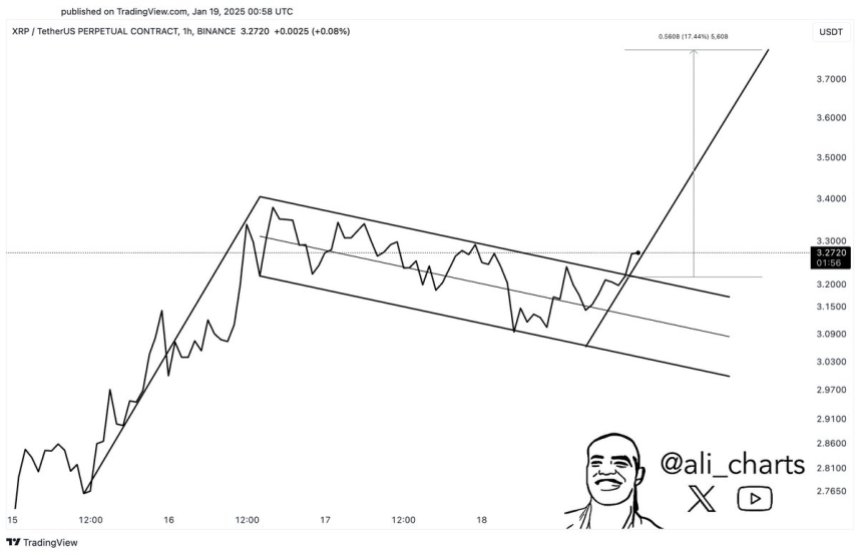

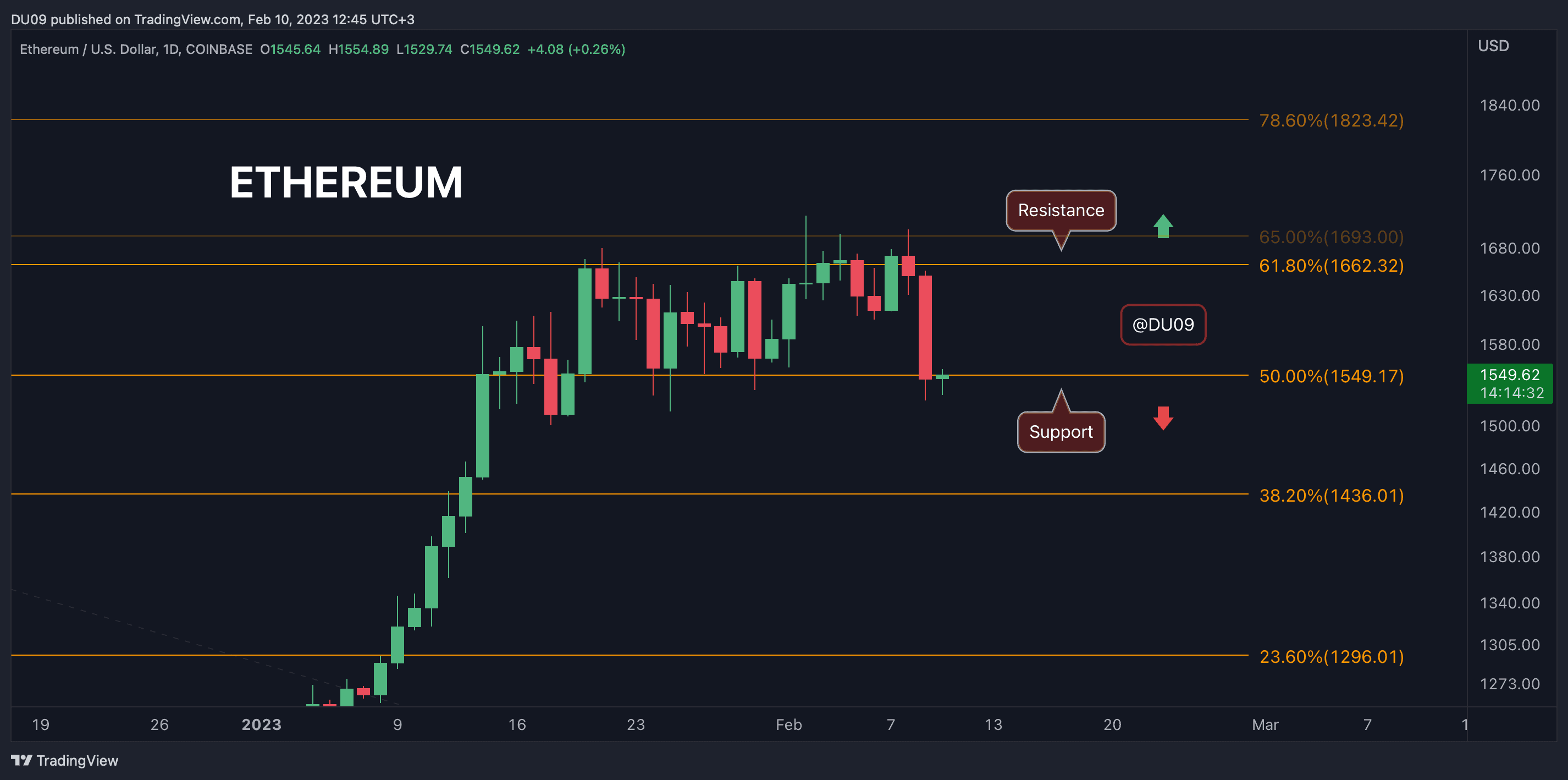

Technical analysts have been closely watching XRP's price charts, looking for patterns and signals that could indicate future price movements. One pattern that has garnered significant attention is a specific bullish formation that has been developing over the past several months.

While the specifics of the pattern (e.g., a descending triangle, a falling wedge) would be determined by detailed chart analysis, the key characteristic is its tendency to precede upward price movements once a breakout occurs.

A breakout happens when the price decisively moves above the upper resistance level of the pattern, suggesting that buying pressure is overwhelming selling pressure. This breakthrough is often considered a confirmation of the pattern's validity and can attract further buyers, potentially driving the price even higher.

Several factors could have contributed to this breakout. Positive developments in the Ripple-SEC case, such as favorable rulings or increased clarity on regulatory frameworks, could boost investor confidence and demand for XRP. Increased adoption of Ripple's payment solutions by financial institutions could also contribute to a positive outlook.

Furthermore, broader market sentiment towards cryptocurrencies as a whole can play a significant role. A rising tide lifts all boats, and a general bull market in crypto could provide additional momentum for XRP.

What's Next? Navigating the Waters

While the breakout from the bullish pattern is undoubtedly a positive sign, it's crucial to approach the situation with a balanced perspective. The cryptocurrency market is known for its volatility, and price movements can be unpredictable. No technical pattern guarantees future performance, and unforeseen events can quickly change the trajectory of the market.

Risk management is essential. Investors should carefully consider their risk tolerance and only invest what they can afford to lose. Setting stop-loss orders can help limit potential losses in case the price reverses direction.

It's also important to conduct thorough research and due diligence before making any investment decisions. Relying solely on technical analysis is not enough; understanding the underlying fundamentals of XRP, Ripple's business model, and the regulatory landscape is crucial for making informed choices.

Staying informed about the Ripple-SEC case is particularly important. Any new developments in the lawsuit could significantly impact XRP's price. Keeping abreast of news and analysis from reputable sources can help investors stay ahead of the curve.

Consider the broader market context. Is this breakout occurring during a broader crypto bull run, or is it an isolated event? Understanding the overall market trends can help assess the sustainability of the upward movement.

Ultimately, the future of XRP will depend on a combination of factors, including the outcome of the legal battle, the adoption of Ripple's technology, and the overall market environment. While the recent breakout is an encouraging sign, investors should remain vigilant and make informed decisions based on their own research and risk tolerance.

A Final Thought

The breakout of XRP from this bullish pattern symbolizes more than just a potential price increase. It represents the resilience and persistence of a digital asset that has weathered significant storms. Whether this marks the beginning of a sustained upward trend remains to be seen.

The journey of XRP serves as a reminder of the dynamic and ever-evolving nature of the cryptocurrency market. It is a space where innovation and uncertainty coexist, demanding both optimism and caution.

Regardless of what the future holds, the story of XRP is a fascinating one, filled with intrigue, challenges, and the unwavering belief of a dedicated community.