How Much Coverage For 9.95 Colonial Penn

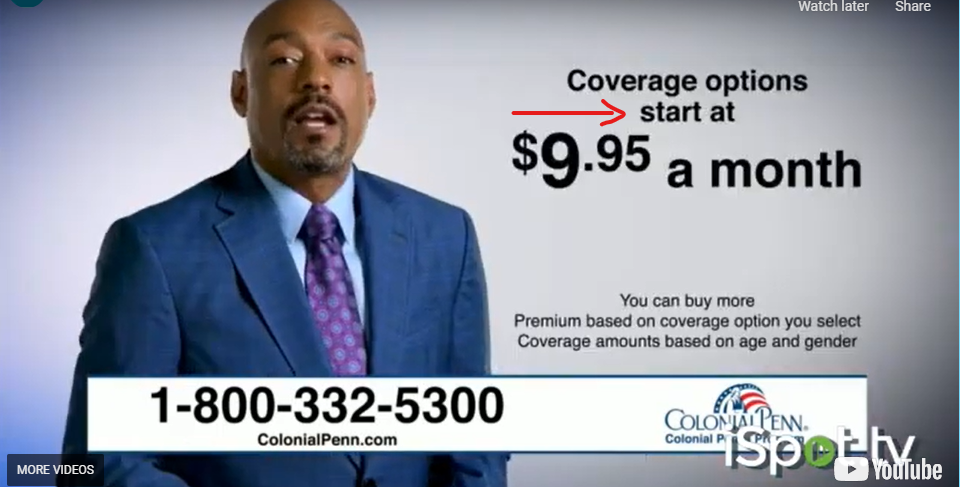

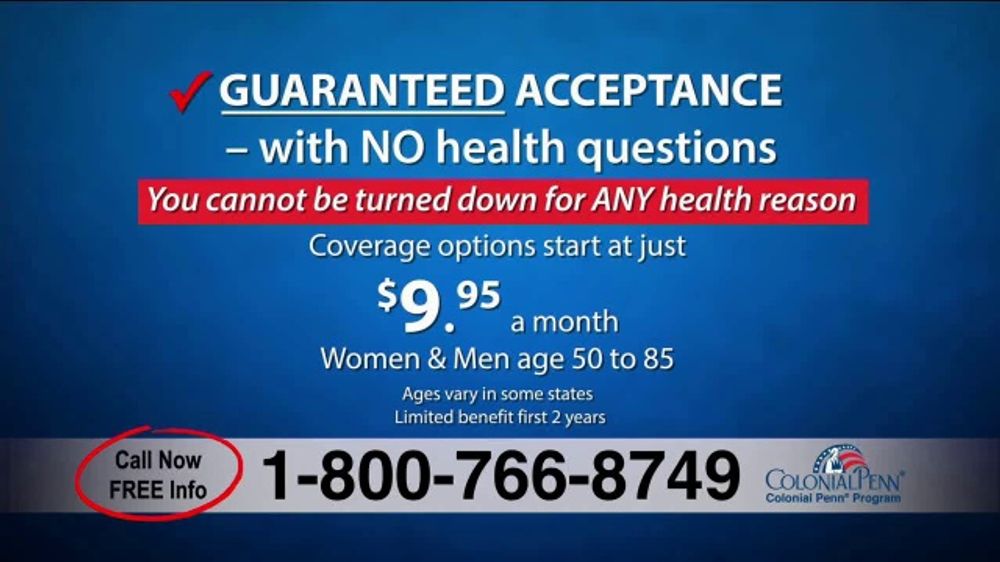

Okay, let's talk about something everyone knows: that Colonial Penn ad. You know, the one with the unbelievably catchy jingle and the promise of life insurance for just $9.95 a month?

But the real question is: How much are we actually talking about? Let's be honest, that's the part that makes most people scratch their heads.

The "$9.95 Question"

So, you're picturing yourself, set for life, all thanks to that affordable monthly premium. Hold your horses! It's not quite as simple as that.

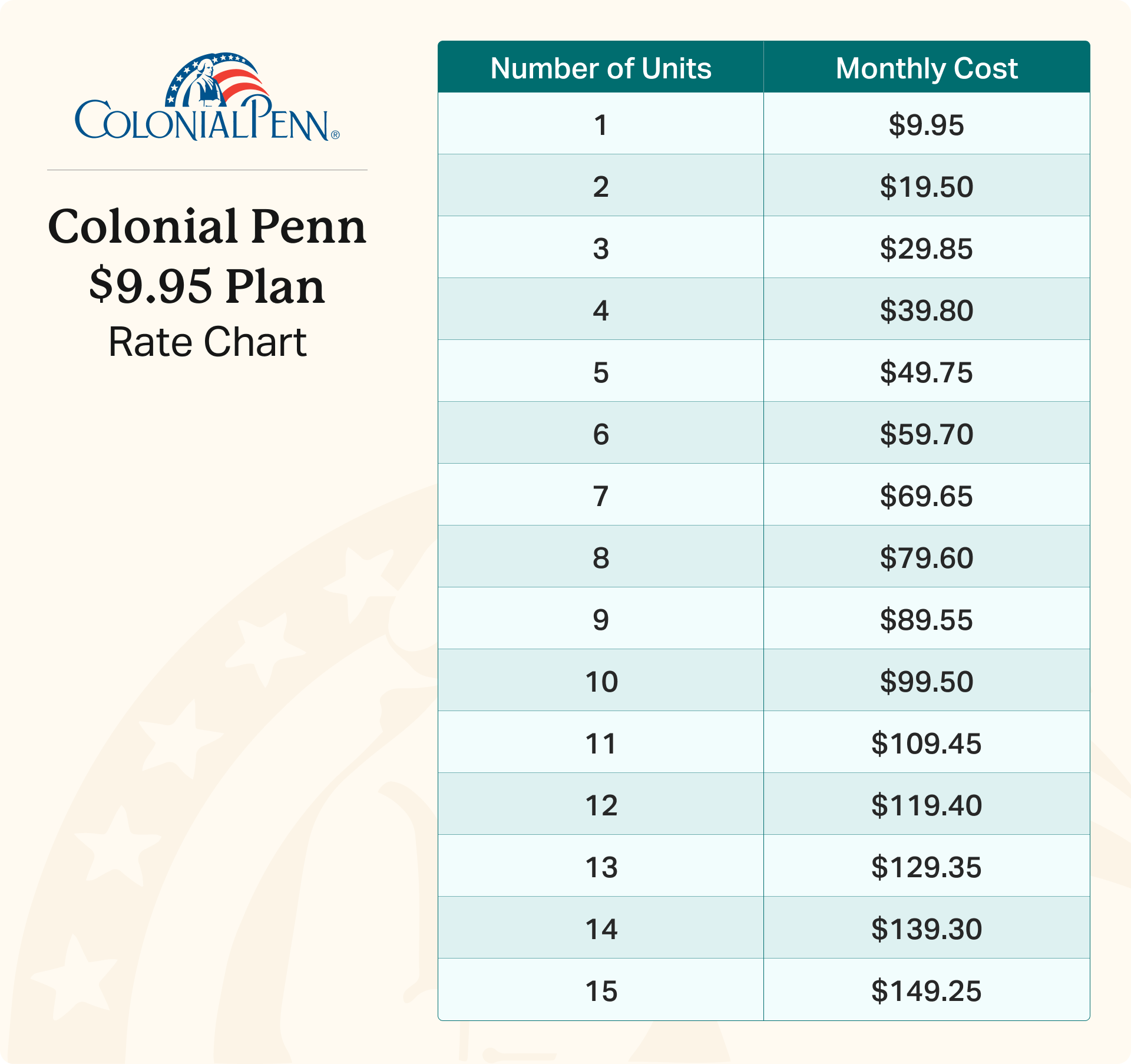

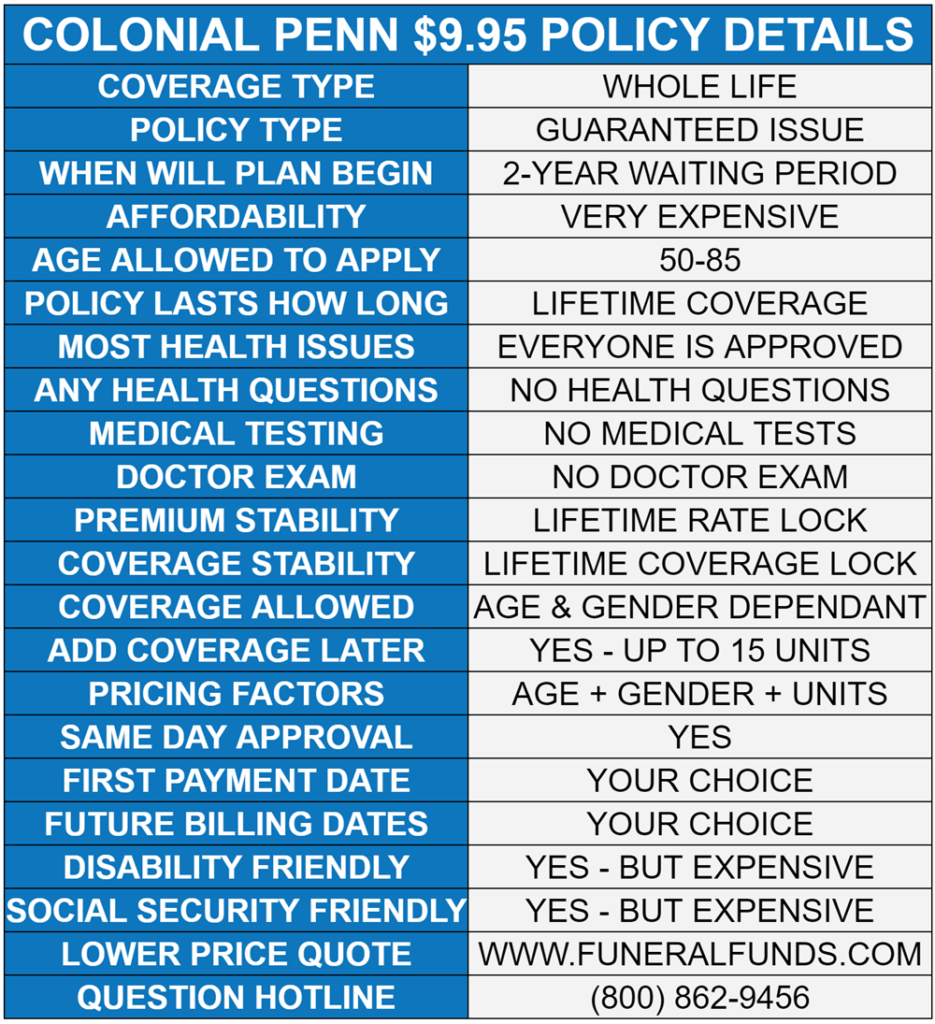

The catch? The $9.95 doesn't buy you a fixed amount of coverage. Instead, it buys you one "unit" of coverage.

What is a "Unit" Anyway?

Think of a "unit" like a slice of pizza. Each slice costs the same ($9.95), but the size of the slice (the amount of coverage) depends on your age and sex.

The older you are, the smaller the "slice" you get. Makes sense, right? The insurance company needs to balance the books somehow!

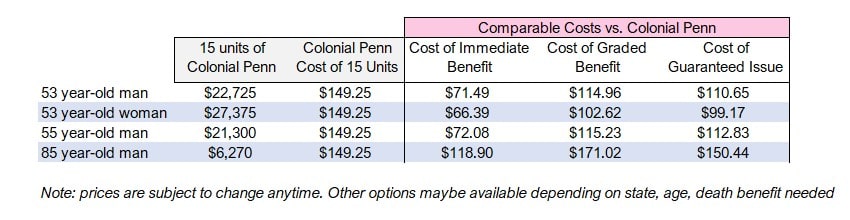

For example, a young, healthy 30-year-old might get significantly more coverage per unit than a 70-year-old. A 40-year-old woman could receive about $1,800.

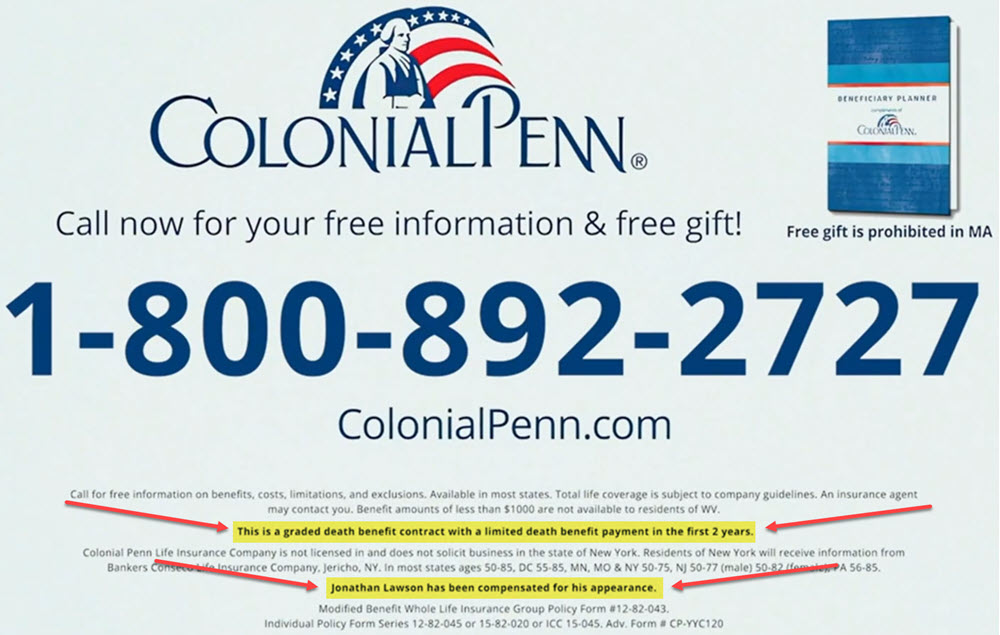

The Fine Print Fiesta

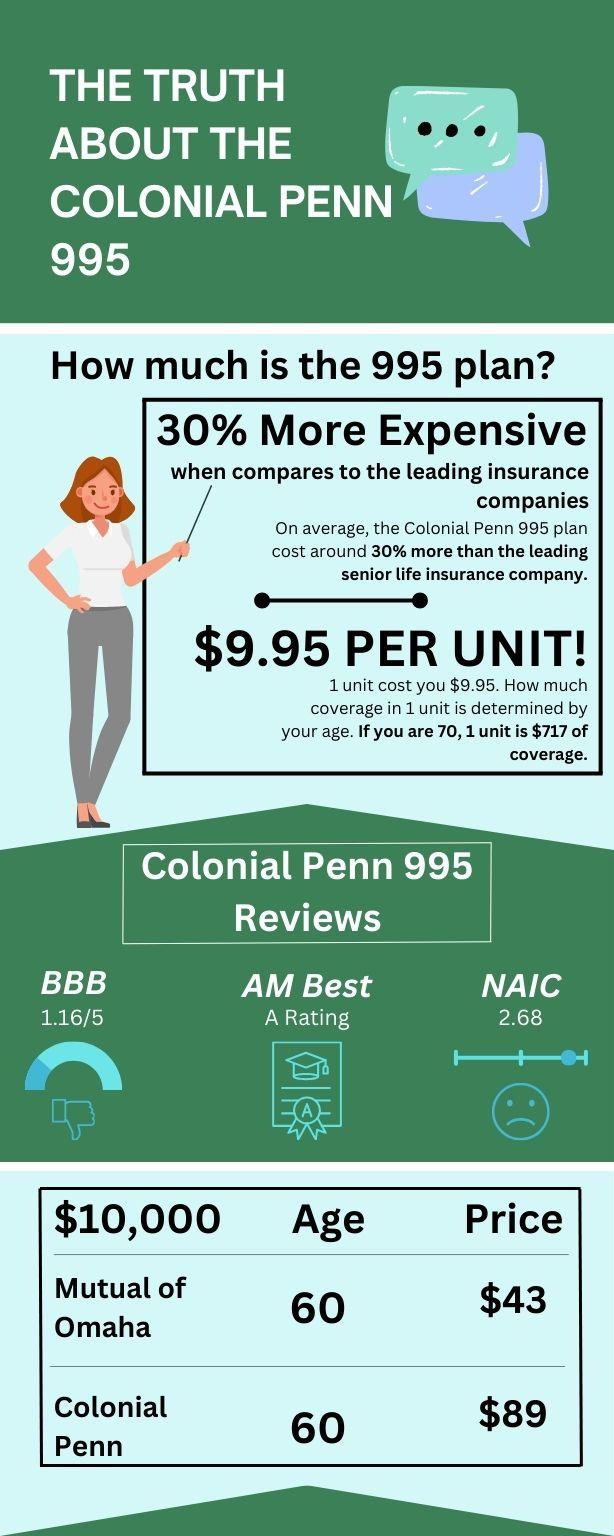

Now, I know what you are thinking: "What’s the real coverage amount?" It varies wildly. This is where the fine print comes into play, folks.

Here's where things get interesting. Colonial Penn doesn’t exactly shout the exact coverage amounts from the rooftops. You’ll have to request personalized information to see what a unit actually buys *you*.

Imagine a birthday party where everyone gets cake, but the slices are different sizes. Some get tiny slivers, others get generous wedges. The price? Still the same!

Why All the Mystery?

Why the secrecy? Well, it's not *secrecy*, exactly. It's more like… personalized pricing. Each person's situation is unique, so the coverage amount varies accordingly.

It allows Colonial Penn to offer insurance to a wider range of people, even those who might be considered higher risk. Everyone gets a slice, just maybe not the same size slice.

This is very important. Be sure you ask your agent to explain the full details for your particular situation.

Is it Worth it?

So, is it worth it? That depends. It's definitely not going to make you rich, or probably even replace your income.

For some, that small amount of coverage might provide peace of mind, enough to cover final expenses and give loved ones a little breathing room.

Think of it as a "starter" life insurance policy, or a supplement to existing coverage. It’s not a replacement for comprehensive insurance, but it could be a helpful addition.

"Life insurance is like a parachute; if you don't have it the first time, you'll probably need it again." - someone witty, probably.

Ultimately, the $9.95 question isn't about getting rich quick. It's about providing a little something for those you leave behind.

So, next time you hear that catchy jingle, remember it's not about the big payout, but the small gesture of love and responsibility. Now that is something to sing about.

Be sure to get a quote from your agent today!