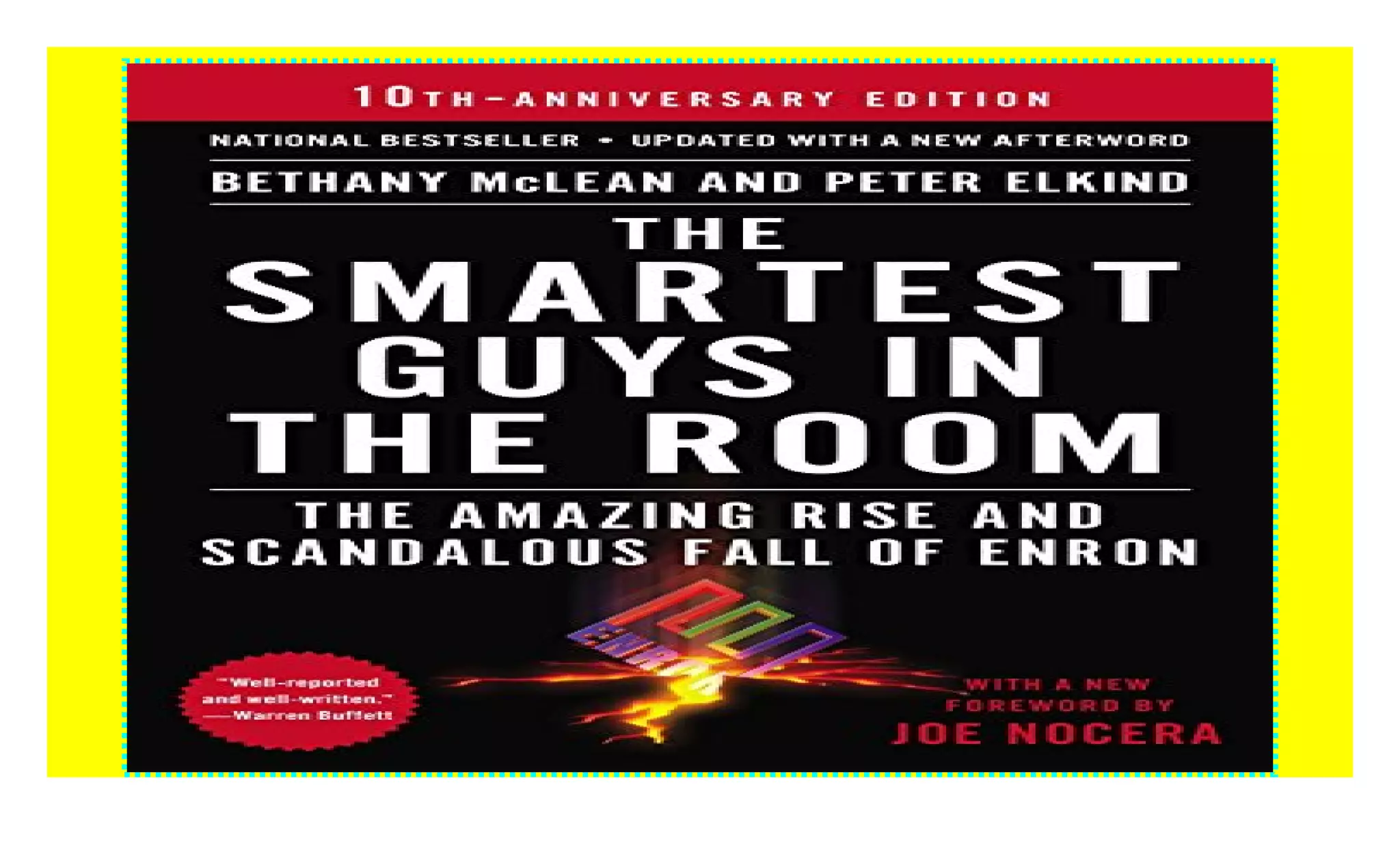

The Smartest Guys In The Room Summary

Okay, let's talk about Enron. You know, that company that everyone thought was, like, totally genius? Then BAM! It imploded.

We're diving into a super-simplified, giggle-inducing take on "The Smartest Guys in the Room". Think of it as Enron for Dummies, but funnier (hopefully!).

Basically, Really, Really Smart (or were they?)

First, we gotta meet the players. We’ve got Ken Lay, the charismatic face of Enron.

Then there’s Jeff Skilling, the brains behind the (crazy) operation. Oh, and let's not forget Andy Fastow, the CFO who was REALLY good at hiding things. Or, you know, allegedly.

These guys? They were convinced they were the smartest people EVER. Hence, the book title, right?

Energy Trading: Sounds Thrilling, Right?

So, Enron started as a natural gas pipeline company. Pretty boring. But then, Skilling had a "brilliant" idea: let’s trade energy like stocks!

Suddenly, Enron wasn't just transporting gas. They were betting on its future price. Kinda like gambling, but with megawatts.

Here's my unpopular opinion: trading energy sounds about as exciting as watching paint dry. But hey, it made them a ton of money...for a while.

The Magical World of Mark-to-Market

This is where things get… creative. "Mark-to-market" accounting allowed Enron to book potential future profits immediately. Like, years in advance.

Imagine selling a pie and claiming all the money you *might* make from it over the next 30 years. Even if no one actually buys the pie!

Sounds fishy? You're not wrong. But hey, who needs actual pie sales when you have imagination?

The House of Cards Begins to Wobble

As Enron grew, they started hiding their debt in these weird shell companies. Think offshore accounts, but for… liabilities. Clever, right?

Andy Fastow was basically running these side hustles. He got super rich, which should have been a red flag to everyone.

My unpopular opinion: anyone getting rich *that* fast should be audited... repeatedly. Just saying.

California Dreaming (Gone Wrong)

Enron also played a big role in the California energy crisis. They manipulated prices to create artificial shortages.

Power outages, sky-high bills… not cool, Enron. Not cool at all.

This is where the "smartest guys in the room" started looking more like… well, you can fill in the blank.

The Inevitable Kaboom

Eventually, the truth came out. The accounting tricks, the hidden debt, the inflated profits... it all unraveled.

Enron stock plummeted. People lost their jobs, their pensions, everything. It was a total disaster.

My unpopular opinion: karma's a tricky thing, but sometimes... it works. Just saying.

The Aftermath: Jail Time and Lessons Learned (Maybe)

Ken Lay and Jeff Skilling were found guilty of fraud. Lay died before sentencing, but Skilling went to jail.

It was a huge scandal that shook the business world. And yet, have we *really* learned our lesson?

Enron’s legacy lives on as a cautionary tale. Just remember: if something sounds too good to be true, it probably is.

So next time you hear about some company promising unbelievable profits, maybe grab a copy of "The Smartest Guys in the Room." Or, you know, just be a little skeptical.

![The Smartest Guys In The Room Summary [Download Book] The Smartest Guys in the Room: The Amazing Rise and](https://image.isu.pub/230722214756-542ffce7ab25eee37aa437cfe1b4a39e/jpg/page_1.jpg)