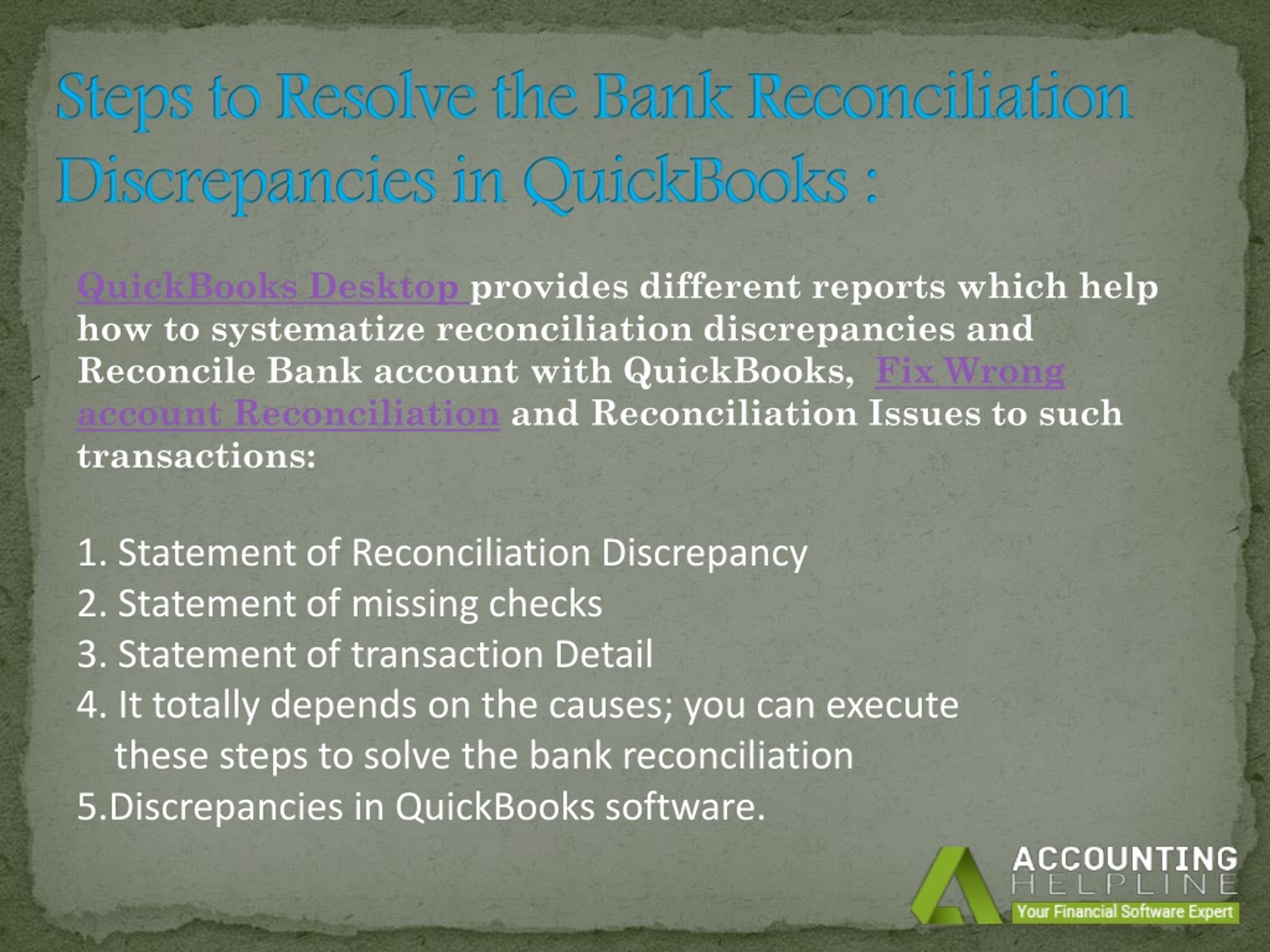

How To Fix Reconciliation Discrepancies In Quickbooks Desktop

Alright, buckle up buttercups! You've hit that reconciliation wall in QuickBooks Desktop. It's like when you try to fold a fitted sheet – frustrating, but conquerable!

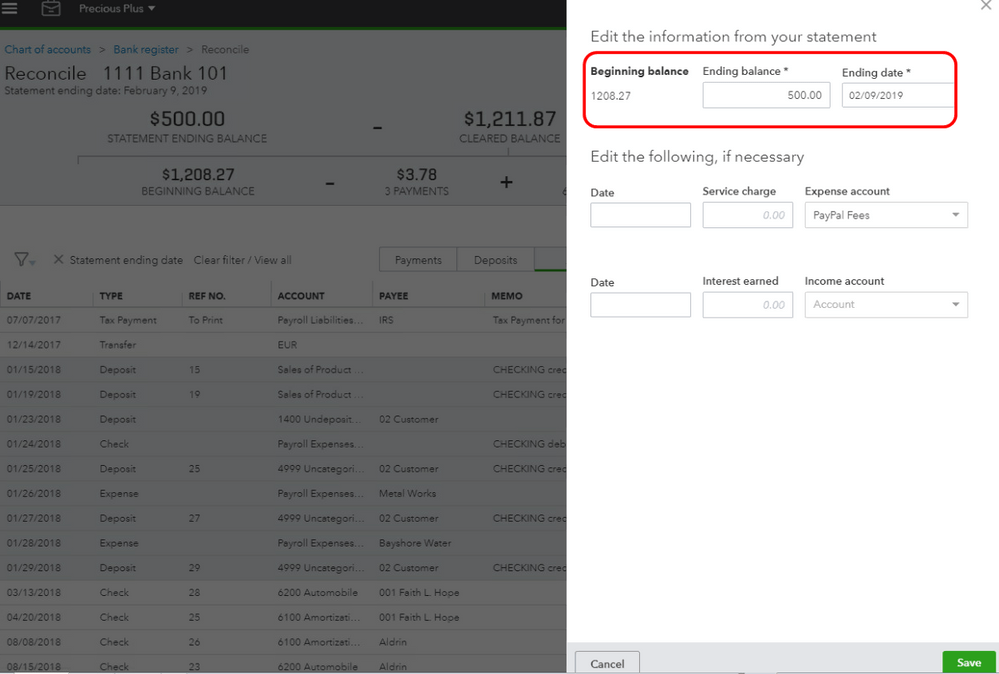

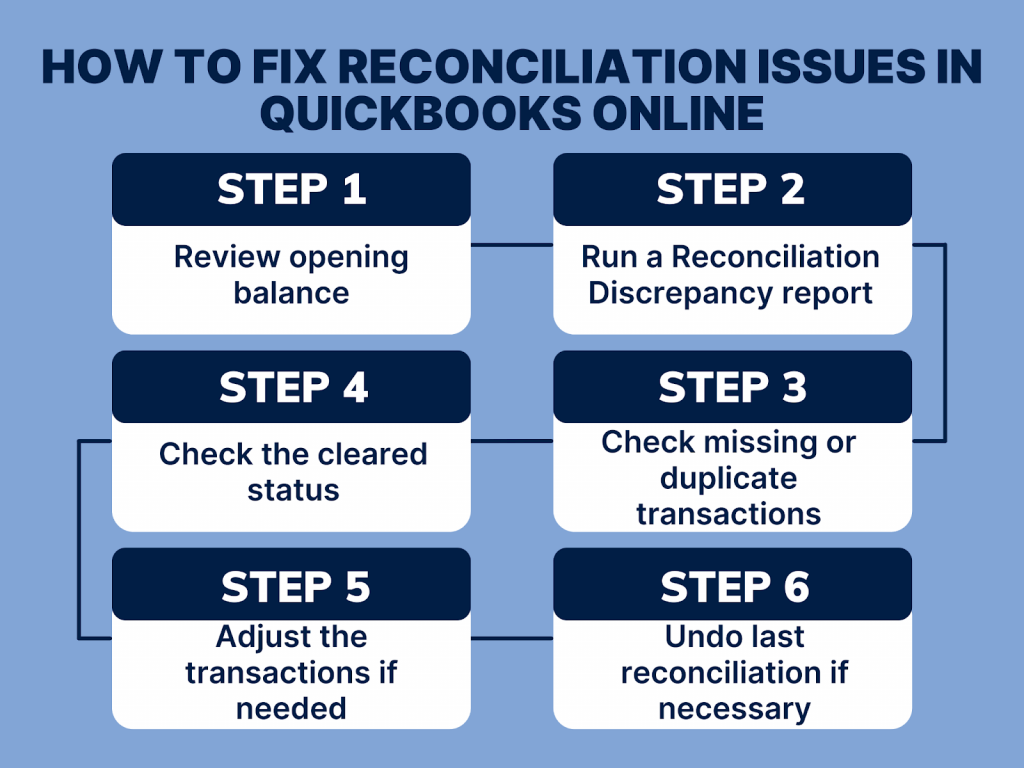

First things first, let's make sure we're comparing apples to apples. Open your bank statement and QuickBooks. Are you staring at the right month?

Sometimes the date is the culprit. You think you are reconciling April, but you actually are looking at May statement.

Simple Scans for Sanity

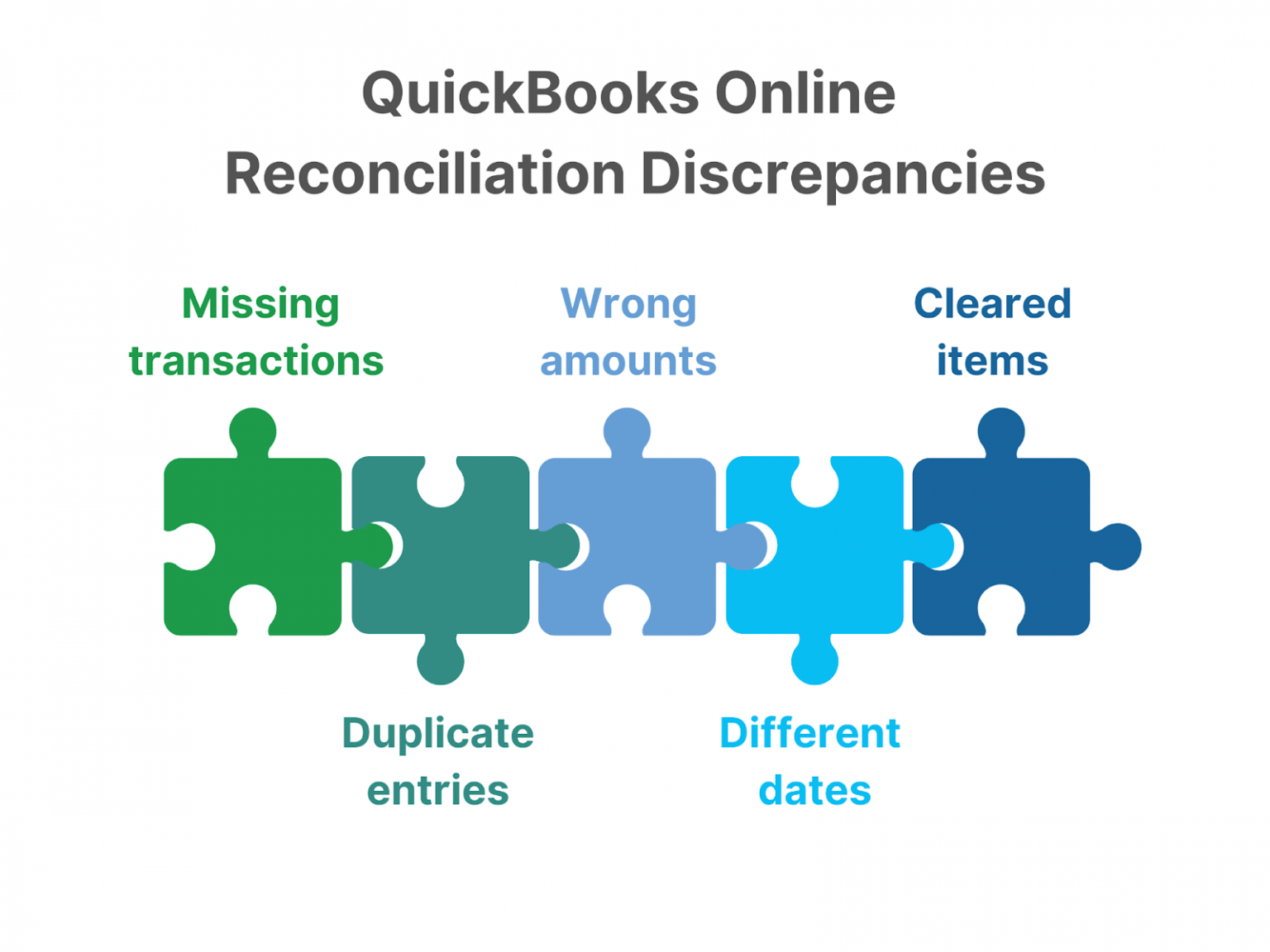

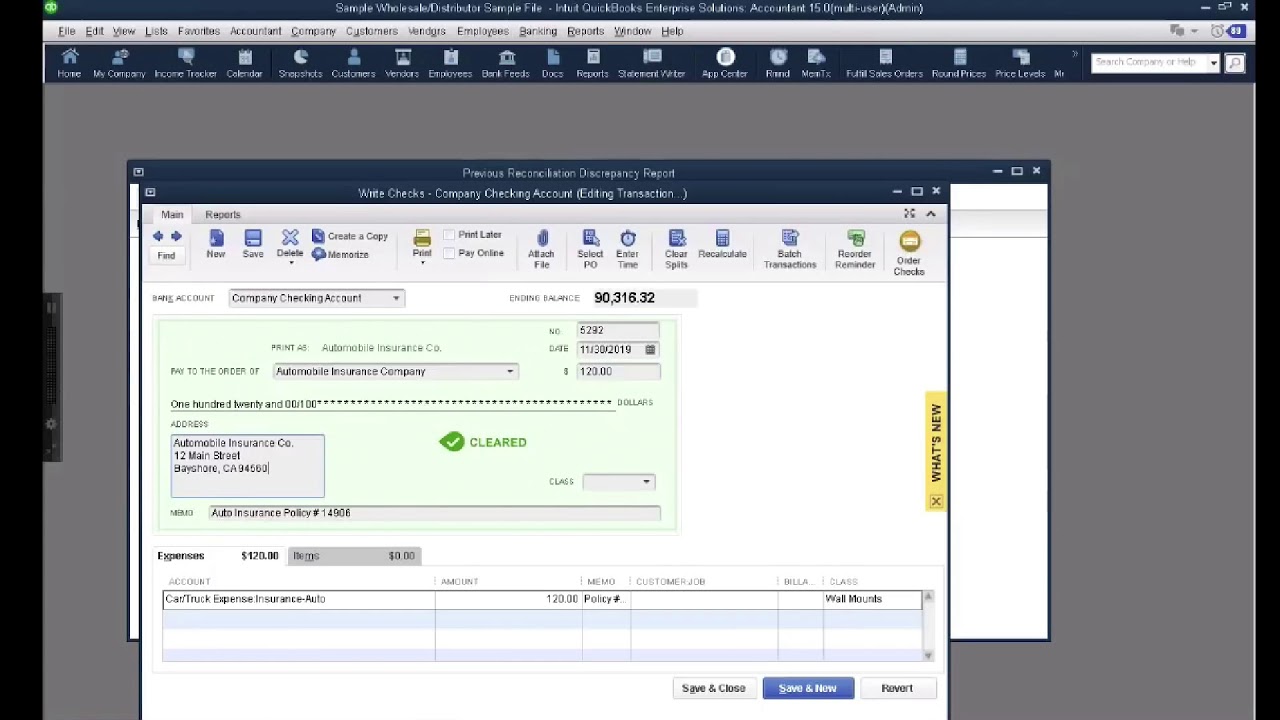

Okay, time to play detective! Start with the easy stuff. Look for transactions that appear only in QuickBooks or only on your bank statement.

Did you accidentally record your cat's vet bill twice in QuickBooks? Or maybe forgot to enter that hefty check you wrote to your landlord? Remove or add those transactions.

These are the low-hanging fruit, grab them quickly to build your confidence.

The Devil's in the Details

Spot a transaction that’s slightly off? Maybe a decimal point went rogue. Find it and fix it!

Someone entered \$100 instead of \$10.00? It happens! A quick edit and you will be back on track.

Numbers are tricky little devils, especially when you are tired!

Decoding Deposits & Debits

Deposits and withdrawals need to match up exactly. Check each and every one against your bank statement.

Did you lump multiple small deposits together in QuickBooks when the bank statement listed them separately? Un-lump them!

Breaking them up like a boyband reunion, make sure each deposit lines up.

Outstanding Issues

Outstanding checks are those you’ve written but haven’t cleared the bank. These are your "maybe later" transactions.

Outstanding deposits are those you've recorded in QuickBooks but haven't shown up on the bank statement yet.

Make sure that your outstanding checks and deposits haven't cleared until the next reconciliation.

The Dreaded Difference

Still off? Let's check the opening balance. Is it correct in QuickBooks?

A wrong opening balance is like starting a race with a flat tire. You are never going to win, until you fix it!

You might need to dig into your previous reconciliation to find the culprit, but it’s a crucial step.

Accountant's Angle

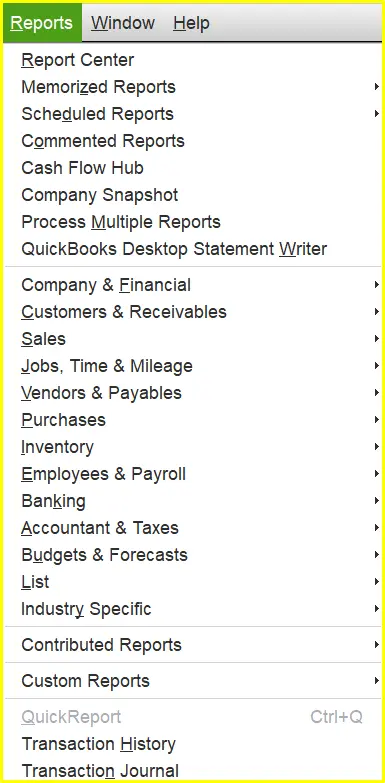

Sometimes, the best medicine is a second opinion. Don’t be afraid to ask your accountant for help. They're like financial wizards!

They can perform magic with numbers that you didn't think was possible.

Seriously, they’ve seen it all and have tricks up their sleeves to get you back on track.

Victory Dance!

Congratulations! You’ve slain the reconciliation beast. Do a little victory dance – you deserve it!

Now, go forth and conquer your finances. And remember, even if you stumble, you now have the tools to get back on your feet.

Until next time, keep those books balanced and your spirits high!

-p-1600.png)