3 4 Schedule 80 Steel Pipe

A seemingly mundane component, 3 and 4 inch Schedule 80 steel pipe, is quietly experiencing heightened scrutiny across industries. Supply chain disruptions, escalating material costs, and evolving regulatory landscapes are converging to create a volatile market for this essential industrial commodity. The implications are far-reaching, impacting everything from construction timelines to the operational budgets of major infrastructure projects.

This article delves into the complexities surrounding 3 and 4 inch Schedule 80 steel pipe, providing a comprehensive overview of current market dynamics, key influencing factors, and potential future trends. We will explore the perspectives of manufacturers, distributors, and end-users, shedding light on the challenges and opportunities that lie ahead. Understanding these nuances is crucial for informed decision-making and strategic planning in an increasingly uncertain economic environment.

Market Overview

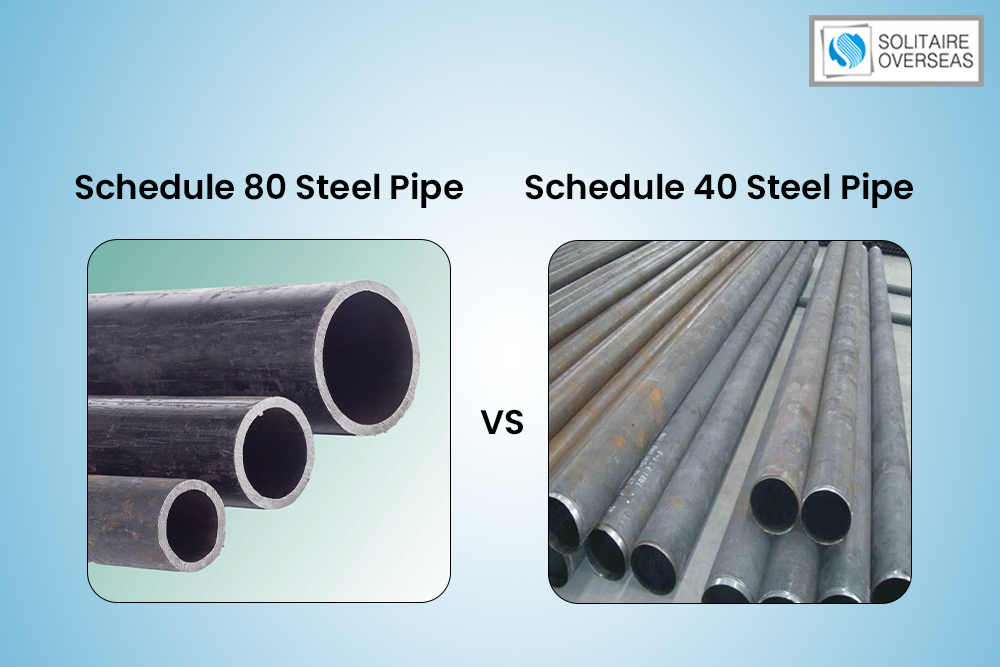

The demand for 3 and 4 inch Schedule 80 steel pipe is primarily driven by the construction, manufacturing, and oil and gas sectors. These pipes are favored for their superior strength and corrosion resistance, making them suitable for high-pressure and high-temperature applications.

Market Research Future, in a recent report, projects a steady growth rate for the steel pipe market overall, but also highlights significant regional variations and fluctuating demand patterns. These fluctuations are influenced by infrastructure investments, regulatory changes, and global economic conditions.

Supply Chain Disruptions

Global supply chains continue to grapple with persistent disruptions, impacting the availability and lead times for steel pipe. The COVID-19 pandemic initially triggered widespread factory shutdowns and transportation bottlenecks, creating a backlog that is still being addressed.

Furthermore, geopolitical tensions and trade disputes have added another layer of complexity, potentially affecting the sourcing of raw materials and finished products. Steel tariffs imposed by various countries have also contributed to price volatility and uncertainty.

"Lead times for certain sizes and grades of steel pipe have increased significantly," explains John Miller, a purchasing manager at a large construction firm. "We're seeing delays of several weeks, sometimes even months, which can throw off project schedules and increase overall costs."

Escalating Material Costs

The price of steel, a primary raw material for pipe manufacturing, has experienced substantial increases in recent years. Factors contributing to this upward trend include rising iron ore prices, increased energy costs, and heightened demand from China and other emerging economies.

According to data from the SteelBenchmarker, a leading steel price index, hot-rolled coil (HRC) prices, a key indicator for steel pipe costs, have fluctuated dramatically. This volatility makes it difficult for manufacturers to accurately forecast production costs and maintain competitive pricing.

"We've had to implement surcharges on our products to account for the rising cost of raw materials," says Sarah Johnson, a spokesperson for a major steel pipe manufacturer. "It's a challenging situation for everyone in the industry."

Regulatory Landscape

Stringent regulatory standards govern the production, transportation, and installation of steel pipe, particularly in environmentally sensitive industries. These regulations are designed to ensure safety, prevent pollution, and maintain the integrity of infrastructure.

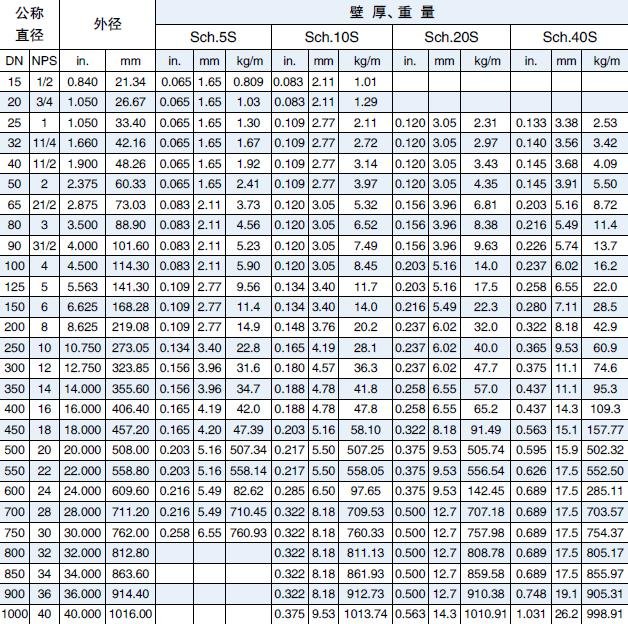

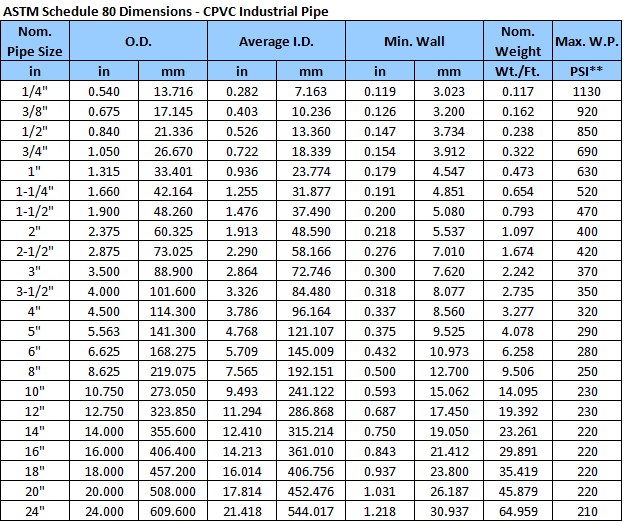

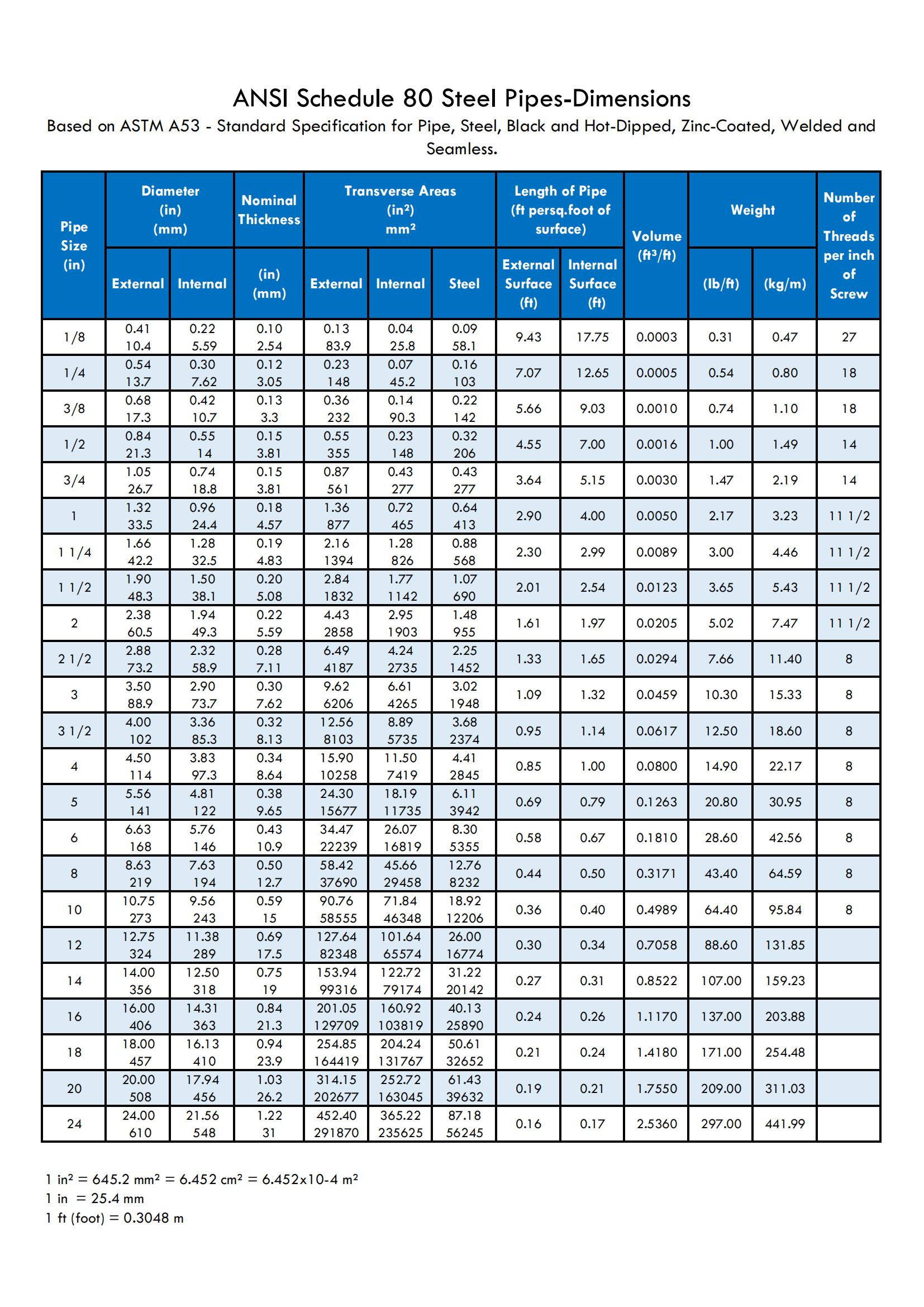

The American Society for Testing and Materials (ASTM) sets industry-recognized standards for steel pipe, including specifications for dimensions, material properties, and testing procedures. Compliance with these standards is essential for ensuring the quality and reliability of the pipe.

Furthermore, environmental regulations pertaining to the use of steel and its impact on carbon emissions are becoming increasingly stringent. Manufacturers are under pressure to adopt more sustainable production practices and reduce their environmental footprint.

Perspectives and Impact

The challenges facing the 3 and 4 inch Schedule 80 steel pipe market are impacting various stakeholders across the value chain. Manufacturers are grappling with rising costs and supply chain disruptions, while distributors are struggling to maintain adequate inventory levels.

End-users, such as construction companies and oil and gas operators, are facing increased project costs and potential delays. Smaller businesses, in particular, may find it difficult to absorb these additional expenses, potentially impacting their profitability and competitiveness.

However, some companies are adapting to the changing market dynamics by exploring alternative sourcing strategies, investing in technology to improve efficiency, and adopting more collaborative approaches to supply chain management.

"We're actively seeking partnerships with suppliers to secure long-term supply agreements and mitigate the impact of price volatility," says David Lee, an engineering manager at an energy company.

Future Trends

Looking ahead, several key trends are likely to shape the future of the 3 and 4 inch Schedule 80 steel pipe market. Increased investment in infrastructure projects, particularly in developing countries, is expected to drive demand.

The adoption of advanced manufacturing technologies, such as automation and digital twins, could improve production efficiency and reduce costs. Furthermore, the development of new materials and coatings could enhance the performance and lifespan of steel pipe.

Sustainability will also play an increasingly important role, with growing emphasis on the use of recycled steel and the development of more environmentally friendly production processes. The move towards a circular economy is likely to influence the entire steel industry.

Conclusion

The 3 and 4 inch Schedule 80 steel pipe market is facing a confluence of challenges, including supply chain disruptions, escalating material costs, and evolving regulatory landscapes. Navigating these complexities requires a proactive and strategic approach.

Companies that can adapt to the changing market dynamics, embrace innovation, and prioritize sustainability are best positioned to succeed. By fostering collaboration across the value chain and investing in long-term solutions, the industry can overcome these challenges and ensure a reliable supply of this essential industrial commodity.

Ultimately, the future of the 3 and 4 inch Schedule 80 steel pipe market depends on the ability of stakeholders to work together to address the challenges and capitalize on the opportunities that lie ahead.