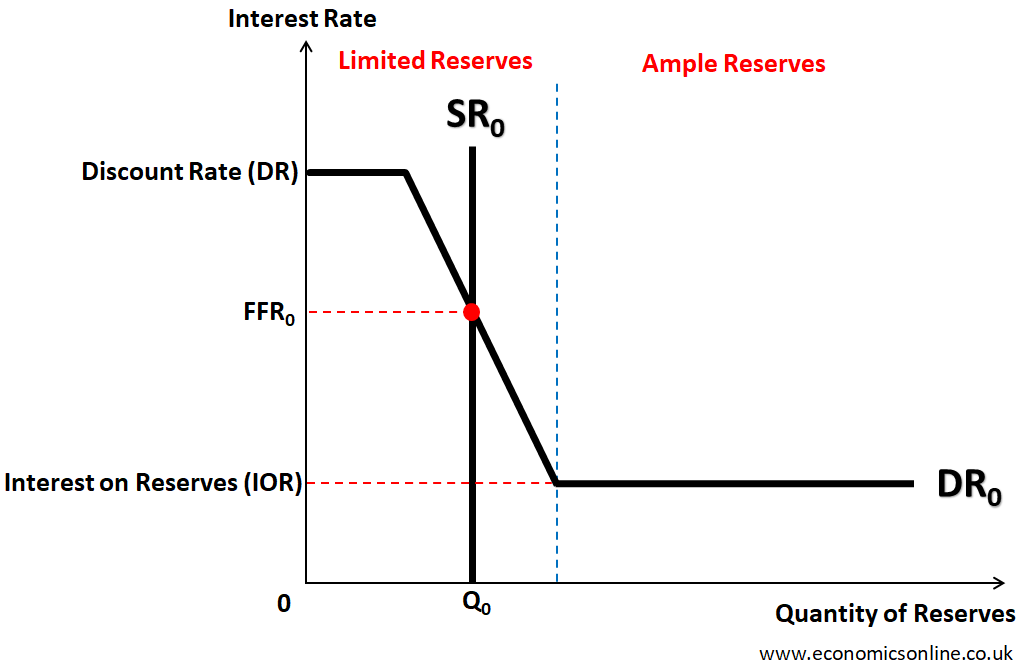

The Banking System In Country A Has Limited Reserves

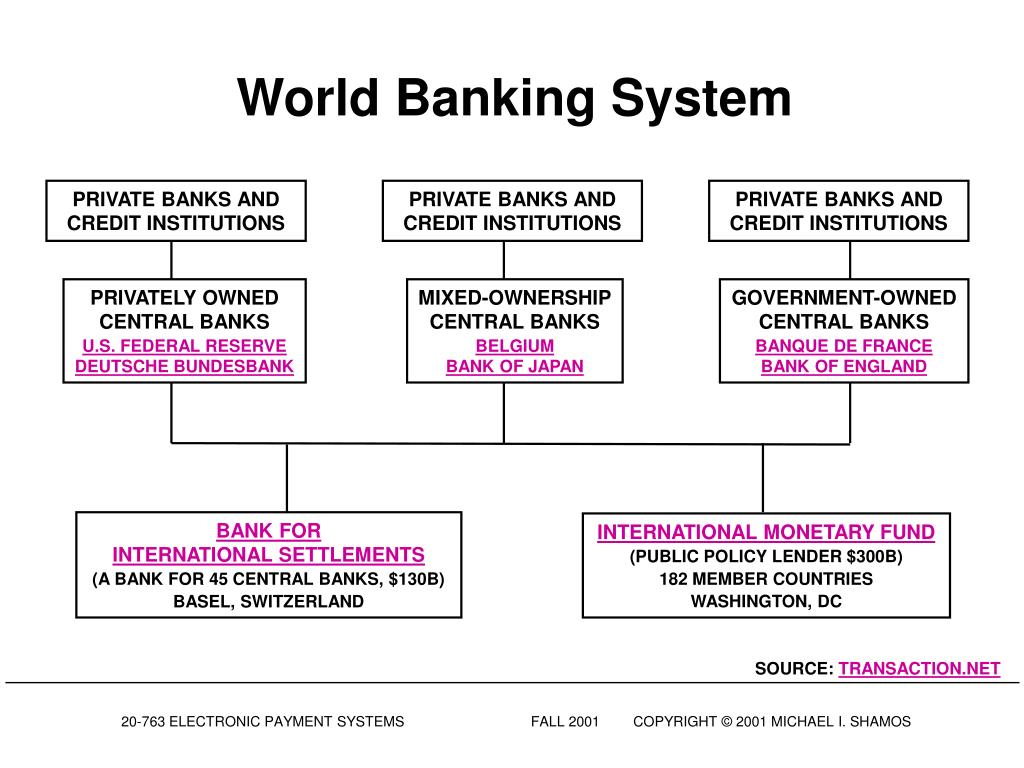

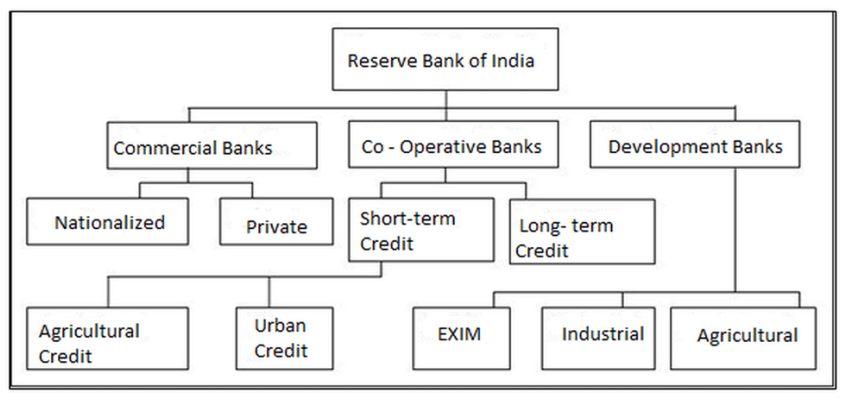

A palpable tension hangs over the financial landscape of Country A as a confluence of economic pressures has left its banking system operating with precariously thin reserves. The situation, flagged in recent reports by the Central Bank of Country A (CBCA) and the International Monetary Fund (IMF), raises serious concerns about the stability of the financial sector and its ability to weather potential economic shocks.

The banking system's limited reserves, a consequence of factors ranging from increased lending to fluctuating currency values, pose a multifaceted challenge. At its core, this issue threatens the banks' capacity to meet deposit withdrawals and other financial obligations, potentially triggering a liquidity crisis. This article will delve into the root causes of the dwindling reserves, analyze the potential repercussions for Country A's economy, and explore the measures being considered to mitigate the risks and restore confidence in the banking sector.

Causes of the Reserve Shortfall

Several key factors have contributed to the current state of affairs.

Firstly, aggressive lending practices in recent years, fueled by a period of rapid economic expansion, have significantly depleted the banks' reserve base. Banks, eager to capitalize on the booming economy, extended credit to businesses and individuals at an accelerated pace, reducing the proportion of assets held in reserve.

Secondly, fluctuations in the value of the national currency, the A-Dollar, have exerted downward pressure on reserves. A weakening currency increases the cost of imported goods and services, leading to capital outflows and a corresponding decline in bank reserves.

Thirdly, a recent spike in non-performing loans (NPLs), particularly in the real estate sector, has further strained the banks' financial health. As borrowers struggle to repay their loans, banks are forced to set aside larger provisions for potential losses, reducing the amount of capital available as reserves.

Potential Repercussions

The implications of limited bank reserves are far-reaching and potentially damaging to Country A's economy.

The most immediate concern is the increased risk of a liquidity crisis. If depositors lose confidence in the banking system and begin to withdraw their funds en masse, banks with insufficient reserves may be unable to meet these demands, leading to bank runs and potential collapses.

Furthermore, the situation could trigger a credit crunch. Banks, facing constrained reserves, may become more risk-averse and curtail lending to businesses and individuals, stifling economic growth and investment.

Professor Anya Sharma, an economist at the University of Country A, warns that "a prolonged period of limited bank reserves could have a cascading effect on the entire economy, leading to job losses, reduced consumer spending, and a significant slowdown in overall economic activity."

Measures to Mitigate the Risks

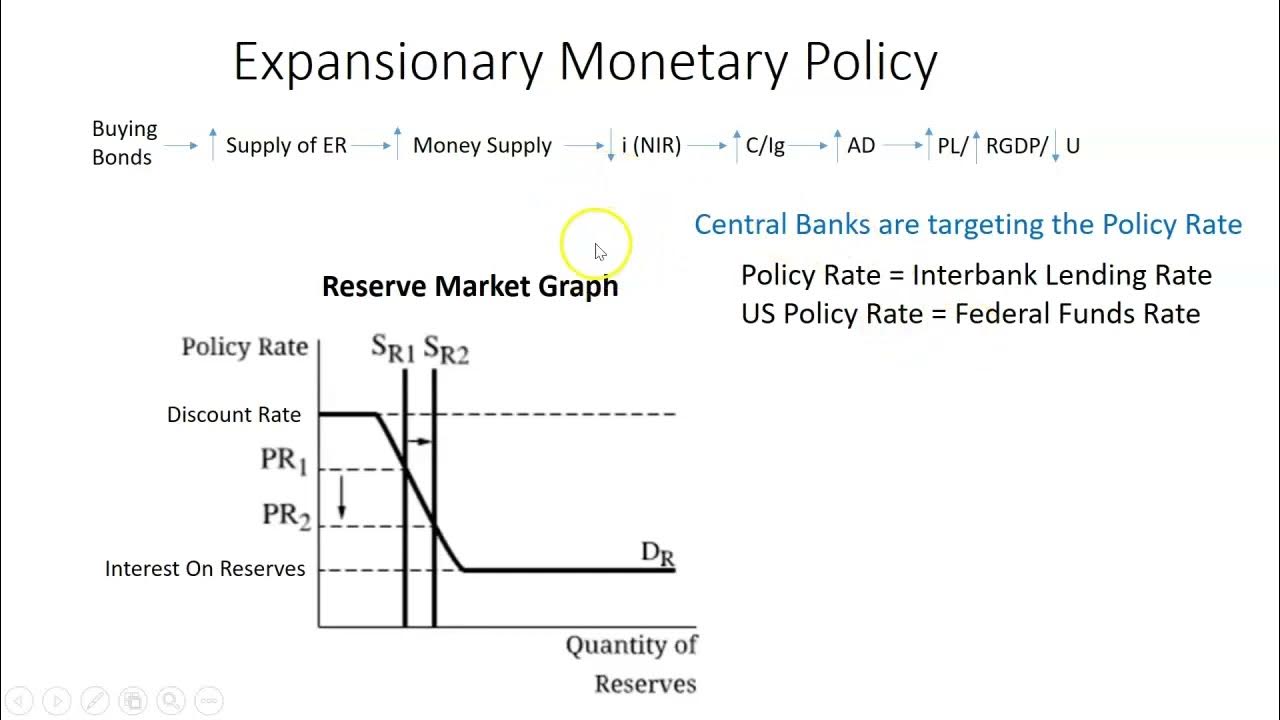

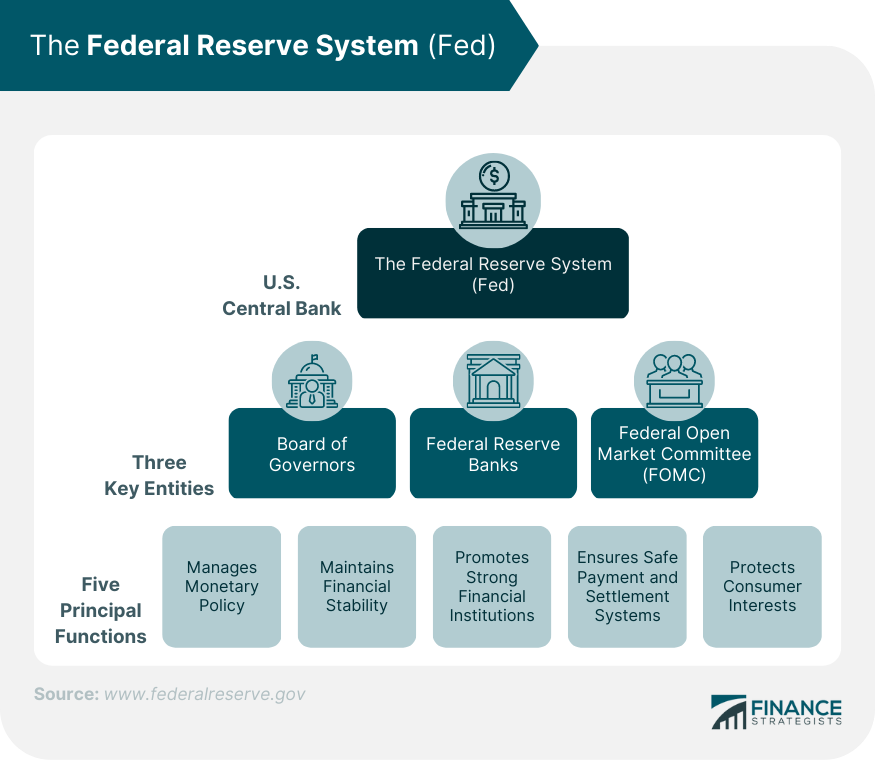

The CBCA is acutely aware of the challenges and has initiated several measures to address the situation.

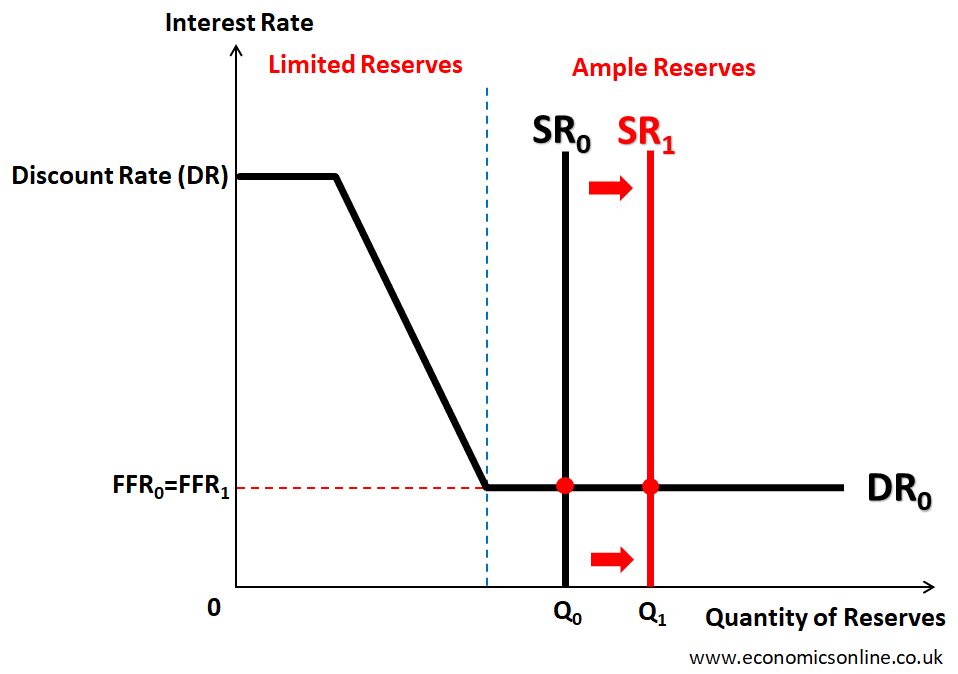

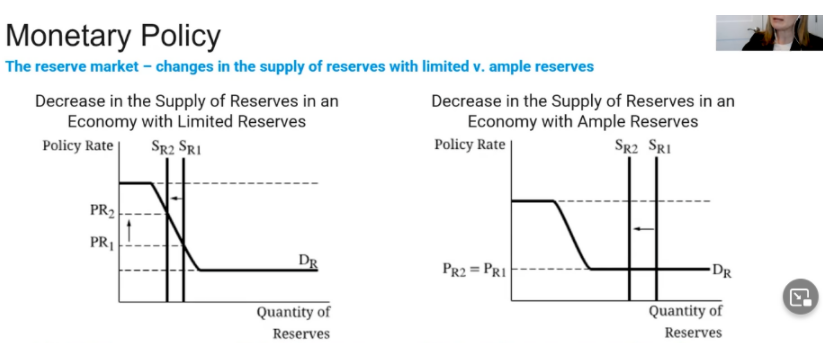

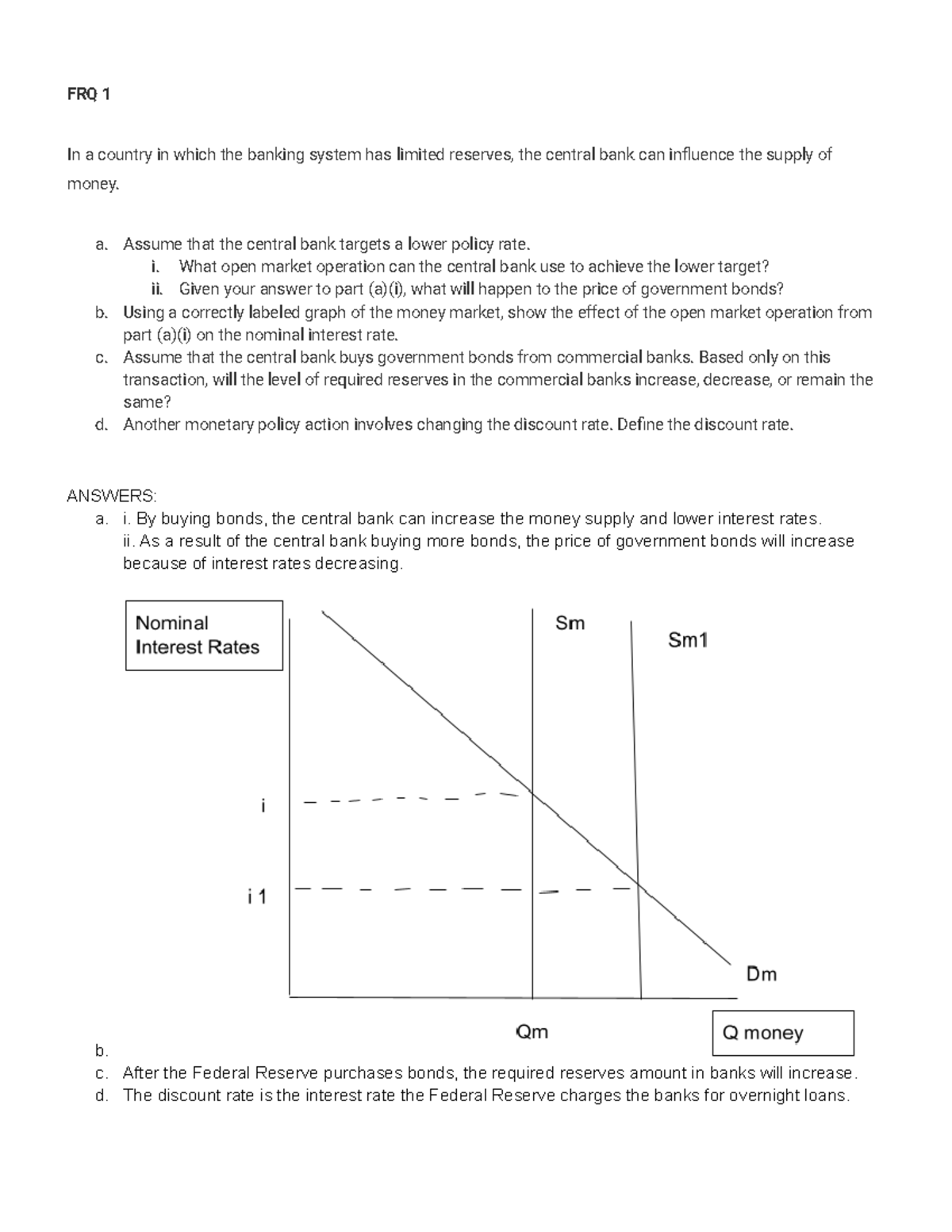

One key strategy is to increase the reserve requirements for banks. By mandating that banks hold a larger percentage of their deposits in reserve, the CBCA aims to bolster the system's overall resilience. However, this measure could also further restrict lending and potentially slow economic growth.

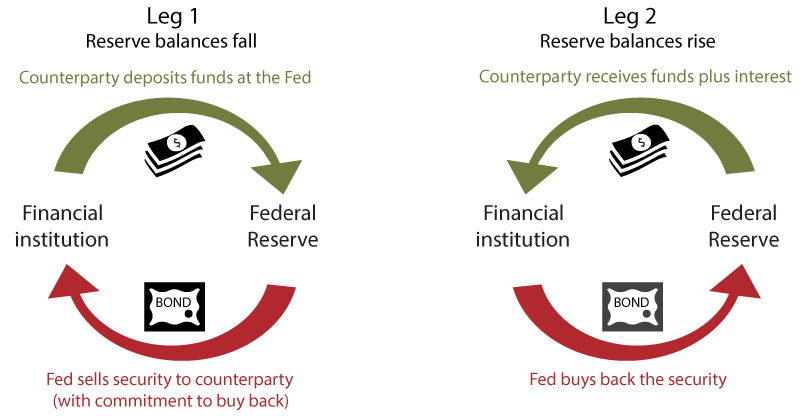

The CBCA is also exploring options to provide liquidity support to struggling banks. This could involve offering emergency loans or purchasing assets from banks to inject capital into the system.

Another critical component of the CBCA's strategy is to improve the monitoring and supervision of the banking sector. This includes conducting more frequent stress tests to assess the banks' ability to withstand potential economic shocks and strengthening regulatory oversight to prevent excessive risk-taking.

The government of Country A is also considering fiscal measures to support the banking sector. This could involve injecting capital directly into banks or providing guarantees to encourage lending.

Finance Minister David Lee stated that "the government is committed to ensuring the stability of the banking system and will take all necessary steps to protect depositors and maintain economic growth."

Alternative Perspectives

While the CBCA and the government are working to address the issue, some critics argue that their measures are insufficient. Dr. Elena Rodriguez, a financial analyst with a leading investment firm, believes that the CBCA needs to be more aggressive in its approach.

She advocates for a more comprehensive restructuring of the banking sector, including potential mergers and acquisitions to consolidate weaker banks and create stronger, more resilient institutions. She argued "Only bold reforms that can restructure the banking sector can restore confidence in its long-term health."

Other critics suggest that the root cause of the problem lies in the government's overly optimistic economic policies and its failure to adequately regulate the financial sector. These critics argue that a more cautious and responsible approach to economic management is needed to prevent similar crises in the future.

Looking Ahead

The situation in Country A's banking system remains precarious, and the coming months will be critical in determining whether the CBCA and the government's efforts will be successful in restoring stability and confidence. The effectiveness of the implemented measures will depend on various factors, including the overall health of the global economy, the stability of the A-Dollar, and the government's ability to implement sound economic policies.

Addressing the limited reserves issue requires a multi-pronged approach that combines prudent monetary policy, strong regulatory oversight, and responsible fiscal management. While challenges remain, the commitment to protect the banking system from collapse remains clear.

Failure to address this challenge effectively could have severe consequences for Country A's economy, potentially triggering a prolonged recession and eroding public trust in the financial system. The stakes are high, and the world will be watching closely to see how Country A navigates this difficult period.