Xylene Industry Capacity And Capex Market

The global xylene industry is undergoing a period of significant expansion, driven by increasing demand from downstream sectors and strategic investments in new production capacities. Chemical companies worldwide are pouring billions of dollars into new facilities and upgrades, reshaping the competitive landscape and aiming to meet the growing needs of industries ranging from plastics and textiles to paints and coatings. This surge in capital expenditure (capex) is poised to have a profound impact on the market dynamics of this crucial petrochemical intermediate.

The xylene industry's current expansion and capital expenditure investments are important because they signal a growing global demand for xylene derivatives, especially purified terephthalic acid (PTA) used in polyester production. These investments will impact the availability and pricing of xylene and its derivatives, potentially influencing the profitability of downstream industries. Furthermore, the geographical distribution of these new capacities could shift trade patterns and impact regional economies.

Demand Drivers Fueling Expansion

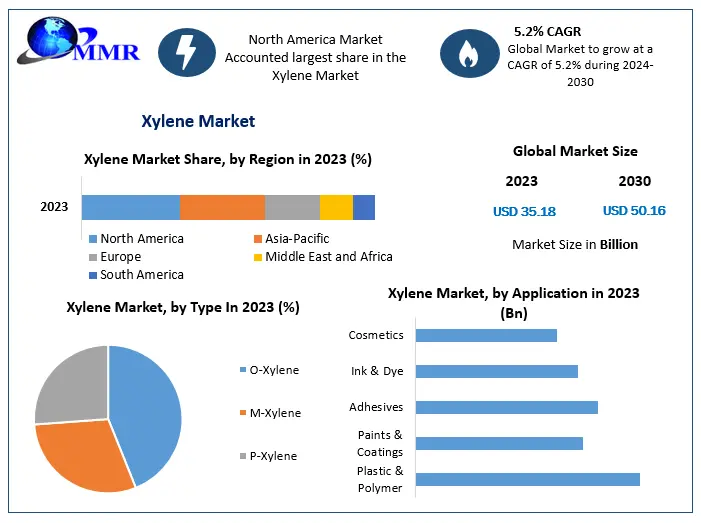

The primary driver behind the xylene industry's growth is the relentless demand for polyester fibers and PET resins. These materials, vital for textiles, packaging, and beverage bottles, rely heavily on PTA, which is derived from paraxylene (PX), a xylene isomer. The burgeoning middle class in developing economies, particularly in Asia, is fueling increased consumption of these products, pushing the demand for PX and, consequently, for mixed xylenes.

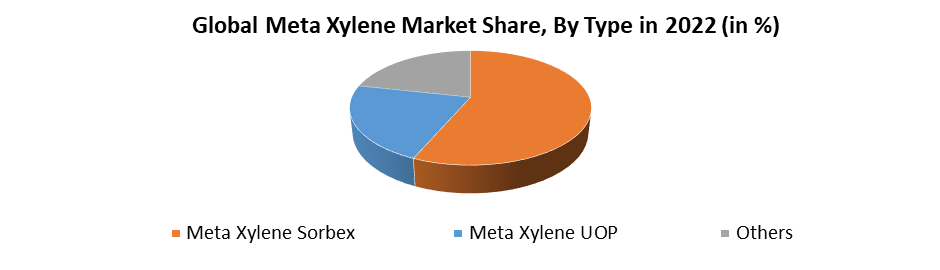

Another significant factor is the increased use of xylene as a solvent in various industrial applications. While regulatory pressures are pushing for greener alternatives, xylene remains a cost-effective and widely used solvent in paints, coatings, adhesives, and printing inks. This sustained demand contributes to the overall robustness of the xylene market.

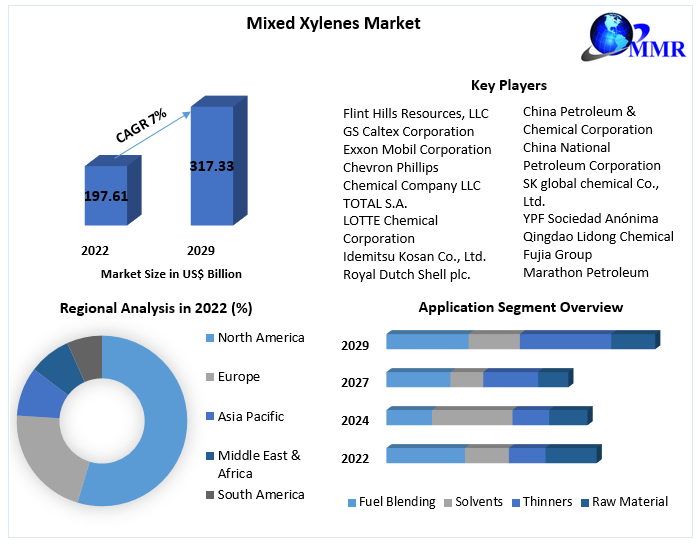

Key Players and Investment Hotspots

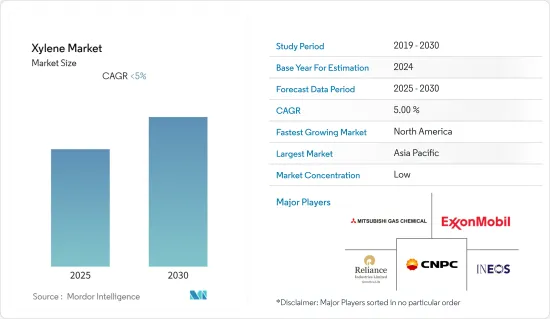

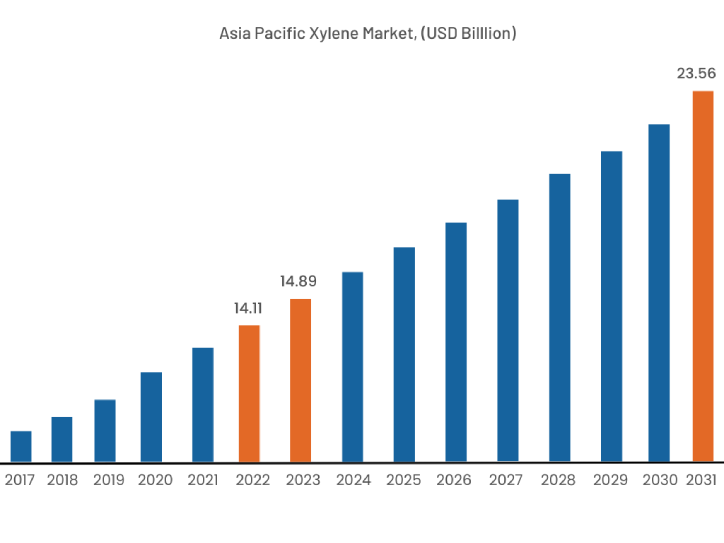

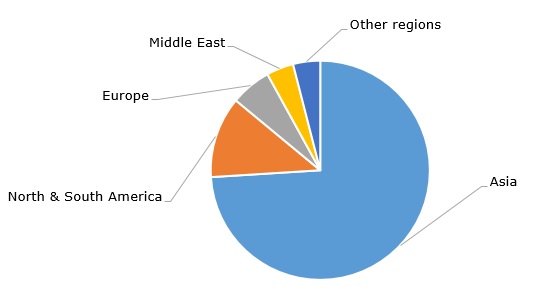

Asia-Pacific is the epicenter of this expansion, with China and India leading the charge in terms of new capacity additions. Major petrochemical companies in these countries are investing heavily in integrated refinery and petrochemical complexes, aiming to secure their supply chains and cater to domestic demand. Several projects are underway to increase the amount of xylene and downstream derivatives.

Outside of Asia, the Middle East and North America are also witnessing significant investment activity. The availability of competitively priced feedstock, such as natural gas and shale gas, is attracting investments in these regions. Companies in the United States are leveraging their access to shale gas to produce xylene and other petrochemicals for both domestic consumption and export.

Regional Capex Breakdown

“The Asia-Pacific region will account for the lion’s share of the new xylene capacity additions over the next five years,” according to a recent report by IHS Markit. “This trend is expected to continue as the region’s demand for polyester and PET continues to outpace that of other regions."

The Middle East is seeing significant investment in integrated refinery and petrochemical complexes, aimed at diversifying their economies away from crude oil exports. These projects often include xylene production units to capitalize on the growing global demand.

North America's investments are primarily focused on leveraging the shale gas advantage to produce xylene and its derivatives. This allows companies to access cheaper feedstock, making them more competitive in the global market.

Impact on Market Dynamics

The influx of new xylene capacity is expected to intensify competition among producers. This increased supply could potentially lead to lower prices, benefiting downstream industries that rely on xylene as a feedstock. However, the impact on prices will also depend on the overall global economic conditions and the supply-demand balance in other related petrochemical markets.

The geographical distribution of these new capacities could also reshape trade patterns. Asian countries are expected to become even more dominant players in the xylene market, potentially increasing their exports to other regions. This could lead to a shift in the global supply chain and impact the competitiveness of producers in other parts of the world.

Environmental Considerations and Sustainability

The expansion of the xylene industry raises concerns about its environmental impact. Xylene is a volatile organic compound (VOC) and can contribute to air pollution. Increased production necessitates stricter environmental regulations and the adoption of cleaner production technologies.

Many companies are investing in research and development to find more sustainable alternatives to xylene. Bio-based solvents and other innovative technologies are being explored to reduce the industry's environmental footprint. The long-term sustainability of the xylene industry will depend on its ability to address these environmental challenges.

Conclusion

The xylene industry is currently experiencing a period of robust growth, driven by strong demand from downstream sectors and strategic investments in new capacities. This expansion is reshaping the competitive landscape and has the potential to impact market dynamics, trade patterns, and environmental considerations. While the future remains uncertain, the xylene industry's continued growth hinges on adapting to environmental pressures and meeting the evolving needs of a globalized market.