Xrp Whales Have Been Actively Trading The Coin.

Activity among XRP whales, entities holding substantial amounts of the cryptocurrency, has recently surged, drawing attention from market analysts and investors alike.

This increased trading volume, characterized by large transfers between wallets, raises questions about the potential drivers and ramifications for the price and overall stability of XRP. Examining these movements offers valuable insights into the sentiment and strategies of major players in the cryptocurrency market, a critical factor for both seasoned traders and newcomers.

Whale Activity: A Deep Dive

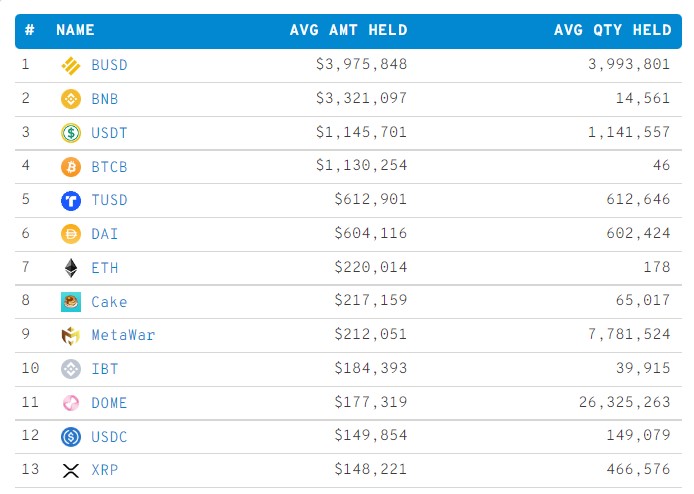

Data from blockchain analytics firms like Whale Alert and Santiment shows a noticeable uptick in large XRP transactions over the past few weeks.

These transactions, often involving millions of XRP tokens, are typically associated with whales, as smaller retail investors rarely move such significant amounts in a single transfer.

The increased activity manifests in various ways, including transfers to and from cryptocurrency exchanges, movements between private wallets, and even participation in decentralized finance (DeFi) platforms.

Key Details of Recent Transactions

One notable trend observed is the movement of XRP from exchange wallets to unknown or private wallets. This could indicate whales are accumulating XRP, possibly with the intention of holding it long-term or participating in staking programs.

Conversely, transfers from private wallets to exchanges often signal a potential intent to sell, which could exert downward pressure on the price. It is important to note that correlating transactions to specific causes, such as accumulation or distribution, requires in-depth analysis and careful considerations.

Identifying the motives behind these transactions necessitates looking into historical trends, broader market dynamics, and regulatory developments. The exact intentions are often opaque.

Possible Drivers and Interpretations

Several factors may be contributing to the increase in whale activity surrounding XRP. The ongoing legal battle between Ripple Labs, the company associated with XRP, and the U.S. Securities and Exchange Commission (SEC) is undoubtedly a significant influence.

Positive developments in the case can lead to increased buying pressure as whales anticipate a favorable outcome. Conversely, setbacks could trigger sell-offs, as large holders look to mitigate potential losses.

Broader market trends, such as the performance of Bitcoin and other major cryptocurrencies, can also influence XRP's price and whale activity. The overall sentiment in the cryptocurrency market is a crucial driving force.

The Ripple-SEC Lawsuit: A Constant Factor

The SEC's lawsuit against Ripple, alleging that XRP was offered as an unregistered security, has cast a long shadow over the cryptocurrency. Any update on the case is sure to trigger reactions in the market.

Investors closely monitor every legal filing and court decision. Even rumors, true or false, can impact XRP trading.

A decisive victory for Ripple could significantly boost XRP's price. But an unfavorable outcome could lead to further regulatory scrutiny and potential delisting from exchanges.

Impact and Implications

Increased whale activity can have a significant impact on XRP's price volatility.

Large buy orders can drive up the price quickly, while large sell orders can cause sharp declines. Smaller retail investors are particularly vulnerable to these sudden price swings.

The concentration of XRP in the hands of a few whales also raises concerns about market manipulation and the potential for unfair trading practices.

"Transparency is paramount in the cryptocurrency space," notes a recent report by CoinDesk, "and understanding whale movements is crucial for maintaining a level playing field."

Navigating the Volatility

For retail investors, it's crucial to exercise caution and conduct thorough research before investing in XRP or any other cryptocurrency. Understanding the potential risks associated with whale activity is paramount.

Diversifying investment portfolios and using risk management tools, such as stop-loss orders, can help mitigate potential losses. Investors should always be aware of their risk tolerance.

Staying informed about market news and regulatory developments is essential for making informed investment decisions. Don't follow trends blindly.

Looking Ahead

The activity of XRP whales will continue to be a key factor influencing the cryptocurrency's price and market dynamics. Monitoring these movements can provide valuable insights for investors seeking to navigate the volatile cryptocurrency landscape.

As the Ripple-SEC lawsuit progresses and the broader cryptocurrency market evolves, the actions of whales will undoubtedly shape the future of XRP.

Ultimately, understanding the drivers and implications of whale activity is essential for anyone seeking to participate in the XRP market, regardless of their investment size.