Best Accounting Software For Home

Juggling finances at home can feel like a second job. Between bills, budgets, and tracking expenses, staying organized is crucial, but often overwhelming.

This article cuts through the noise to help value-conscious shoppers find the best accounting software for home use. We'll analyze options, compare features, and highlight the practical considerations to empower you to make an informed decision that fits your needs and budget.

Why Home Accounting Software Matters

Effective home accounting software goes beyond simple expense tracking.

It provides insights into spending habits, aids in budget creation and adherence, and simplifies tax preparation. Ultimately, it offers peace of mind knowing your financial house is in order.

Shortlist of Recommended Software

Here are some recommended software tailored to different audiences and budgets:

- Best Overall: YNAB (You Need a Budget) - For serious budgeters.

- Best Free Option: Mint - Excellent for basic tracking and budgeting.

- Best for Simplicity: Personal Capital - Focuses on net worth and investment tracking.

- Best for Small Business Owners: QuickBooks Self-Employed - If you're freelancing.

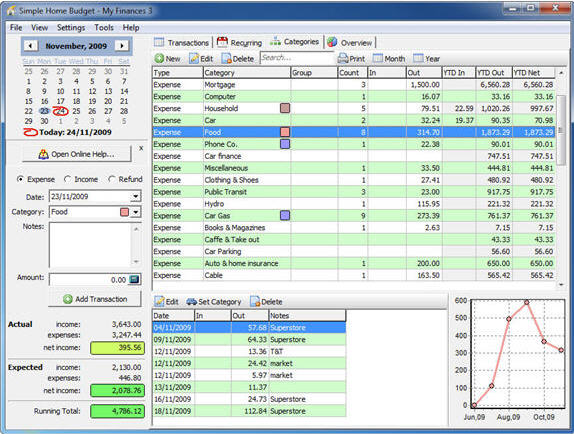

Detailed Reviews

YNAB (You Need a Budget)

YNAB operates on a zero-based budgeting philosophy. Every dollar is assigned a job, promoting mindful spending and proactive financial planning.

It requires a paid subscription but offers comprehensive features, including bank synchronization, goal setting, and detailed reporting. The learning curve can be steep, but the payoff in financial awareness is significant.

Mint

Mint is a free, web-based application that aggregates your financial accounts in one place.

It automatically categorizes transactions, tracks spending, and provides budget suggestions. While free, it relies on advertising, which can be intrusive at times.

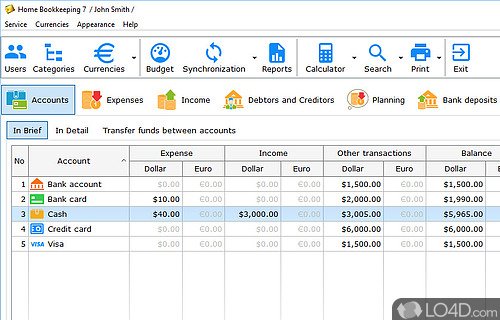

Personal Capital

Personal Capital is designed for individuals who want to monitor their net worth and investment performance.

It offers free tools for tracking assets, liabilities, and investment returns. Paid advisory services are available for those seeking professional financial guidance, but the core tracking features are robust and free.

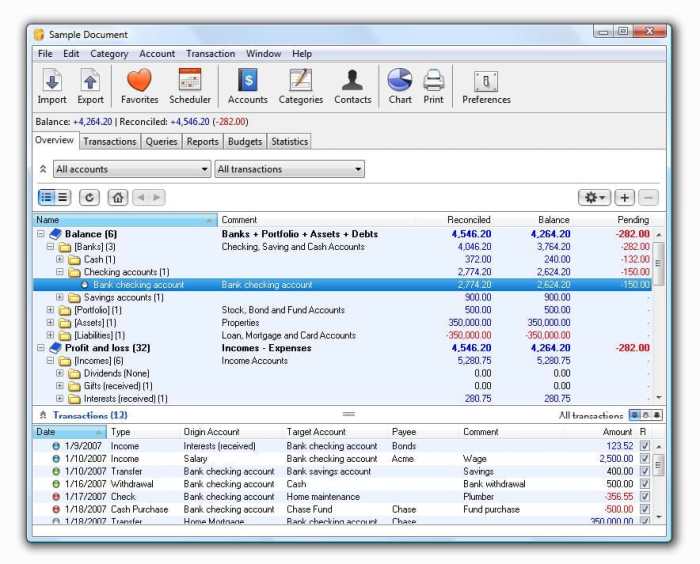

QuickBooks Self-Employed

QuickBooks Self-Employed is geared towards freelancers and independent contractors. It simplifies income and expense tracking for tax purposes, calculating estimated quarterly taxes.

While more expensive than basic home accounting software, it's invaluable for those with self-employment income. It integrates with other QuickBooks products for seamless accounting.

Side-by-Side Specs Table

| Software | Price | Budgeting | Expense Tracking | Investment Tracking | Reporting | Ease of Use | Performance Score (out of 5) |

|---|---|---|---|---|---|---|---|

| YNAB | Subscription | Excellent | Excellent | Limited | Excellent | Good | 4.5 |

| Mint | Free | Good | Good | Limited | Good | Excellent | 4.0 |

| Personal Capital | Free (Paid Advisory) | Basic | Good | Excellent | Excellent | Good | 4.2 |

| QuickBooks Self-Employed | Subscription | Good | Excellent | Limited | Excellent | Good | 4.3 |

Practical Considerations

When choosing accounting software, consider your specific needs and priorities.

Do you need detailed budgeting tools, investment tracking, or tax preparation assistance? Think about the level of technical expertise you possess and how much time you're willing to invest in learning a new system.

Data security is also a crucial factor. Opt for software that employs robust security measures to protect your financial information.

Key Takeaways

Selecting the right home accounting software is a personal decision.

Weigh the features, costs, and ease of use of each option against your individual needs and financial goals. Consider factors like budgeting requirements, investment tracking, and tax preparation support.

Data security should always be a top priority.

Make an Informed Decision

Ready to take control of your finances? Explore the software options discussed in this article and try free trials or demos where available.

By carefully considering your needs and the features offered by each software, you can choose the best tool to achieve your financial goals. Start your journey to financial clarity today!

Frequently Asked Questions (FAQ)

Q: Is free accounting software really safe?

A: While some free options are safe, be cautious of those that lack robust security measures or rely heavily on advertising. Reputable free software like Mint employs encryption and other security protocols to protect your data.

Q: Can I import my bank transactions into these programs?

A: Most modern accounting software offers bank synchronization, allowing you to automatically import transactions. Check the software's documentation for specific instructions and supported banks.

Q: Do I need accounting experience to use these programs?

A: No, most home accounting software is designed for users with little to no accounting experience. The interfaces are user-friendly, and many programs offer tutorials and support resources.

Q: Can these programs help with tax preparation?

A: Yes, many accounting programs can generate reports and summaries that simplify tax preparation. QuickBooks Self-Employed is specifically designed for this purpose.

Q: What if my needs change in the future?

A: Many accounting programs offer scalable features, allowing you to upgrade or downgrade your subscription as your needs evolve. Consider software that offers flexibility and future-proofing.

![Best Accounting Software For Home 10 Best Accounting Software for Small Businesses [2024 Updated]](https://onebasemedia.co.uk/wp-content/uploads/2024/01/best-accounting-software-for-small-business.jpg)

![Best Accounting Software For Home The 10 Best Cloud Based Accounting Software [2025 Updated List]](https://www.softwaretestinghelp.com/wp-content/qa/uploads/2020/09/10-Top-Accounting-Software.png)