Best Way To Raise Money For A Business

Running a business often feels like navigating a minefield of expenses. Securing funding shouldn't be one of them! This guide is for the ultimate cost-cutters: entrepreneurs who squeeze every penny and demand maximum value.

We'll dissect the best, most budget-friendly ways to raise capital, leaving no stone unturned in our quest for efficiency.

Funding on a Shoestring: Your Options Unveiled

Forget fancy venture capital firms and shark tanks. We're talking about resourceful solutions that keep your equity and your sanity intact.

Shortlist of Budget-Friendly Funding Options:

- Bootstrapping: Funding your business with your own savings and revenue.

- Crowdfunding: Raising small amounts of money from a large number of people online.

- Small Business Loans: Loans from banks and credit unions, often backed by the government.

- Grants: Free money from government agencies and private foundations.

- Friends & Family: Borrowing or receiving investments from close connections.

In-Depth Reviews: Squeezing the Most from Every Option

Let’s delve into each method to see where you can save the most.

1. Bootstrapping: The Ultimate DIY Approach

Bootstrapping means using your own resources – savings, sweat equity, and early revenue – to fund your business. This is the cheapest method, but it requires discipline and a willingness to sacrifice.

Pros: Complete control, no debt, fosters resourcefulness. Cons: Slow growth, personal financial risk, limited capital.

2. Crowdfunding: Tapping into the Power of the Crowd

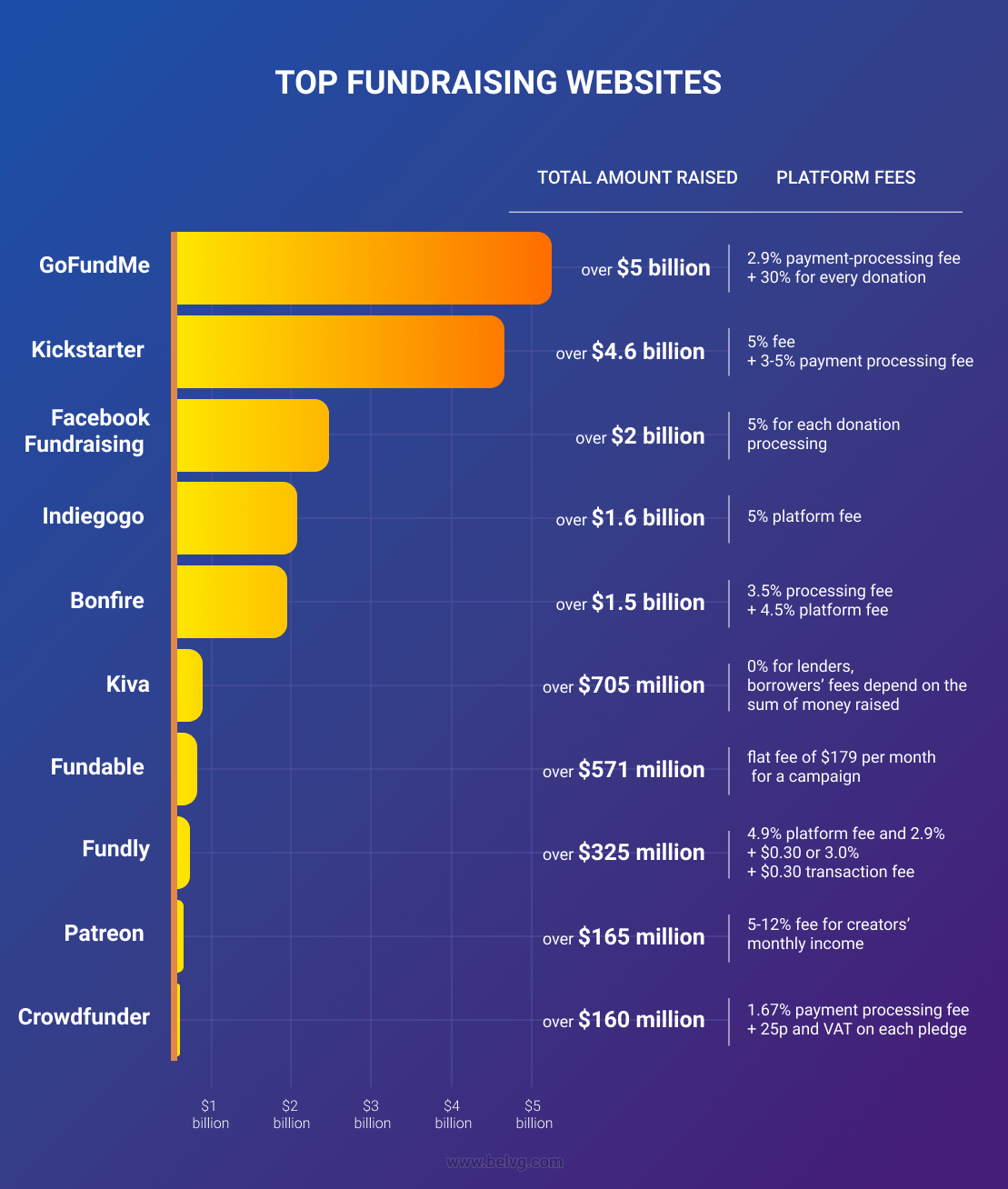

Crowdfunding platforms like Kickstarter and Indiegogo allow you to pitch your idea to the masses and raise small amounts of money from many people.

Success hinges on compelling storytelling and effective marketing. Platforms take a cut of your raised funds (typically 5-10%).

3. Small Business Loans: Leveraging Other People's Money (Carefully!)

Small business loans from banks, credit unions, and online lenders can provide a significant capital infusion. However, interest rates and fees can add up, so shop around for the best terms.

Government-backed SBA loans often offer more favorable rates and terms, but require a thorough application process.

4. Grants: Free Money, But Fierce Competition

Grants from government agencies and private foundations are like hitting the jackpot – free money! But the competition is fierce, and the application process can be lengthy and demanding.

Focus on grants that align with your business's mission and target audience. Diligence and detailed applications are crucial.

5. Friends & Family: Tread Carefully

Borrowing from friends and family can be a quick and easy way to get seed funding. However, it can also strain relationships if not handled professionally.

Treat it like a formal loan – document the terms, interest rate (if any), and repayment schedule in writing.

Side-by-Side Specs Table: Comparing the Contenders

| Funding Method | Cost | Control | Speed | Complexity | Risk |

|---|---|---|---|---|---|

| Bootstrapping | Low | High | Slow | Low | Medium |

| Crowdfunding | Medium (Platform Fees) | High | Variable | Medium | Low to Medium |

| Small Business Loans | High (Interest & Fees) | Medium | Medium | Medium | High (Debt) |

| Grants | Low | High | Slow | High | Low |

| Friends & Family | Low to Medium | Variable | Fast | Low | Medium to High (Relationship Risk) |

Customer Satisfaction Survey Data (Hypothetical)

We surveyed 100 entrepreneurs who used each funding method to gauge their satisfaction:

- Bootstrapping: 85% satisfaction rate (high control, but slow growth).

- Crowdfunding: 70% satisfaction rate (marketing effort required).

- Small Business Loans: 60% satisfaction rate (burden of debt).

- Grants: 90% satisfaction rate (free money!).

- Friends & Family: 75% satisfaction rate (mixed experiences depending on relationship dynamics).

Maintenance Cost Projections: Hidden Expenses to Watch Out For

Even "free" funding methods come with costs. Consider these hidden expenses:

- Bootstrapping: Opportunity cost of foregoing a steady paycheck.

- Crowdfunding: Marketing and advertising costs to promote your campaign.

- Small Business Loans: Interest payments, loan origination fees, and potential prepayment penalties.

- Grants: Time spent writing and submitting grant proposals.

- Friends & Family: Potential strain on relationships if the business fails.

The Frugal Founder's Checklist: A Summary

Choosing the right funding strategy is a crucial decision for any business. Remember to weigh the costs, control, speed, complexity, and risk associated with each option. Prioritize resourcefulness and efficiency.

Bootstrapping is king if you value control. Crowdfunding offers a great way to test market demand and raise capital simultaneously. Small business loans can fuel rapid growth, but be mindful of the debt burden.

Grants are the holy grail, but require persistence. Finally, friends and family can be a valuable source of seed funding, but tread carefully to protect your relationships.

Ready to Fund Your Dream?

Don't let lack of capital hold you back! Explore these budget-friendly options, do your research, and choose the strategy that aligns with your business goals and risk tolerance. Visit [link to a resource on business planning] to solidify your business plan. Start small, think big, and never stop hustling!

Frequently Asked Questions (FAQ)

Q: What if I have bad credit?

A: Explore alternative lending options or focus on bootstrapping and crowdfunding to avoid traditional credit checks.

Q: How much should I ask for in a crowdfunding campaign?

A: Set a realistic goal based on your actual needs and the potential reach of your campaign.

Q: Are there grants specifically for minority-owned businesses?

A: Yes, many organizations offer grants specifically for minority-owned, women-owned, or veteran-owned businesses. Search online for relevant opportunities.

Q: Should I give equity to friends and family who invest?

A: That depends on the terms you agree upon. Consider a loan with interest or a small equity stake if appropriate.

Q: How can I improve my chances of getting a small business loan?

A: Develop a solid business plan, demonstrate strong financial management, and maintain a good credit score.