How To Stop Making Impulsive Decisions

Ever find yourself staring at your credit card bill, wondering where all that money went? Chances are, impulsive decisions are quietly sabotaging your budget. We understand the struggle and this guide provides practical strategies and tools to regain control of your spending habits, helping you achieve your financial goals.

Understanding the Impulsive Urge

Impulsive decisions are often driven by immediate gratification, bypassing logical reasoning. These decisions are fueled by emotions and triggered by external stimuli like advertising or internal states like boredom. Recognizing these triggers is the first step in breaking the cycle.

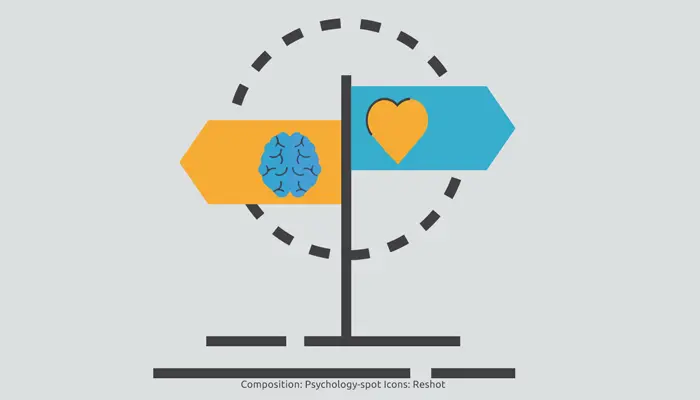

The Psychology of Impulse

The amygdala, the brain's emotional center, plays a significant role in impulsive behavior. When faced with a tempting offer, the amygdala can override the prefrontal cortex, the part of the brain responsible for planning and decision-making. This neurological battle explains why resisting impulses can feel so difficult.

Identifying Your Triggers

What situations or emotions lead you to spend impulsively? Are you more likely to splurge when stressed, bored, or feeling down? Keeping a spending diary can help you pinpoint your specific triggers and develop coping mechanisms.

Strategies to Curb Impulsive Spending

Fortunately, there are proven techniques to manage impulsive behavior and reclaim control of your finances. These strategies focus on creating barriers to impulsive spending and cultivating mindful decision-making.

Implement the "24-Hour Rule"

Before making a non-essential purchase, wait 24 hours (or longer for larger items). This allows you time to cool down and consider whether you truly need the item. Often, the urge to buy will subside during this waiting period.

Unsubscribe from Temptation

Unsubscribe from marketing emails and unfollow tempting accounts on social media. Reducing exposure to advertising and promotional material can significantly decrease the urge to spend. Out of sight, out of mind truly works!

Create a Budget and Stick to It

A budget provides a framework for your spending and helps you prioritize your financial goals. When you know where your money is going, you're less likely to spend it impulsively. Explore budgeting apps and methodologies to find one that suits your lifestyle.

Practice Mindfulness and Meditation

Mindfulness techniques can help you become more aware of your thoughts and emotions, allowing you to respond to impulses rather than react to them. Even a few minutes of daily meditation can make a difference. Consider using apps like Headspace or Calm to get started.

Find Healthy Distractions

When the urge to spend strikes, engage in a healthy distraction. Go for a walk, read a book, call a friend, or pursue a hobby. Replacing the impulsive behavior with a positive activity can effectively break the cycle.

Tools to Aid Your Journey

Various tools and resources can support your efforts to curb impulsive spending. These range from budgeting apps to website blockers, each offering unique features to help you stay on track.

Budgeting Apps: A Side-by-Side Comparison

The right app can be a game-changer. Mint, YNAB (You Need A Budget), and Personal Capital are popular choices. Let's examine their key features.

| App | Price | Key Features | Performance Score (Out of 5) |

|---|---|---|---|

| Mint | Free | Budgeting, bill tracking, credit score monitoring | 4.0 |

| YNAB | Subscription | Zero-based budgeting, debt management, goal setting | 4.5 |

| Personal Capital | Free (with paid advisory services) | Net worth tracking, investment analysis, budgeting | 4.2 |

Detailed Reviews:

Mint: A solid free option for basic budgeting and tracking expenses. However, its budgeting features are less sophisticated than YNAB. Its automatic transaction categorization is a major plus.

YNAB: Requires a subscription but offers powerful budgeting tools, particularly for those wanting granular control over their finances. It enforces the "give every dollar a job" philosophy. A steep learning curve may be a deterrent for some.

Personal Capital: Ideal for individuals with investments, offering robust investment tracking and analysis. Budgeting features are somewhat secondary to its investment focus. It also offers financial advisor services for a fee.

Website Blockers:

For value-conscious shoppers, consider free extensions like StayFocusd (Chrome) or LeechBlock NG (Firefox). If you are willing to invest, Freedom or Cold Turkey Blocker offer cross-platform functionality. These extensions prevent you from accessing tempting shopping websites during designated hours.

Practical Considerations:

Consider your personal spending habits, financial goals, and technological comfort level when choosing tools. What works for one person may not work for another. Experiment to see what fits your unique needs.

Don't be discouraged by setbacks. Impulsive behavior is a habit, and breaking habits takes time and effort. Celebrate small victories and learn from your mistakes. Be patient with yourself and keep practicing the strategies outlined above.

Seek professional help if you suspect your impulsive spending is a symptom of a deeper issue, such as anxiety or depression. A therapist or financial advisor can provide personalized guidance and support.

Summary

Curbing impulsive spending requires self-awareness, strategic planning, and the right tools. Identifying your triggers, creating barriers to impulsive behavior, and cultivating mindful decision-making are key. Evaluate your options based on your individual needs and stick to your budget!

Take Control Today

Start by identifying one trigger and implement one strategy from this guide. Track your progress and adjust your approach as needed. Reclaim your financial freedom and start building a more secure future.

Frequently Asked Questions (FAQ)

Q: How long does it take to break an impulsive spending habit?

A: It varies from person to person, but studies suggest it can take anywhere from 18 to 254 days to form a new habit. Consistency is key.

Q: What if I slip up and make an impulsive purchase?

A: Don't beat yourself up. Acknowledge the mistake, learn from it, and get back on track with your plan.

Q: Are there any benefits to impulsive spending?

A: While occasional small treats can provide a temporary mood boost, the long-term consequences of impulsive spending far outweigh any potential benefits. Focus on finding healthier ways to manage stress and emotions.

Q: Can medication help with impulsive spending?

A: In some cases, medication may be prescribed to treat underlying conditions that contribute to impulsive behavior, such as ADHD or depression. Consult with a doctor to discuss your options.

Q: How can I involve my family in my efforts to curb impulsive spending?

A: Open communication is essential. Share your goals with your family and enlist their support. Work together to create a shared budget and avoid enabling each other's impulsive spending habits.