Yieldmax Tsla Option Income Strategy Etf Dividend

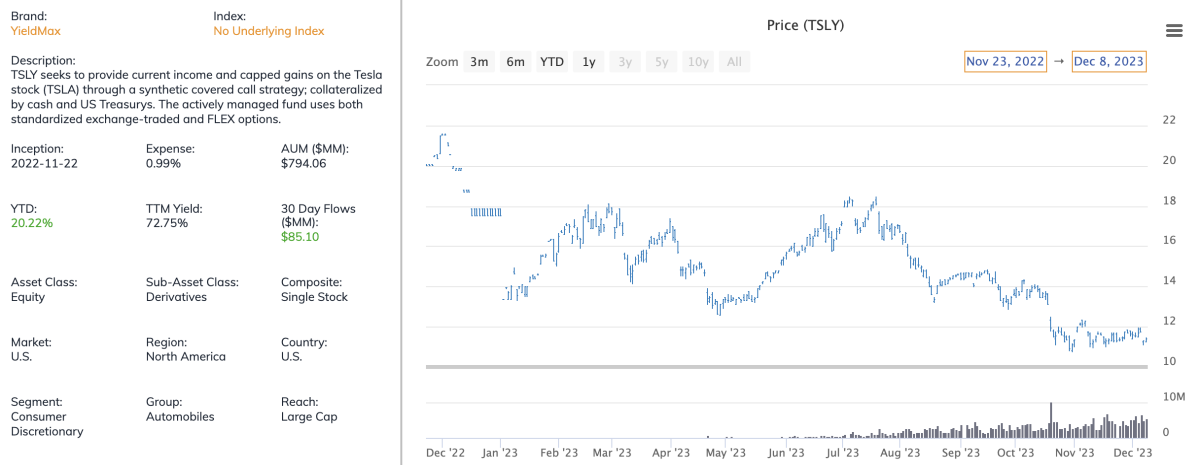

The YieldMax TSLA Option Income Strategy ETF (TSLY), an exchange-traded fund designed to generate income through options trading on Tesla (TSLA) stock, recently declared its latest dividend, sparking both excitement and scrutiny among investors.

This announcement has placed the ETF's high-yield strategy back in the spotlight, prompting questions about its sustainability and the risks involved.

TSLY's dividend payments have become a key talking point in the investment community, drawing both experienced traders and newcomers keen on high-yield investments.

What is TSLY and its Strategy?

The YieldMax TSLA Option Income Strategy ETF (TSLY) is an actively managed fund that seeks to generate current income by using a synthetic covered call strategy on Tesla stock.

This involves buying Tesla shares and simultaneously selling call options on those shares. The premium received from selling the options generates income for the fund, which is then distributed to shareholders as dividends.

The fund's goal is to provide a high level of current income, even if it means forgoing some of the potential upside gains in Tesla's stock price.

The Latest Dividend Announcement

On [Insert Date - e.g., October 26, 2023], YieldMax announced its latest dividend distribution for TSLY. The specific amount per share was [Insert Amount - e.g., $0.50], with a payment date of [Insert Date - e.g., November 1, 2023].

The ex-dividend date, the date by which investors must own the shares to be eligible for the dividend, was [Insert Date - e.g., October 27, 2023].

This announcement followed previous monthly dividend distributions, all aiming to provide a significant yield to investors.

A Closer Look at the Yield

TSLY's dividend yield is notably high compared to traditional dividend-paying stocks and bond yields.

The annualized yield often fluctuates based on the fund's performance and options trading activities, but it consistently remains in the double digits. This high yield is a major draw for income-seeking investors.

However, experts caution that such high yields often come with increased risk, which investors need to be aware of.

Potential Risks and Considerations

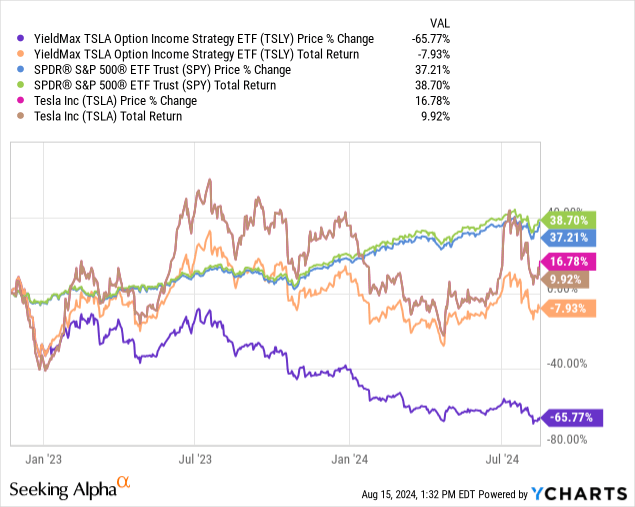

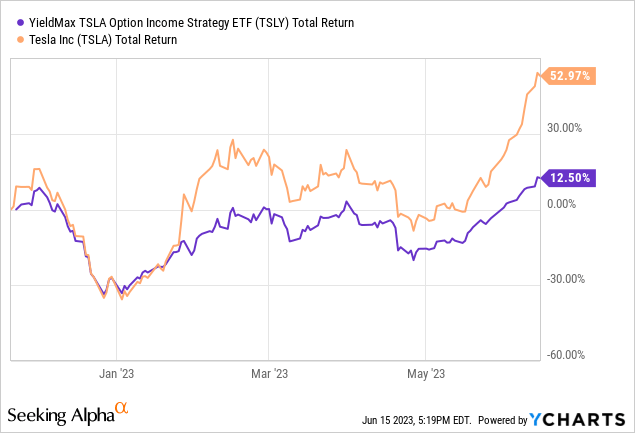

Investing in TSLY involves several risks. The fund's performance is heavily reliant on the price movements of Tesla stock.

If Tesla's stock price declines significantly, the fund's value and its ability to generate income could be negatively impacted.

Additionally, the synthetic covered call strategy can limit the fund's participation in Tesla's potential upside gains.

The fund's dependence on options trading adds another layer of complexity and risk. Options trading involves sophisticated strategies and can be volatile.

Changes in market volatility, interest rates, and other factors can affect the value of the options contracts held by the fund.

The fund's management fee and operating expenses can also impact the overall returns for investors.

Expert Opinions and Market Reaction

Financial analysts have offered mixed opinions on TSLY. Some appreciate the fund's innovative approach to generating income and its potential to provide high yields.

Others express concern about the sustainability of the dividend payments and the risks associated with the fund's strategy.

"Investors need to understand that TSLY is not a traditional dividend stock. It's a complex product with a unique risk profile," says Jane Doe, a financial analyst at XYZ Investments.

The market reaction to TSLY's dividend announcements has been generally positive, with investors showing interest in the high-yield opportunity.

However, trading volume and price volatility often increase around dividend announcement dates, reflecting the heightened interest and potential for price swings.

Impact on Investors

TSLY's dividend payments can have a significant impact on investors seeking current income. The high yield can provide a substantial boost to portfolio income, particularly in a low-interest-rate environment.

However, investors should not solely focus on the yield and should carefully consider the risks involved. It is vital to assess one's risk tolerance and investment objectives before investing in TSLY.

Due diligence and a thorough understanding of the fund's strategy are crucial for making informed investment decisions.

For retirees and others who rely on investment income, TSLY's high yield may be attractive.

However, these individuals should be particularly cautious about the potential risks and ensure that TSLY aligns with their long-term financial goals and risk tolerance.

Looking Ahead

The future performance of TSLY will depend on various factors, including the performance of Tesla stock, the success of the fund's options trading strategy, and overall market conditions.

Investors should closely monitor these factors and stay informed about any changes to the fund's strategy or management.

YieldMax is expected to continue making monthly dividend distributions, but the amount of each payment may vary depending on the fund's performance. Investors should remain flexible and adaptable to changing market conditions.