43 Questions To Ask When Buying A Business

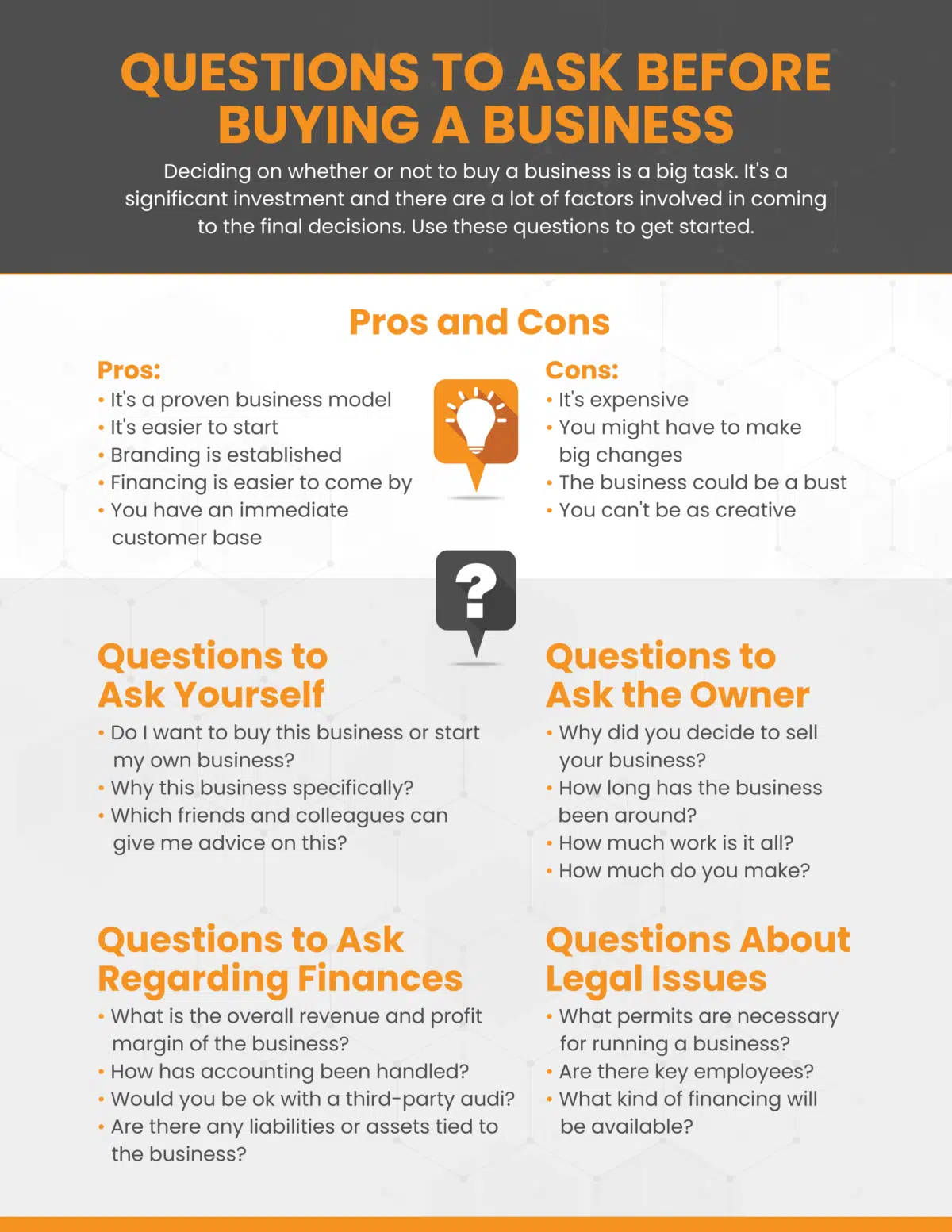

Thinking of buying a business? Don't jump in without asking the right questions; your financial future depends on it.

Due diligence is paramount; inadequate preparation can lead to devastating financial consequences. This article outlines 43 critical questions to ask before signing on the dotted line, ensuring you're equipped to make an informed decision.

Financial Performance & Records

Revenue and Profitability

What are the historical revenue trends for the past 3-5 years? What is the gross profit margin and net profit margin for the same period?

Obtain detailed profit and loss statements to verify these figures.

Cash Flow

What is the average monthly cash flow? How consistent is the cash flow?

Review bank statements and cash flow projections.

Assets and Liabilities

What are the business's current assets and liabilities? Obtain a detailed balance sheet.

Are there any outstanding loans, liens, or legal claims?

Financial Projections

What are the projected revenues and expenses for the next 3-5 years? What assumptions are these projections based on?

Carefully scrutinize the assumptions and supporting data.

Tax Returns

Obtain copies of the business's tax returns for the past 3-5 years.

This will provide further verification of financial performance.

Operational Aspects

Customer Base

What is the size and composition of the customer base? What is the customer retention rate?

Understand who the business's customers are and how loyal they are.

Supplier Relationships

Who are the key suppliers? What are the terms of the supplier agreements?

Assess the stability and reliability of the supply chain.

Employees

How many employees does the business have? What are their salaries and benefits?

Understand the employee structure, roles, and associated costs.

Operations

How are the business's day-to-day operations managed? What systems and processes are in place?

Evaluate the efficiency and effectiveness of the operational structure.

Inventory

What is the current value of the inventory? How is inventory managed?

A physical inventory count is essential for proper valuation.

Legal & Regulatory Compliance

Licenses and Permits

What licenses and permits are required to operate the business? Are all licenses and permits current and in good standing?

Contracts

What contracts are in place with customers, suppliers, or other parties? What are the terms and conditions of these contracts?

Review all contracts carefully for potential liabilities.

Legal Issues

Are there any pending lawsuits or legal claims against the business? Has the business been involved in any legal disputes in the past?

Environmental Compliance

Is the business in compliance with all environmental regulations? Are there any potential environmental liabilities?

Intellectual Property

Does the business own any trademarks, patents, or copyrights? Are these intellectual property rights properly protected?

Market & Competition

Market Size and Trends

What is the size of the market in which the business operates? What are the current market trends?

Understand the broader market context.

Competition

Who are the main competitors? What are their strengths and weaknesses?

Analyze the competitive landscape.

Market Share

What is the business's market share? How has the market share changed over time?

Purchase Agreement & Transition

Purchase Price

How was the purchase price determined? Is the price justified based on the business's financial performance and assets?

Get an independent valuation.

Terms of Sale

What are the terms of the sale? What are the payment terms and closing date?

Due Diligence Period

How long is the due diligence period? What information will be provided during due diligence?

Ensure adequate time for thorough investigation.

Transition Plan

What is the seller's plan for transitioning the business to the new owner? Will the seller be available to provide support after the sale?

Non-Compete Agreement

Will the seller sign a non-compete agreement? What are the terms of the non-compete agreement?

Protect your investment.

This list is not exhaustive but covers essential areas. Consult with legal and financial professionals to ensure a thorough due diligence process. Thorough due diligence is non-negotiable; act now to protect your investment and secure your future. Ignoring these questions could lead to financial ruin.

+(1).png?format=1500w)