A Bear Market Condition Is Associated With

Stocks are reeling as a confluence of factors push markets closer to, or deeper into, bear market territory, signaling potential economic headwinds.

The sharp decline, defined as a 20% or more drop from recent highs, is associated with a cocktail of concerns: rising inflation, aggressive interest rate hikes by the Federal Reserve, geopolitical instability stemming from the war in Ukraine, and lingering supply chain disruptions.

Understanding the Bear Market

A bear market signifies a prolonged period of declining stock prices, typically triggered by investor pessimism and economic uncertainty. This pessimistic outlook is now fueled by tangible economic data and significant global events.

The S&P 500, a benchmark for the overall market performance, has fallen over 20% from its peak in early January 2022. This meets the widely accepted definition of a bear market. The Nasdaq Composite, more heavily weighted towards technology stocks, had already entered bear market territory earlier in the year.

Key Factors Driving the Decline

Inflation remains a primary concern. The Consumer Price Index (CPI) reading for [Insert most recent CPI data and date] showed that inflation remains stubbornly high, exceeding expectations. This forces the Federal Reserve to maintain its hawkish stance on interest rates.

The Federal Reserve's aggressive interest rate hikes aim to curb inflation by reducing demand. However, these hikes also increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings.

The war in Ukraine continues to disrupt global supply chains, exacerbating inflationary pressures and creating further uncertainty. Sanctions against Russia, a major energy producer, have contributed to rising energy prices worldwide.

Supply chain bottlenecks, initially triggered by the COVID-19 pandemic, persist. These disruptions are causing shortages of goods and pushing prices higher, further contributing to inflationary pressures.

Impact on Investors

The bear market is impacting investors across the board. Retirement accounts, investment portfolios, and even individual stock holdings are experiencing significant losses.

Volatility has increased substantially, making it difficult for investors to predict market movements. This heightened volatility can lead to panic selling and further downward pressure on stock prices.

Many investors are re-evaluating their investment strategies, seeking safer assets such as bonds or cash. However, even these options are not immune to the effects of inflation.

Historical Context

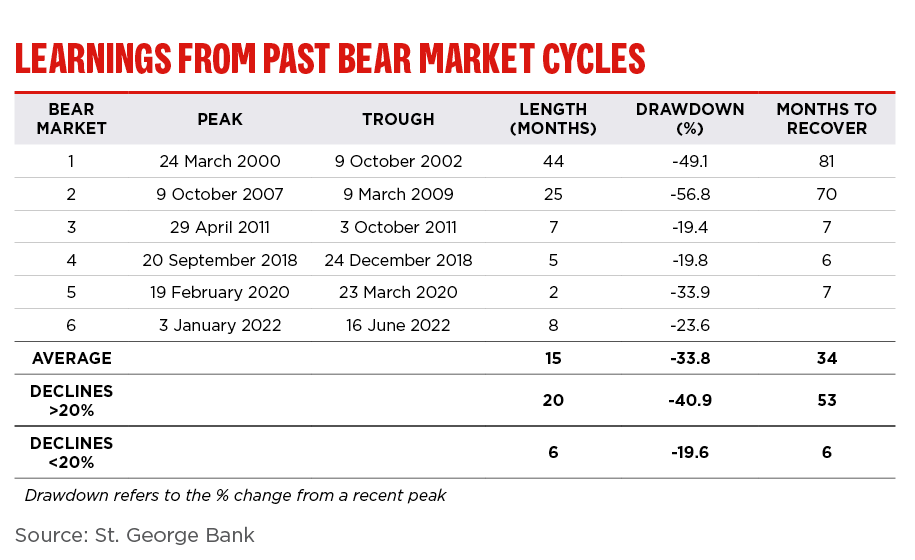

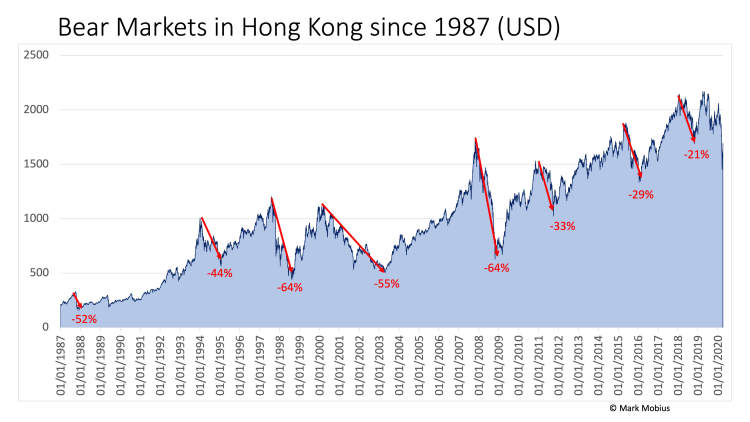

Bear markets are a normal part of the economic cycle. Historically, they have been followed by periods of recovery and growth. However, the duration and severity of each bear market vary.

The last major bear market occurred during the 2008 financial crisis. The S&P 500 declined by nearly 50% during that period. It took several years for the market to fully recover.

Other notable bear markets include the dot-com bubble burst in the early 2000s and the oil price shock of the 1970s.

Expert Opinions

"We are in a period of significant uncertainty," said [Name and Title of Financial Analyst] at [Name of Financial Institution]. "Investors should remain cautious and avoid making rash decisions."

Another expert, [Name and Title of Financial Analyst] at [Name of Financial Institution], stated: "While the bear market is concerning, it also presents opportunities for long-term investors to buy quality stocks at discounted prices."

However, caution is advised, as the bottom may not yet be in sight, and further declines are possible.

What's Next?

The Federal Reserve is expected to continue raising interest rates in the coming months to combat inflation. The pace and magnitude of these rate hikes will significantly impact the market's direction.

Geopolitical developments, particularly the war in Ukraine, will continue to influence global markets. Any escalation of the conflict could further exacerbate inflationary pressures and economic uncertainty.

Investors should closely monitor economic data, corporate earnings reports, and geopolitical events to make informed decisions. Consulting with a financial advisor is recommended.

This bear market highlights the inherent risks of investing and underscores the importance of a well-diversified portfolio and a long-term investment strategy. Stay informed and remain vigilant.