Characteristics Of Capital Budgeting Include Check All That Apply

Capital budgeting, the process of evaluating and selecting long-term investments, is undergoing a significant transformation. The confluence of rapid technological advancements, volatile economic landscapes, and increasing stakeholder expectations demands a more dynamic and sophisticated approach.

The Rise of Agile Capital Budgeting

Traditional capital budgeting often relies on rigid, long-term forecasts that are quickly outdated in today's fast-paced business environment. A growing trend is the adoption of agile capital budgeting, which prioritizes flexibility and adaptability.

This approach involves breaking down large projects into smaller, manageable phases, allowing for continuous monitoring and adjustments based on real-time data and market feedback. Companies are increasingly using scenario planning and simulation tools to prepare for a range of potential outcomes.

Characteristics of Agile Capital Budgeting: Check All That Apply

Several key characteristics define this evolving methodology. Prioritizing real-time data analysis is critical for informed decision-making.

Embracing iterative project development to adapt to changing circumstances is another vital aspect. Regular performance reviews and adjustments allow for course correction and optimization.

Cross-functional collaboration ensures that diverse perspectives are considered throughout the process. Finally, integrating sustainability and ESG factors reflects a broader commitment to long-term value creation.

Addressing the Challenge of Intangible Assets

A major challenge in modern capital budgeting is the accurate valuation of intangible assets. These assets, such as brand reputation, intellectual property, and data, are increasingly crucial drivers of value creation but are difficult to quantify using traditional metrics.

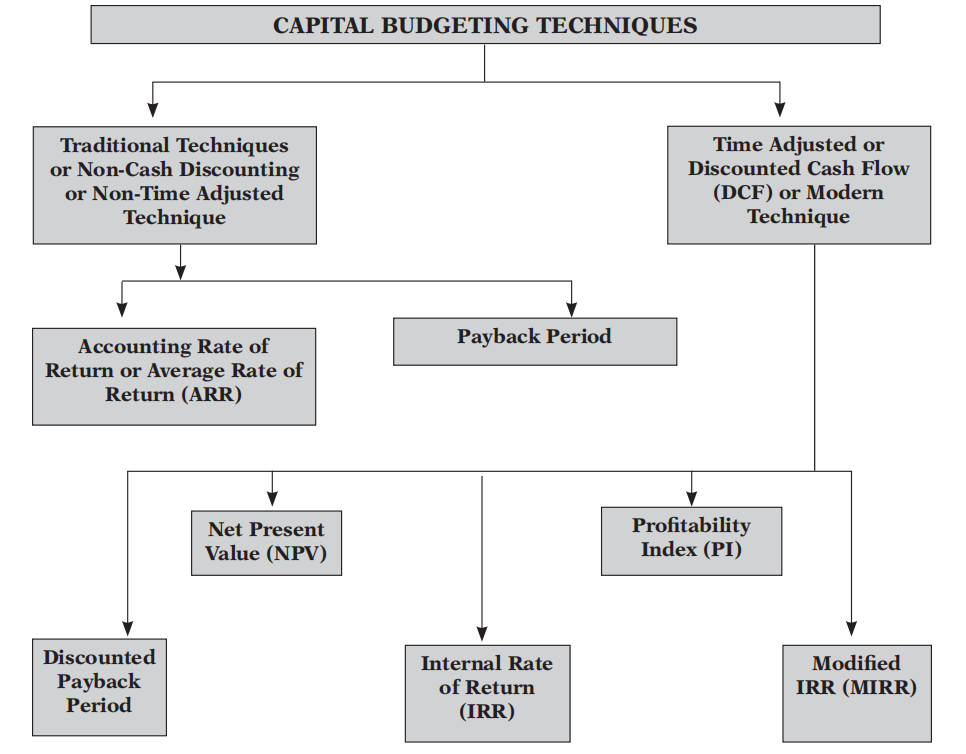

Companies are experimenting with new approaches to better account for intangible assets. This includes using enhanced discounted cash flow (DCF) models that incorporate sensitivity analysis.

Furthermore, it requires non-financial metrics and qualitative assessments to capture the full value of these assets. Investing in sophisticated data analytics and AI can help to reveal the hidden value of intangible assets.

Leveraging Technology for Improved Decision-Making

Technology plays a pivotal role in enhancing capital budgeting processes. Advanced analytics platforms provide the ability to analyze vast amounts of data, identify trends, and forecast future performance with greater accuracy.

AI-powered tools can automate repetitive tasks, freeing up financial professionals to focus on strategic decision-making. Furthermore, cloud-based solutions facilitate collaboration and data sharing across different departments and geographic locations.

The use of blockchain technology can improve transparency and security in capital budgeting by providing a tamper-proof record of transactions and investments.

The Opportunity for Sustainable and Socially Responsible Investing

Capital budgeting is increasingly being viewed as an opportunity to drive sustainable and socially responsible investing. Investors and stakeholders are demanding that companies prioritize environmental, social, and governance (ESG) factors in their investment decisions.

Companies are now incorporating ESG metrics into their capital budgeting processes. This involves considering the environmental impact, social responsibility, and corporate governance implications of each investment.

Furthermore, it entails investing in projects that generate positive social and environmental outcomes, such as renewable energy projects, sustainable agriculture, and affordable housing. This alignment with stakeholder values strengthens brand reputation, attracts talent, and reduces risks associated with unsustainable practices.

Conclusion

Capital budgeting is no longer a static, annual exercise. The shift towards agile methodologies, improved valuation of intangible assets, leveraging technology, and integrating ESG considerations is transforming the landscape.

Companies that embrace these changes will be better positioned to make informed investment decisions, drive sustainable growth, and create long-term value for their stakeholders. Ignoring these trends risks being left behind in an increasingly competitive and dynamic marketplace.