Which Statement Regarding The Waiver Of Premium Rider Is Accurate

Imagine a business owner, Sarah, suddenly facing a long-term illness. Would her business survive if she couldn't work and also had to worry about life insurance premiums? This scenario highlights the importance of understanding life insurance riders, specifically the Waiver of Premium rider.

Choosing the right life insurance policy is crucial for business owners and managers. A key decision is whether to include riders, which are essentially add-ons to the base policy.

What is the Waiver of Premium Rider?

The Waiver of Premium rider is a life insurance policy add-on. It ensures that if the policyholder becomes totally disabled, the insurance company will waive the premium payments.

The policy remains in force. The insured continues to receive coverage without having to pay premiums during the disability period.

This can be a significant benefit. It protects the life insurance coverage when the policyholder's income may be reduced due to the disability.

The Importance for Business Owners

For business owners, the Waiver of Premium rider offers a critical layer of financial security. A prolonged illness or injury can severely impact a business owner's ability to generate income.

Without the rider, maintaining life insurance coverage during this difficult time could become a financial strain. This could potentially force the policyholder to lapse the policy.

With a Waiver of Premium rider, the business owner can focus on recovery. They can also focus on managing the business without the added pressure of premium payments.

Which Statement Regarding the Waiver of Premium Rider is Accurate?

Let's clarify which statement regarding the Waiver of Premium rider is accurate. It essentially boils down to understanding the rider's core function and its limitations.

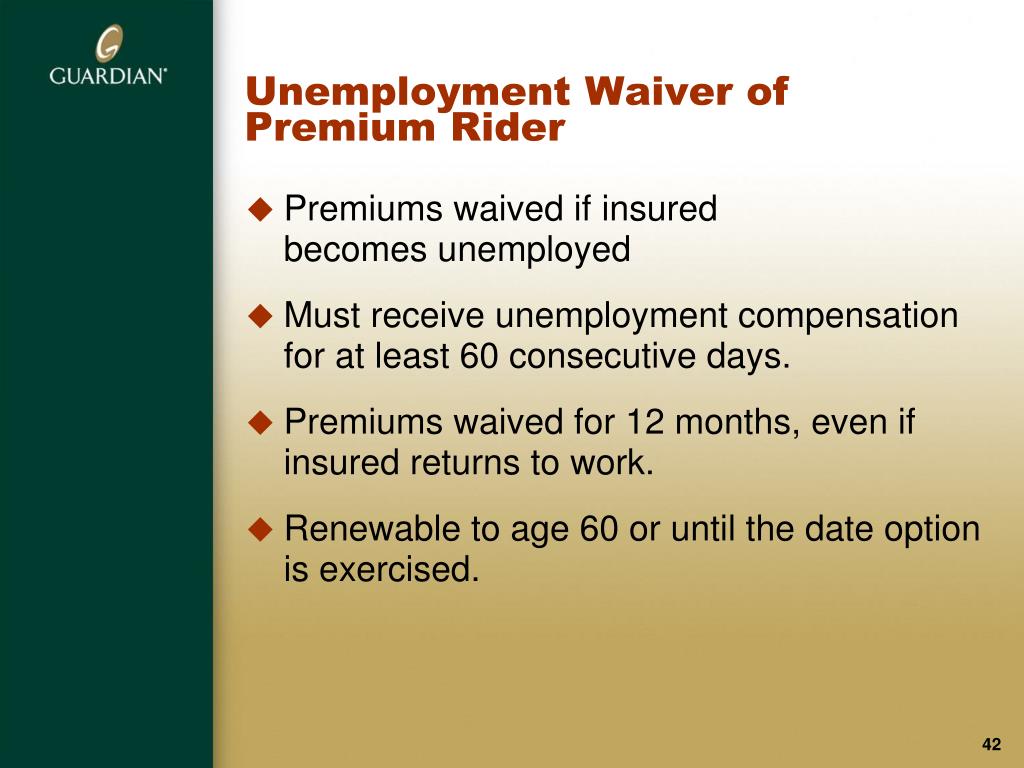

Accurate Statement: The Waiver of Premium rider waives premium payments if the insured becomes totally disabled, as defined by the policy, after a waiting period. The policy will remain in force during the period of disability.

Other statements may be inaccurate due to the following reasons:

Common Misconceptions:

Inaccurate Statement: The Waiver of Premium rider pays out a cash benefit to the insured upon disability. This is incorrect. The rider only waives premiums; it does not provide a cash payment.

Inaccurate Statement: The Waiver of Premium rider covers partial disabilities. Generally, it does not. Most riders require total disability, meaning the insured is unable to perform the substantial duties of their occupation.

Inaccurate Statement: The Waiver of Premium rider starts waiving premiums immediately upon disability. This is false. Most riders have a waiting period, often 90 days to six months, before the waiver takes effect.

Key Considerations

Several factors should be considered when evaluating a Waiver of Premium rider. Review the definition of "total disability" in the policy.

Understand the waiting period. Also, inquire about any exclusions (e.g., disabilities caused by self-inflicted injuries).

The cost of the rider is also important. It will increase the overall premium of the life insurance policy.

Example

John, a construction business owner, purchased a life insurance policy with a Waiver of Premium rider. After a serious accident, John was unable to manage his business for over six months.

Because of the rider, his life insurance premiums were waived. This allowed him to maintain coverage without further financial strain during his recovery.

Without the rider, John might have had to lapse his policy. This would leave his family and business partners without the intended financial protection.

Conclusion

The Waiver of Premium rider is a valuable tool for business owners. It provides financial protection in the event of a disabling illness or injury.

Understanding the specifics of the rider, including the definition of total disability and the waiting period, is essential. Business owners should carefully evaluate their needs and consult with a financial advisor to determine if this rider is right for them. According to LIMRA, a research and consulting organization serving the insurance and financial services industry, riders can provide "peace of mind" during uncertain times. (LIMRA, "Life Insurance Ownership in Focus, 2022").

Don't let a disability jeopardize your life insurance coverage. Consider the Waiver of Premium rider to safeguard your financial future and protect your business interests.