Best Ways To Have Multiple Incomes

Tired of living paycheck to paycheck? Dreaming of financial freedom and the ability to pursue your passions without the constant worry of money? You're not alone.

In today's world, relying on a single income stream can feel precarious. Diversifying your income is no longer a luxury, but a necessity for long-term financial security.

This guide is for you, the first-time buyer, the curious explorer venturing into the world of multiple incomes. We'll demystify the process, providing practical strategies and insights to help you build a more resilient financial future.

Why Multiple Income Streams Matter

Think of your income like a sturdy chair. One leg might be your full-time job, while the others could be side hustles, investments, or passive income sources. If one leg breaks, the chair (your finances) doesn't collapse.

Having multiple income streams provides a financial safety net, reduces stress, and allows you to pursue opportunities that might otherwise be out of reach. It's about creating options and building a more stable financial foundation.

This article will explore some of the best ways to generate multiple incomes, outlining their pros and cons, and helping you choose the strategies that align with your skills, interests, and financial goals.

Top 5 Income Stream Options: A Quick Comparison

Here's a brief overview of five popular income stream options to get you started:

| Income Stream | Potential Income | Startup Cost | Time Commitment | Risk Level |

|---|---|---|---|---|

| Freelancing (e.g., Writing, Design) | Variable - Depends on skills and demand | Low - Computer & internet | Flexible - You set your hours | Low - Depends on contract terms |

| Online Courses/E-books | Scalable - Based on sales and reach | Moderate - Course creation & marketing | High initially, then passive | Moderate - Market demand can change |

| Affiliate Marketing | Variable - Commission-based | Low - Website/Social Media | Moderate - Content creation & promotion | Low - Relies on third-party products |

| Rental Property | Passive - Monthly rent | High - Down payment & maintenance | Moderate - Property management | High - Market fluctuations & tenant issues |

| Dividend Investing | Passive - Dividend income | Moderate - Investment amount | Low - Ongoing monitoring | Moderate - Market risk |

Detailed Reviews of Popular Income Streams

Freelancing: Monetize Your Skills

Freelancing offers a low-barrier-to-entry way to earn extra income by leveraging your existing skills. Whether you're a writer, designer, programmer, or virtual assistant, there's a demand for your expertise.

Pros: Flexibility, control over your rates, and the ability to choose projects you enjoy. Cons: Inconsistent income, self-employment taxes, and the need for self-discipline.

Popular platforms like Upwork, Fiverr, and Guru connect freelancers with clients worldwide.

Online Courses/E-books: Share Your Knowledge

Do you have specialized knowledge or a unique skill? Creating and selling online courses or e-books can be a lucrative way to generate passive income.

Pros: High earning potential, scalable, and allows you to reach a global audience. Cons: Significant upfront time investment, marketing efforts, and the need to stay updated in your field.

Platforms like Teachable, Udemy, and Amazon Kindle Direct Publishing make it easy to create and sell your content.

Affiliate Marketing: Promote Other People's Products

Affiliate marketing involves promoting products or services from other companies and earning a commission on each sale. You don't need to create your own products; you simply drive traffic to the seller's website.

Pros: Low startup cost, no need to handle inventory or customer service, and the potential for high earnings. Cons: Reliance on third-party products, the need for strong marketing skills, and the potential for commission rate changes.

Popular affiliate programs include Amazon Associates, ShareASale, and Commission Junction.

Rental Property: Invest in Real Estate

Investing in rental property can provide a steady stream of passive income. However, it requires a significant upfront investment and ongoing management responsibilities.

Pros: Potential for long-term appreciation, tax benefits, and a reliable source of rental income. Cons: High initial investment, property management responsibilities, and the risk of vacancies or tenant issues.

Thoroughly research the market, understand landlord-tenant laws, and be prepared to handle maintenance and repairs.

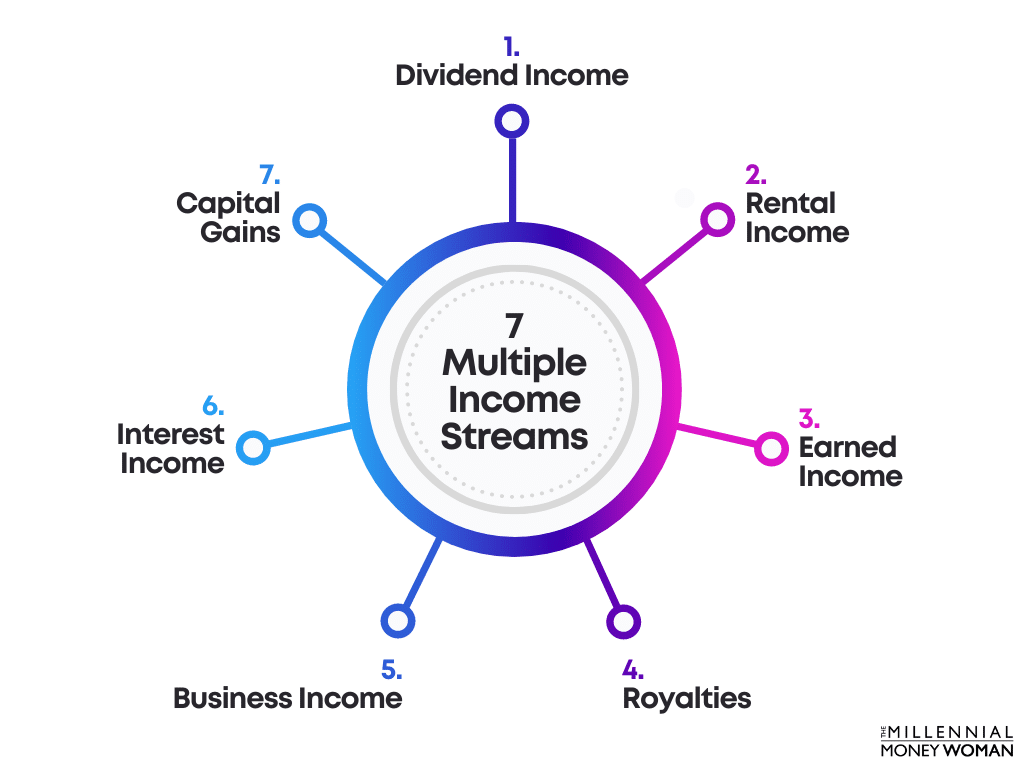

Dividend Investing: Earn from Stock Ownership

Dividend investing involves buying stocks that pay regular dividends, which are distributions of a company's profits to its shareholders. It's a relatively passive way to generate income, but it requires careful research and a long-term perspective.

Pros: Passive income, potential for capital appreciation, and diversification of your investment portfolio. Cons: Market risk, dividend cuts, and the need for financial knowledge.

Consult with a financial advisor to determine the right dividend stocks for your investment goals.

Used vs. New: Considering the Options

While the concept of "used vs. new" doesn't directly apply to all income streams, it's relevant when considering investments like rental properties or equipment needed for freelancing.

Used (Rental Property): Can be more affordable initially, but may require more repairs and renovations. New (Rental Property): Higher initial cost, but potentially lower maintenance and appeal to tenants.

Used (Freelancing Equipment): Lower upfront cost, but may have limited lifespan or functionality. New (Freelancing Equipment): Higher cost, but typically better performance and warranty.

Reliability Ratings by Brand (Example - Freelancing Platforms)

Reliability can be assessed based on user reviews and platform features. It's important to note that this is a subjective assessment.

- Upwork: Generally reliable, with strong dispute resolution mechanisms.

- Fiverr: High volume, but quality can vary; read reviews carefully.

- Guru: Known for higher-paying clients and more specialized projects.

Checklist: 5 Must-Check Features Before Starting

- Market Demand: Is there a need for your skills or product? Research before investing time and resources.

- Startup Costs: Can you afford the initial investment? Factor in equipment, software, and marketing expenses.

- Time Commitment: How much time are you willing to dedicate? Be realistic about your availability.

- Risk Tolerance: Are you comfortable with the potential for loss? Assess the risk level of each income stream.

- Scalability: Can you grow your income over time? Consider the potential for expansion and automation.

Key Takeaways

Building multiple income streams is a powerful strategy for achieving financial security and independence. There are many options available, each with its own pros and cons.

Carefully consider your skills, interests, financial goals, and risk tolerance when choosing the right income streams for you. Remember to start small, learn as you go, and be patient.

Diversification is key, but don't spread yourself too thin. Focus on a few strategies and master them before adding more.

Ready to Get Started?

Don't wait any longer to take control of your financial future. Explore the income stream options discussed in this article, do your research, and take the first step towards building a more secure and fulfilling life.

Start small, be persistent, and remember that even a small side hustle can make a big difference over time. Visit our blog for more detailed guides on each income stream and exclusive tips for first-time buyers.