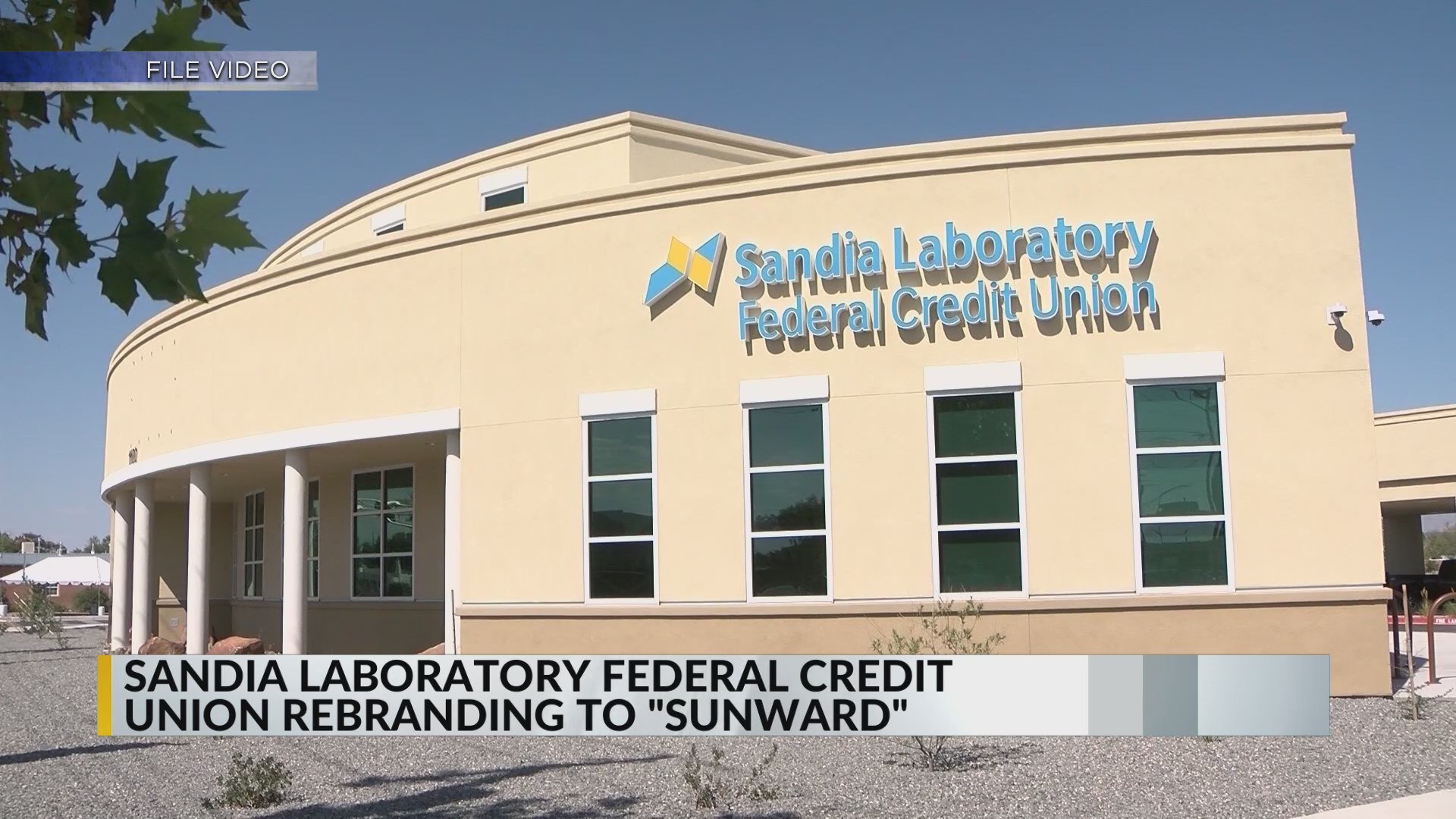

Sandia Laboratory Federal Credit Union Login

Imagine a crisp New Mexico morning, the sun painting the Sandia Mountains in hues of orange and gold. A local scientist, fresh from a groundbreaking research session, reaches for their phone to quickly check their finances before heading home. For thousands of members of Sandia Laboratory Federal Credit Union (SLFCU), this daily routine often begins with a simple act: logging in.

The SLFCU login is more than just a gateway to banking services; it's a portal to financial security and convenience for a community deeply intertwined with the innovative spirit of Sandia National Laboratories. This article explores the significance of this seemingly simple login process, delving into its background, the security measures in place, and the impact it has on the lives of SLFCU members.

A Legacy of Service and Innovation

Founded in 1948, SLFCU was created to serve the financial needs of employees at Sandia National Laboratories. From its humble beginnings, the credit union has grown to become a trusted financial institution, serving not only Sandia employees but also those of related organizations and communities in New Mexico.

Its roots are firmly planted in a culture of innovation and service, mirroring the ethos of the laboratory it serves. This legacy influences every aspect of SLFCU's operations, including the design and security of its digital services.

The Evolution of Access

The SLFCU login has evolved significantly over the years, reflecting the rapid advancements in technology and the changing needs of its members. What started as a basic online portal has transformed into a sophisticated platform accessible across various devices.

Early versions offered rudimentary balance checks and transaction histories. Today, members can manage accounts, pay bills, transfer funds, apply for loans, and access a wealth of financial planning resources, all from the convenience of their computer or mobile device.

The transition to mobile-friendly interfaces has been particularly important, catering to the on-the-go lifestyles of many members. This accessibility is a key factor in SLFCU's continued success and member satisfaction.

Security at the Forefront

In today's digital age, security is paramount. SLFCU understands this implicitly and has invested heavily in robust security measures to protect member accounts and data.

The SLFCU login employs multiple layers of security, including encryption, firewalls, and intrusion detection systems. These technologies work together to prevent unauthorized access and protect against cyber threats.

Multi-Factor Authentication (MFA)

One of the most important security features is Multi-Factor Authentication (MFA). MFA adds an extra layer of protection by requiring members to verify their identity using a second factor, such as a code sent to their mobile device or email address.

This means that even if someone were to obtain a member's username and password, they would still need the second factor to gain access to the account. MFA significantly reduces the risk of unauthorized access.

SLFCU actively encourages all members to enable MFA on their accounts. This is a crucial step in safeguarding personal financial information.

Ongoing Security Enhancements

SLFCU's commitment to security is ongoing. The credit union continuously monitors emerging threats and updates its security protocols accordingly.

Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities. SLFCU also invests in employee training to ensure that staff members are well-versed in the latest security best practices.

This proactive approach to security is essential in maintaining the trust and confidence of SLFCU members.

Impact on the Community

The SLFCU login is more than just a technological tool; it plays a vital role in the financial well-being of the community it serves. By providing convenient and secure access to financial services, SLFCU empowers its members to manage their finances effectively.

Members can easily track their spending, monitor their account balances, and make informed financial decisions. This level of control and transparency can lead to improved financial literacy and greater financial stability.

Supporting Local Growth

SLFCU's commitment to the community extends beyond providing convenient online banking services. The credit union actively supports local organizations and initiatives.

SLFCU offers financial education programs, scholarships, and grants to help individuals and organizations thrive. This investment in the community strengthens the fabric of the region and promotes economic growth.

Through its online services and community involvement, SLFCU is a true partner in the success of its members and the region it serves.

Looking Ahead

As technology continues to evolve, the SLFCU login will undoubtedly undergo further transformations. The credit union is committed to staying ahead of the curve and providing its members with the most innovative and secure banking services available.

Future enhancements may include biometric authentication, such as fingerprint or facial recognition. These technologies offer even greater security and convenience.

SLFCU will also continue to invest in artificial intelligence (AI) and machine learning to personalize the online banking experience and provide members with tailored financial advice.

A Secure Gateway to Financial Well-being

The Sandia Laboratory Federal Credit Union login represents a seamless blend of technology, security, and community commitment. It is a testament to the credit union's unwavering dedication to serving the financial needs of its members.

For the scientist starting their day or the retiree managing their savings, the SLFCU login provides a secure and convenient pathway to financial well-being. It's a small act with a significant impact, reflecting the core values of innovation, service, and trust that define SLFCU.

As the sun sets over the Sandia Mountains, casting long shadows across the landscape, the digital connection between SLFCU and its members remains strong, a symbol of financial security and a promise of continued service for years to come.