When Buying A Business What Questions To Ask

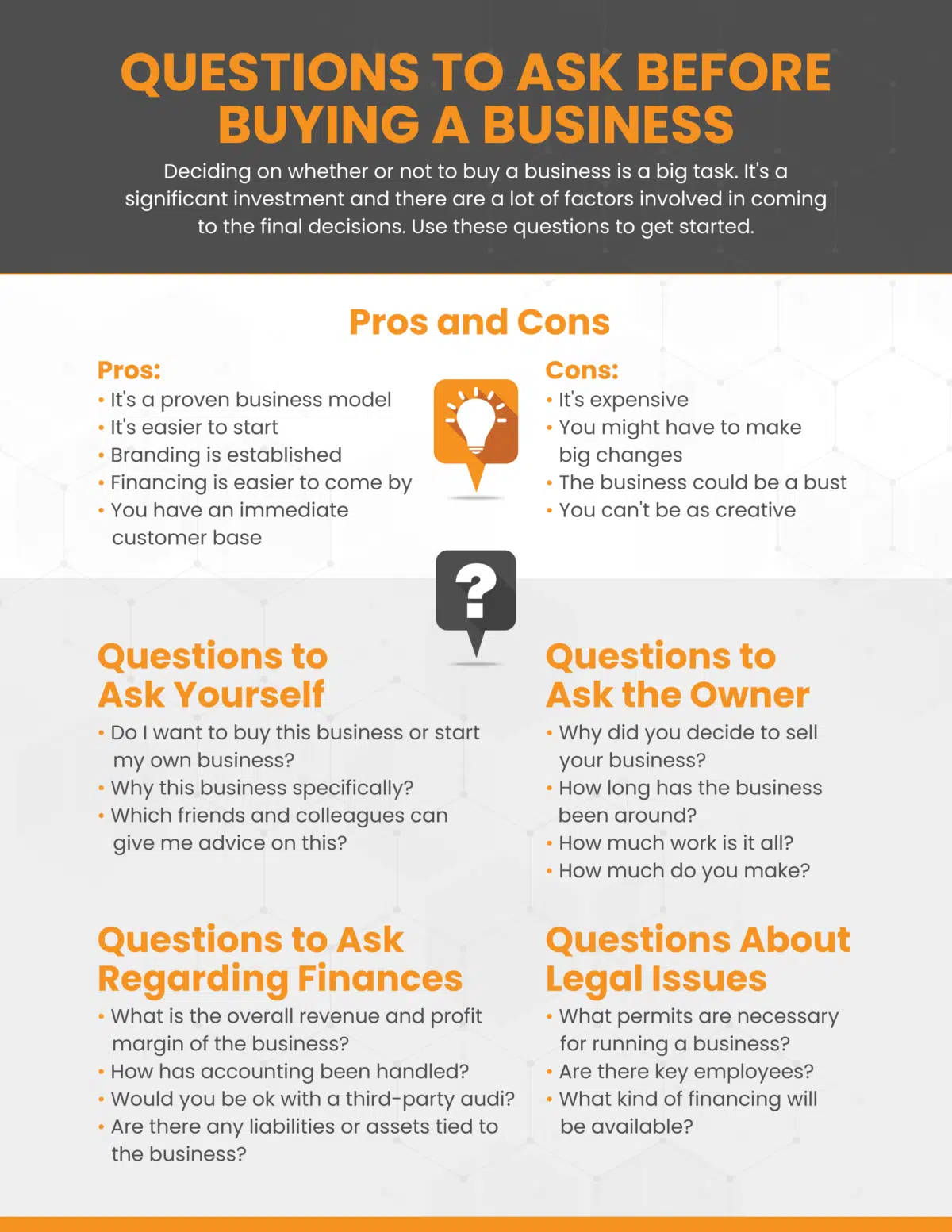

Acquiring a business can be a lucrative venture, but it’s also fraught with potential pitfalls. Savvy buyers understand that thorough due diligence, primarily driven by asking the right questions, is crucial to ensuring a sound investment. The success of a business acquisition hinges on understanding not just the surface-level appeal, but also the underlying realities of its operations, finances, and legal standing.

What questions should prospective buyers ask when considering a business acquisition? This article delves into the critical areas of inquiry, offering a roadmap for navigating the complexities of buying a business. This is to help buyers avoid costly mistakes and maximize their chances of success.

Financial Performance and Stability

A deep dive into the target company’s financials is paramount. Understanding the revenue streams, profit margins, and cash flow is key. Profit and loss statements for the past 3-5 years provide a historical perspective, revealing trends and potential weaknesses.

Balance sheets offer a snapshot of the company’s assets, liabilities, and equity. Scrutinize these documents closely and inquire about any unusual spikes or dips in performance. Be sure to get audited financial statements.

Key questions to ask include: What are the primary revenue drivers? Are there significant customer concentrations? What are the recurring expenses and are there any upcoming capital expenditures planned?

Operational Efficiency and Processes

Beyond the numbers, understanding how the business actually operates is essential. This involves assessing the efficiency of its processes, the quality of its equipment, and the capabilities of its employees. Request a tour of the facilities, if applicable.

Talk to key personnel to understand their roles and responsibilities. Evaluate the efficiency of the supply chain and the quality control measures in place.

Important questions include: What are the key operational processes? Are there any bottlenecks or inefficiencies? What is the average employee tenure? What are the business's Intellectual Properties (IP)?

Legal and Regulatory Compliance

A business is only as good as its legal standing. Thoroughly review all contracts, licenses, and permits. Ensure the business is in compliance with all applicable regulations.

Consult with legal counsel to identify any potential liabilities or lawsuits. Investigate any past or pending litigation.

Relevant questions include: Are there any pending lawsuits or claims against the company? Are all licenses and permits up-to-date? What are the terms of the key contracts?

Market Position and Competitive Landscape

Assess the company's market position and its competitive landscape. Understand its target market, its market share, and its competitive advantages. What are the strengths and weaknesses relative to competitors?

Research the industry trends and potential disruptors. Evaluate the company's ability to adapt to changing market conditions.

Crucial questions include: Who are the major competitors? What are the barriers to entry in the market? What are the company's marketing and sales strategies?

Customer Relationships and Retention

A strong customer base is a valuable asset. Understand the company's customer relationships and retention rates. Analyze customer satisfaction surveys and feedback.

Identify any key customer relationships that are critical to the business's success. Understand the terms of any customer contracts.

Important questions include: What is the customer churn rate? What is the average customer lifetime value? What are the key customer demographics?

Employee Matters

Employees are the backbone of any business. Understanding their skills, experience, and morale is crucial. Review employee contracts, benefits packages, and any union agreements.

Assess the company's employee retention rates and any outstanding employee disputes. Understand the company's human resource policies and procedures.

Key questions include: What is the employee turnover rate? Are there any outstanding employee grievances? What are the company's training and development programs?

Hidden Liabilities and Potential Risks

Uncovering hidden liabilities and potential risks is a critical part of due diligence. This involves investigating environmental issues, tax liabilities, and any other potential problems that could impact the business's value.

Conduct a thorough environmental assessment, if applicable. Review tax returns and any tax audits.

Important questions include: Are there any environmental liabilities? Are there any outstanding tax liabilities? What are the potential risks associated with the business?

Asking these questions, and many more specific to the industry and business, is paramount. The answers will help the buyer determine if the asking price is reasonable. Due diligence is not just a formality; it's a necessity for making an informed and successful business acquisition.

![When Buying A Business What Questions To Ask 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)