Difference Between 2d And 3d Payment Gateway

Ever bought something online and felt that little jolt of… is this *really* safe? That's your brain dealing with the mysteries of payment gateways, the unsung heroes (or sometimes villains) of online shopping.

Today, we're diving into the difference between two types: 2D and 3D payment gateways.

2D Payment Gateways: The Wild West of Online Shopping

Think of a 2D payment gateway as the online equivalent of handing your credit card to a waiter in a bustling restaurant. They disappear into the back, swipe your card, and return with a receipt. You're trusting them, and the restaurant's security, to keep your card details safe.

With 2D, you typically just enter your card number, expiry date, and CVV. It’s quick, easy, and sometimes… a bit *too* easy. This simplicity, while convenient, can be a playground for fraudsters.

Imagine someone’s hacked your email and found your credit card details stored in a less-than-secure document. With a 2D gateway, they could potentially go on a shopping spree before you even realize what's happening! Scary, right?

3D Payment Gateways: The Bodyguards of Your Bank Account

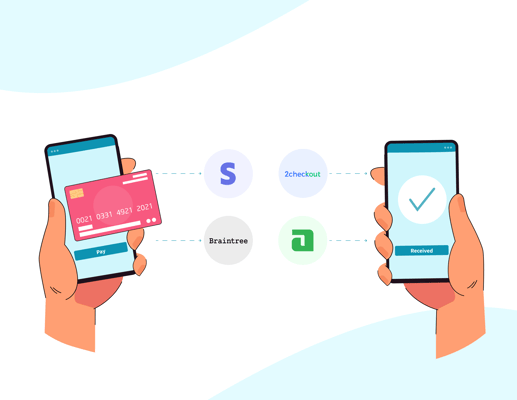

Now, picture the 3D payment gateway as having a personal bodyguard for your bank account. Before any transaction goes through, this bodyguard (in the form of an extra verification step) demands to see some ID. In most cases, that's a one-time password (OTP) sent to your phone.

It’s like a secret handshake between you and your bank, confirming it's *really* you making the purchase. This added layer of security is known as 3D Secure authentication.

You might be familiar with names like Verified by Visa or Mastercard SecureCode. These are examples of 3D Secure protocols. They are designed to prevent fraudulent transactions by adding an extra step of authentication.

The Not-So-Secret World of OTPs

We’ve all been there: desperately searching for that blinking cursor in the OTP field while the timer ticks down. It can be a minor inconvenience, but it’s worth it for the peace of mind.

Think of it this way: that slight delay is a tiny price to pay for keeping your hard-earned money safe from cyber-crooks. Besides, who doesn't love feeling like a secret agent entering a crucial code to save the world (or at least, your credit card limit)?

So, Which is Better?

While 2D gateways offer a smoother, faster checkout experience, they come with higher risk. 3D gateways, with their added security, provide greater protection against fraud.

It's a classic trade-off: convenience versus security. Most reputable online retailers now use 3D Secure to protect their customers and themselves from fraudulent transactions.

The choice ultimately depends on the risk appetite of the business and the preferences of the customer. Many businesses choose a hybrid approach, offering both options and allowing customers to select the method they are most comfortable with.

"In the world of online payments, knowledge is power," says Professor Fintech, a leading expert in digital finance. "Understanding the difference between 2D and 3D payment gateways is the first step towards making informed decisions and protecting your financial well-being."

So, the next time you're buying something online, take a moment to appreciate the unsung heroes working behind the scenes. They might be invisible, but they're crucial for keeping your online shopping experiences safe and secure. Happy shopping!