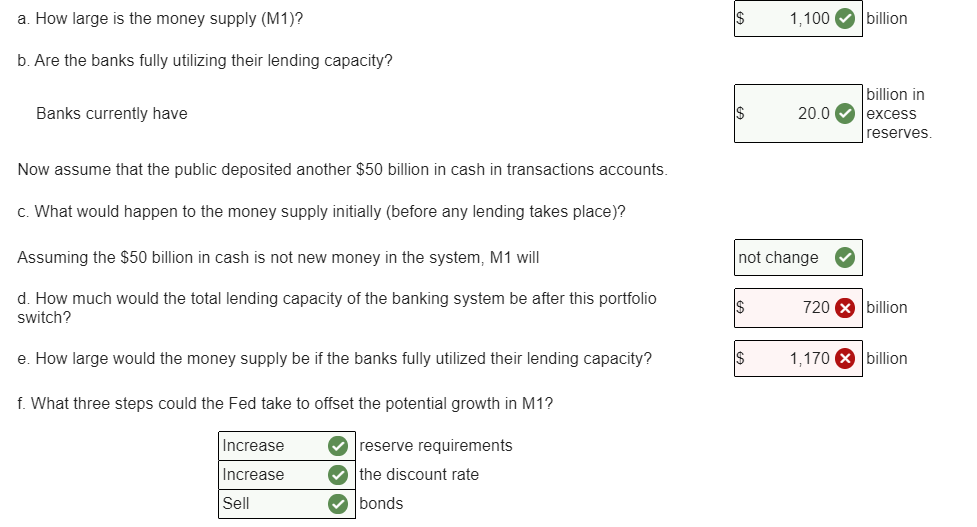

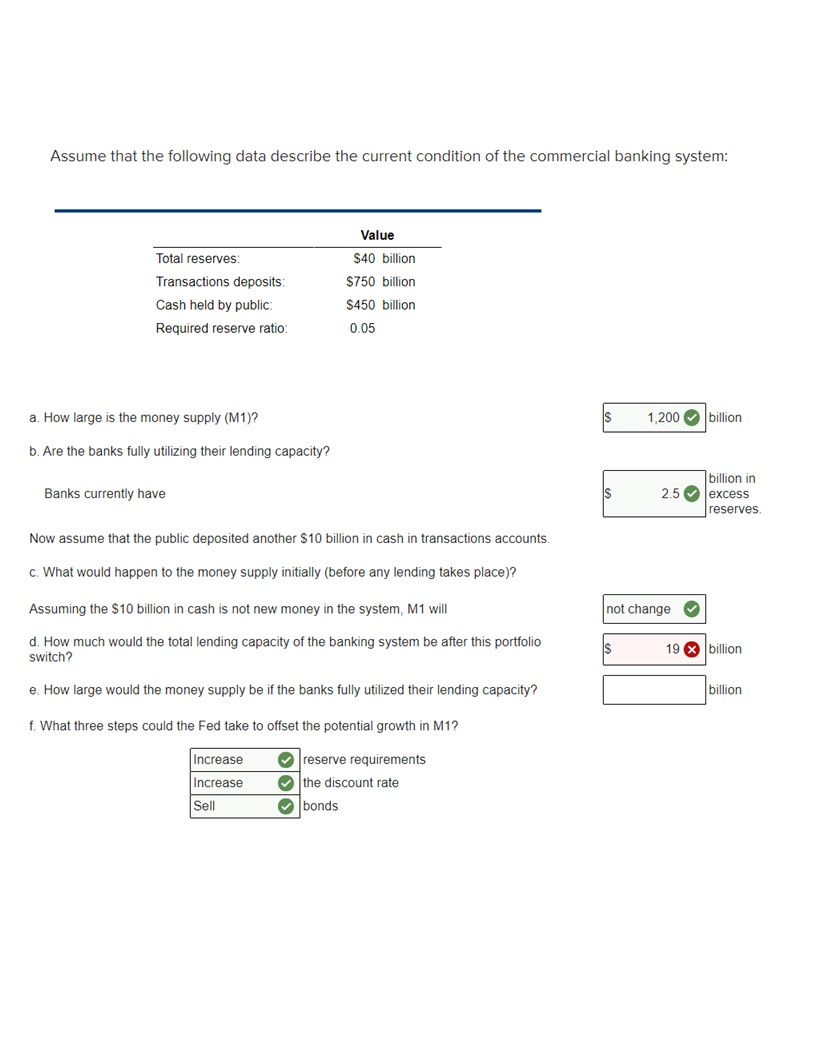

A Commercial Bank Is Facing The Conditions Given Above

A chilling wind is sweeping through the hallowed halls of First National Trust Bank (FNTB). Once a titan of the financial landscape, the bank now finds itself teetering on the precipice of instability, facing a confluence of challenges that threaten its very existence. Whispers of potential government intervention and a possible takeover are growing louder, casting a long shadow over the institution and its stakeholders.

FNTB is grappling with a perfect storm of rising interest rates, a deteriorating loan portfolio, increased regulatory scrutiny, and a rapidly shifting technological landscape. The confluence of these factors has eroded investor confidence, sending the bank's stock plummeting and raising serious questions about its long-term viability. Understanding the gravity of FNTB's situation requires a deep dive into each of these contributing factors, the bank's response, and the potential ramifications for the wider economy.

The Interest Rate Quagmire

The Federal Reserve's aggressive interest rate hikes, designed to combat inflation, have significantly impacted FNTB's bottom line. These hikes have increased the cost of borrowing, leading to a slowdown in loan origination and putting pressure on existing borrowers to meet their obligations. This, in turn, has contributed to the deterioration of FNTB's loan portfolio, a major source of concern for investors and regulators alike.

According to a recent report from the Federal Deposit Insurance Corporation (FDIC), banks with a high concentration of adjustable-rate mortgages are particularly vulnerable in a rising interest rate environment. FNTB, unfortunately, falls squarely into this category. The bank's heavy reliance on adjustable-rate mortgages has left it exposed to the vagaries of interest rate fluctuations, exacerbating its current financial woes.

Loan Portfolio Deterioration

The rising interest rates, coupled with a broader economic slowdown, have taken a toll on FNTB's loan portfolio. Delinquency rates have been steadily climbing across various sectors, including commercial real estate, personal loans, and auto loans. This has forced the bank to increase its loan loss reserves, further impacting its profitability.

Analysts at Moody's Investors Service have downgraded FNTB's credit rating, citing concerns about the quality of its loan portfolio and its ability to withstand further economic shocks. The downgrade has made it more expensive for FNTB to borrow money, further squeezing its already strained financial resources.

Regulatory Scrutiny Intensifies

In the wake of recent bank failures, regulators are paying closer attention to the health and stability of financial institutions. FNTB is now under intense scrutiny from the Office of the Comptroller of the Currency (OCC), which is examining the bank's risk management practices, capital adequacy, and overall financial condition.

A leaked internal memo suggests that the OCC has identified several deficiencies in FNTB's risk management framework, including inadequate oversight of its loan portfolio and a lack of preparedness for rising interest rates. The OCC is reportedly considering imposing stricter capital requirements on FNTB, which would further limit its ability to lend money and grow its business.

The Digital Disruption Dilemma

The rise of fintech companies and digital banking platforms has created a new competitive landscape for traditional banks like FNTB. These nimble competitors are offering innovative financial products and services that are often more convenient and user-friendly than those offered by traditional banks.

FNTB has been slow to adapt to the digital age, lagging behind its competitors in terms of technology investment and innovation. This has resulted in a loss of market share and a decline in customer loyalty. The bank's outdated technology infrastructure also makes it more vulnerable to cyberattacks, posing a significant risk to its operations and reputation.

FNTB's Response and Potential Outcomes

In an attempt to address its challenges, FNTB has announced a series of cost-cutting measures, including branch closures and layoffs. The bank is also exploring strategic alternatives, such as selling off non-core assets and seeking a potential merger partner. However, these efforts may not be enough to turn the tide.

"We are taking decisive action to strengthen our financial position and navigate this challenging environment," said FNTB CEO, John Anderson, in a recent statement. "We remain committed to serving our customers and ensuring the long-term stability of our institution."

Several potential outcomes are possible for FNTB. One possibility is that the bank will be acquired by a larger, more stable financial institution. Another possibility is that the government will step in to provide financial assistance, as it has done in past crises. The worst-case scenario is that FNTB will be unable to overcome its challenges and will be forced to close its doors.

Wider Economic Implications

The failure of FNTB would have significant ramifications for the wider economy. It could trigger a chain reaction of bank failures, leading to a credit crunch and a sharp economic downturn. It could also erode public confidence in the banking system, making it more difficult for banks to attract deposits and lend money.

The situation at FNTB serves as a stark reminder of the fragility of the financial system and the importance of sound risk management. Regulators and policymakers must learn from this experience and take steps to prevent similar crises from occurring in the future.

Looking Ahead

The future of FNTB remains uncertain. The bank faces a long and difficult road ahead, and its survival will depend on its ability to adapt to the changing financial landscape, strengthen its balance sheet, and regain the trust of investors and customers. Whether FNTB can successfully navigate these challenges remains to be seen.

The coming months will be crucial for FNTB. The bank's actions, and the response of regulators and the market, will determine whether it can weather the storm or become another casualty of the current economic climate. The lessons learned from FNTB's predicament will undoubtedly shape the future of the banking industry for years to come.

:max_bytes(150000):strip_icc()/COMMERCIAL-BANK-FINAL-64996d1c0c1748d5994860dd9c190045.jpg)