1000 Cash Loan No Credit Check

Imagine a single parent, Sarah, staring at a pile of bills, a sick child needing medicine, and an empty refrigerator. Her credit score, bruised by past misfortunes, slams the door on traditional loans. Panic starts to set in, but then a glimmer of hope appears: a "1000 Cash Loan No Credit Check" ad promises instant relief. But is this lifeline a true rescue, or a siren song leading to deeper financial waters?

This article delves into the world of "1000 Cash Loan No Credit Check" options, examining their allure, the potential pitfalls, and offering a balanced perspective for those considering this route. We'll explore the fine print, dissect the alternatives, and offer practical advice for navigating these often-murky financial waters.

The Allure of Instant Relief

The promise of quick cash without a credit check is undeniably appealing, especially to those facing urgent financial needs. These loans, often offered by online lenders and payday loan providers, seem like a simple solution to complex problems.

For many, the traditional banking system feels inaccessible. Red tape, stringent requirements, and the ever-present shadow of a low credit score can leave individuals feeling helpless and desperate. "1000 Cash Loan No Credit Check" options capitalize on this vulnerability.

Understanding the Landscape

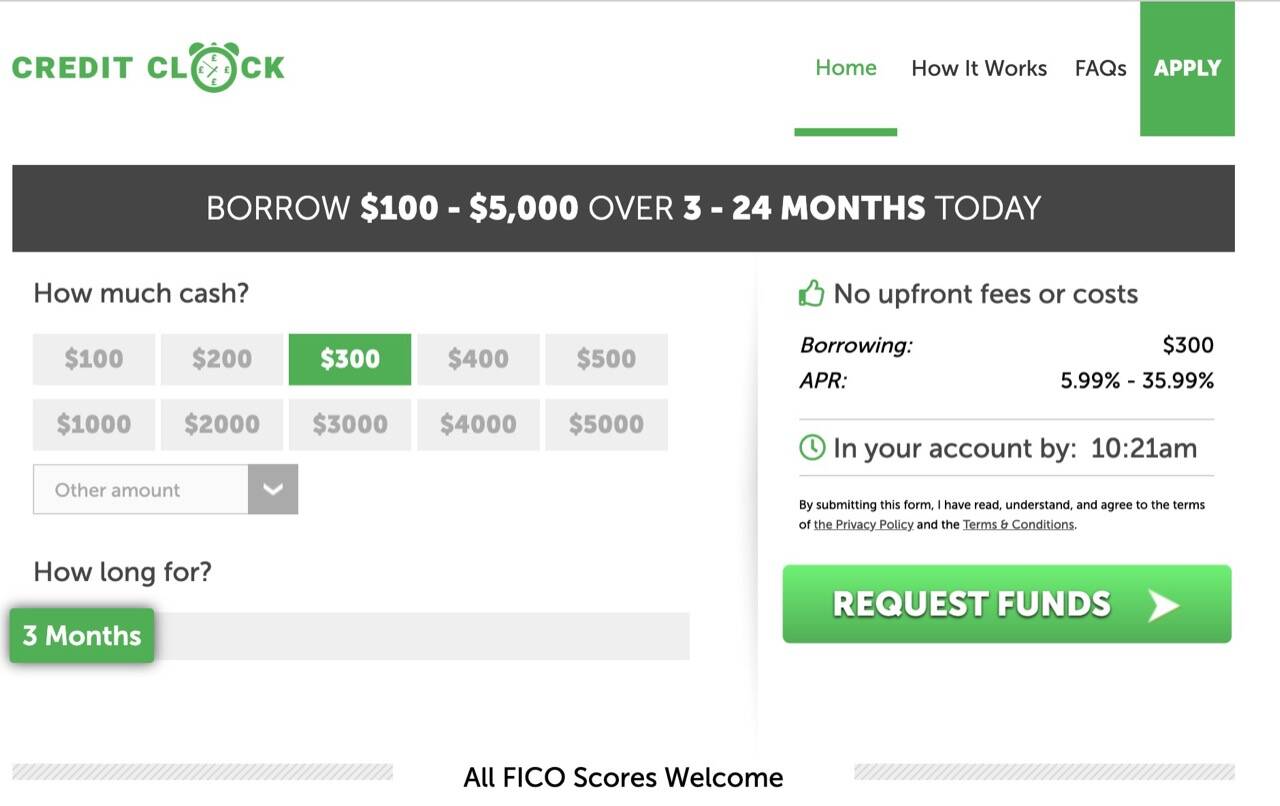

These loans typically fall under the category of payday loans or short-term installment loans. They are characterized by their small loan amounts, high interest rates, and short repayment periods.

Unlike traditional loans, lenders offering "no credit check" options often rely on other factors to assess risk, such as proof of income and employment history. While this may seem inclusive, it often comes at a steep price.

The Price of Convenience

The primary drawback of "1000 Cash Loan No Credit Check" is the exorbitant interest rates and fees. According to a report by the Consumer Financial Protection Bureau (CFPB), payday loans can carry an Annual Percentage Rate (APR) of up to 400% or even higher. These high rates can quickly turn a small loan into a debt trap.

Consider a scenario where Sarah takes out a $1000 loan with a 300% APR. If she's unable to repay the loan within the short repayment period (often just a few weeks), the interest and fees can snowball, making it even harder to break free from the cycle of debt.

Furthermore, some lenders engage in predatory lending practices, masking hidden fees and making it difficult for borrowers to understand the true cost of the loan. These practices can have devastating consequences for vulnerable individuals and families.

Predatory Practices and Hidden Fees

Beyond the headline interest rate, borrowers should be wary of additional fees, such as origination fees, late payment fees, and prepayment penalties. These fees can significantly increase the overall cost of the loan.

Some lenders may also require borrowers to provide access to their bank accounts, allowing them to automatically withdraw funds. This can be risky, as it can lead to overdraft fees if the borrower doesn't have sufficient funds in their account.

Alternatives to "No Credit Check" Loans

Before resorting to a "1000 Cash Loan No Credit Check," it's essential to explore alternative options that may be more affordable and sustainable. Several resources are available to help individuals facing financial difficulties.

Nonprofit organizations, community-based lenders, and credit unions often offer small-dollar loans with lower interest rates and more flexible repayment terms. These organizations are committed to helping individuals improve their financial well-being.

Consider also exploring options like paycheck advances from your employer, negotiating payment plans with creditors, or seeking assistance from government assistance programs.

Building a Financial Safety Net

While short-term solutions can provide immediate relief, it's crucial to focus on building a long-term financial safety net. This involves creating a budget, tracking expenses, and saving for emergencies.

Consider setting up an emergency fund, even if it's just a small amount each month. Over time, this fund can provide a buffer against unexpected expenses and reduce the need for high-cost loans. The Federal Deposit Insurance Corporation (FDIC) offers resources to help individuals improve their financial literacy.

The Ethical Considerations

The rise of "no credit check" loans raises ethical questions about the responsibility of lenders and the potential for exploitation. While some lenders genuinely aim to provide access to credit, others prioritize profit over the well-being of their customers.

Responsible lending practices involve transparency, fair interest rates, and a commitment to helping borrowers succeed. Borrowers, in turn, must be diligent in understanding the terms of the loan and seeking help when needed.

Increased regulation and oversight of the payday loan industry are needed to protect vulnerable consumers from predatory lending practices. This includes capping interest rates, limiting fees, and promoting financial education.

Navigating the Digital Landscape

The internet has made it easier than ever to access loans, but it has also created opportunities for fraud and deception. Borrowers should be cautious of online lenders that make unrealistic promises or pressure them to sign up for loans without fully understanding the terms.

Always check the lender's credentials and read reviews before applying for a loan. Look for lenders that are licensed and regulated by state or federal agencies.

Conclusion: A Path to Financial Stability

The promise of a "1000 Cash Loan No Credit Check" can be tempting, but it's crucial to approach these loans with caution and awareness. While they may provide temporary relief, they often come with significant risks and can lead to a cycle of debt.

Instead of relying on high-cost loans, focus on building a strong financial foundation, exploring alternative resources, and seeking help from trusted organizations. Financial stability is a journey, not a destination, and it requires patience, discipline, and a commitment to making informed decisions.

Sarah, armed with this knowledge, can now make a more informed decision. She understands the risks associated with "no credit check" loans and will explore alternative options, seeking help from local charities and financial counselors. She's determined to break free from the cycle of debt and build a brighter future for herself and her child. And so can you.