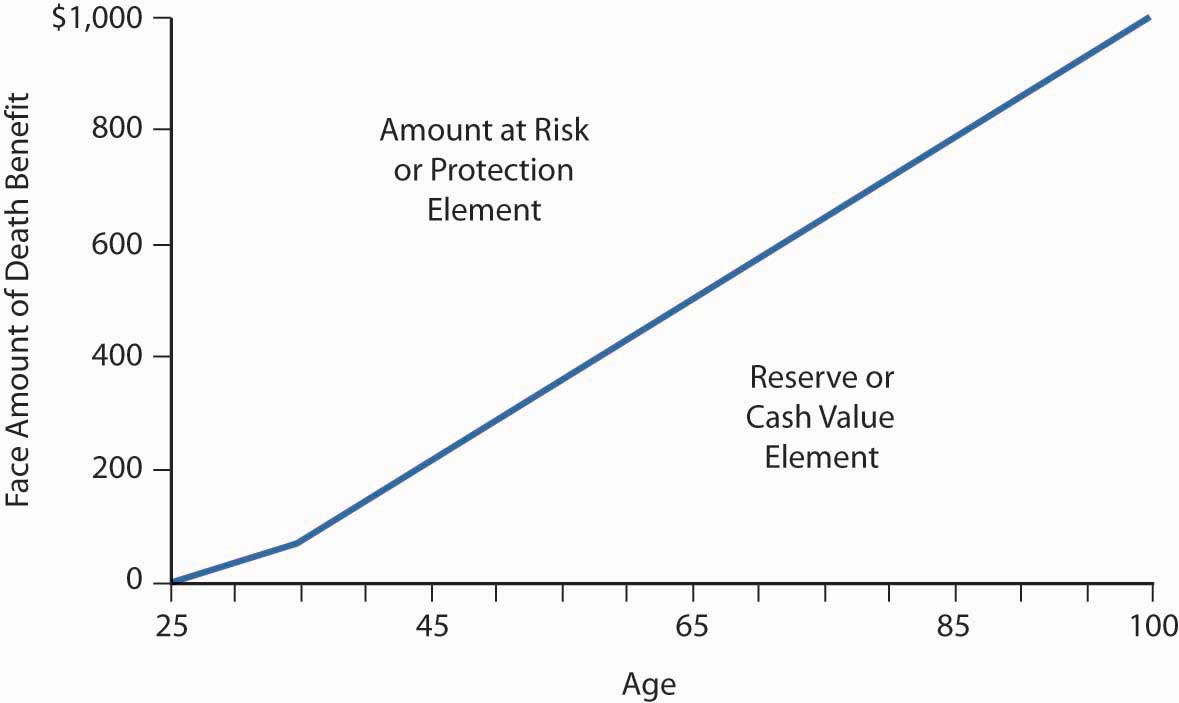

Level Premium Permanent Insurance Accumulates A Reserve That Will

The life insurance landscape is undergoing a significant shift. Level premium permanent life insurance, long a cornerstone of financial planning, faces renewed scrutiny in light of evolving investment opportunities and changing consumer preferences.

This article will explore the current trend of leveraging the cash value accumulation within these policies, presenting both the challenges and opportunities this presents for policyholders and financial institutions.

The Evolving Role of Cash Value in a Low-Yield Environment

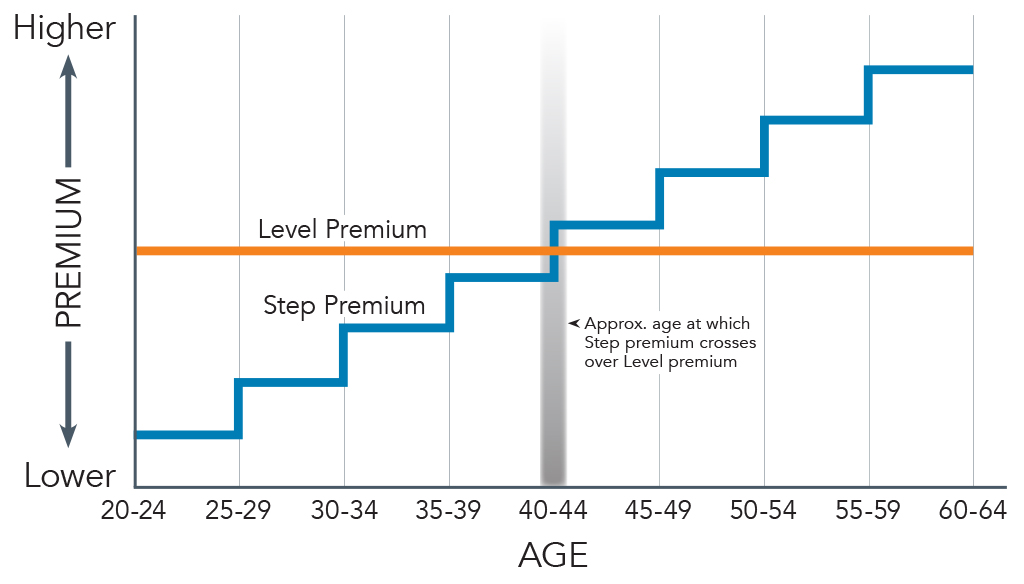

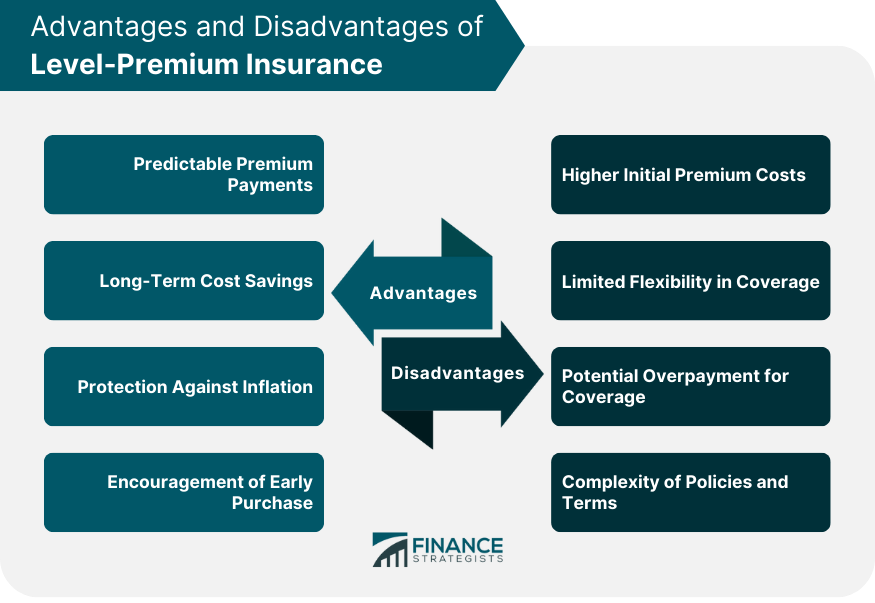

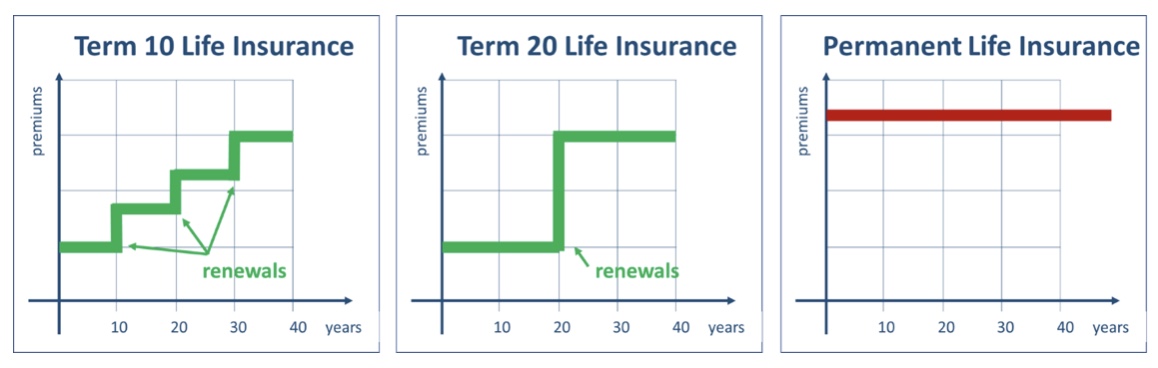

Traditionally, the cash value accumulation within level premium permanent life insurance served as a conservative, long-term savings component. However, with relatively low interest rates persisting across many investment vehicles, individuals are seeking alternative strategies to maximize returns.

The challenge is to balance the inherent safety of the cash value with the potential for higher growth offered by other investments. This balancing act has become increasingly complex.

Leveraging Policy Loans for Investment: A Double-Edged Sword

One popular strategy involves taking policy loans against the cash value and reinvesting those funds. The idea is simple: borrow at a relatively low rate from the policy and invest in opportunities with potentially higher returns.

This approach, however, carries significant risks. Market volatility could lead to investment losses that outweigh the gains, ultimately depleting the policy's cash value and potentially triggering a lapse.

Furthermore, outstanding loans reduce the death benefit, affecting the policy's primary purpose.

Tax Implications and Strategic Considerations

Understanding the tax implications is crucial when leveraging cash value. While policy loans are generally not taxable, the interest paid on the loan is typically not deductible unless the loan is used for business purposes.

Consulting with a qualified tax advisor is essential to navigate these complexities.

Strategic considerations also involve analyzing the policy's internal rate of return and comparing it to other investment options. Is the policy truly providing a competitive return compared to alternatives, even after considering the life insurance component?

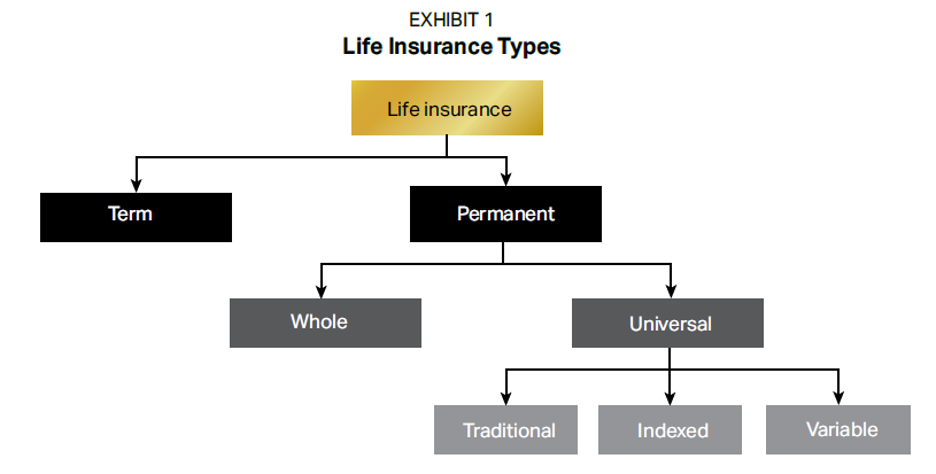

The Resurgence of Indexed Universal Life (IUL) Policies

Indexed Universal Life (IUL) policies have gained traction as a potential solution. These policies offer the potential for cash value growth linked to a market index, such as the S&P 500, but with downside protection.

The growth is capped, limiting potential gains during bull markets, but also providing a floor to protect against losses during downturns. This feature provides a degree of security appealing to risk-averse investors.

Understanding the Fine Print: Caps, Participation Rates, and Fees

It's crucial to thoroughly understand the specifics of IUL policies. Caps, participation rates, and fees can significantly impact the policy's performance.

Caps limit the maximum interest credited to the policy, even if the underlying index performs exceptionally well. Participation rates determine the percentage of the index's gains that are credited to the policy.

High fees can erode returns and negate the benefits of market-linked growth.

The Role of Technology and Transparency

Technology plays a vital role in enhancing transparency and empowering policyholders. Sophisticated software can model different scenarios, allowing individuals to visualize the potential impact of policy loans, investment choices, and market fluctuations.

Financial advisors are increasingly utilizing these tools to provide customized advice and help clients make informed decisions.

Increased transparency in fees and policy performance is also becoming a priority. Consumers are demanding clearer explanations of the costs associated with these policies.

Financial Advisors: Navigating the Complexities

The role of the financial advisor is more critical than ever. Advisors must possess a deep understanding of insurance products, investment strategies, and tax laws.

They must also act as fiduciaries, prioritizing the client's best interests above all else. This requires honesty and transparency in all interactions.

Ethical considerations are paramount in advising clients on how to leverage the cash value of their life insurance policies.

Conclusion: A Balanced Approach to Long-Term Financial Security

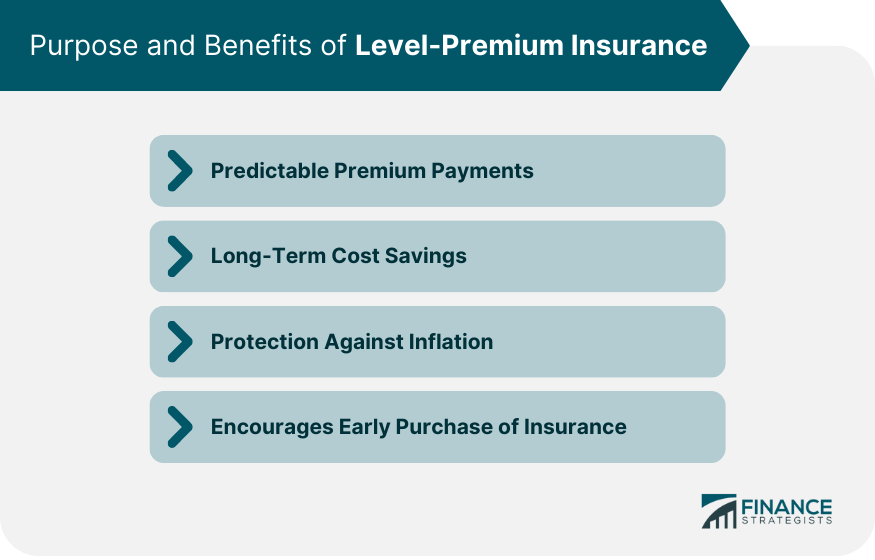

Level premium permanent life insurance, with its accumulated cash value, remains a valuable tool for long-term financial planning. However, the evolving investment landscape demands a more nuanced and strategic approach.

By understanding the risks and opportunities associated with leveraging cash value, seeking expert advice, and embracing transparency, individuals can maximize the benefits of these policies while maintaining financial security.

The key is to strike a balance between safety and growth, ensuring that the life insurance policy continues to serve its primary purpose: providing financial protection for loved ones.