Best Accounting Software For

Juggling invoices, tracking expenses, and managing your books can feel overwhelming, especially when you're just starting your business journey. Imagine spending less time on paperwork and more time on growing your company. That's where accounting software comes in – your secret weapon for financial control.

This article is for you, the first-time business owner, freelancer, or entrepreneur who's ready to ditch the spreadsheets and embrace a more efficient way to manage your finances. We'll explore the best accounting software options, break down the jargon, and help you make a confident decision.

Why Accounting Software Matters

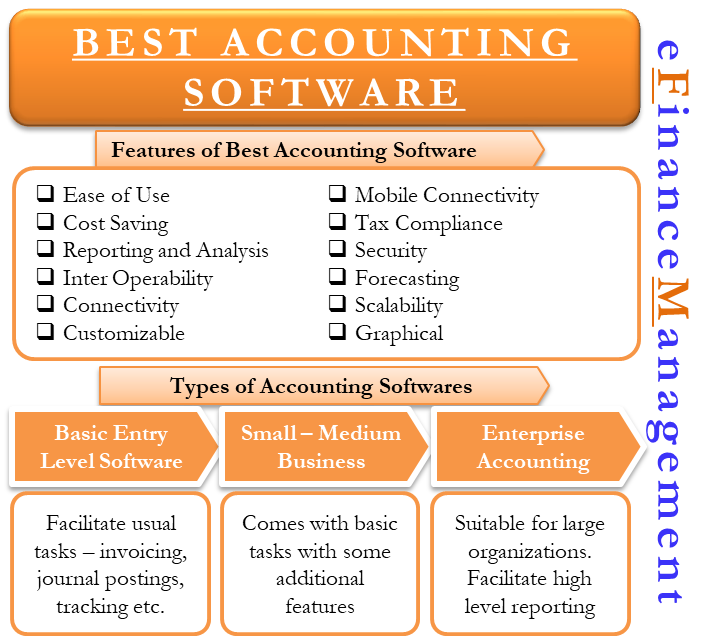

Accurate financial records are the backbone of any successful business. They allow you to track profitability, manage cash flow, and stay compliant with tax regulations. Accounting software automates many of these tasks, saving you time and reducing the risk of errors.

Investing in the right software can also provide valuable insights into your business performance. You'll be able to identify trends, make informed decisions, and ultimately, improve your bottom line. Think of it as your financial co-pilot, guiding you toward success.

Top 5 Accounting Software Options: A Quick Comparison

Let's dive into a comparison of some leading accounting software solutions. Here's a table showcasing key features, pricing, and other relevant information to help you get a feel for the market.

| Software | Starting Price (Monthly) | Key Features | Warranty/Support |

|---|---|---|---|

| QuickBooks Online | $30 | Invoicing, expense tracking, reporting, payroll integration | Phone & chat support, online resources |

| Xero | $13 | Invoicing, bank reconciliation, inventory management, project tracking | 24/7 online support |

| FreshBooks | $17 | Invoicing, time tracking, project management, expense tracking | Email & phone support |

| Zoho Books | $0 (limited) / $20 | Invoicing, expense tracking, bank reconciliation, CRM integration | Email & phone support, online resources |

| Sage Intacct | Contact Sales | Advanced reporting, multi-entity consolidation, budgeting and planning | Phone and online support |

Detailed Reviews: A Closer Look

Now, let's explore each software option in more detail. We'll highlight the strengths and weaknesses to help you understand which one might be the best fit for your specific needs.

QuickBooks Online

QuickBooks Online is a popular choice for small businesses due to its user-friendly interface and comprehensive features. It offers a wide range of tools for invoicing, expense tracking, and reporting. Plus, it integrates seamlessly with many other business applications.

However, the pricing can be a bit higher compared to some alternatives. Also, the features become more complex as you upgrade to higher tiers.

Xero

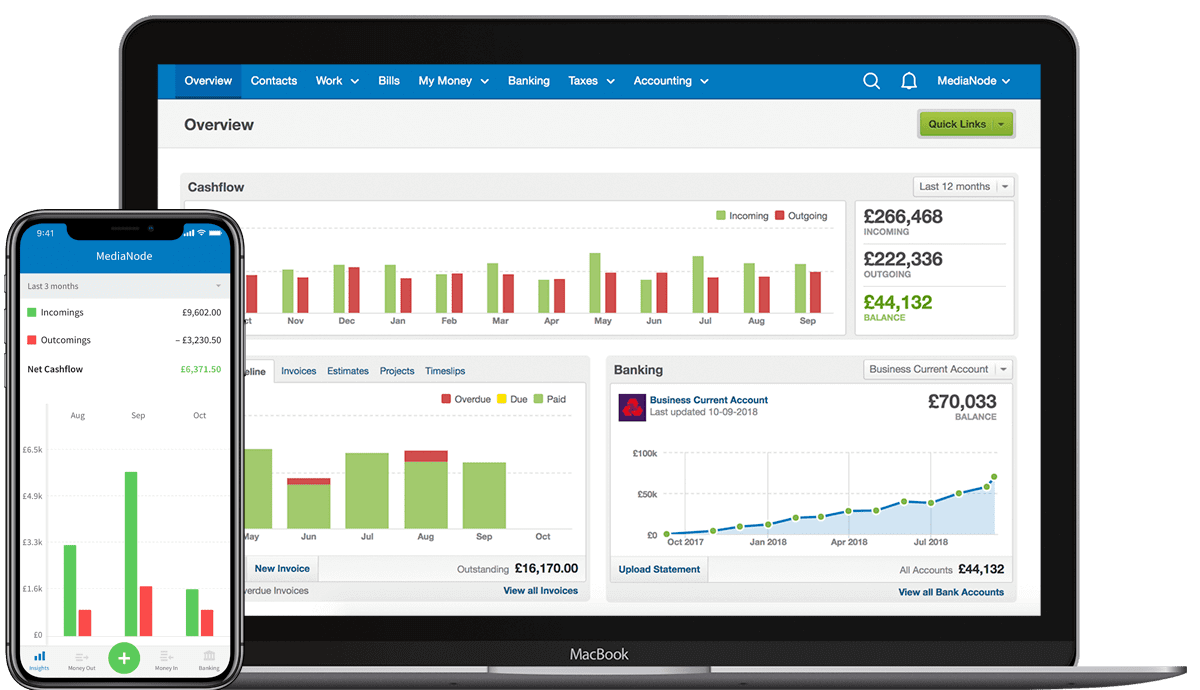

Xero is another strong contender, known for its excellent bank reconciliation capabilities. It offers a clean interface and integrates well with third-party apps. Xero provides 24/7 online support, which can be a lifesaver when you encounter issues.

Its pricing structure can be a bit confusing, and some users find the reporting features less intuitive than QuickBooks.

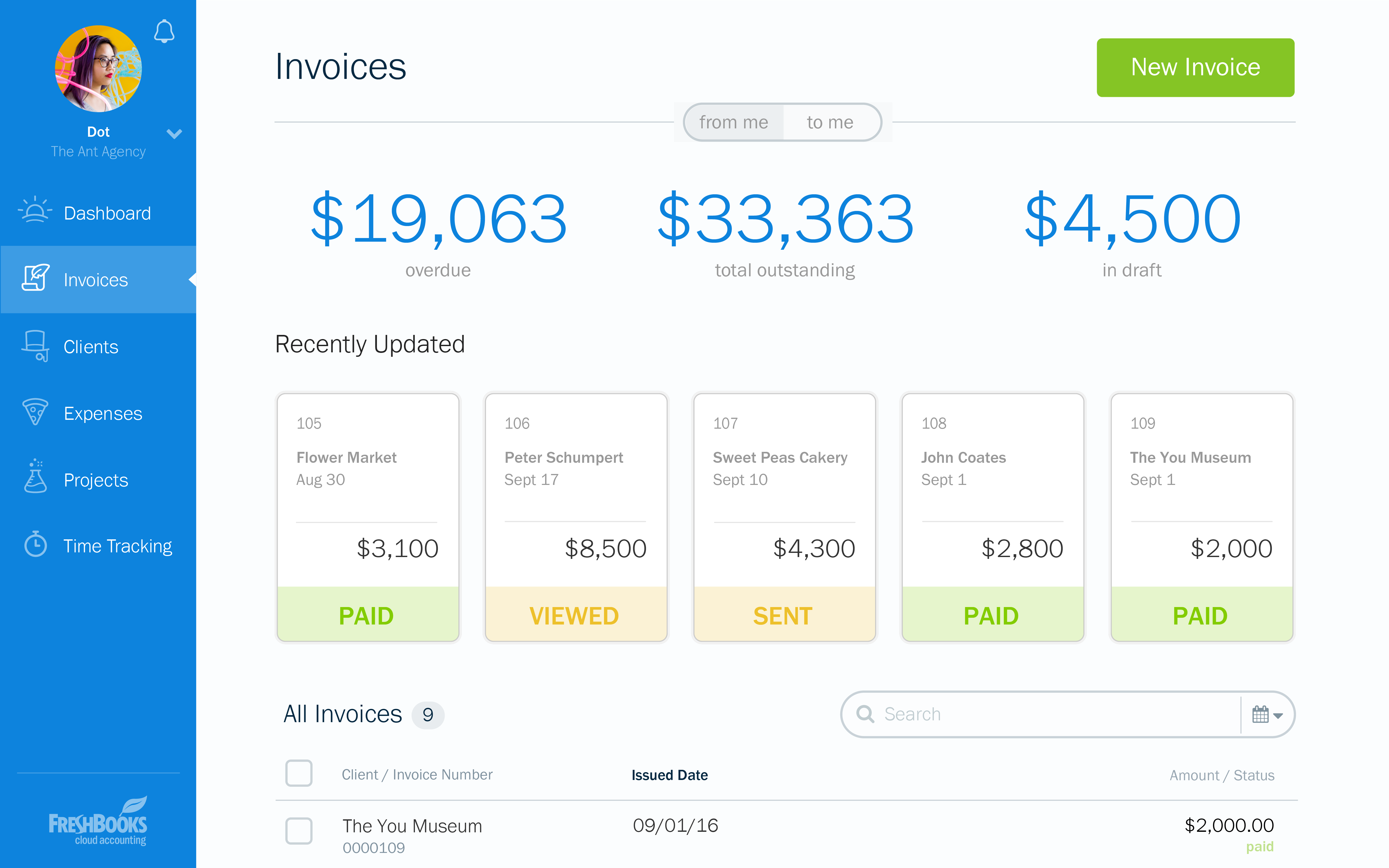

FreshBooks

FreshBooks is designed specifically for freelancers and service-based businesses. Its strengths lie in invoicing, time tracking, and project management. The interface is clean and intuitive, making it easy to get started.

It's less suitable for businesses with complex inventory or manufacturing needs. Its reporting capabilities are also less robust than some of its competitors.

Zoho Books

Zoho Books is part of the Zoho ecosystem, offering a wide range of business applications. It's a cost-effective option, especially with its free plan for very small businesses. It also integrates seamlessly with other Zoho apps like Zoho CRM.

The free plan has limitations, and the interface may feel less polished than some of the other options. Also, some users have reported a steeper learning curve.

Sage Intacct

Sage Intacct stands out with advanced reporting, multi-entity consolidation, and budgeting tools. Suited for scaling businesses needing in-depth insights and multi-faceted financial management.

Pricing is custom, geared towards businesses needing an enterprise-grade solution. This software targets more established companies and may not be suitable for startups.

Used vs. New: Which is Right for You?

Unlike some types of software, accounting software is typically not purchased "used". Instead, the choice is between different subscription plans and potentially migrating data from a previous system.

Pros of "New" (Subscribing):- Latest features and updates

- Access to customer support

- Data security and compliance

- Ongoing subscription costs

- Potential learning curve

- Reliance on internet connectivity

Reliability Ratings by Brand

Reliability is crucial when it comes to accounting software. You need to know that your data is safe and secure and that the software will be available when you need it.

Based on user reviews and industry reports, here's a general overview of the reliability ratings for each brand:

- QuickBooks Online: Generally reliable, with a large user base and extensive resources. Occasional outages can occur.

- Xero: Known for its robust infrastructure and reliable performance.

- FreshBooks: A solid choice with generally good uptime and data security.

- Zoho Books: Reliable, especially when integrated within the broader Zoho ecosystem.

- Sage Intacct: Enterprise-grade reliability, suitable for complex operational environments.

Checklist: 5 Must-Check Features Before Buying

Before you commit to a specific accounting software, make sure it meets your essential needs. Here's a checklist of five key features to consider:

- Invoicing: Can you easily create and send professional invoices?

- Expense Tracking: How well does the software handle expense categorization and reconciliation?

- Reporting: Does it provide the reports you need to understand your business performance?

- Bank Reconciliation: Can you easily connect your bank accounts and reconcile transactions?

- Integration: Does it integrate with other tools you use, such as your CRM or payment processor?

Key Takeaways

Choosing the right accounting software is a critical decision for your business. QuickBooks Online offers a comprehensive suite of features and broad support. Xero excels at bank reconciliation. FreshBooks is perfect for freelancers. Zoho Books provides a cost-effective solution, especially for those already using the Zoho ecosystem. Sage Intacct delivers powerful features for larger, scaling organizations.

Remember to carefully evaluate your specific needs and consider the factors discussed in this article. Don't hesitate to take advantage of free trials to test out different options before making a final decision.

Ultimately, the best accounting software is the one that helps you manage your finances efficiently and effectively. By making an informed decision, you'll be well on your way to financial success.

Ready to Take Control of Your Finances?

Start your free trial today and discover the power of automated accounting! Don't delay; your business future is waiting.

![Best Accounting Software For The 11 Best Accounting Software [Bookkeeping Software Review]](https://www.softwaretestinghelp.com/wp-content/qa/uploads/2020/09/10-Top-Accounting-Software.png)