14 States Don't Allow Prepayment Penalties On Car Loans

Imagine the relief. You've scrimped and saved, maybe even doubled down on your side hustle, all with one goal in mind: paying off that car loan early. The weight of monthly payments, the interest accruing daily – you're ready to be done with it all. Now picture the gut-wrenching feeling when you discover, hidden in the fine print, a prepayment penalty. A fee for being responsible and paying off your debt ahead of schedule. It's a frustrating scenario, and thankfully, not one everyone faces.

In a landscape often riddled with hidden fees and complex financial jargon, a beacon of consumer protection shines through in 14 states: they do not allow prepayment penalties on car loans. This article delves into which states offer this protection, the implications for borrowers, and the broader conversation around fair lending practices.

Understanding Prepayment Penalties

What exactly is a prepayment penalty? Simply put, it's a fee charged by a lender when a borrower pays off their loan before the agreed-upon schedule.

The lender argues they are losing out on potential interest income they anticipated collecting over the life of the loan.

These penalties can take various forms, sometimes a percentage of the remaining balance or a fixed fee.

The 14 States Offering Protection

Navigating the nuances of auto loan regulations can be tricky, as these rules are governed at the state level. Consumers in these 14 states don't have to worry about prepayment penalties when they’re eager to pay their car loan off early. The states are: Alaska, Colorado, Connecticut, Iowa, Maine, Massachusetts, Minnesota, New Hampshire, New Jersey, New Mexico, New York, Oklahoma, Rhode Island, and Wisconsin.

It’s worth emphasizing that while the general prohibition of prepayment penalties is the law in those 14 states, there can be subtle differences and complexities within each state’s specific regulations. Always best to consult with financial experts and read all documents carefully.

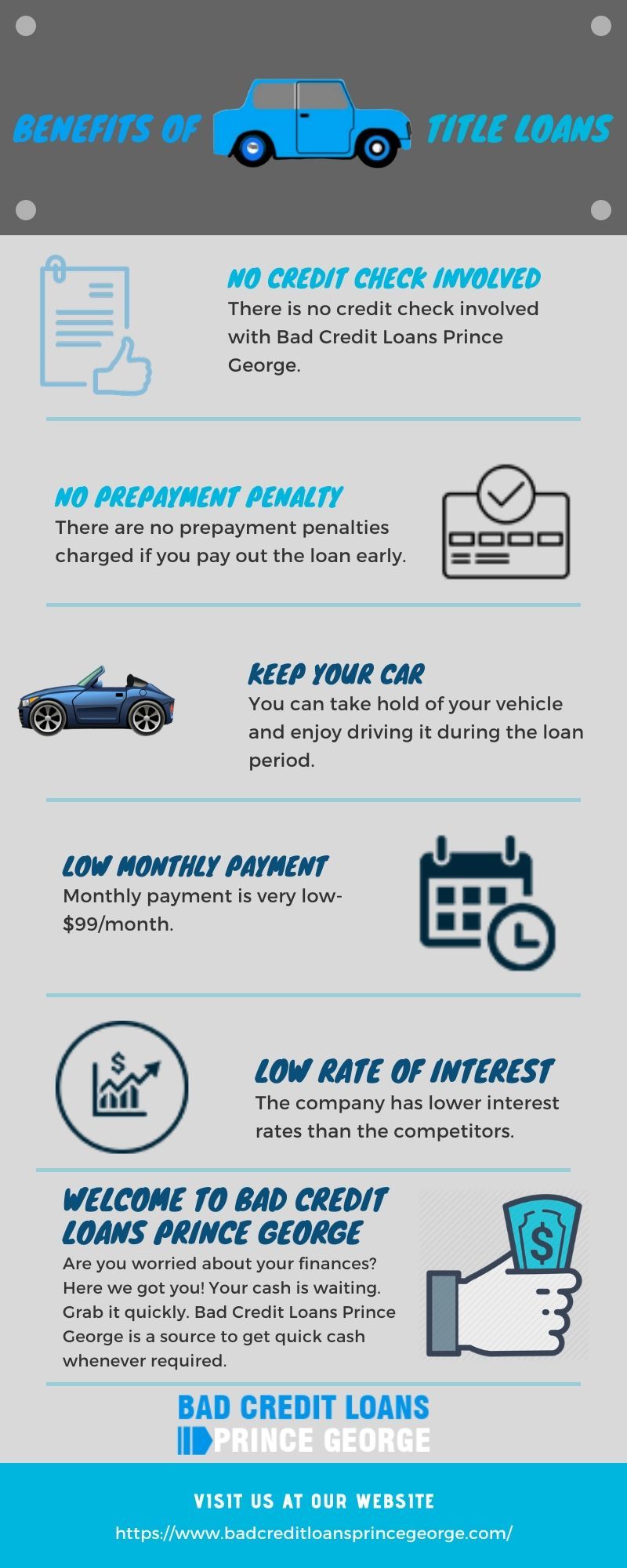

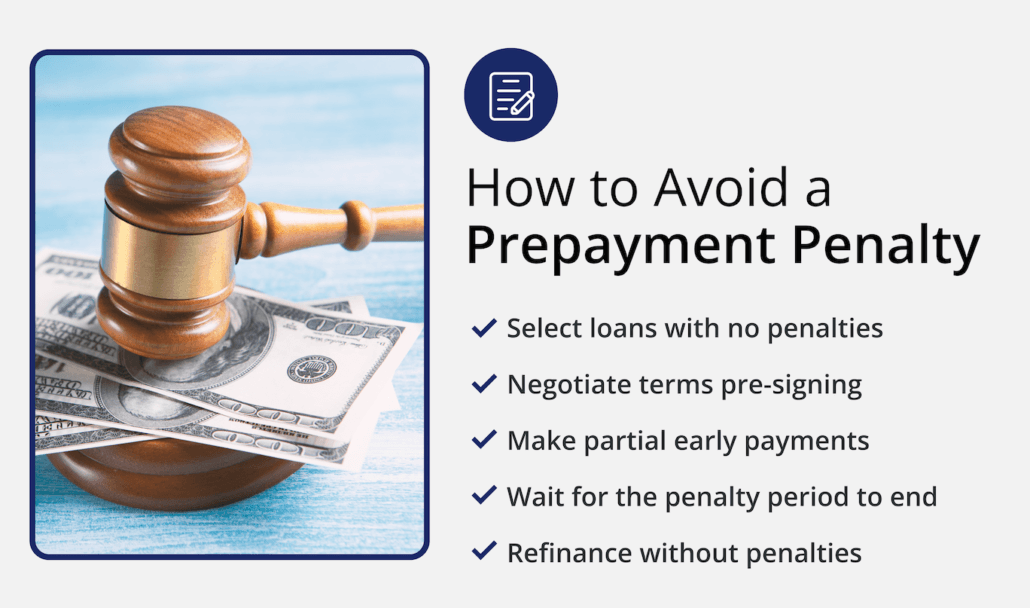

Consumers located elsewhere aren’t necessarily without options for avoiding this potential pitfall, such as selecting lenders that don’t have prepayment penalties written into the contract.

The Borrower's Perspective

The absence of prepayment penalties offers significant advantages to borrowers. It provides financial flexibility and encourages responsible debt management. The ability to pay off a loan early, without incurring extra costs, can be a major relief, freeing up cash flow for other financial goals like saving for a down payment on a house or investing for retirement.

Consider this scenario: a young family receives an unexpected bonus at work. They decide to use a portion of that bonus to pay down their car loan, shortening the loan term and saving on future interest payments. Without a prepayment penalty, they can do so with peace of mind.

It's about empowering individuals to take control of their finances and make choices that best suit their circumstances.

Fair Lending Practices and Transparency

The debate over prepayment penalties touches on broader issues of fair lending practices and transparency. Advocates for consumer protection argue that these penalties can be predatory, disproportionately affecting low-income borrowers who may be more vulnerable to such fees.

They argue that lenders should be transparent about all fees associated with a loan, allowing borrowers to make informed decisions. According to a report by the Consumer Financial Protection Bureau (CFPB), transparency is paramount in creating a fair and competitive lending market.

The CFPB has consistently advocated for greater clarity in financial products, ensuring that consumers understand the terms and conditions of their loans.

The Lender's Perspective

While prepayment penalties may seem unfair to borrowers, lenders often argue that they serve a legitimate purpose. Lenders say that they help offset the costs associated with originating and servicing loans.

When a loan is paid off early, the lender loses the anticipated interest income they factored into their profitability calculations. Therefore, prepayment penalties are a way to recoup those lost earnings.

However, critics contend that lenders can still profit from loans even without prepayment penalties, especially if they are offering competitive interest rates. It's a balancing act between lender profitability and consumer fairness.

Navigating Auto Loans: Tips for Consumers

Regardless of where you live, being a savvy consumer is key when securing an auto loan. Here are a few tips to keep in mind:

Read the fine print: This seems obvious, but it's crucial. Understand all the terms and conditions of the loan, including any potential fees, before signing on the dotted line.

Shop around: Don't settle for the first loan offer you receive. Compare rates and terms from multiple lenders to find the best deal. Credit unions often offer favorable terms.

Ask questions: Don't be afraid to ask the lender to explain anything you don't understand. If a prepayment penalty exists, understand how it's calculated.

Negotiate: Some fees are negotiable. Try to negotiate the removal of prepayment penalties or other unfavorable terms.

Consider your long-term plans: If you anticipate being able to pay off your loan early, prioritize lenders who don't charge prepayment penalties.

Looking Ahead

The debate over prepayment penalties is likely to continue, with consumer advocates pushing for greater protections and lenders defending their business practices. As awareness grows, more states may consider enacting legislation to restrict or prohibit these fees.

The 14 states that currently ban prepayment penalties on car loans serve as a model for other states to follow. Their commitment to consumer protection sets a positive example for the rest of the country.

Ultimately, the goal is to create a fair and transparent lending environment that benefits both borrowers and lenders.

The landscape of auto loans is always evolving, shaped by changing economic conditions and regulatory reforms. However, one thing remains constant: the importance of informed decision-making.

Whether you live in a state that prohibits prepayment penalties or not, being a proactive and informed consumer is your best defense against unfair fees and unfavorable loan terms.

Take your time, do your research, and empower yourself to make the best financial choices for your future.

/GettyImages-155420951-56a066c55f9b58eba4b0454a.jpg)