A Common Service Offered By Investment Companies Is

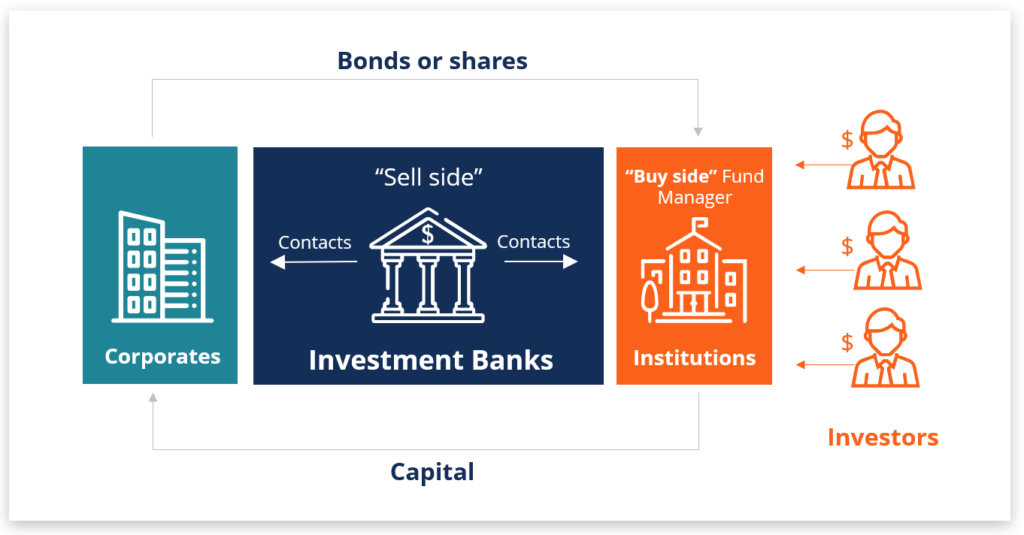

Navigating the complex world of investments can be daunting. For many, the sheer volume of options and market fluctuations present a significant hurdle. This is where financial advisors and investment companies step in, offering a range of services to guide individuals and institutions toward their financial goals.

A common service provided by these firms is portfolio management. This involves the professional handling of a client's investments, tailored to their specific needs and risk tolerance. It's a service that can significantly impact an individual's financial future and the overall health of the economy.

Understanding Portfolio Management

Portfolio management is the art and science of making decisions about investment mix and policy, matching investments to objectives, asset allocation for individuals and institutions, and balancing risk against performance. It encompasses a wide range of activities, from initial consultation and strategy development to ongoing monitoring and adjustments.

At its core, portfolio management aims to maximize returns while minimizing risk. This is achieved through diversification, asset allocation, and active or passive investment strategies.

Who Benefits from Portfolio Management?

The service isn't limited to the ultra-wealthy. Portfolio management can benefit anyone with investable assets, regardless of the amount.

Busy professionals who lack the time to actively manage their investments, individuals approaching retirement, and those simply seeking expert guidance can all find value in professional portfolio management. Even large institutional investors like pension funds and endowments rely on portfolio managers to navigate complex financial markets.

The Process: How Portfolio Management Works

The portfolio management process typically begins with a thorough assessment of the client's financial situation. This includes understanding their income, expenses, assets, liabilities, and investment goals. A risk tolerance questionnaire is often used to gauge the client's comfort level with market volatility.

Based on this information, the portfolio manager develops an investment strategy tailored to the client's specific needs. This strategy outlines the asset allocation (the proportion of investments in different asset classes like stocks, bonds, and real estate), the investment vehicles to be used (mutual funds, ETFs, individual securities), and the overall investment philosophy.

Once the strategy is implemented, the portfolio manager continuously monitors the portfolio's performance and makes adjustments as needed. Market conditions change, and the client's circumstances may also evolve, requiring modifications to the initial strategy. Rebalancing, which involves selling some assets and buying others to maintain the desired asset allocation, is a crucial aspect of ongoing portfolio management.

Regular communication is also a key component. Portfolio managers provide clients with performance reports and updates on market conditions, ensuring transparency and maintaining a strong working relationship.

Active vs. Passive Management

A critical decision within portfolio management is whether to pursue an active or passive investment strategy. Active management involves trying to outperform the market by actively selecting individual securities and timing market movements. This approach requires significant research and expertise.

Passive management, on the other hand, aims to replicate the performance of a specific market index, such as the S&P 500. This is typically achieved through index funds or exchange-traded funds (ETFs) with low expense ratios.

The choice between active and passive management depends on the client's beliefs about market efficiency and their willingness to pay higher fees for the potential of outperformance.

The Impact on Society

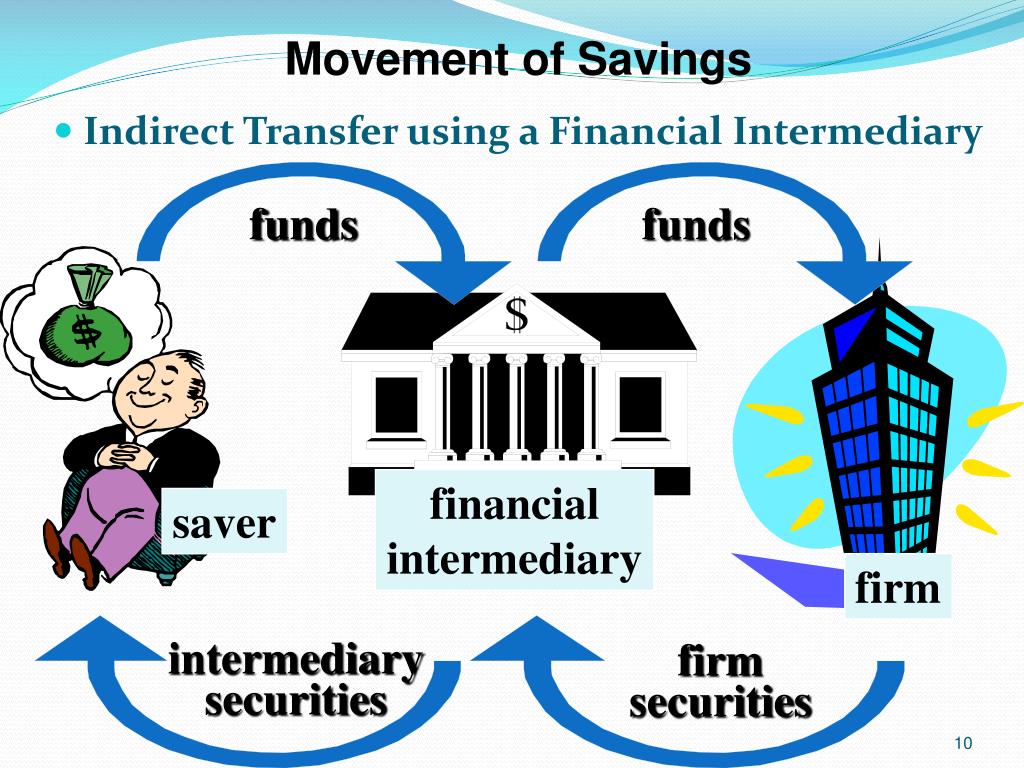

Portfolio management has a broader impact than just individual financial well-being. By directing capital to various sectors of the economy, portfolio managers play a crucial role in resource allocation and economic growth. They invest in companies, driving innovation and job creation. They also provide capital to governments, funding essential public services.

However, the industry also faces scrutiny regarding ethical considerations and potential conflicts of interest. Ensuring transparency, fair dealing, and client-centric advice is paramount to maintaining public trust and safeguarding the integrity of the financial system. The regulatory framework governing portfolio management is constantly evolving to address these concerns.

Conclusion

Portfolio management is a vital service offered by investment companies, providing individuals and institutions with expert guidance in navigating the complex world of finance. It involves tailoring investment strategies to specific needs, actively managing assets, and continuously monitoring performance.

While the potential benefits are significant, choosing the right portfolio manager and understanding the associated fees and risks are essential. By doing so, individuals can increase their chances of achieving their financial goals and building a secure future.