How To Fix Undeposited Funds In Quickbooks Online

Ever feel like your QuickBooks Online is playing hide-and-seek with your money? It's probably those sneaky undeposited funds! Let's dive into how to wrangle them.

Step 1: Find the Culprits

First things first, let's locate these financial fugitives. Head over to your QuickBooks Online dashboard. It’s like a treasure hunt, but with numbers!

Look for the "Reports" section. There might be a report called "Undeposited Funds." Click on it.

This magical report shows you all the payments that are lingering in limbo. These are the guys we need to deal with!

Step 2: The Deposit Detective

Now, put on your detective hat! We need to figure out where these funds actually landed.

Think back to when you received those payments. Did you deposit them into your bank account? Check your bank statements.

Compare the dates and amounts. Spotting the match is incredibly satisfying!

Step 3: Making the Match in QuickBooks

Okay, you've found the match in your bank statement. Now it's time to make QuickBooks Online understand what happened.

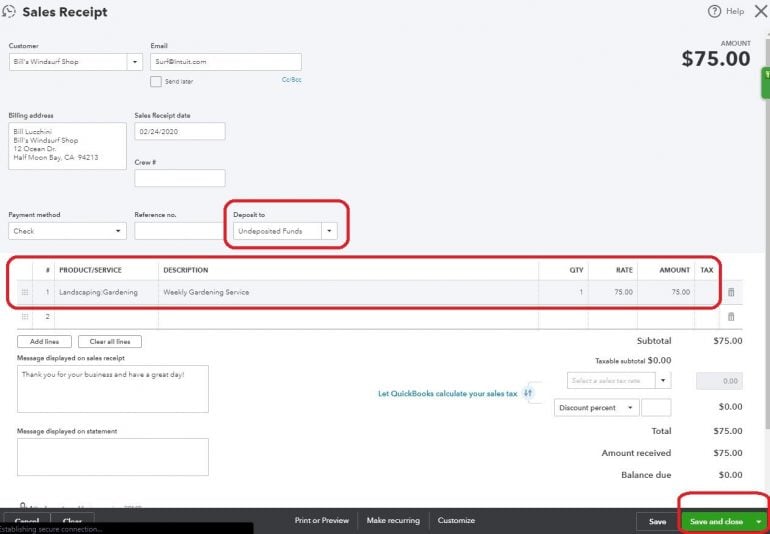

Go to the "+" icon (usually in the upper right corner). Select "Bank Deposit."

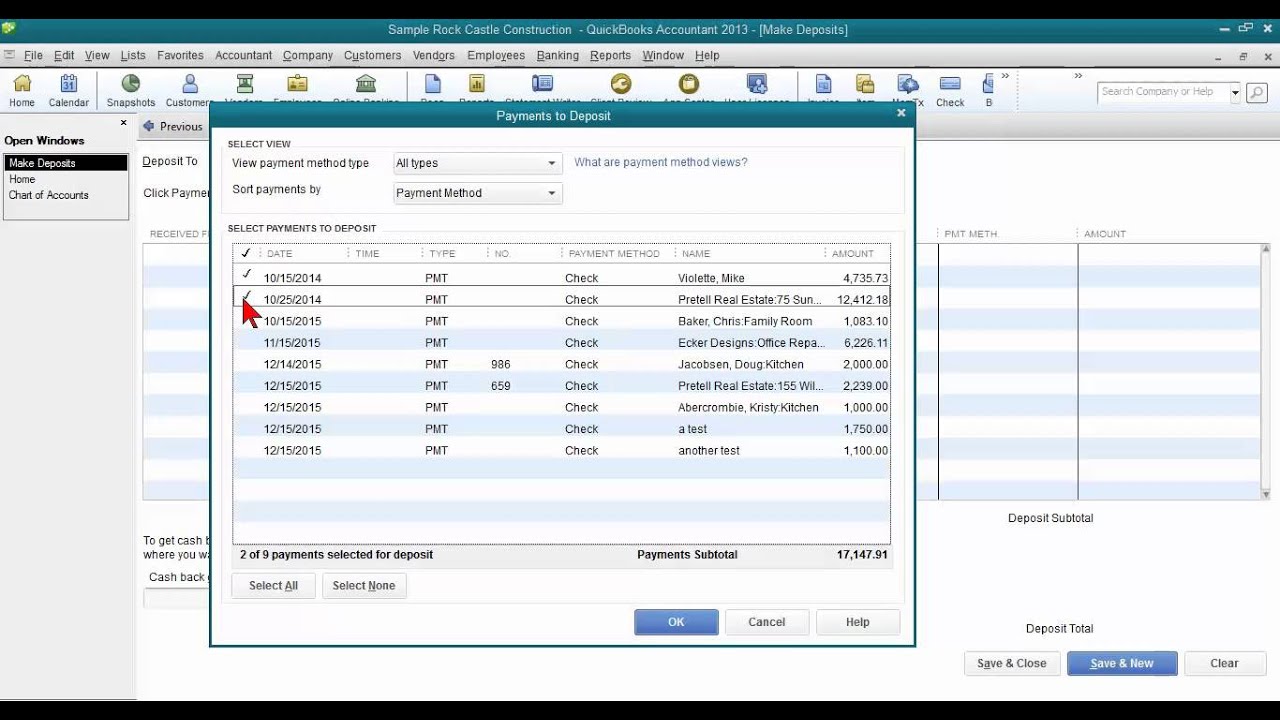

Here comes the fun part! Choose the bank account where you deposited the money. Then, carefully select the undeposited funds items that match the deposit.

Step 4: The Reconciliation Revelation

Once you've matched everything correctly, the deposit amount in QuickBooks Online should match your bank statement. Isn't that neat?

Save the deposit. This is where the magic happens! The undeposited funds items disappear, and your accounts are balanced. It’s like solving a puzzle!

Step 5: Alternative Adventures (When Things Get Tricky)

Sometimes, things aren't so straightforward. Maybe you accidentally created a deposit already.

Or perhaps you combined multiple payments into one deposit at the bank. Don’t panic!

If you already created a deposit, you might need to edit it. Find the deposit. Then, add or remove the undeposited funds items to match what actually happened.

Step 6: The Journal Entry Journey

For truly tricky situations (like correcting past mistakes), you might need a journal entry.

This is a bit more advanced. Proceed with caution. If unsure, it is best to ask your accountant.

A journal entry lets you manually move money between accounts. You can use it to clear out the undeposited funds account. This requires understanding debit and credit, though.

Step 7: The Accountant's Aid

Still feeling lost in the financial wilderness? Don't be afraid to call in the pros!

Your accountant can be your guide. They can untangle even the most complex QuickBooks Online mysteries. A good accountant is worth their weight in gold!

Step 8: Regular Check-Ups

The best way to avoid undeposited funds chaos? Regularly check your QuickBooks Online and reconcile your bank accounts.

This keeps everything tidy and prevents surprises. Think of it as financial spring cleaning. Plus, you'll find it more exciting than actual spring cleaning!

Step 9: Bank Feeds For the Win

Consider connecting your bank accounts to QuickBooks Online via bank feeds. This automates the process.

Your transactions will automatically import, making reconciliation much easier. It's like having a robot assistant for your finances!

The Undeniable Allure of Organized Finances

Dealing with undeposited funds might seem tedious at first. But once you master it, you unlock a new level of financial clarity. Embrace the process. You might even start to enjoy it!

So, go forth and conquer those undeposited funds! Your bank account (and your sanity) will thank you. And who knows, maybe you'll discover your inner accounting superhero!

Remember: Keeping your QuickBooks Online tidy is like keeping your financial house in order. It brings peace of mind and helps you make better business decisions. And that, my friends, is pretty entertaining stuff!