How Much Coverage For 9.95 With Colonial Penn

Ever seen those commercials with Alex Trebek (RIP, legend!) promising life insurance for just $9.95 a month? That's Colonial Penn! But what exactly does $9.95 get you? Let's dive in and see if this deal is as amazing as it sounds.

The $9.95 Promise: What's the Catch?

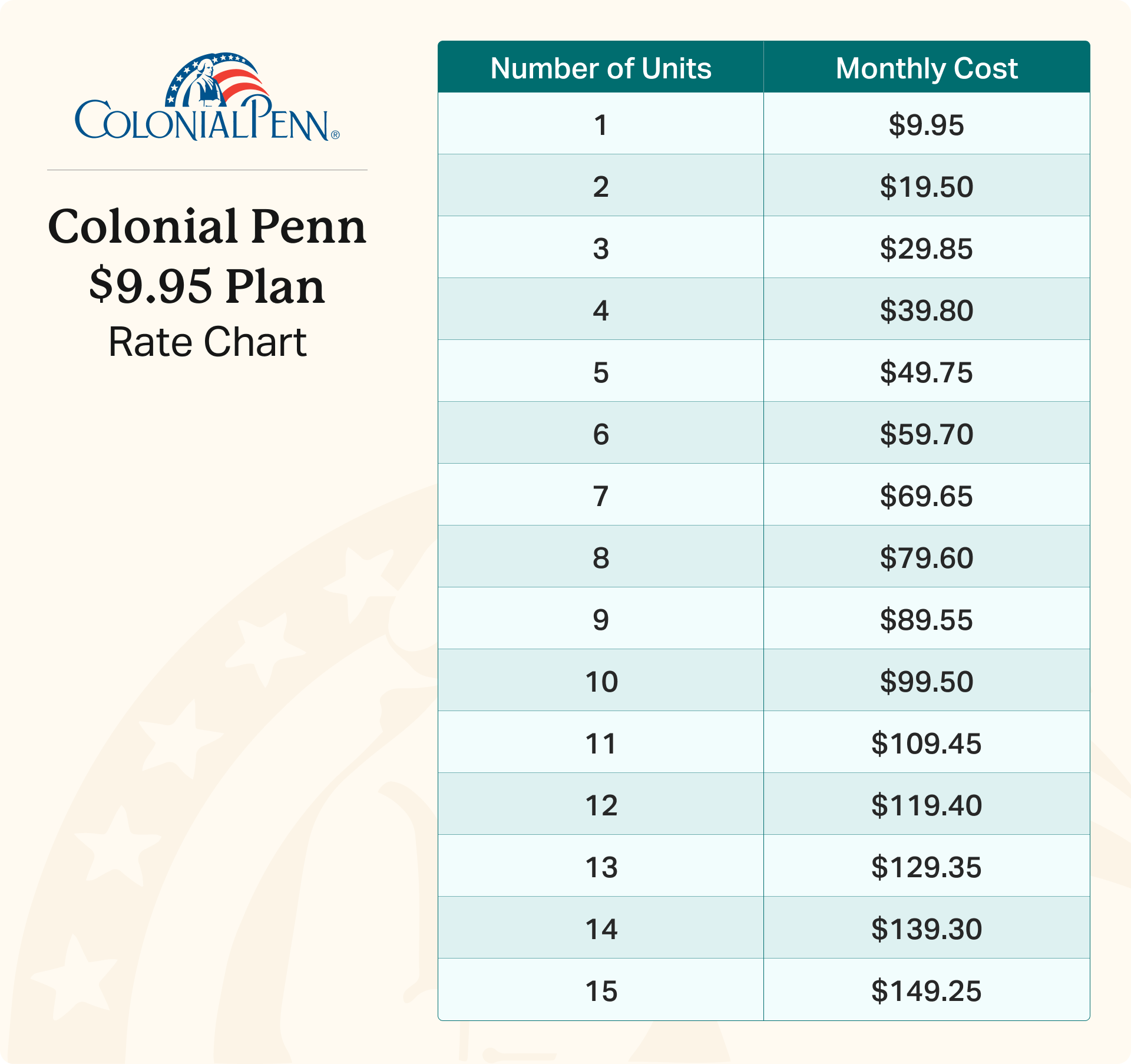

Okay, there's no real "catch," but it's not *exactly* what you might think. With Colonial Penn, you're buying units of coverage. Each unit costs $9.95 a month.

The amount of coverage you get per unit depends on your age and sex. Seriously. That's just how they roll.

Age and Sex Matter (Apparently!)

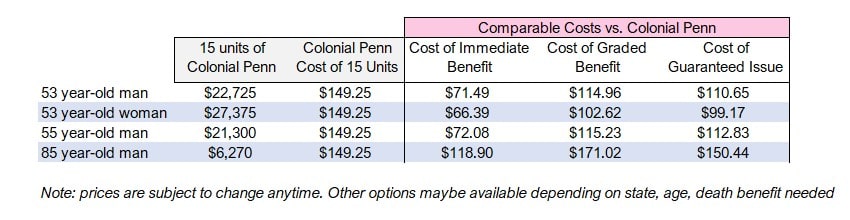

So, a younger, healthier person will get more coverage per $9.95 unit than an older person. It's like a life insurance version of a sliding scale. Makes sense, right?

Think of it like this: the older you are, the more likely (statistically speaking) you are to, well, you know. So the insurance company has to balance the risk.

Let's say you're older and sign up. You might only get a few hundred dollars of coverage per unit. Someone younger might get thousands. The mystery unfolds!

Why is This So…Captivating?

Honestly? It's the simplicity! “$9.95 a month” is super catchy. It sticks in your head like a good jingle.

Plus, let's face it, those commercials are *memorable*. They're like little mini-dramas of life insurance persuasion. You know, without the actual drama.

And who doesn't love a simple price point? It's like buying a candy bar – except it's…life insurance. A little morbid, maybe? But undeniably simple.

It's All About the Units, Baby!

The key is understanding that "one unit" isn't a standardized amount. It's a variable. It depends. (Are you tired of hearing that yet?)

So, don't just hear "$9.95" and assume you're getting a fortune. Do your homework! Get a quote tailored to *you*.

Find out how many units *you* need to get the coverage *you* want. Then you can decide if the price is right!

Is Colonial Penn Right For You?

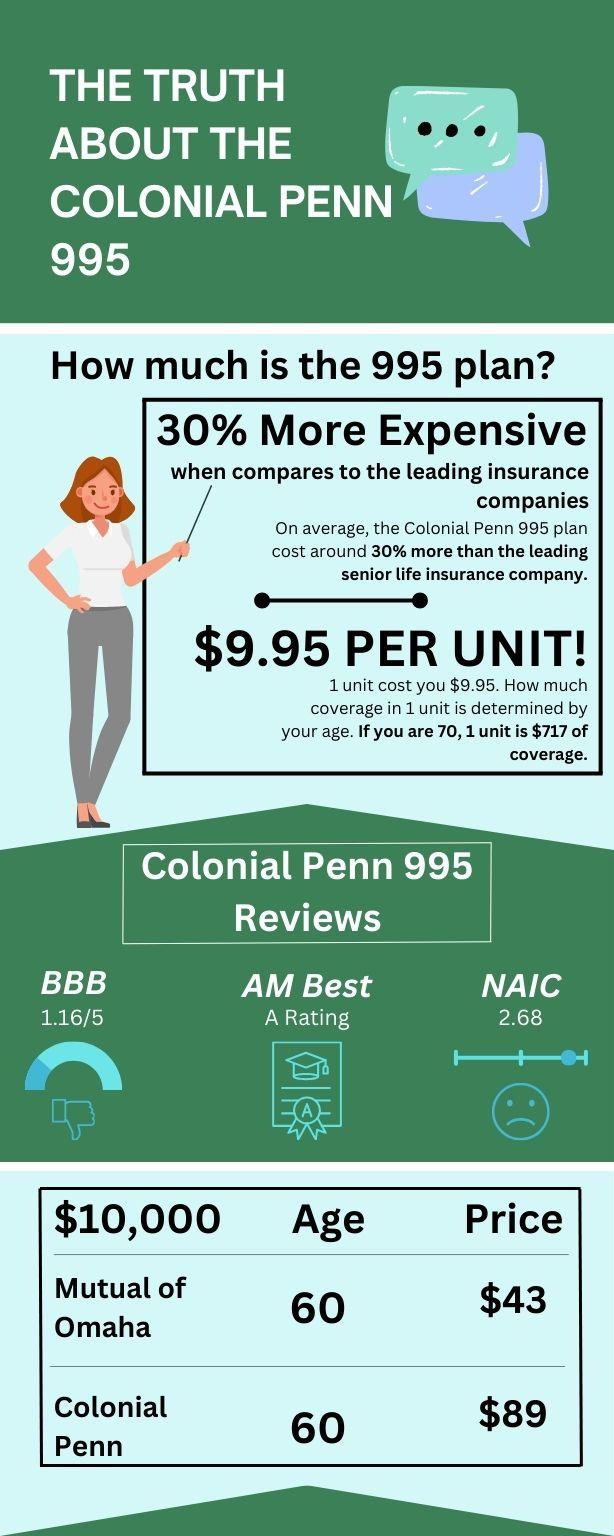

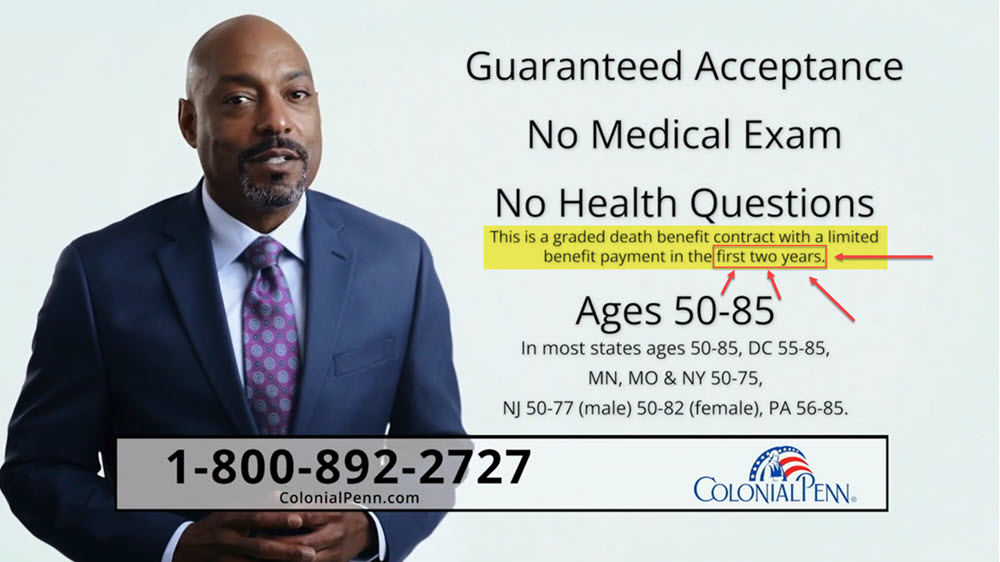

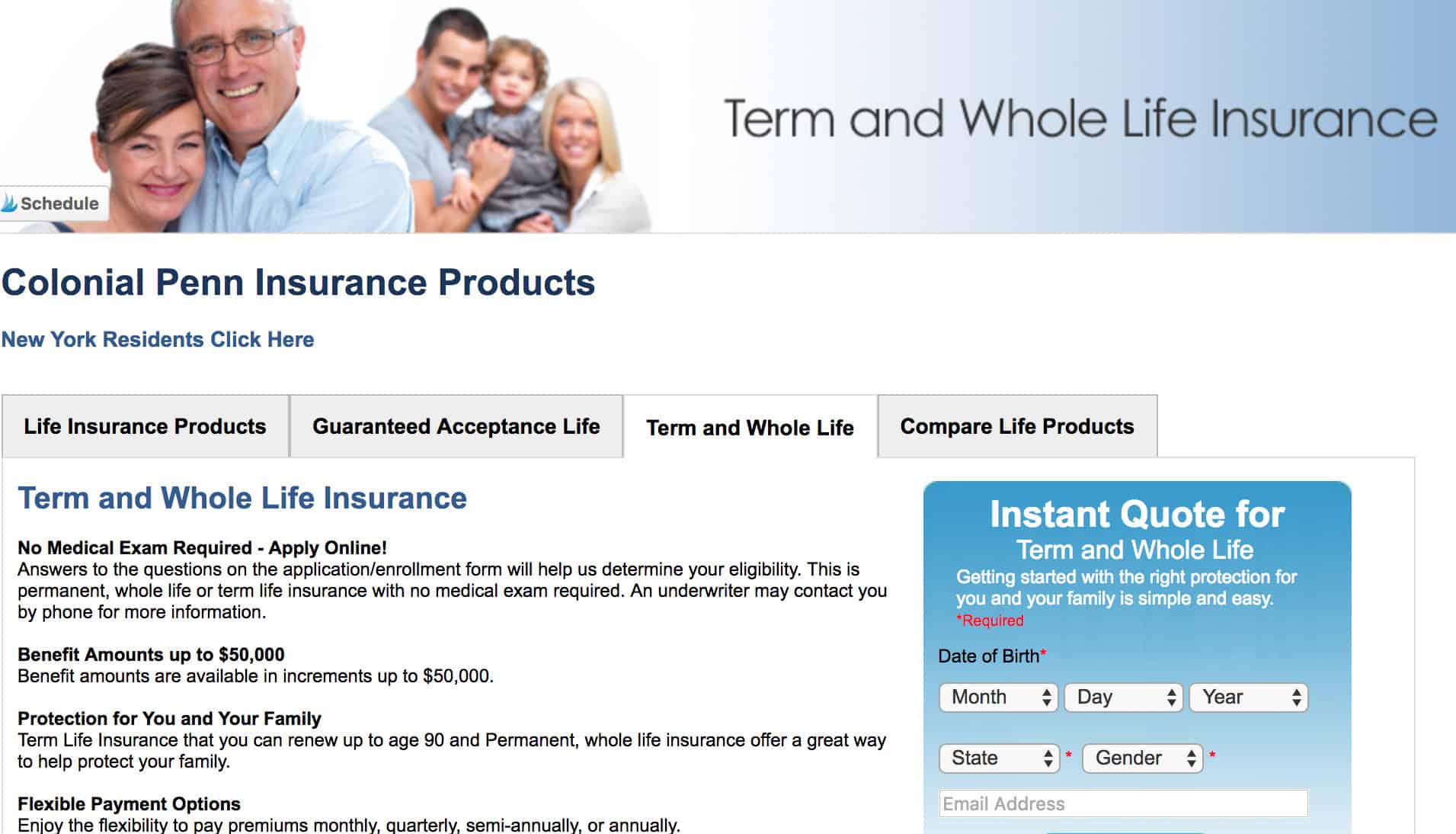

That's the million-dollar question (well, the $9.95-per-unit question). It could be! Especially if you're looking for a small, guaranteed acceptance policy.

These policies are usually smaller death benefits. But they can help cover final expenses. Burial costs are sadly expensive.

If you're young and healthy, you might find better deals elsewhere. Look into term life insurance if you can. It's often cheaper for larger amounts of coverage.

Before You Sign Up…

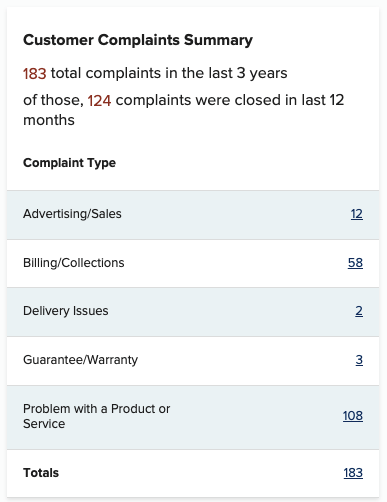

Get a personalized quote. Shop around. Compare! Don't just jump on the $9.95 bandwagon without checking the route.

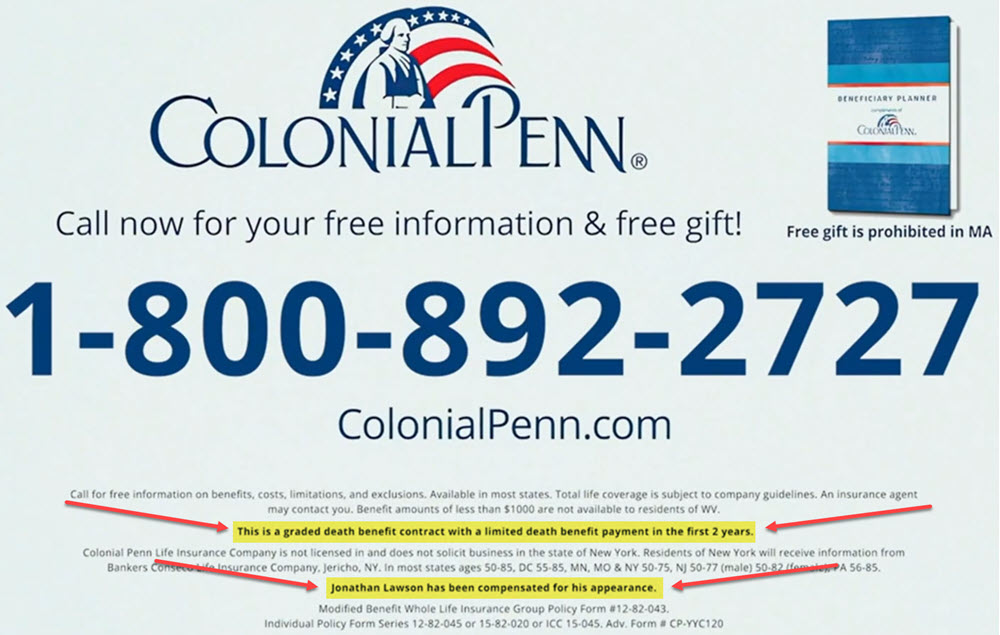

Read the fine print! Seriously. Insurance policies are notorious for being complicated. Make sure you understand what you're buying.

Talk to a financial advisor. They can help you assess your needs and find the best policy for *your* situation. Don't be afraid to ask for help!

The Verdict? Intriguing, But Investigate!

Colonial Penn's $9.95 offer is certainly attention-grabbing. It's a smart marketing move, for sure.

Just remember that the coverage amount varies. Do your research. It may be the right fit for some, but definitely not all.

So, go forth and explore the world of life insurance. Just remember to always read the fine print. And maybe hum a little jingle while you're at it!