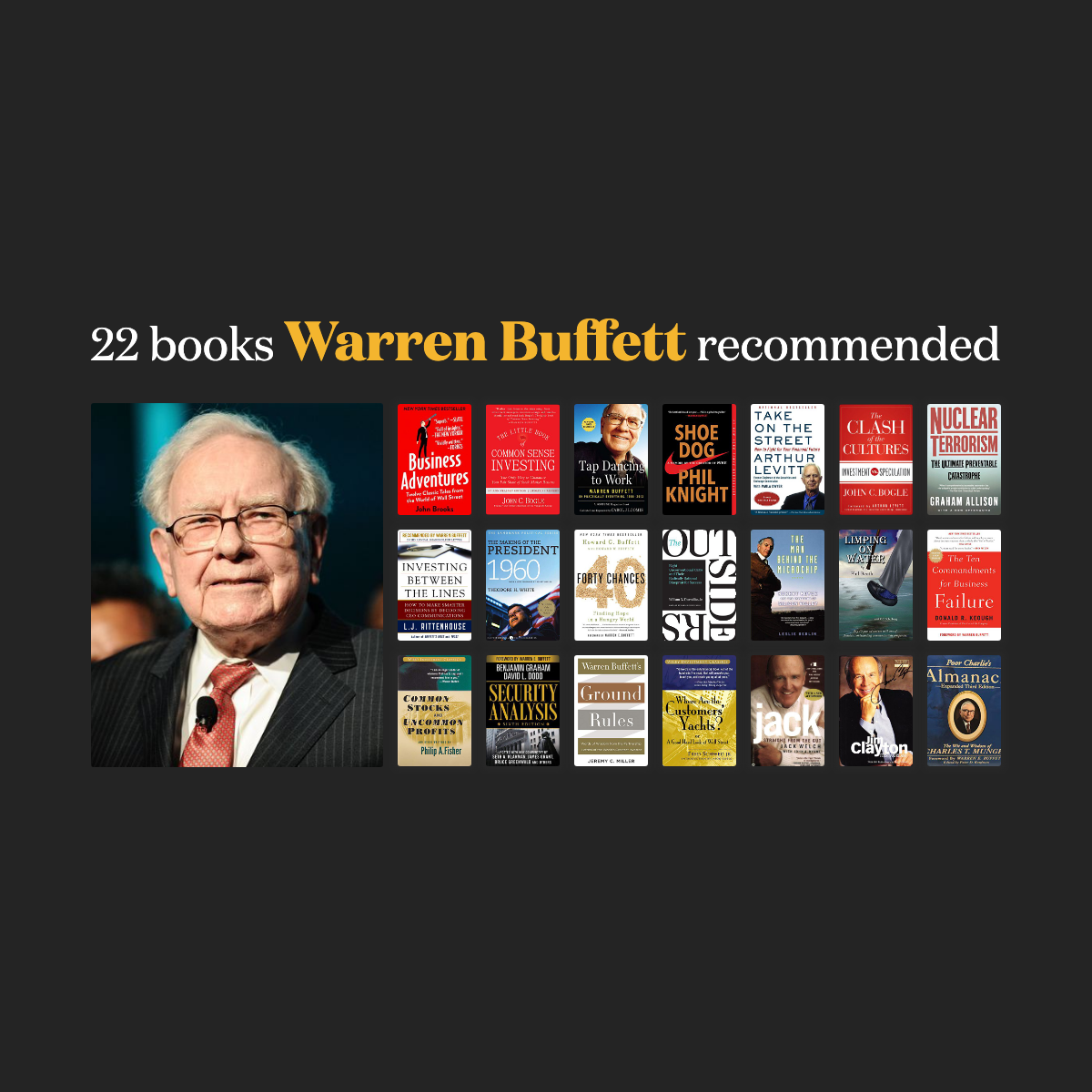

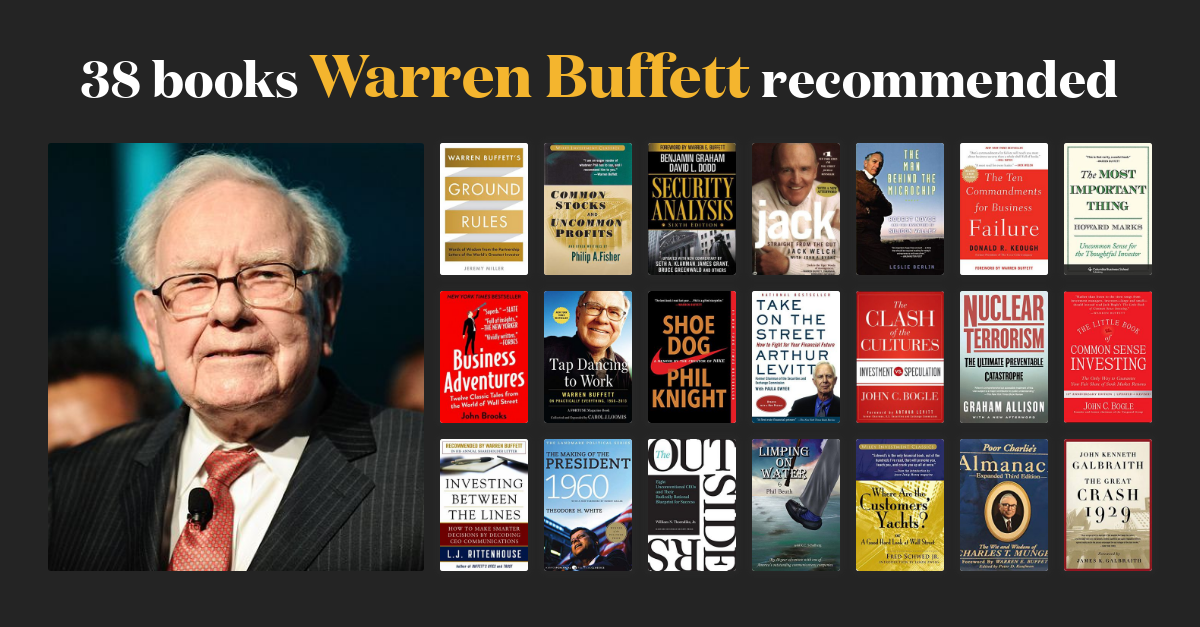

Best Investing Books Recommended By Warren Buffett

For the value-conscious investor seeking financial wisdom, there's no better endorsement than the recommendations of Warren Buffett himself. These books, handpicked by the Oracle of Omaha, offer timeless principles that cut through market noise. This article dissects Buffett's favorite investing books, helping you choose the best resources to bolster your investment acumen.

Why Learn From Investing Books?

Investing books provide a structured and time-tested approach to financial literacy. They offer insights into value investing, risk management, and understanding market cycles. This knowledge empowers you to make informed decisions, rather than relying on speculation or fleeting trends.

Shortlist of Buffett-Recommended Books

Here's a curated selection catering to various needs and budgets:

- The Intelligent Investor by Benjamin Graham (Best Overall)

- Security Analysis by Benjamin Graham and David Dodd (For Deep Dive Analysis)

- The Interpretation of Financial Statements by Benjamin Graham and Spencer B. Meredith (For Beginners)

- Common Stocks and Uncommon Profits by Philip Fisher (For Growth Stock Investors)

- Where Are the Customers' Yachts? by Fred Schwed Jr. (For a Humorous Take on Wall Street)

Detailed Reviews

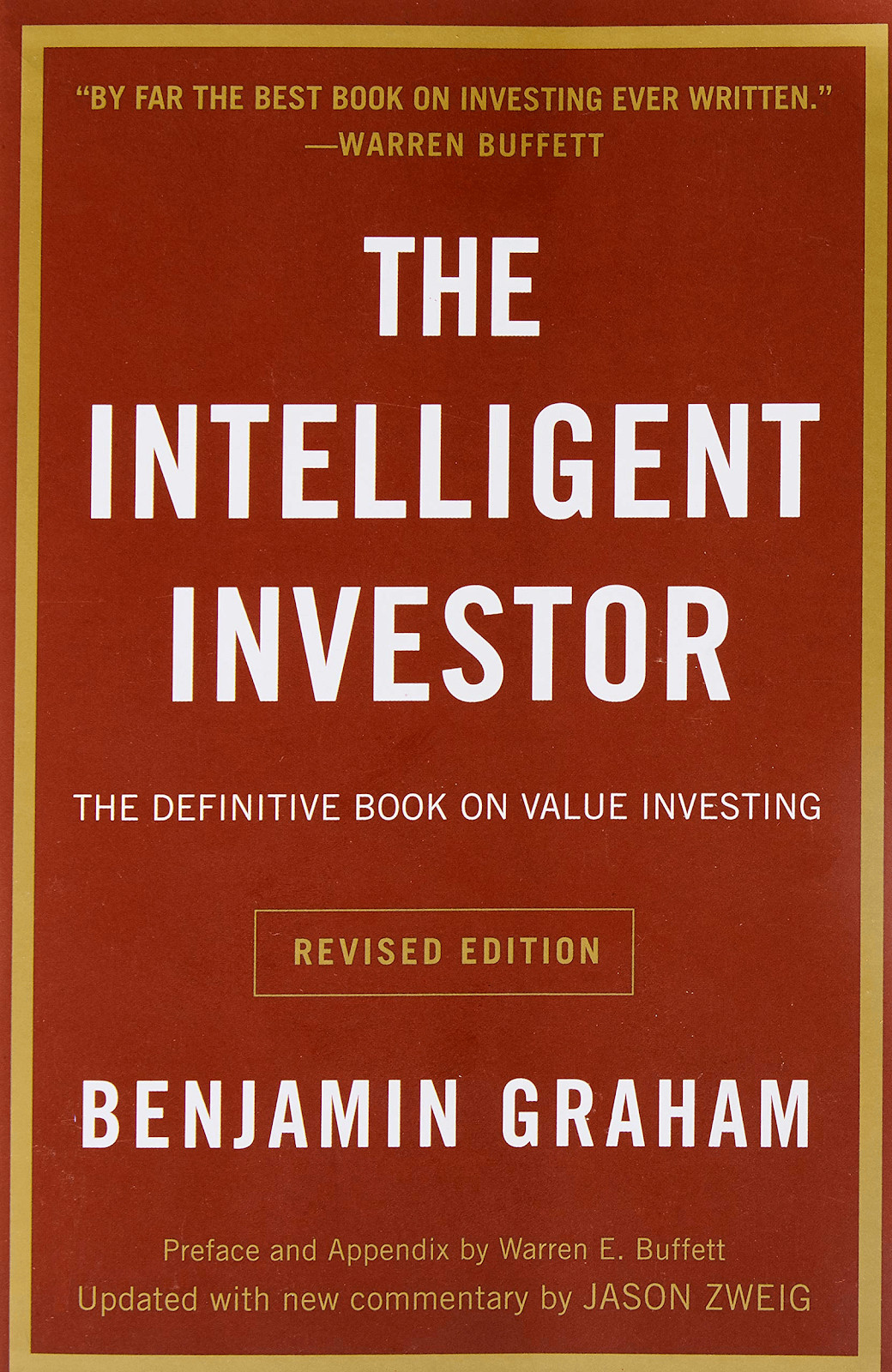

The Intelligent Investor by Benjamin Graham

Often cited as Warren Buffett's favorite, The Intelligent Investor is a cornerstone of value investing. Graham's "Mr. Market" analogy teaches investors to exploit market volatility rather than be swayed by it. The book emphasizes a disciplined approach to identifying undervalued companies with a margin of safety.

The target audience is any investor seeking a long-term, risk-averse strategy. It is particularly beneficial for beginners, but its principles remain relevant for experienced investors. The book is available in various editions, so budget shouldn't be a barrier.

Security Analysis by Benjamin Graham and David Dodd

This is a more in-depth exploration of value investing principles. Security Analysis provides a rigorous framework for analyzing financial statements and assessing a company's intrinsic value. It's a challenging read, but rewarding for those committed to fundamental analysis.

Security Analysis is best suited for serious investors or those pursuing a career in finance. This requires a significant time commitment and a solid understanding of accounting. Expect to pay a premium for newer editions.

The Interpretation of Financial Statements by Benjamin Graham and Spencer B. Meredith

A perfect starting point for understanding company financials. The Interpretation of Financial Statements breaks down complex concepts into digestible insights. This book is an essential tool for any investor wanting to understand how to analyze balance sheets, income statements, and cash flow statements.

This book is ideal for novice investors who don't yet feel comfortable reviewing financial statements. It offers a gentle introduction to essential business concepts. You can often find it at an affordable price.

Common Stocks and Uncommon Profits by Philip Fisher

While Graham focuses on quantitative analysis, Philip Fisher emphasizes qualitative factors. Common Stocks and Uncommon Profits outlines fifteen points to look for in a company, including management integrity and growth potential. This book is particularly valuable for those interested in growth stocks.

This book is beneficial to those interested in understanding how to evaluate a business's prospects based on key factors. It is a good option for those who want to balance quantitative and qualitative factors. The price is generally moderate.

Where Are the Customers' Yachts? by Fred Schwed Jr.

A humorous and insightful critique of Wall Street's often-misaligned incentives. Where Are the Customers' Yachts? exposes the absurdities and potential pitfalls of blindly following financial advice. It teaches skepticism and independent thinking, essential qualities for any investor.

Where Are the Customers' Yachts? is suitable for all investors, regardless of experience level. This provides invaluable lessons about trusting yourself and analyzing information. This offers a lighthearted but sharp perspective on finance.

Side-by-Side Specs Table

| Book Title | Author(s) | Focus | Difficulty | Value Investing Score (1-5, 5 being highest) | Growth Investing Score (1-5, 5 being highest) |

|---|---|---|---|---|---|

| The Intelligent Investor | Benjamin Graham | Value Investing Fundamentals | Moderate | 5 | 2 |

| Security Analysis | Benjamin Graham and David Dodd | In-Depth Financial Analysis | Difficult | 5 | 1 |

| The Interpretation of Financial Statements | Benjamin Graham and Spencer B. Meredith | Understanding Financial Statements | Easy | 4 | 1 |

| Common Stocks and Uncommon Profits | Philip Fisher | Growth Stock Investing | Moderate | 2 | 5 |

| Where Are the Customers' Yachts? | Fred Schwed Jr. | Wall Street Critique | Easy | 3 | 3 |

Practical Considerations

Warren Buffett's recommended reading list emphasizes long-term value investing. Understanding your own investment goals and risk tolerance is crucial. Decide whether you prefer a quantitative or qualitative approach.

Consider your current level of financial knowledge. Start with introductory texts like The Interpretation of Financial Statements if you're new to finance. You can then move to more complex works like Security Analysis.

Library borrowing can be a cost-effective option to sample books before purchasing. Newer editions often include updated commentary and examples. These newer editions can be more accessible for modern readers.

Summary

Warren Buffett's curated list provides a robust foundation for value investing. Books such as The Intelligent Investor offer time-tested principles and proven frameworks. Understanding your individual needs and risk appetite will guide your selection.

Each book offers unique insights, from fundamental analysis to understanding market psychology. Evaluate your knowledge and investing style to make an informed decision. This will allow you to select resources best suited to your personal journey.

Consider borrowing from a library before investing in multiple titles. This allows you to assess the material and see if it suits your interest. Remember, knowledge is an investment with potentially high returns.

Take Action

Begin your investment journey today by exploring Warren Buffett's recommended reading list. Choose a book that aligns with your current knowledge and investment goals. Commit to continuous learning and apply these principles to your investment decisions.

Frequently Asked Questions (FAQ)

Q: Which book is best for beginners?

A: The Interpretation of Financial Statements is a great starting point for learning about company financials.

Q: Are these books still relevant in today's market?

A: Absolutely. The core principles of value investing are timeless and applicable to any market environment.

Q: Do I need a finance background to understand these books?

A: Some books, like Security Analysis, are more technical and may require some background knowledge. Start with the easier reads and gradually progress.

Q: Where can I find these books at the best price?

A: Check online retailers like Amazon, as well as used bookstores and libraries.

Q: Is it necessary to read all of these books?

A: No. Choose the books that align with your specific interests and investment style.

![Best Investing Books Recommended By Warren Buffett 25 Must Read Warren Buffett Recommended Books [Best Selling]](https://saltmoney.org/wp-content/uploads/2023/03/25-Must-Reads-Warren-Buffett-Recommended-Books.jpg)