How Much Coverage Does 9.95 With Colonial Penn

Okay, let's talk about life insurance! Specifically, that famous plan from Colonial Penn, the one you see advertised with Alex Trebek (may he rest in peace!). It's the one that always asks, "9.95 a month – is that all?"

Well, buckle up, buttercup, because we're about to dive into what that "$9.95" actually gets you. We're going to tackle the coverage, and we're going to do it with a smile!

So, How Much Coverage Are We Talking?

Here's the deal: that $9.95 doesn't buy you a yacht-sized inheritance. Think of it more like a charming rowboat. It gets you somewhere, but it's not going to circumnavigate the globe.

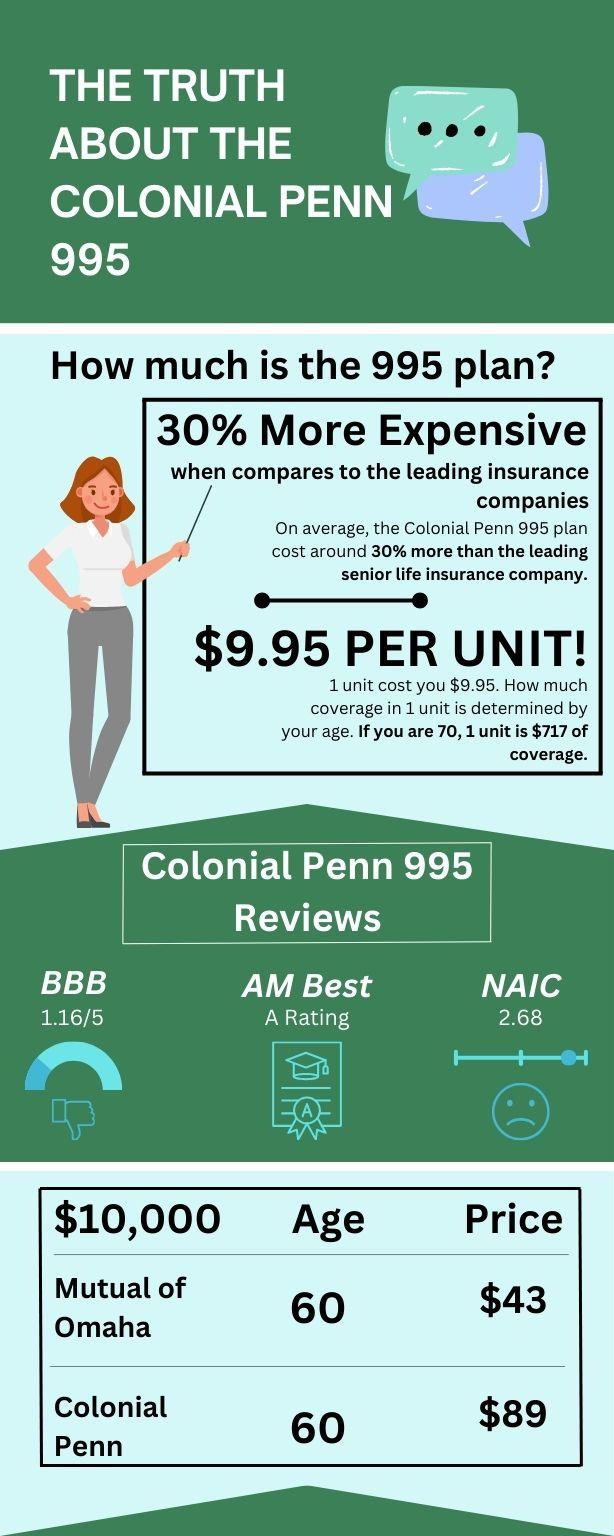

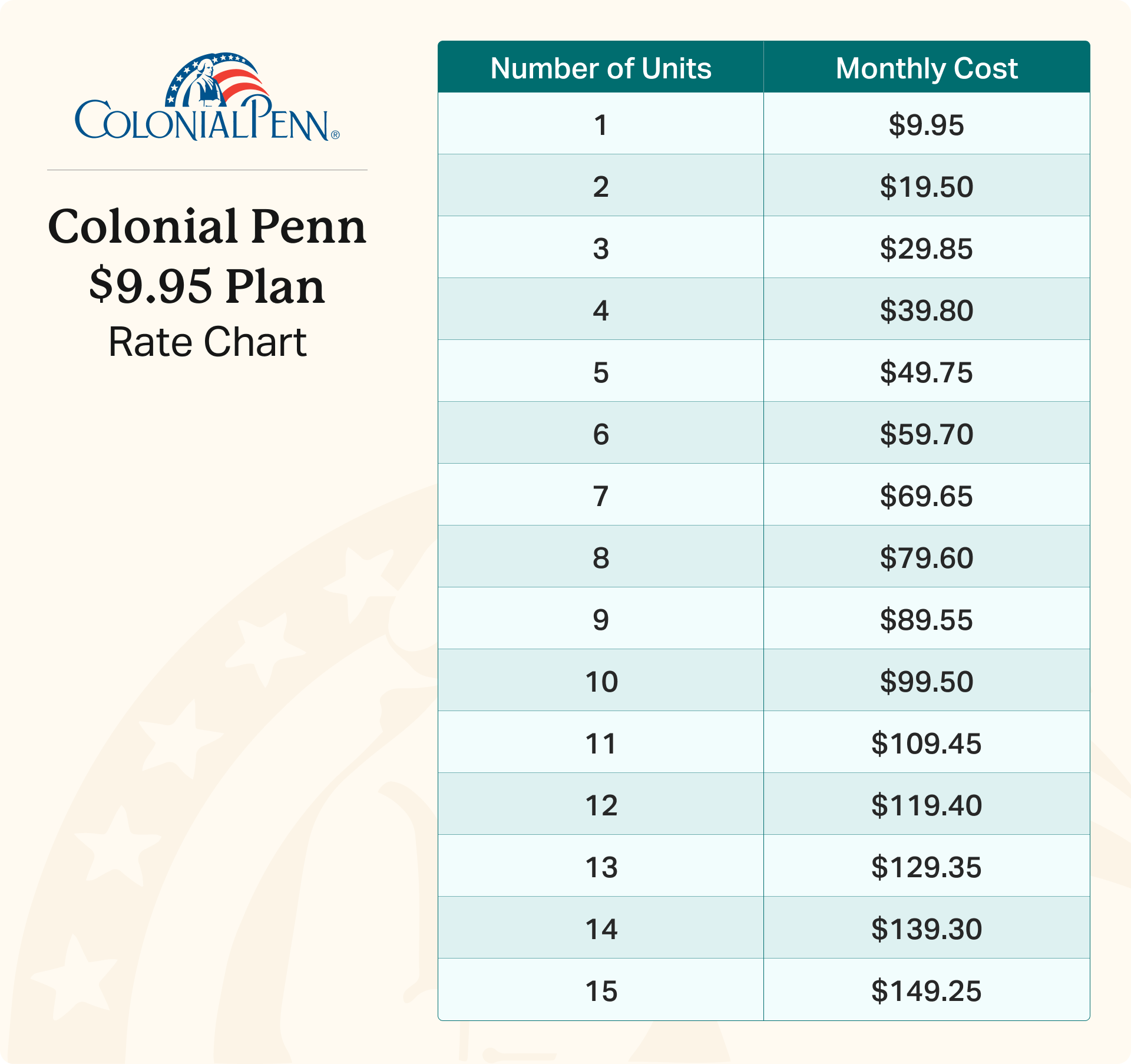

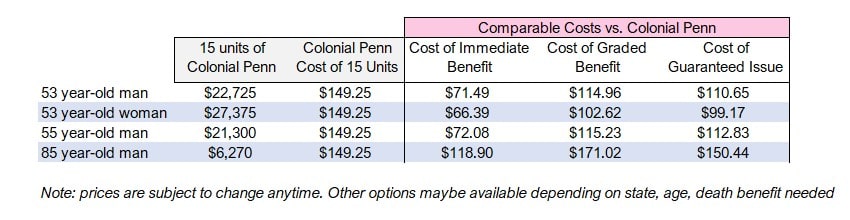

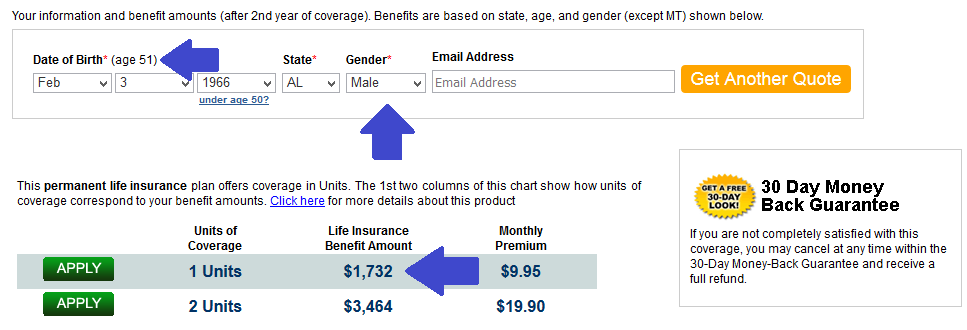

With Colonial Penn's plan, you buy units of coverage. Each unit costs $9.95 a month. The amount of coverage you get per unit depends on your age and gender. It's like a sliding scale of awesomeness (or, you know, life insurance benefits!).

Let's Break it Down (Without Too Much Math!)

Imagine a sprightly 50-year-old. They might get, say, $1,900 of coverage for that single unit costing $9.95. Now, picture a wise and wonderful 75-year-old. They might get closer to $400 for the same unit.

Why the difference? The younger you are, statistically, the longer you're likely to stick around, right? So, the insurance company can offer more coverage for the same price.

Basically, less risk for them equals more potential reward for you. Age plays a big role!

Is It the Right Choice for You?

Now, the big question: is this the golden ticket to securing your family's financial future? Well, that depends.

For some folks, it's a great starting point! Maybe you're on a tight budget but want to leave something behind. Or perhaps you just need a little extra cushion for final expenses.

Think of it as a safety net. Maybe not a trampoline, but definitely a net.

However, if you're dreaming of paying off your mortgage and sending all your grandkids to college with your life insurance policy alone... well, you might need a bigger boat (or a more comprehensive policy).

Seriously, you might need to scale up a bit.

The Upsides and Downsides (A Quick Peek!)

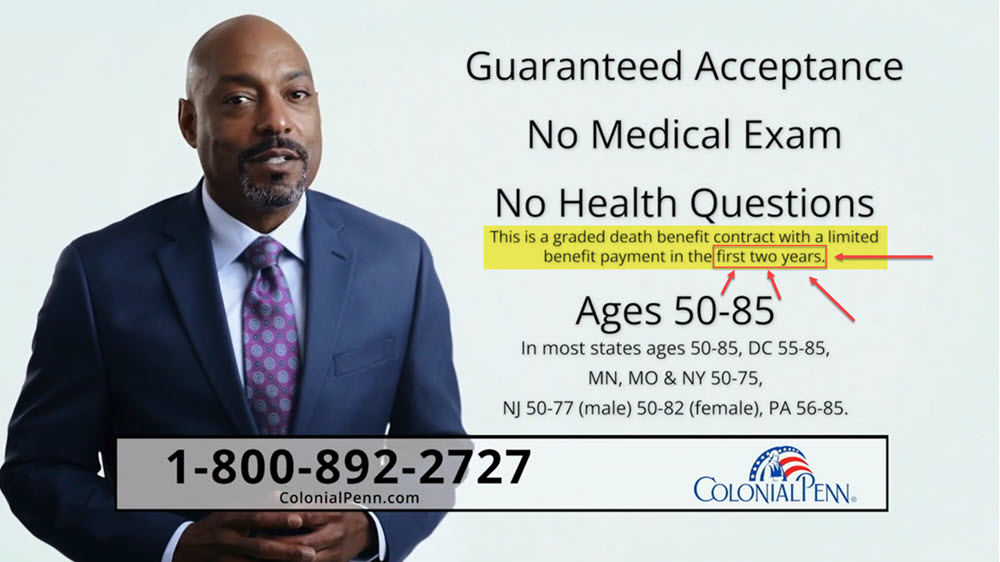

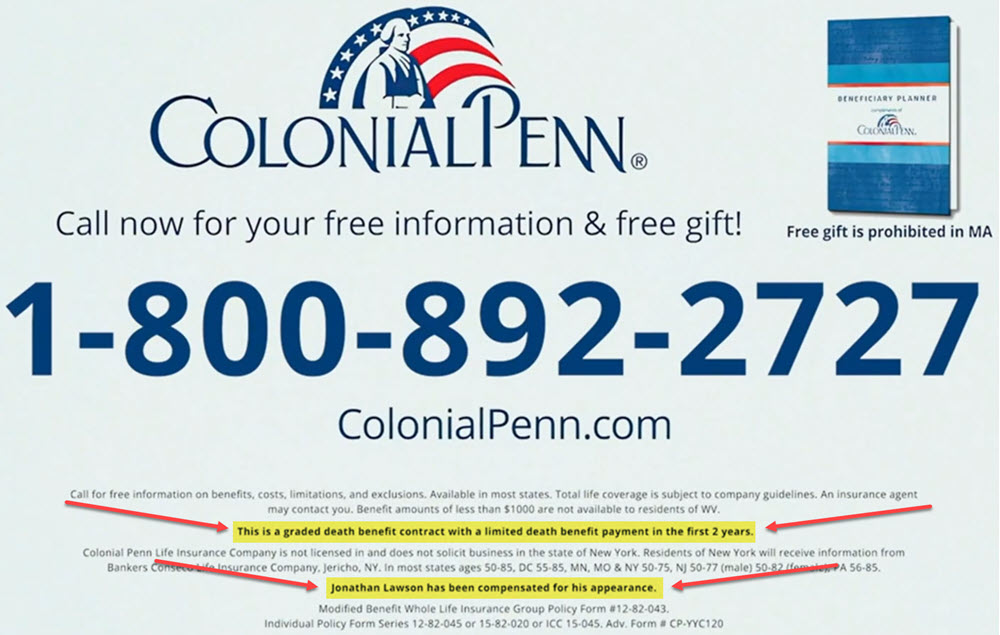

The Good: Easy to understand, no medical exam (usually!), and affordable monthly payments.

The Not-So-Good: The coverage amount might be relatively small compared to other policies.

"Think of it like this: it's a good starter kit, but you might need to upgrade to the deluxe edition eventually!"

It all depends on your individual needs and circumstances. What are your goals? What can you comfortably afford?

Do Your Homework!

The best advice? Don't just take my word for it (or Alex Trebek's, bless his soul!). Get a quote from Colonial Penn. Compare it to other options. Talk to a financial advisor.

Shop around, kick the tires, and make sure you're getting the coverage that's right for you and your loved ones. And hey, while you're at it, treat yourself to a nice cup of tea. You deserve it!

Life insurance doesn't have to be scary. It can be empowering! Just remember to do your research and choose wisely.

Now go forth and conquer, secure in the knowledge that you're one step closer to financial peace of mind. Good luck!