Plains All American Pipeline Investor Relations

Imagine a bustling town hall, not unlike those of yesteryear, but instead of farmers discussing crop yields, the room is filled with analysts, fund managers, and individual investors, all leaning forward, keen to hear the latest insights from a company that quite literally fuels much of modern life: Plains All American Pipeline.

This scene, perhaps repeated virtually or in person across the country, underscores the vital role of investor relations (IR) in bridging the gap between a major energy infrastructure company and the individuals and institutions that entrust it with their capital.

This article explores how Plains All American Pipeline navigates the complex landscape of investor relations, balancing the need for transparency, financial communication, and building long-term shareholder value in an ever-evolving energy market.

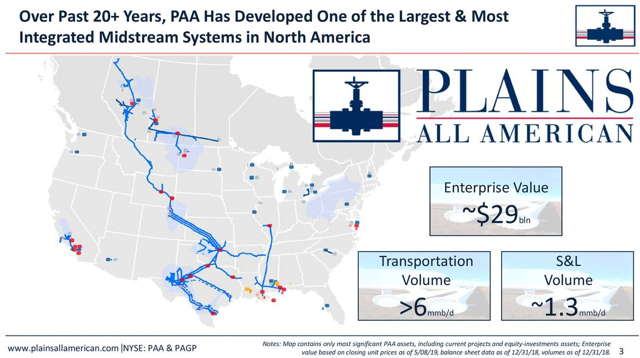

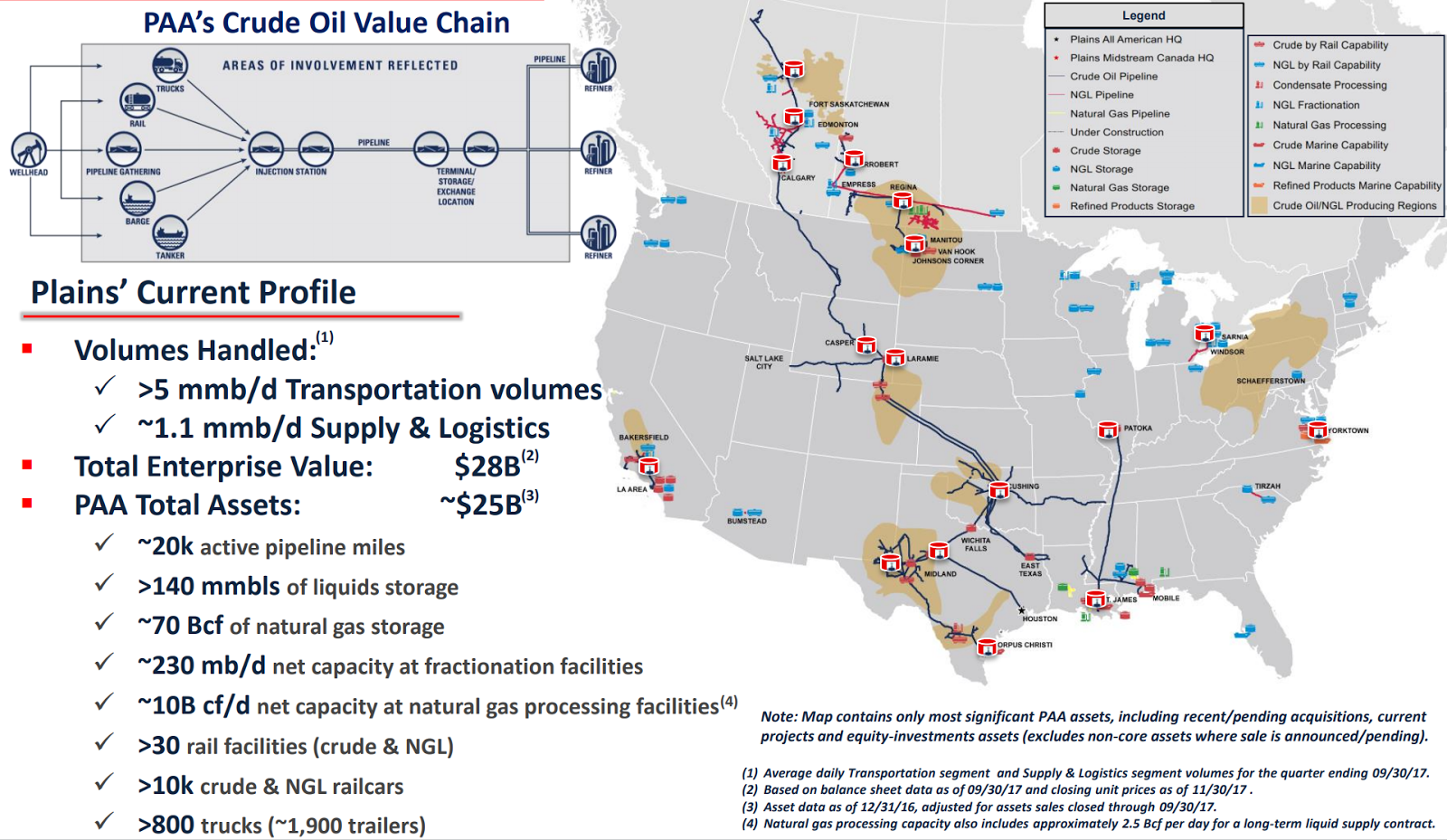

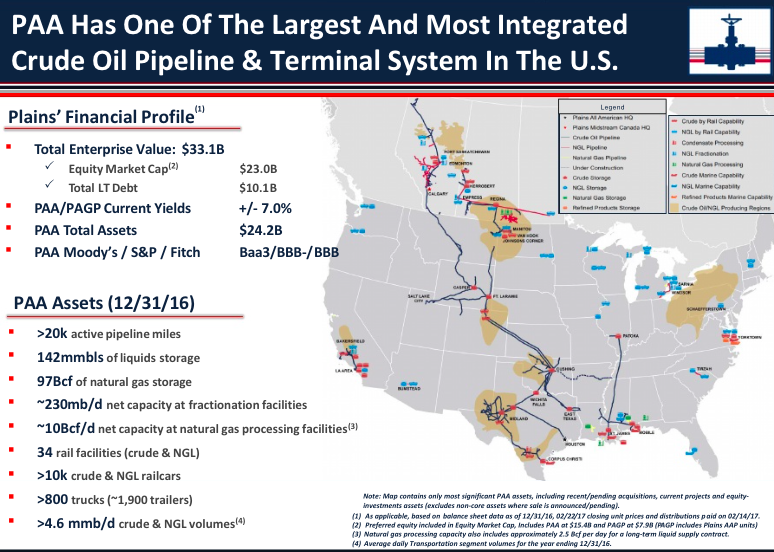

Plains All American Pipeline, L.P. (PAA) is one of the largest midstream energy infrastructure providers in North America.

The company specializes in the transportation, storage, processing, and marketing of crude oil and natural gas liquids (NGLs).

Its vast network of pipelines and terminals crisscrosses the continent, playing a crucial role in connecting producers with refineries and ultimately, consumers.

The Foundation: Transparency and Communication

Effective investor relations hinges on transparency and consistent communication.

PAA understands that investors need a clear and accurate picture of the company's performance, strategy, and outlook to make informed decisions.

This commitment is evident in the comprehensive information provided on its investor relations website.

The website serves as a central hub for investors, offering access to financial reports, SEC filings, investor presentations, and earnings call transcripts.

PAA also proactively engages with investors through various channels, including quarterly earnings calls, investor conferences, and one-on-one meetings.

These interactions provide opportunities for investors to ask questions, gain deeper insights into the company's operations, and assess management's vision for the future.

The quarterly earnings calls are particularly important events, with senior management providing a detailed review of the company's financial performance and operational highlights.

Analysts and investors closely scrutinize these calls for clues about future performance and potential challenges.

Management also uses these opportunities to articulate the company's strategic priorities, such as capital allocation, debt management, and growth initiatives.

Navigating the Energy Transition

The energy industry is undergoing a significant transformation, driven by growing concerns about climate change and the increasing demand for renewable energy sources.

For midstream companies like PAA, navigating this transition requires careful planning, strategic investments, and proactive communication with investors.

PAA recognizes the importance of adapting to the changing energy landscape and has taken steps to integrate sustainability into its business strategy.

This includes investing in technologies that reduce emissions, improving operational efficiency, and exploring opportunities in emerging energy sectors.

PAA also understands the importance of communicating its sustainability efforts to investors.

The company publishes an annual sustainability report that details its environmental, social, and governance (ESG) performance.

This report provides investors with a comprehensive overview of the company's commitment to responsible operations and its progress in addressing environmental and social challenges.

ESG Considerations

Environmental, Social, and Governance (ESG) factors have become increasingly important to investors.

Companies are now being evaluated not only on their financial performance but also on their impact on the environment, their social responsibility, and the quality of their corporate governance.

PAA has responded to this trend by enhancing its ESG disclosures and integrating ESG considerations into its decision-making processes.

This includes setting targets for reducing greenhouse gas emissions, promoting diversity and inclusion in the workplace, and strengthening its corporate governance practices.

By addressing ESG concerns, PAA aims to attract and retain investors who are committed to responsible investing.

Building Long-Term Shareholder Value

Ultimately, the goal of investor relations is to build long-term shareholder value.

PAA seeks to achieve this by delivering consistent financial performance, managing its capital effectively, and maintaining a strong balance sheet.

The company's focus on operational excellence and cost control has helped it to generate strong cash flow, which it uses to invest in growth projects, reduce debt, and return capital to shareholders through dividends.

Willie Chiang, Chairman and CEO of Plains All American, has emphasized the importance of disciplined capital allocation and a commitment to financial strength.

PAA's investor relations team plays a crucial role in communicating this message to investors and ensuring that they understand the company's value proposition.

"Our financial strength and flexibility, combined with our strategic asset footprint, position us well to execute on our long-term growth objectives," said Chiang during a recent earnings call.

PAA's commitment to shareholder returns is also evident in its dividend policy.

The company has a long history of paying dividends to its unitholders and has consistently increased its dividend payout over time, demonstrating its confidence in its ability to generate sustainable cash flow.

Challenges and Opportunities

While PAA has a strong track record of investor relations, the company faces several challenges in the current environment.

These include volatile energy prices, regulatory uncertainty, and increasing competition from other midstream companies.

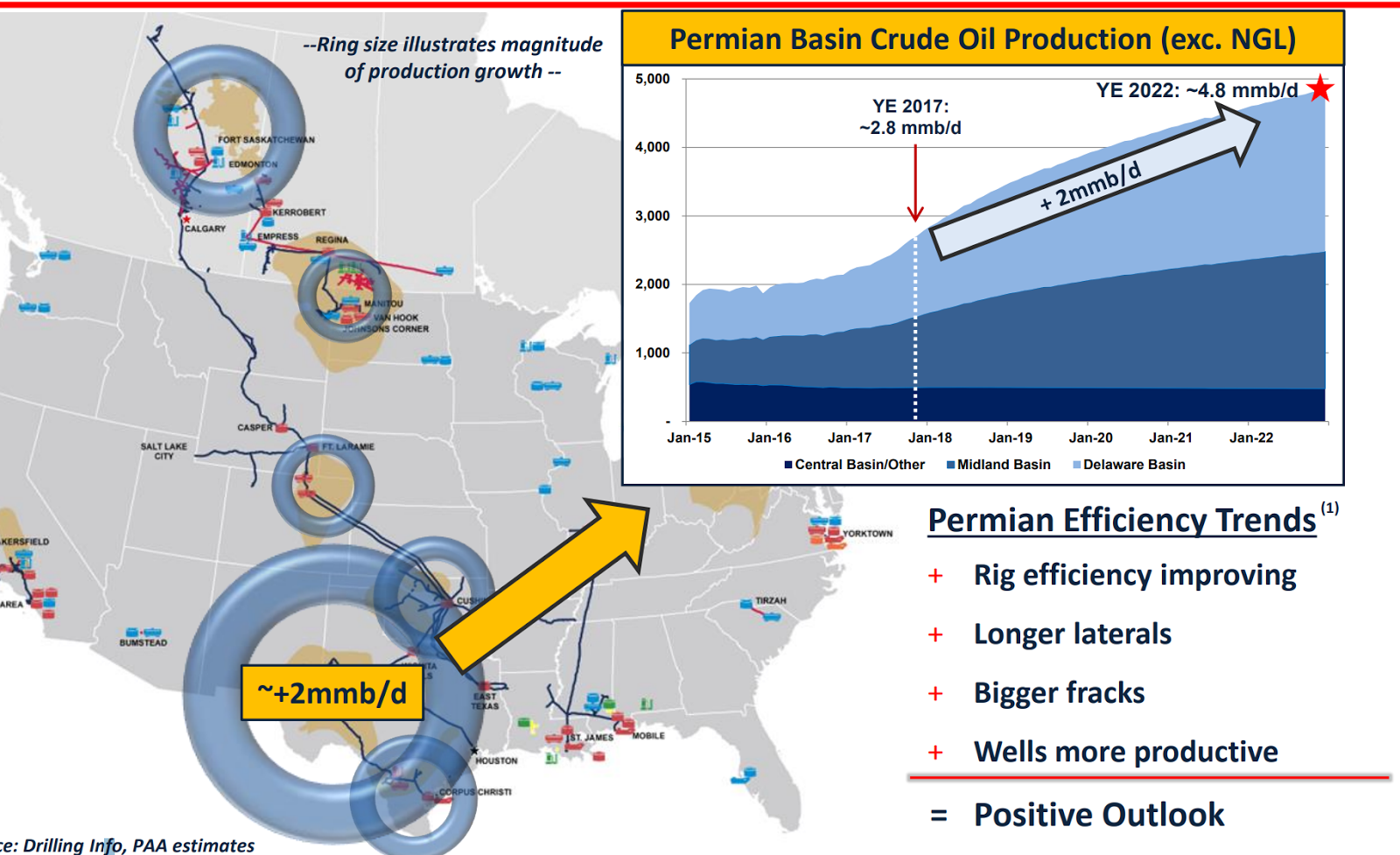

Despite these challenges, PAA also has significant opportunities to grow its business and create value for its shareholders.

These opportunities include expanding its pipeline network, investing in new technologies, and capitalizing on the growing demand for energy infrastructure.

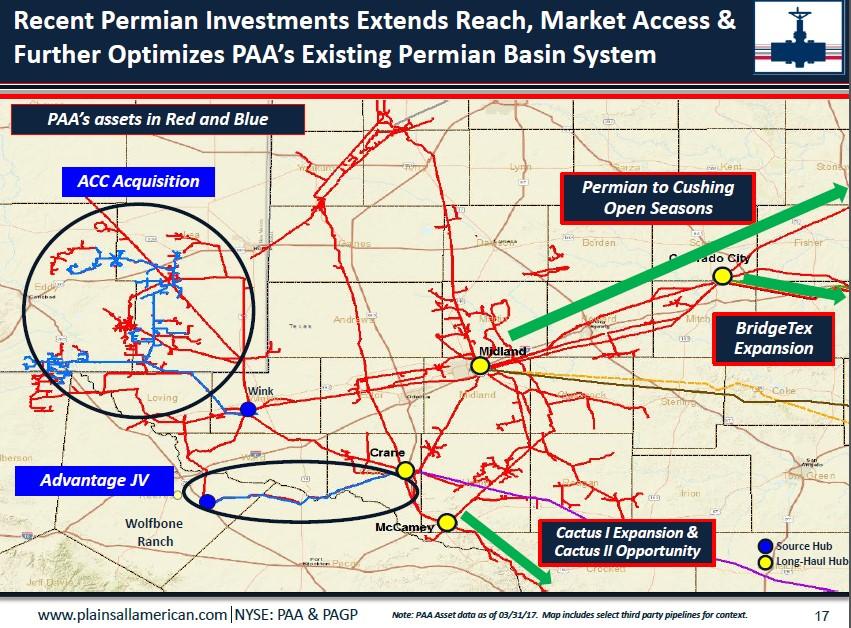

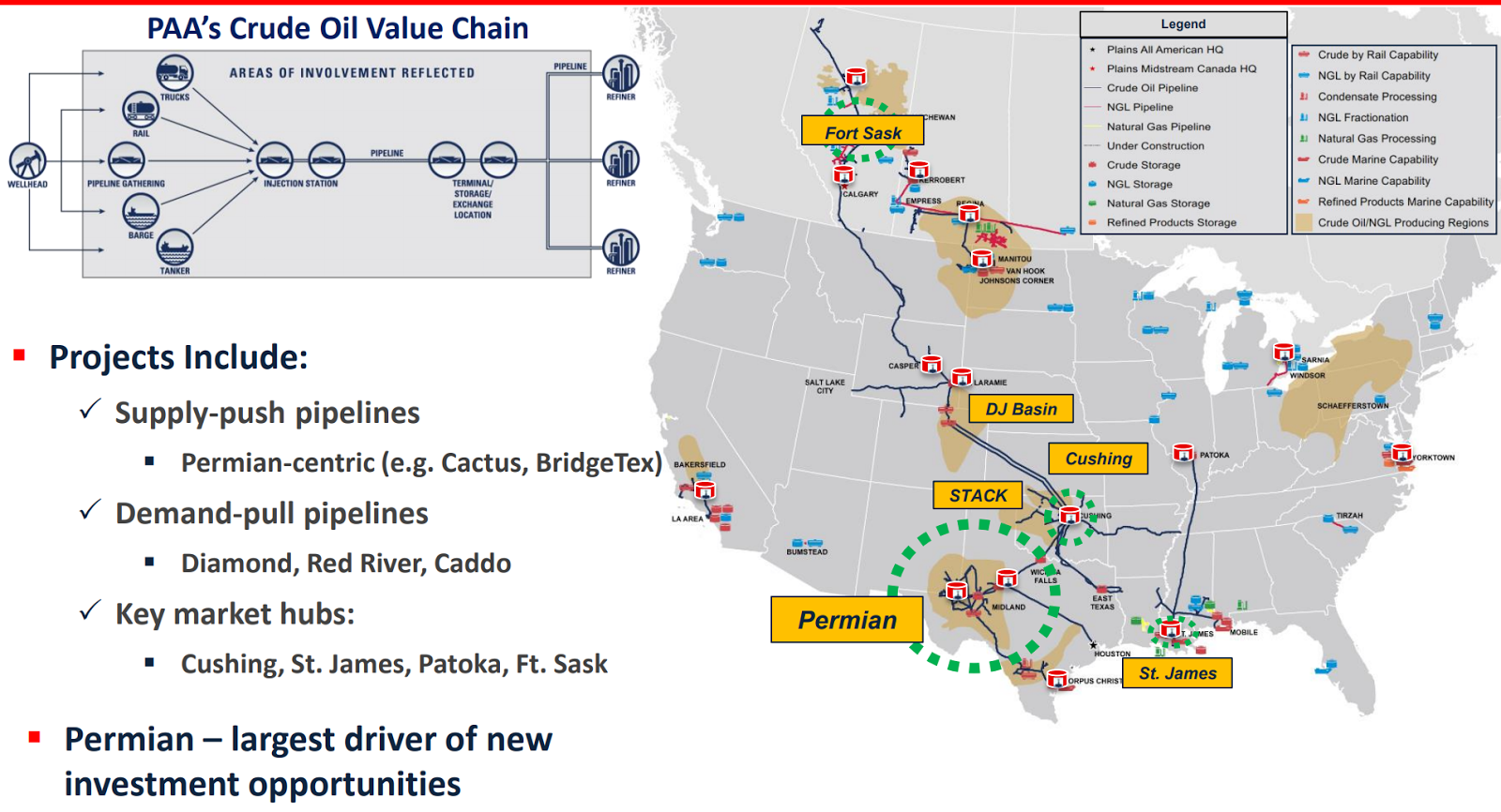

The Permian Basin, for example, remains a key growth area for PAA, with increasing production driving demand for transportation and storage capacity.

By effectively managing its risks and capitalizing on its opportunities, PAA can continue to deliver strong financial performance and create long-term value for its shareholders.

The Human Element

Beyond the financial reports and investor presentations, it's important to remember the human element of investor relations.

At its core, IR is about building relationships and fostering trust between a company and its investors.

PAA's investor relations team works diligently to provide timely and accurate information, answer investor questions, and address any concerns.

They are the face of the company to the investment community, and their professionalism and integrity are essential to maintaining investor confidence.

By building strong relationships with investors, PAA can create a loyal shareholder base that is more likely to support the company through thick and thin.

This is particularly important in the volatile energy industry, where investor sentiment can change quickly in response to market conditions.

Looking Ahead

As the energy industry continues to evolve, PAA's investor relations strategy will need to adapt to meet the changing needs of investors.

This includes enhancing its ESG disclosures, communicating its sustainability efforts more effectively, and engaging with investors on emerging issues such as climate change and energy transition.

By staying ahead of the curve and proactively addressing investor concerns, PAA can maintain its position as a leader in the midstream energy sector and continue to create value for its shareholders.

The company's commitment to transparency, communication, and long-term value creation will be essential to its success in the years to come.

In the ever-shifting landscape of energy, where pipelines form the veins and arteries of our modern world, PAA’s story serves as a reminder that open communication and unwavering commitment to shareholders are just as crucial as the steel and ingenuity that underpin their vast network.