Financial Questions To Ask A Business Owner

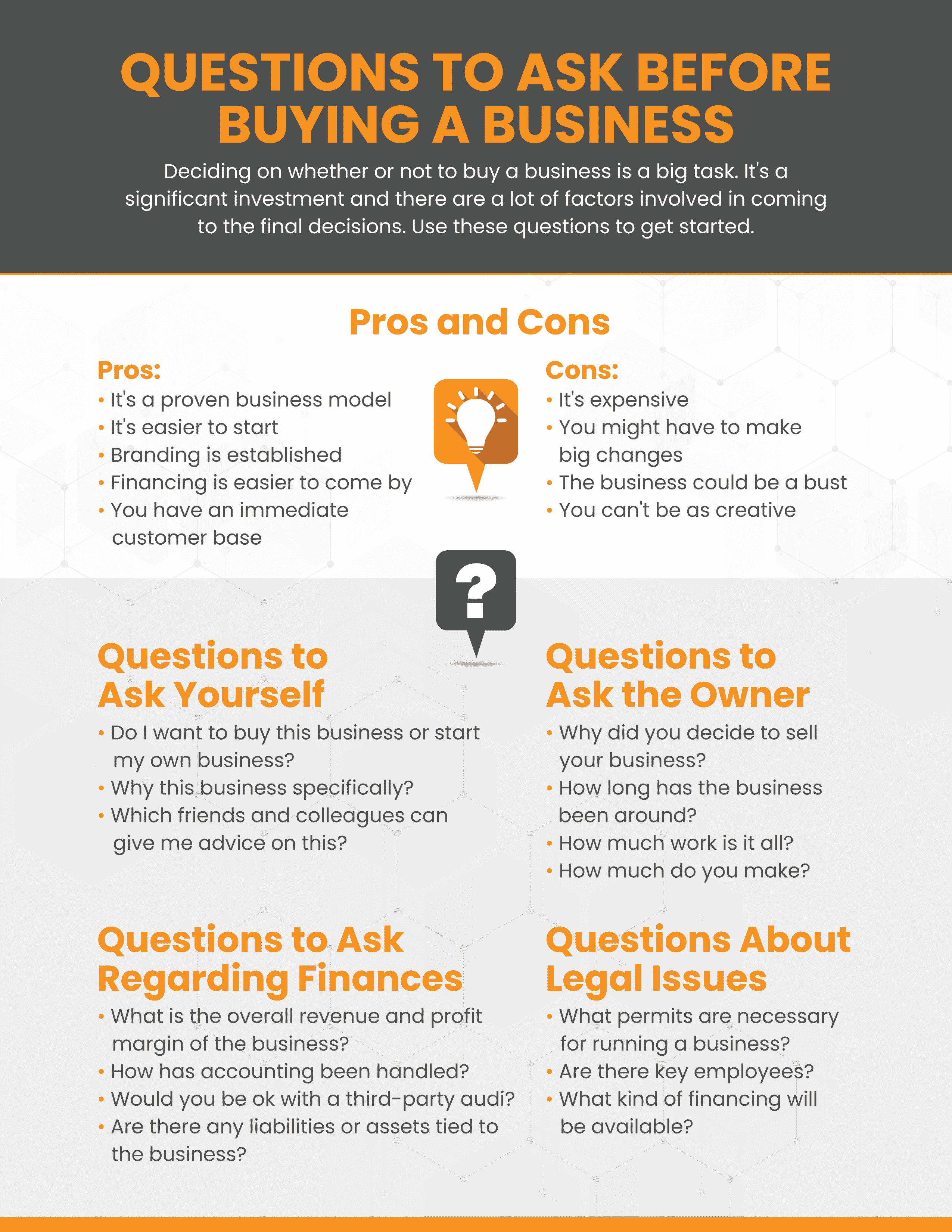

Navigating the financial landscape of a business, whether you're an investor, a potential buyer, or even a close associate, requires asking the right questions. Understanding a business's financial health is crucial for making informed decisions and mitigating potential risks.

This article outlines key financial questions to ask a business owner to gain a comprehensive understanding of their company's performance and future prospects. These questions cover profitability, cash flow, debt, and overall financial stability, providing a framework for due diligence and informed decision-making.

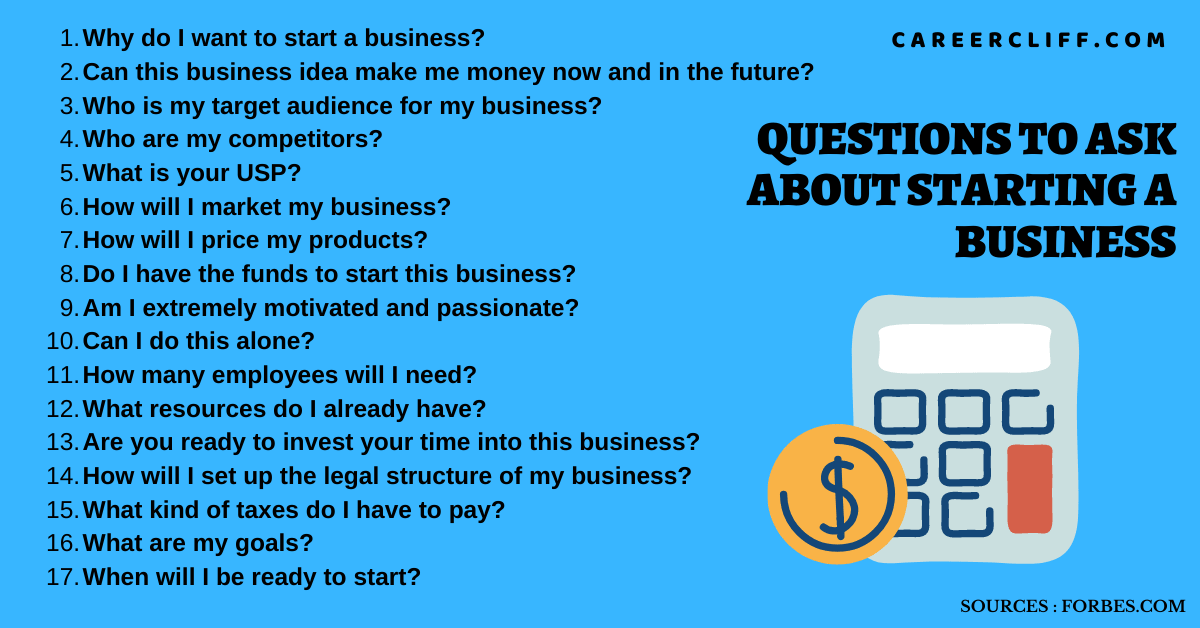

Profitability and Revenue

One of the first areas to explore is the business's profitability. Start by asking about the business's revenue streams. What are the primary sources of revenue, and how diversified are they?

Inquire about the company's gross profit margin. Understanding how much revenue is left after deducting the cost of goods sold reveals the efficiency of the core business operations.

Dig deeper into net profit margin. What is the business’s net profit margin after all expenses, including taxes and interest, are accounted for?

Cash Flow Management

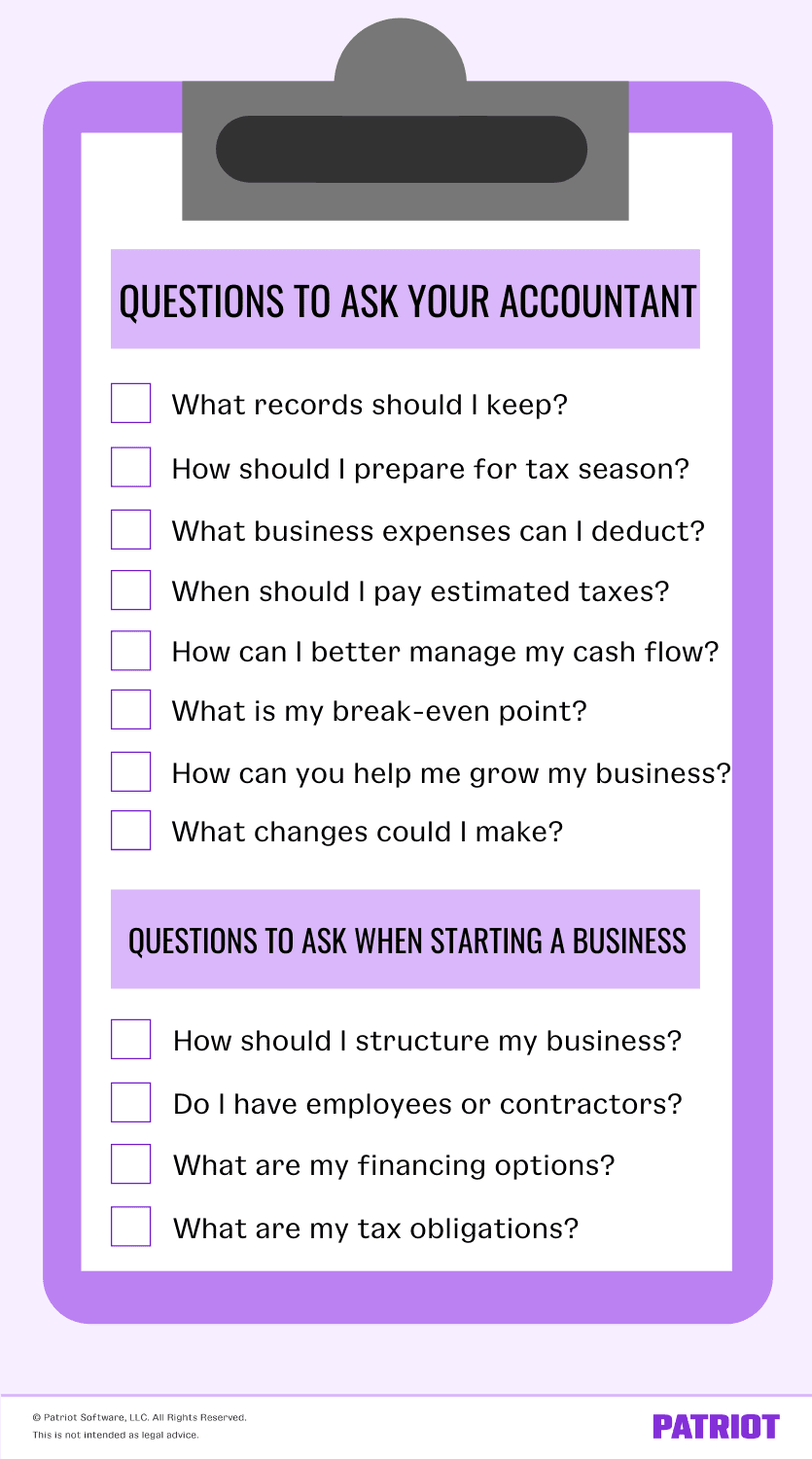

Profitability is important, but cash flow is king. It is crucial to understand how well the business manages its cash flow.

Ask for a cash flow statement to review the business's ability to generate cash from operations. Are there any seasonal fluctuations in cash flow that need to be considered?

Delve into accounts receivable and payable. What are the average collection periods for receivables, and how quickly does the business pay its suppliers?

Debt and Liabilities

Understanding the business's debt obligations is crucial. Request a schedule of all outstanding debts, including interest rates and repayment terms.

Calculate the debt-to-equity ratio. This provides insights into the leverage of the business and its ability to meet its obligations. High debt ratios can indicate higher risk.

Inquire about any contingent liabilities, such as pending lawsuits or warranty claims. These can significantly impact the financial health of the business.

Financial Stability and Future Projections

Assessing the overall financial stability is critical for predicting future performance. Ask about the business's working capital. Is there sufficient working capital to meet short-term obligations?

Review the balance sheet to assess assets and liabilities. This will give a clear picture of the company's financial position at a specific point in time.

Request financial projections for the next 3-5 years. What are the key assumptions underlying these projections, and how realistic are they?

Understanding key performance indicators (KPIs). What are the KPIs the business uses to track its performance, and how have they trended over time?

Operational Efficiency

Operational efficiency plays a crucial role in a company's financial health. Understanding the details can significantly impact decision-making.

Inquire about the business's inventory turnover. How quickly does the business sell its inventory, and are there any obsolete or slow-moving items?

Explore operating expenses. What are the major categories of operating expenses, and how are they managed?

Understanding the business’s reliance on key customers or suppliers is essential. What would be the impact if the relationships with these key partners were severed?

By asking these comprehensive questions, you can gain a clearer understanding of the financial health and future prospects of a business. This information is invaluable for investors, potential buyers, and anyone seeking to make informed decisions about a business venture. Remember to verify the information provided with independent due diligence and seek professional advice from financial experts when necessary. Always consult with a certified public accountant (CPA) or financial advisor to ensure a thorough assessment.

.jpg?format=1500w)