Notary Signing Agent Invoice Template

Notary Signing Agents (NSAs) face a critical need for streamlined invoicing. A readily accessible and customizable invoice template is now vital for NSAs to ensure prompt and accurate payments.

This article addresses the increasing demand for a standardized Notary Signing Agent Invoice Template, exploring its key features, benefits, and available resources.

The Imperative for Efficient Invoicing

The demand for NSAs continues to rise amid fluctuating interest rates. A professional invoice ensures clear communication with clients and minimizes payment delays.

Time is money. NSAs need templates that are easily editable and customizable to reflect their specific services and rates.

Core Components of an Effective Template

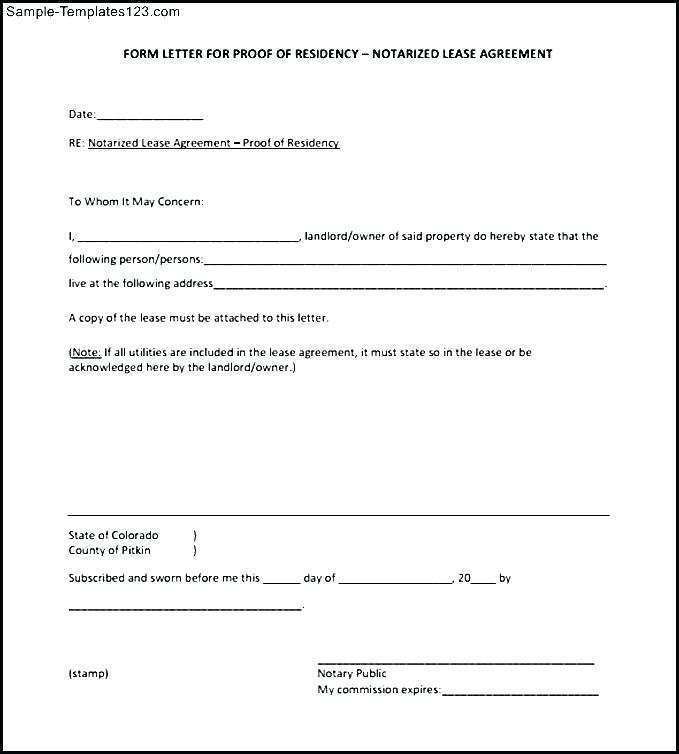

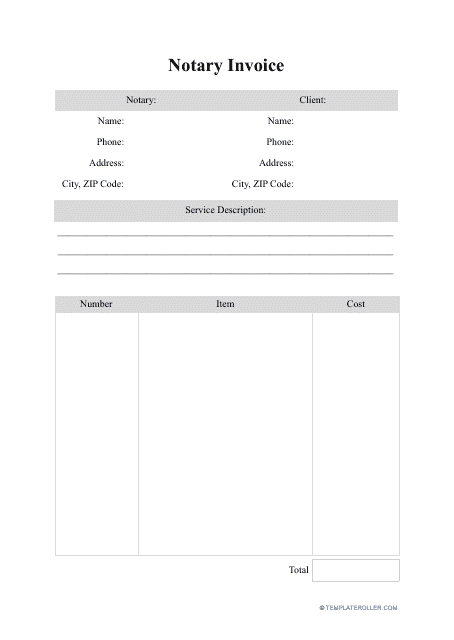

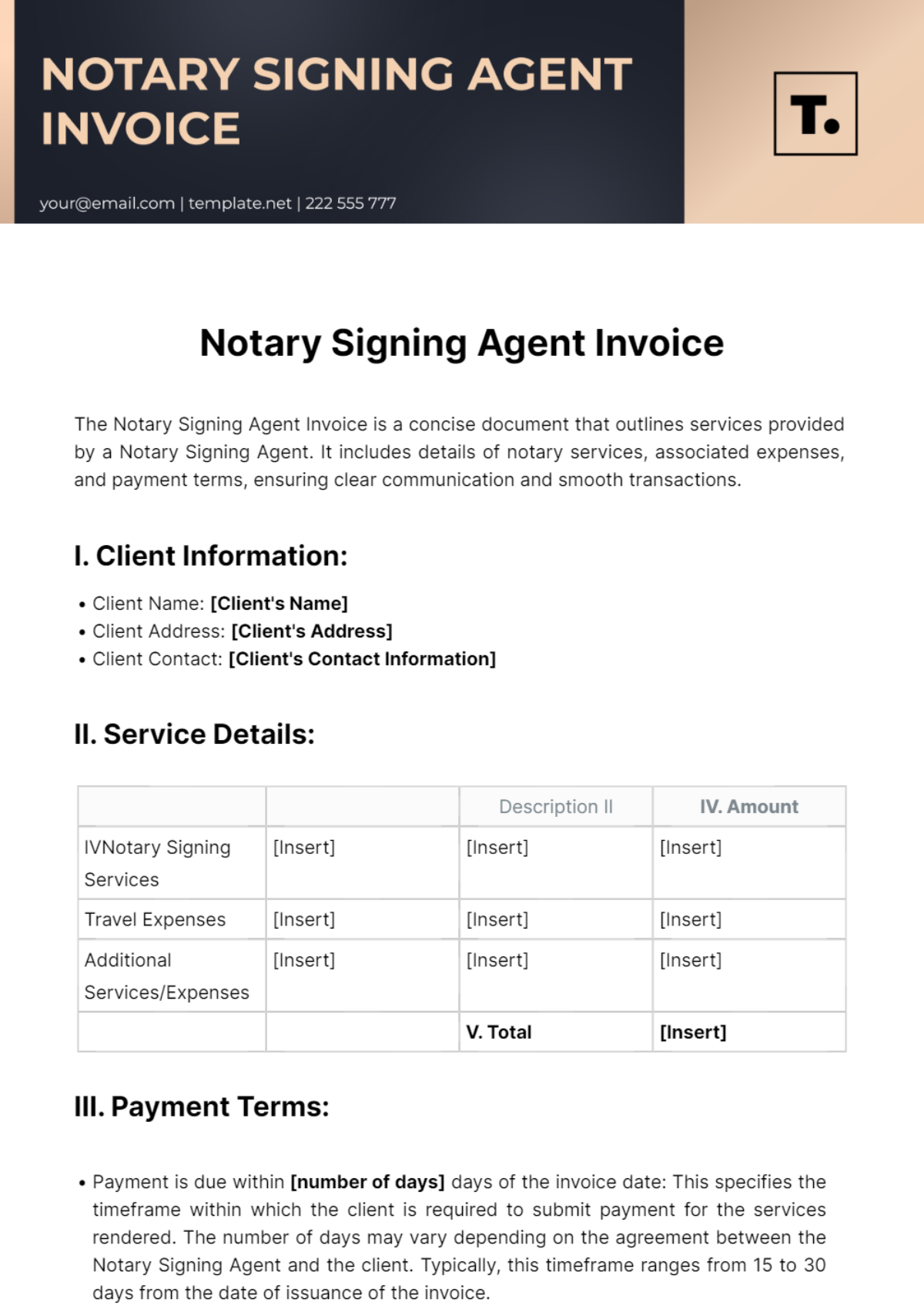

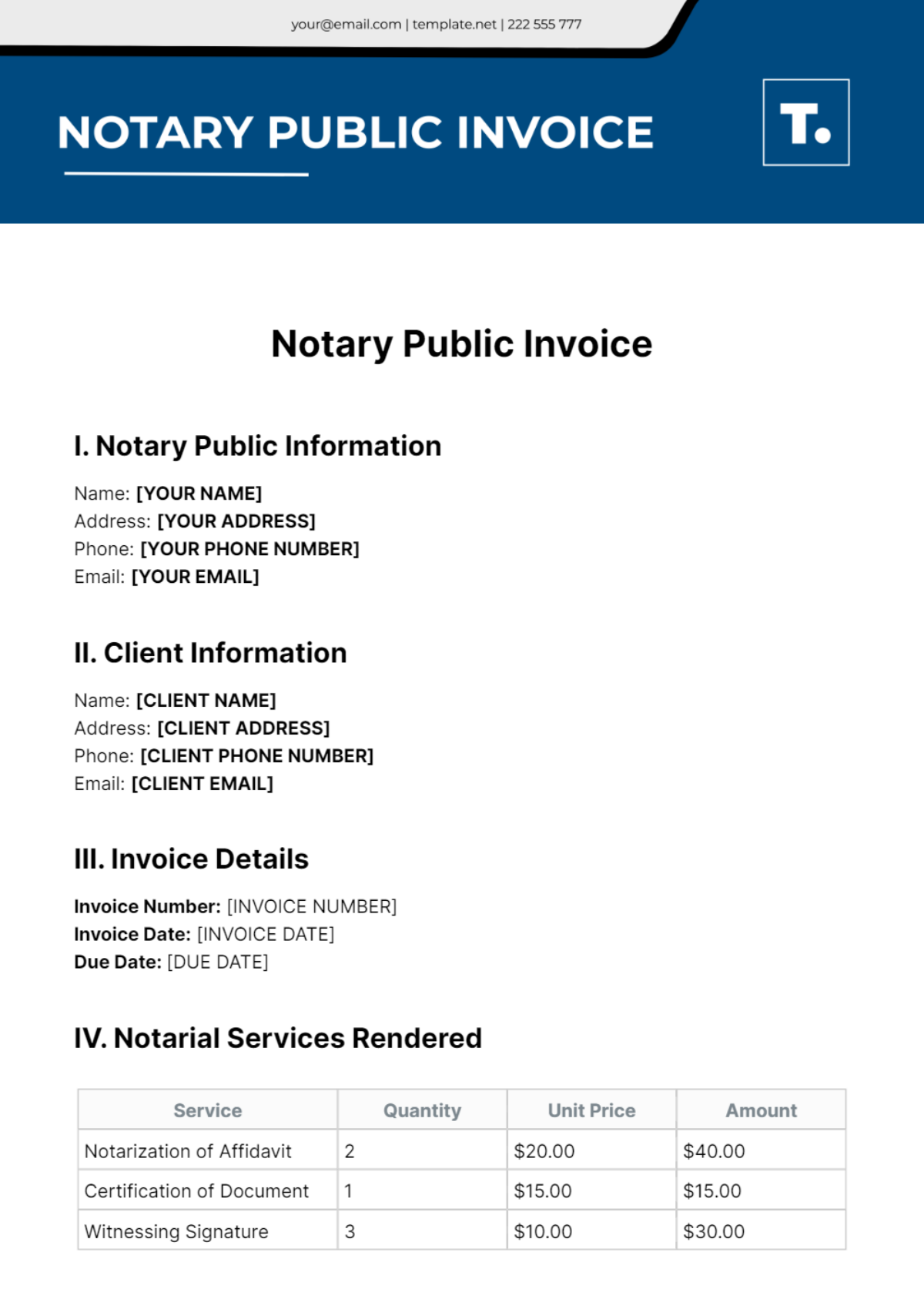

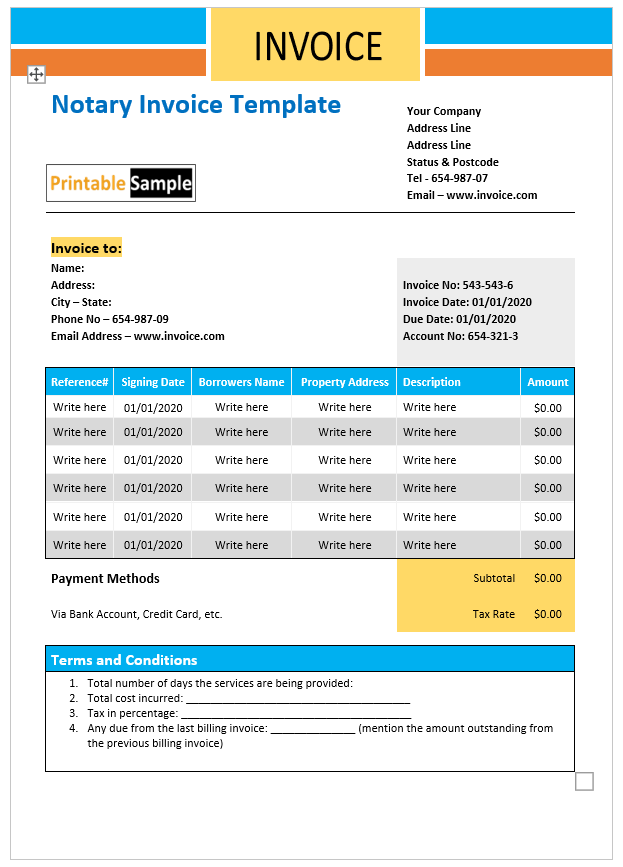

An effective template includes the NSA's contact information, client details, and a unique invoice number for tracking purposes.

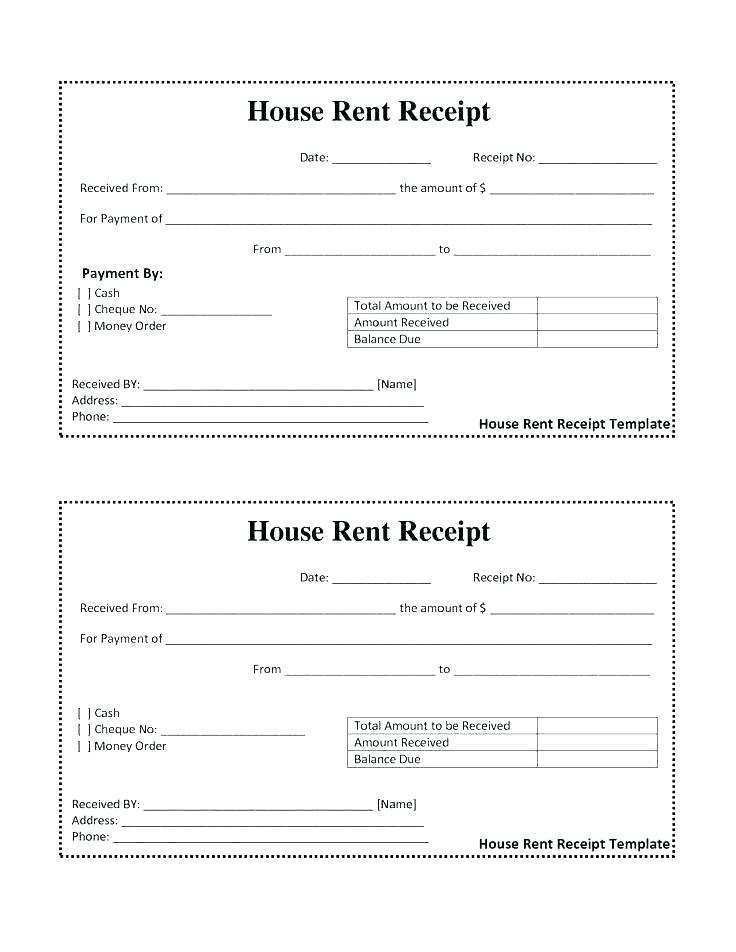

Detailed descriptions of services rendered, dates, times, and locations are crucial. Line items should clearly outline fees for notarization, travel, printing, and other expenses.

The template must also specify the total amount due, payment terms (e.g., net 30), and accepted payment methods.

Benefits of Using a Standardized Template

Using a standardized invoice template enhances professionalism and credibility.

It reduces the risk of errors and omissions, leading to faster payment processing and improved cash flow. A clear and concise invoice minimizes client confusion and potential disputes.

Efficient invoicing saves time and allows NSAs to focus on their core duties.

Accessing and Customizing Templates

Numerous free and paid templates are available online. Resources such as National Notary Association and legal document websites offer customizable templates.

Software like Microsoft Word, Excel, and Google Docs can be used to create and edit invoice templates. Several accounting software programs, such as QuickBooks and FreshBooks, also offer built-in invoicing features.

NSAs should tailor the template to their specific needs and branding by adding a logo and adjusting the layout.

Key Considerations for Compliance

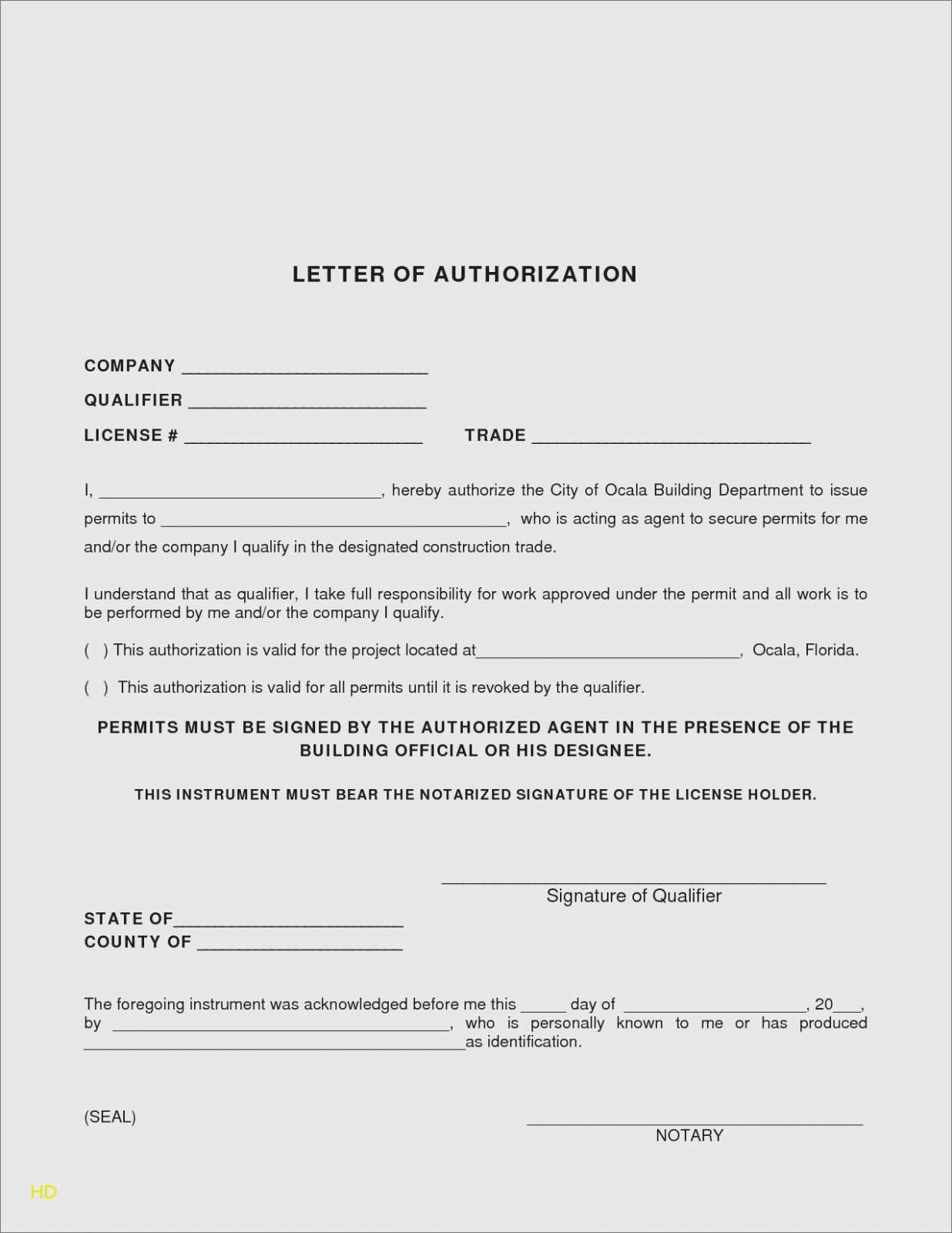

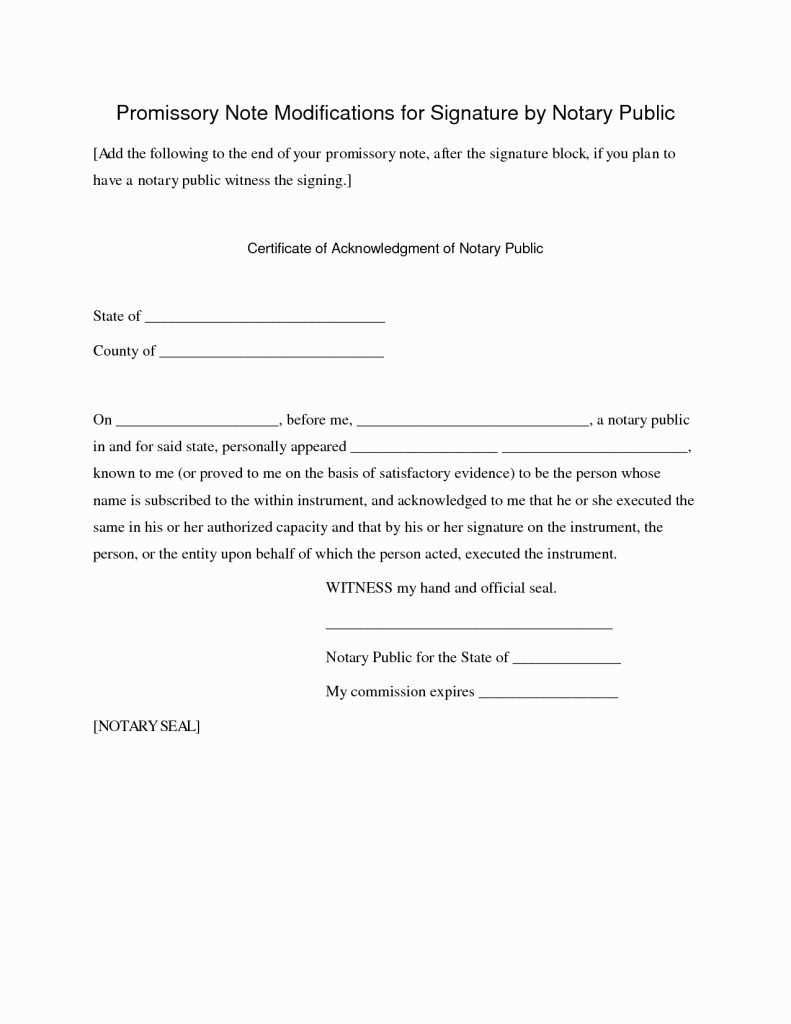

Invoices should comply with all applicable state and federal regulations. NSAs must maintain accurate records of all invoices for tax purposes.

Consulting with a tax professional or accountant is recommended to ensure compliance with local laws.

Clearly state the late payment penalties, if any, on the invoice.

The Future of NSA Invoicing

The trend toward digital invoicing and online payment solutions is expected to continue. Embracing these technologies can further streamline the invoicing process and improve efficiency.

NSAs should stay informed about the latest industry best practices and adapt their invoicing strategies accordingly.

Ongoing developments in fintech will likely offer even more sophisticated tools for managing finances and invoicing in the future.

Next Steps for NSAs

Immediately implement a standardized Notary Signing Agent Invoice Template to improve payment efficiency. Explore available online resources and customize a template that aligns with your business needs.

Review your current invoicing practices and identify areas for improvement.

Consult with a financial advisor to ensure compliance and optimize financial management.