Best Finance App For Small Business

Running a small business is a whirlwind of tasks, and managing your finances shouldn't add to the chaos. The right finance app can be a game-changer, providing clarity, control, and ultimately, peace of mind.

This review is tailored for value-conscious small business owners seeking efficient and affordable financial management solutions. We'll cut through the marketing jargon and provide an analytical look at the best finance apps available.

Why Your Small Business Needs a Dedicated Finance App

Gone are the days of relying solely on spreadsheets and manual bookkeeping. A dedicated finance app streamlines tasks, saving you valuable time and reducing the risk of errors.

Real-time insights into your cash flow, automated expense tracking, and simplified invoicing are just a few benefits. These tools empower you to make informed decisions and proactively manage your business's financial health.

Shortlist: Top Finance Apps for Small Businesses

Here's a curated list of top finance apps, catering to different needs and budgets:

- Best Overall: QuickBooks Online

- Best for Solopreneurs: Zoho Books

- Best Free Option: Wave Accounting

- Best for Expense Tracking: Expensify

- Best for Inventory Management: Xero

Detailed Reviews

QuickBooks Online

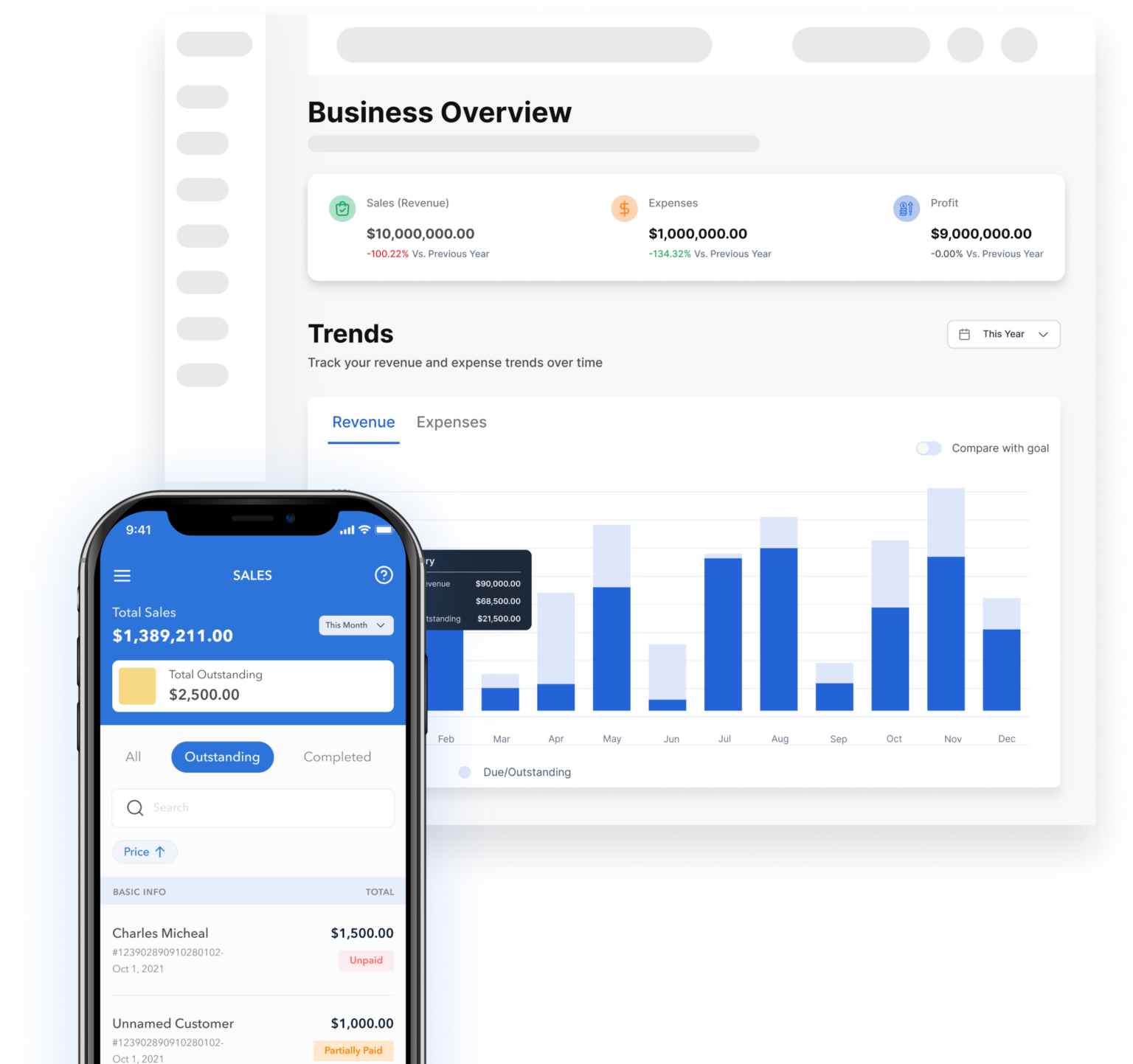

QuickBooks Online is a powerhouse, offering a comprehensive suite of features for managing every aspect of your business finances. From invoicing and expense tracking to payroll and advanced reporting, it's a robust solution for growing businesses.

While it comes with a higher price tag than some competitors, the depth of functionality justifies the investment for many. The platform integrates seamlessly with other popular business tools, further enhancing its value.

Zoho Books

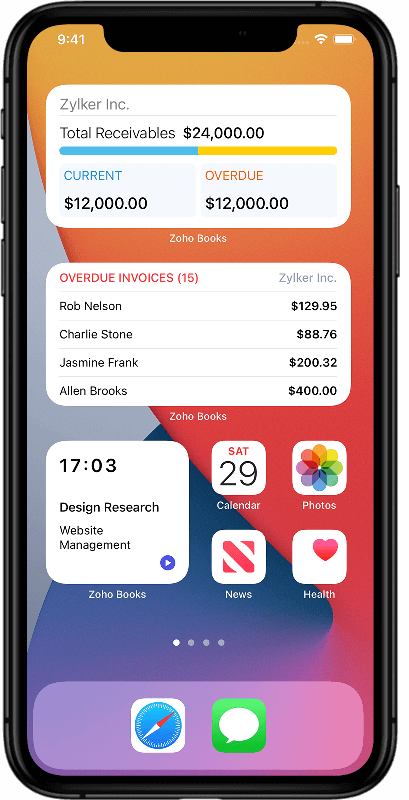

Zoho Books stands out with its user-friendly interface and affordable pricing, making it an excellent choice for solopreneurs and small teams. It offers a full range of accounting features, including invoicing, expense tracking, and bank reconciliation.

Zoho Books integrates seamlessly with the Zoho suite of business applications. This allows users to create a streamlined workflow.

Wave Accounting

For businesses on a tight budget, Wave Accounting offers a surprisingly feature-rich free plan. It includes core accounting functionalities like invoicing, expense tracking, and financial reporting.

The free plan is supported by transaction fees for payment processing and payroll. This makes it a cost-effective solution for startups and freelancers with simple financial needs.

Expensify

Expensify excels at simplifying expense tracking and reimbursement. Its automated features, such as receipt scanning and expense report generation, save time and eliminate manual data entry.

The app integrates seamlessly with accounting software like QuickBooks Online and Xero. This allows for a streamlined workflow from expense capture to reconciliation.

Xero

Xero is a popular accounting software known for its intuitive interface and robust features. It's particularly strong in inventory management, making it a great choice for businesses that sell physical products.

Xero offers various plans to cater to different business sizes and needs. Its real-time reporting capabilities provide valuable insights into your business's financial performance.

Side-by-Side Specs Table

| App | Pricing | Key Features | Ease of Use (1-5) | Value for Money (1-5) | Overall Score (1-5) |

|---|---|---|---|---|---|

| QuickBooks Online | Starts at $30/month | Invoicing, expense tracking, payroll, reporting, inventory management | 4 | 4 | 4.5 |

| Zoho Books | Starts at $0/month | Invoicing, expense tracking, bank reconciliation, project management | 4.5 | 5 | 4.5 |

| Wave Accounting | Free (transaction fees apply) | Invoicing, expense tracking, basic reporting | 4 | 5 | 4 |

| Expensify | Starts at $5/month | Expense tracking, receipt scanning, expense reports | 4.5 | 4 | 4 |

| Xero | Starts at $25/month | Invoicing, expense tracking, inventory management, reporting | 4 | 4 | 4 |

Practical Considerations

Choosing the right finance app involves more than just comparing features and prices. Consider your business's specific needs, technical expertise, and growth plans.

Scalability is crucial if you anticipate significant growth in the future. Ensure the app can accommodate increasing transaction volumes, users, and complexity.

Integration with other business tools, such as CRM or e-commerce platforms, can streamline workflows and improve efficiency. Look for apps that offer robust API and pre-built integrations.

Customer support is essential, especially when dealing with financial matters. Check the app's support channels, response times, and user reviews regarding customer service quality.

Summary

Selecting the best finance app for your small business is a critical decision. QuickBooks Online offers a comprehensive solution for growing businesses, while Zoho Books provides an affordable and user-friendly option for solopreneurs.

Wave Accounting is a great free choice for basic needs, and Expensify excels at expense tracking. For those needing inventory management, Xero is a strong contender.

Carefully consider your specific requirements, budget, and long-term goals. The right app will streamline your financial management, providing you with clarity and control.

Take Action Today

Ready to take control of your business finances? Explore the apps mentioned above, take advantage of free trials, and find the perfect fit for your needs. Start simplifying your financial management today and unlock your business's full potential.

Frequently Asked Questions (FAQ)

Q: What is the best free accounting software for small businesses?

Wave Accounting is a popular choice for free accounting software. It offers essential features like invoicing, expense tracking, and basic reporting. However, transaction fees apply for payment processing and payroll.

Q: Do I need an accountant if I use accounting software?

Accounting software can automate many tasks, but an accountant can still provide valuable expertise. They can help with tax planning, financial analysis, and strategic decision-making. Consider consulting with an accountant regularly, especially as your business grows.

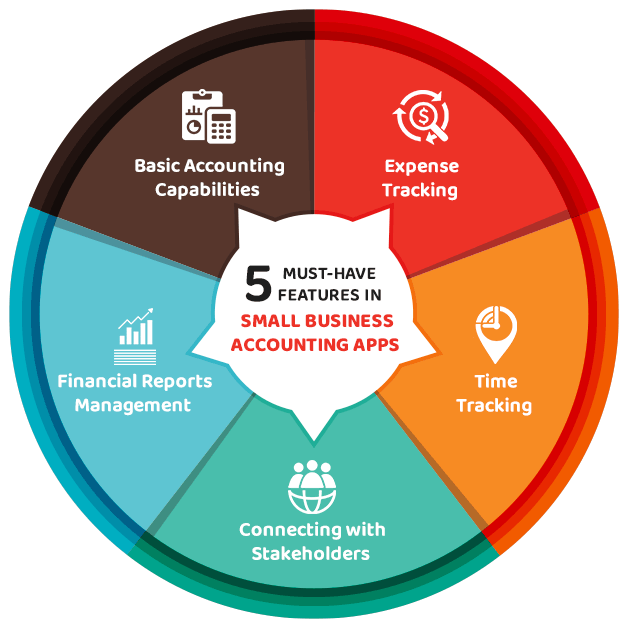

Q: What are the essential features to look for in a finance app?

Essential features include invoicing, expense tracking, bank reconciliation, financial reporting, and payment processing. The specific features you need will depend on your business's specific requirements.

Q: How do I migrate my existing financial data to a new finance app?

Most finance apps offer data import tools or integrations with other platforms. Check the app's documentation or contact their support team for assistance with data migration. Consider hiring a bookkeeper or accountant to help with the transition.

Q: Is it safe to store my financial data in the cloud?

Reputable finance apps use robust security measures to protect your data. Look for apps that offer encryption, multi-factor authentication, and regular security audits. Always use strong passwords and keep your software up to date.