Will An Inheritance Affect My Social Security Retirement Benefits

Did you know that the average inheritance in the U.S. is around $46,000? But what happens if you're already receiving Social Security retirement benefits? Many people worry that a sudden influx of money might impact their hard-earned benefits. Let's explore how an inheritance may or may not affect your Social Security payments.

Understanding this is crucial. It can help you plan your finances effectively and avoid any unexpected surprises. Proper planning ensures you maximize your retirement income and secure your financial future.

Understanding Social Security Retirement Benefits

Social Security retirement benefits are designed to provide income during your retirement years. These benefits are based on your lifetime earnings and contributions to the Social Security system.

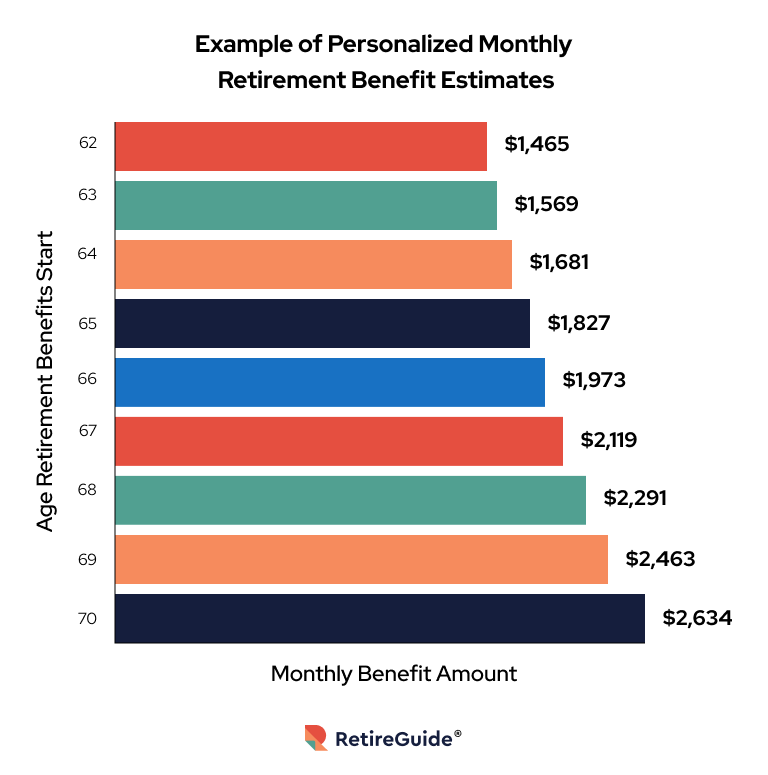

The amount you receive is determined by several factors, including your earnings history, the age at which you retire, and any spousal or dependent benefits you may be eligible for.

The Good News: Inheritance and Social Security Retirement

Here's the straightforward answer: receiving an inheritance generally does not affect your Social Security retirement benefits. Social Security retirement benefits are not means-tested.

This means your eligibility and the amount you receive are not dependent on your current assets or wealth. An inheritance, whether it's cash, stocks, or property, is considered a one-time event.

Why Inheritance Doesn't Affect Retirement Benefits

Social Security retirement benefits are earned through years of contributions via payroll taxes. Your benefits are essentially a return on your investment in the system.

Since the program is based on your earnings record and not your current financial status, an inheritance doesn't alter the calculation or your eligibility.

Supplemental Security Income (SSI): A Key Difference

It’s important to differentiate Social Security retirement benefits from Supplemental Security Income (SSI). SSI is a needs-based program.

SSI provides financial assistance to individuals with limited income and resources who are aged, blind, or disabled. An inheritance can affect your eligibility for SSI.

How Inheritance Impacts SSI

SSI has strict income and asset limits. If your inheritance pushes your assets above these limits, your SSI benefits may be reduced or terminated.

As of 2024, the asset limit for an individual is $2,000, and for a couple, it's $3,000. An inheritance that exceeds these amounts would likely impact your SSI eligibility.

Potential Indirect Impacts of Inheritance

While your Social Security retirement benefits themselves aren't directly affected, an inheritance could have indirect consequences. These consequences depend on how you manage the inherited assets.

For example, if you invest the inheritance and generate significant income, that income could potentially affect other needs-based programs or your tax situation. For example, a dramatic increase in income could significantly impact your tax bracket.

Tax Implications of Inheritance

Inheritances are generally not considered taxable income at the federal level. This means you won't pay income tax on the value of the assets you receive.

However, it's crucial to understand that any income generated from the inherited assets, such as dividends, interest, or capital gains from selling stocks, is taxable.

Smart Planning with Your Inheritance

Consider consulting with a financial advisor or tax professional to develop a plan for managing your inheritance. This is especially important if you anticipate significant income generation from the assets.

Proper planning can help you minimize taxes and ensure your inheritance supports your long-term financial goals without negatively impacting other aspects of your financial life.

Real-Life Scenario

Imagine John, a retiree receiving Social Security benefits. He inherits $100,000 from his parents. This inheritance does not impact John's Social Security retirement benefits.

However, if John invests the inheritance and starts earning a significant amount of taxable income, it could affect his overall tax liability. Careful planning is essential for John.

Key Takeaways

Relax! Receiving an inheritance generally does not affect your Social Security retirement benefits.

However, be mindful of the potential impact on needs-based programs like SSI and the tax implications of income generated from inherited assets. Plan wisely to maximize the benefits of your inheritance while safeguarding your financial security.

Always consult with a qualified professional to address your specific financial situation.

Disclaimer: This article provides general information and should not be considered financial or legal advice. Consult with a qualified professional for personalized guidance.

Sources:

- Social Security Administration: https://www.ssa.gov/

- Internal Revenue Service (IRS): https://www.irs.gov/