When Should Checks From Patients And Other Sources Be Deposited

Did you know that a delay in depositing checks, even by a day, can impact your cash flow and potentially lead to reconciliation issues? When it comes to managing your finances, knowing when to deposit checks from patients and other sources is crucial.

Consider this: A medical practice with $50,000 in outstanding checks delayed by just three days could miss out on earning interest or utilizing those funds for immediate operational needs.

Why Prompt Deposit Matters

Depositing checks promptly is essential for maintaining healthy business finances.

It directly impacts your cash flow, ensuring you have the necessary funds available for expenses like payroll, rent, and supplies.

Delays can create unnecessary financial strain.

Improved Cash Flow Management

Timely deposits allow you to accurately track your income and expenditures.

This provides a clearer picture of your financial health, enabling better budgeting and forecasting.

Effective cash flow management is the backbone of any successful business.

Reduced Risk of Errors and Fraud

The longer you hold onto checks, the higher the risk of misplacing or losing them.

This can lead to reconciliation errors and potential financial losses.

Additionally, delaying deposits gives fraudsters more time to potentially intercept or alter checks.

Stronger Vendor and Employee Relationships

Prompt deposits enable you to pay your vendors and employees on time.

This fosters trust and strengthens relationships, ensuring smooth operations and employee satisfaction.

Late payments due to delayed deposits can damage your reputation and lead to strained partnerships.

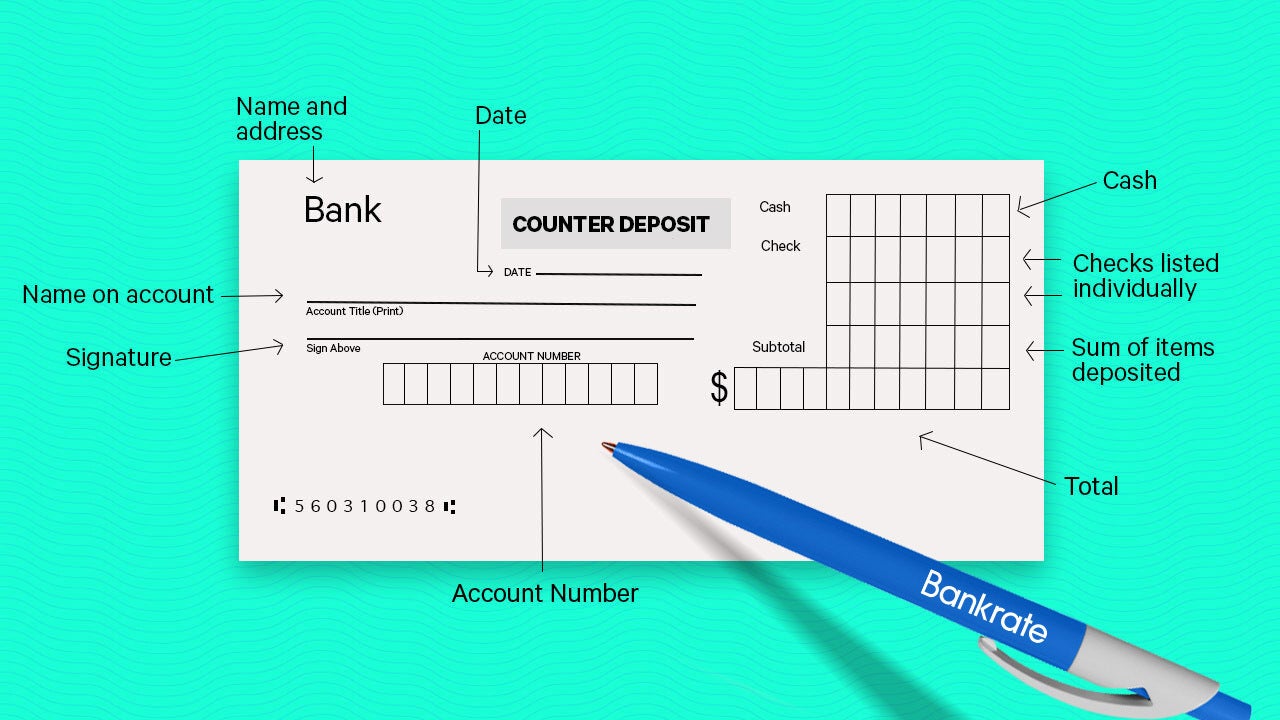

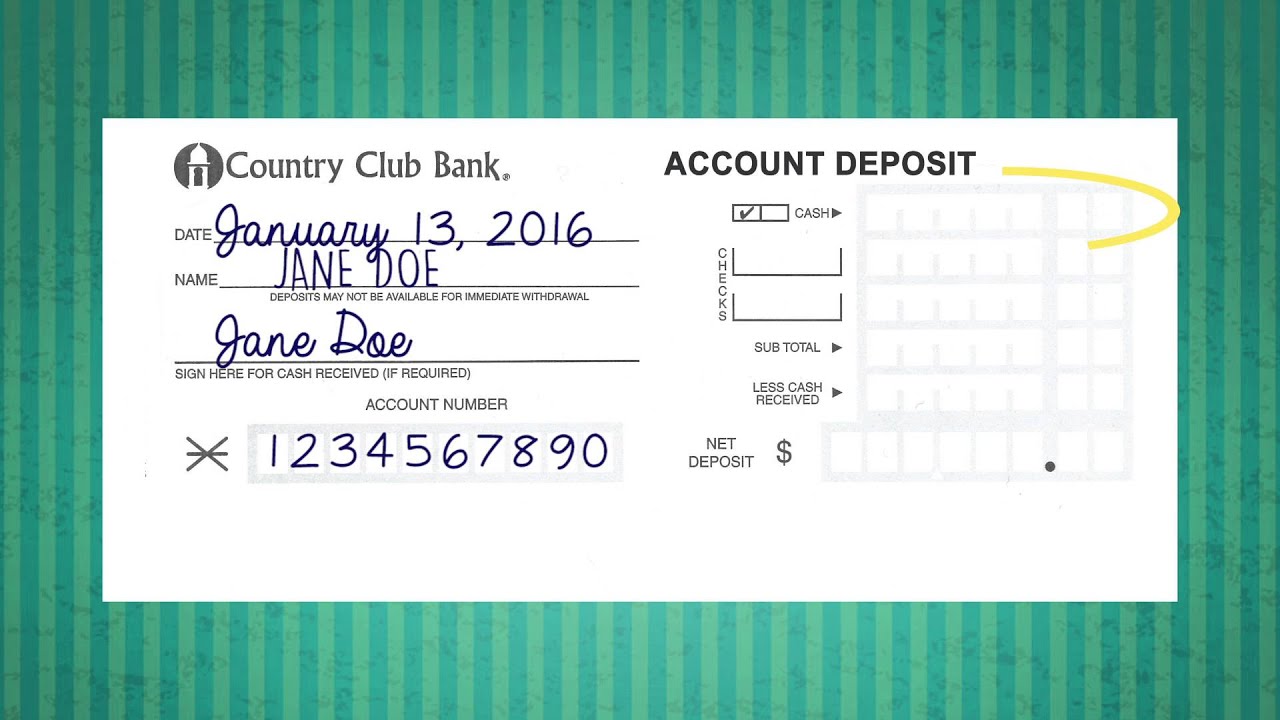

Best Practices for Check Deposits

Establishing clear and consistent procedures for handling check deposits is crucial.

Here are some best practices to consider.

Daily Deposits

The general rule of thumb is to deposit checks daily, especially if you receive a significant volume of payments.

This minimizes the risk of loss and ensures funds are available as quickly as possible.

Daily deposits also streamline your accounting processes.

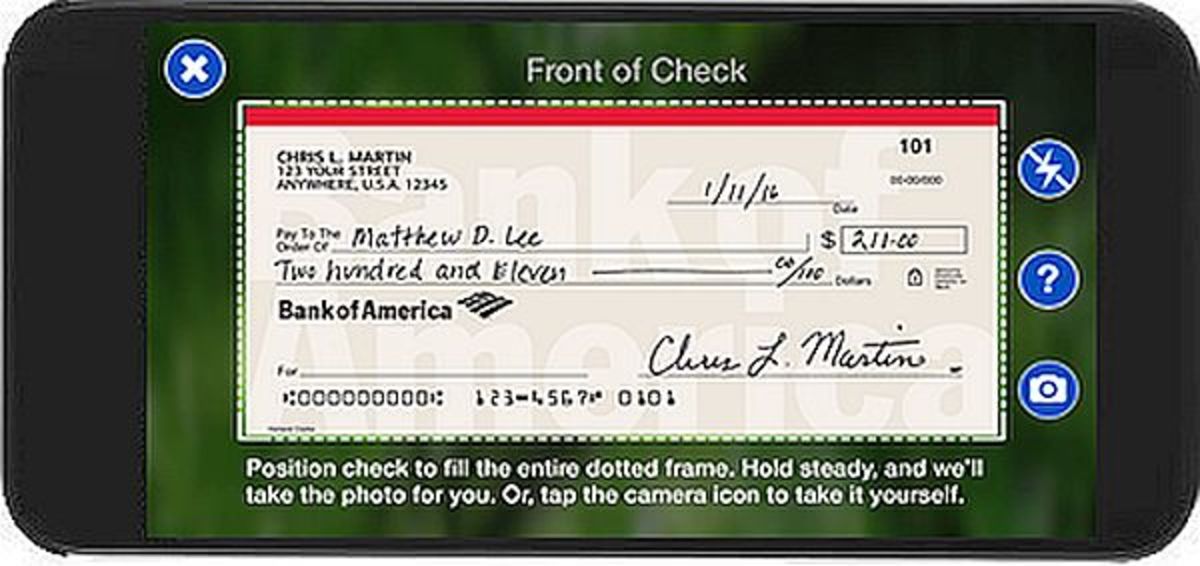

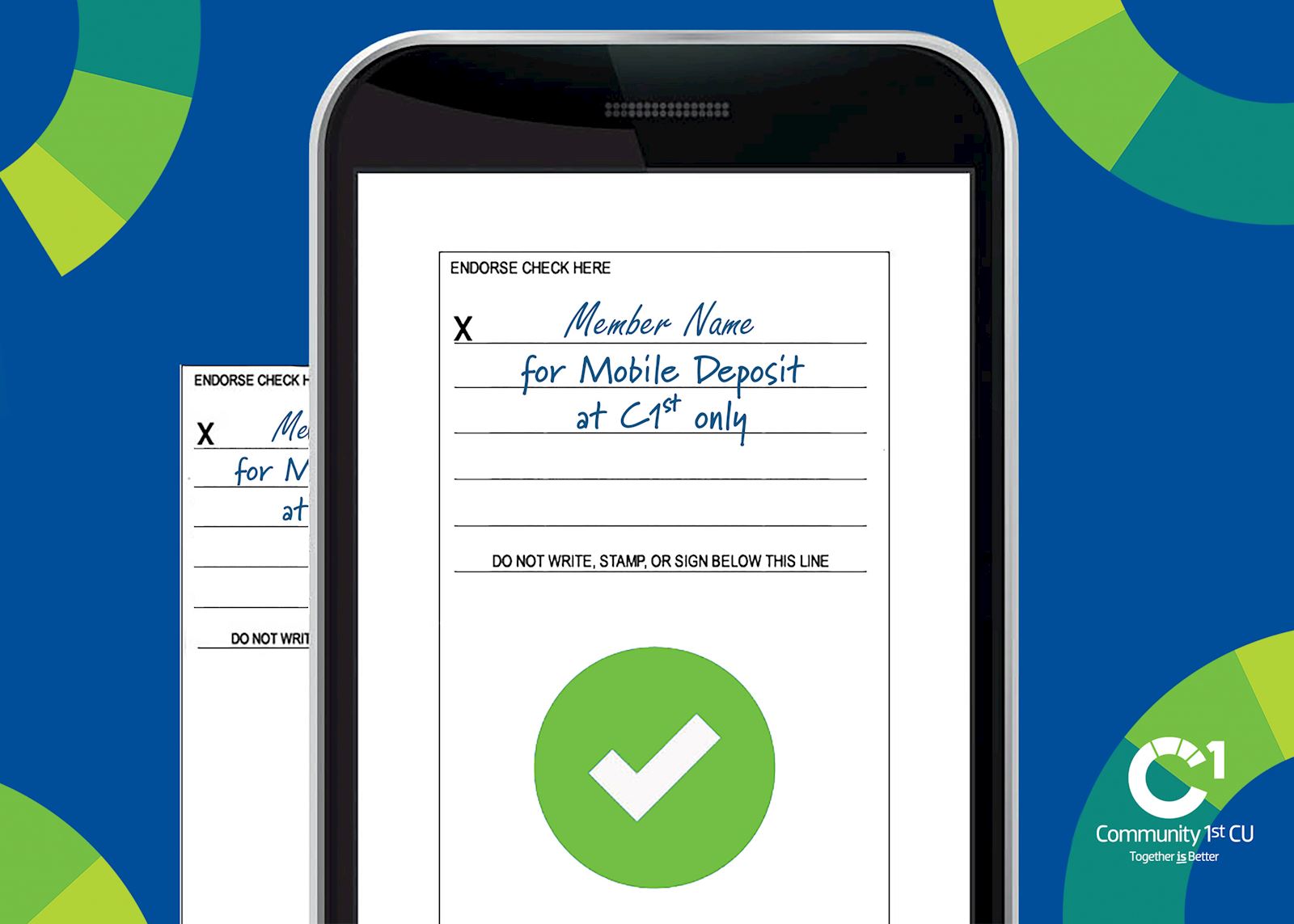

Consider Remote Deposit Capture

Remote Deposit Capture (RDC) allows you to deposit checks electronically by scanning them with a desktop scanner or mobile device.

This eliminates the need to physically visit the bank, saving time and resources. American Bankers Association offers resources and information on RDC.

RDC provides a convenient and efficient way to manage check deposits.

Establish Clear Procedures

Develop a written policy outlining the process for handling and depositing checks.

Assign responsibility for deposits to a specific employee or team.

Ensure all staff members are properly trained on the procedures.

Regular Reconciliation

Reconcile your bank statements regularly to identify any discrepancies or errors.

This helps ensure that all deposits are accurately recorded and accounted for.

Prompt reconciliation prevents financial surprises.

Secure Check Storage

Before checks are deposited, store them in a secure location to prevent loss or theft.

Consider using a locked drawer or safe.

Implement security measures to protect your financial assets.

Addressing Specific Scenarios

The optimal deposit schedule may vary depending on the nature of your business.

Consider these scenarios.

Small Business with Low Volume

Even with a low volume of checks, aim to deposit them at least two to three times per week.

This ensures funds are available within a reasonable timeframe.

Consistency is key, regardless of volume.

Large Healthcare Practice

Healthcare practices often receive a high volume of checks from patients and insurance companies.

Daily deposits are crucial to manage cash flow and minimize risk.

Explore solutions like lockbox services to streamline the deposit process.

Online Businesses

While online businesses primarily receive electronic payments, some may still receive checks.

Implement a system to quickly process and deposit these checks to avoid delays. Small Business Trends suggests exploring mobile deposit options for online businesses.

Don't neglect the occasional paper check.

Promptly depositing checks is a fundamental aspect of sound financial management.

By implementing best practices and tailoring your approach to your specific business needs, you can optimize cash flow, reduce risk, and build stronger relationships with vendors and employees.

Take control of your check deposits and experience the benefits of efficient financial management.

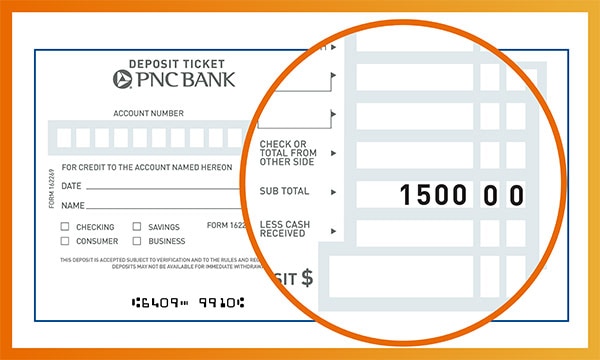

+Deposit+slip.jpg)