A Comparison Between Two Components Of Financial Information

The global financial landscape is a complex ecosystem, constantly evolving under the influence of market forces, regulatory changes, and technological advancements. Understanding its nuances is crucial for investors, policymakers, and businesses alike.

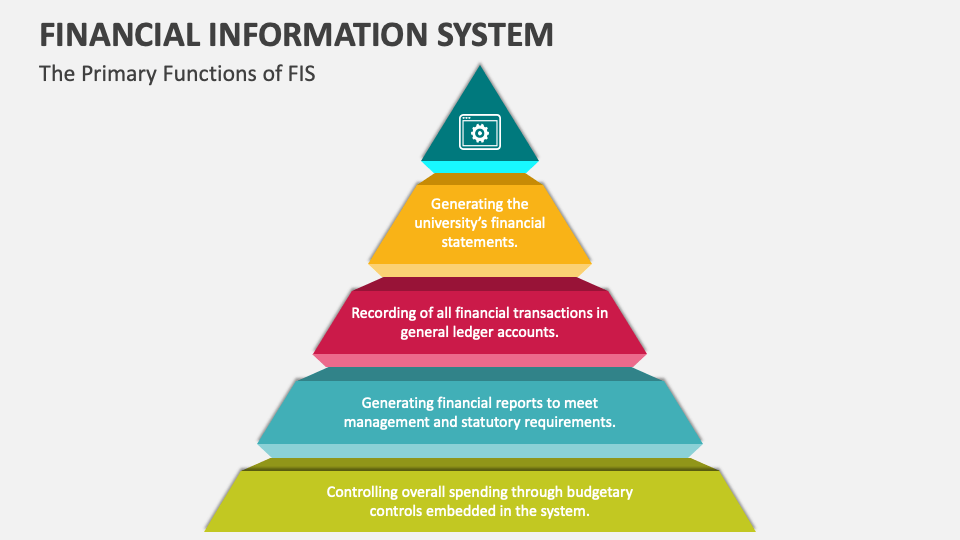

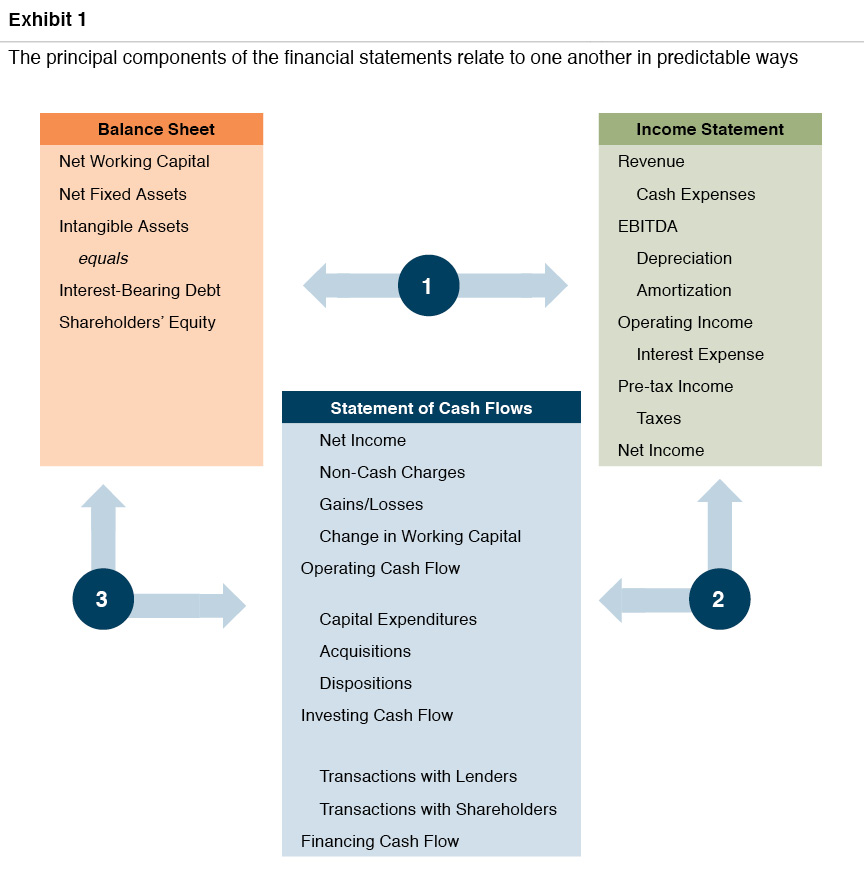

Two critical components that paint a picture of a company's financial health are the balance sheet and the income statement. While both provide valuable insights, they offer distinct perspectives and serve different purposes.

Unpacking the Financial Puzzle: Balance Sheet vs. Income Statement

This article delves into a detailed comparison between the balance sheet and the income statement, dissecting their structures, key metrics, and the unique information they convey. We will explore how these two financial statements complement each other, providing a comprehensive understanding of a company's financial performance and position.

By examining real-world examples and drawing upon expert opinions, we aim to equip readers with the knowledge needed to effectively interpret these crucial financial documents.

The Balance Sheet: A Snapshot in Time

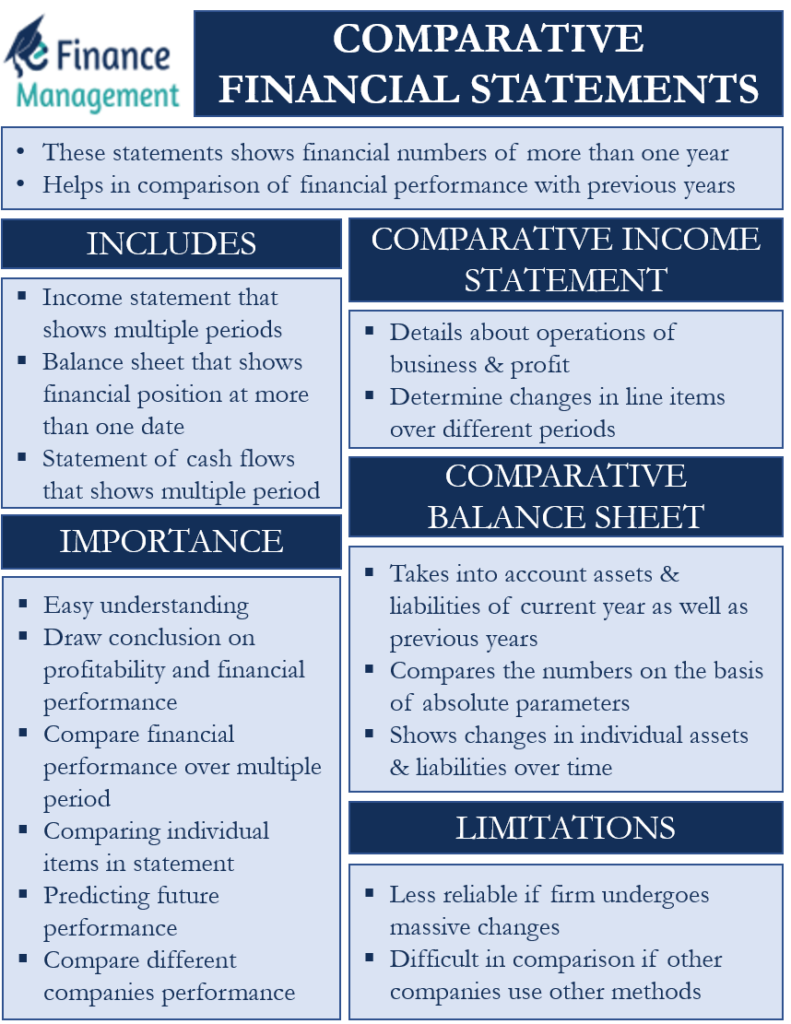

The balance sheet, often referred to as the "statement of financial position," provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It operates under the fundamental accounting equation: Assets = Liabilities + Equity.

Assets represent what a company owns, including cash, accounts receivable, inventory, and property, plant, and equipment (PP&E). Liabilities represent what a company owes to others, such as accounts payable, salaries payable, and debt.

Equity represents the owners' stake in the company, calculated as the difference between assets and liabilities. This includes retained earnings and contributed capital.

Essentially, the balance sheet answers the question: What does the company own and owe at this specific moment?

“The balance sheet is like a financial photograph, capturing a company's resources and obligations at a particular instant," explains Dr. Anya Sharma, a professor of finance at the University of Metropolitan.

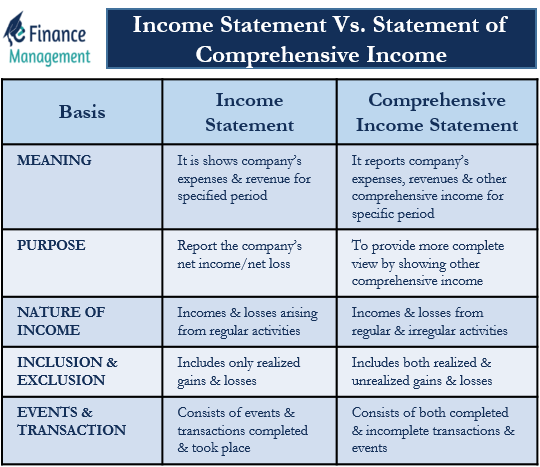

The Income Statement: A Performance Report Over Time

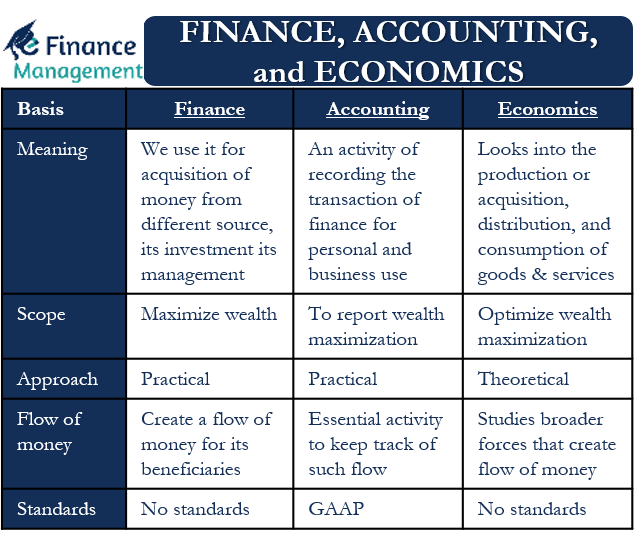

The income statement, also known as the "profit and loss statement," summarizes a company's financial performance over a specific period, such as a quarter or a year. It reports revenues, expenses, and ultimately, net income or loss.

Revenues represent the income generated from a company's primary business activities. Expenses represent the costs incurred in generating those revenues, including cost of goods sold (COGS), operating expenses, and interest expense.

Net income, the "bottom line," is calculated as revenues less expenses. It represents the company's profit or loss for the period. The income statement essentially answers the question: How profitable was the company over this period?

"The income statement tells the story of a company's profitability, tracking its revenues and expenses to determine its net income," says Mark Johnson, a senior financial analyst at Global Investments.

Key Differences and Complementary Roles

The balance sheet is a static snapshot, while the income statement is a dynamic performance report. The balance sheet focuses on a company's financial position at a specific point, while the income statement focuses on its performance over a period of time.

The balance sheet follows the accounting equation, while the income statement follows the revenue and expense recognition principles. While they are distinct, they are interconnected.

For example, net income from the income statement flows into the retained earnings section of the balance sheet. Similarly, depreciation expense from the income statement is related to the value of PP&E on the balance sheet.

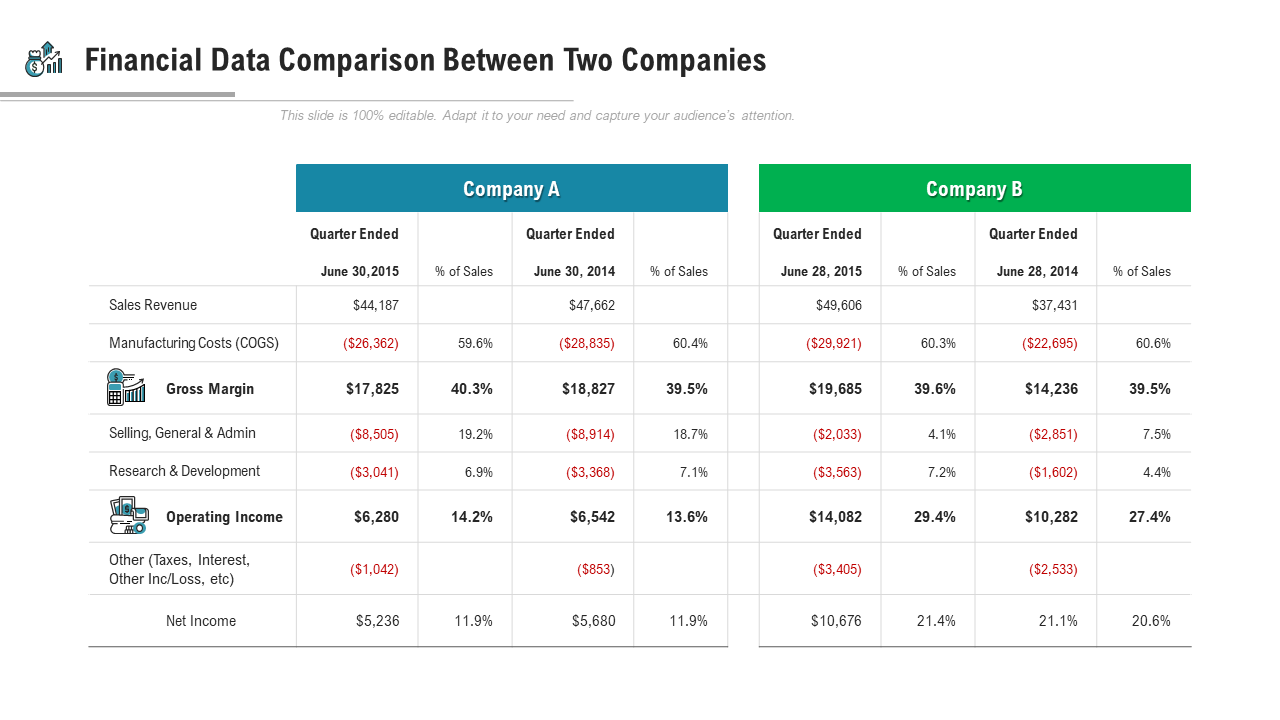

Analyzing Key Metrics: A Comparative Perspective

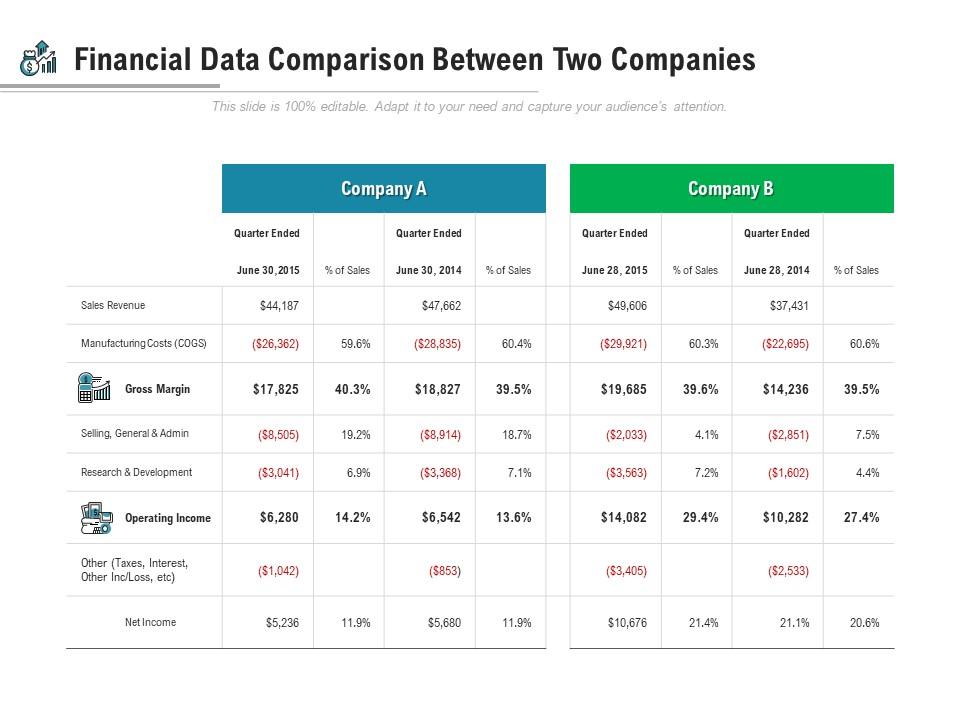

The balance sheet provides metrics such as the current ratio (current assets divided by current liabilities), which indicates a company's ability to meet its short-term obligations. It also shows the debt-to-equity ratio (total debt divided by total equity), which indicates the company's leverage.

The income statement provides metrics such as gross profit margin (gross profit divided by revenue), which indicates the profitability of a company's core operations. Also shows net profit margin (net income divided by revenue), which indicates overall profitability.

Analyzing these metrics in conjunction provides a more complete picture. A high current ratio and a healthy net profit margin suggest a financially sound and profitable company.

Real-World Example: Apple Inc.

Consider Apple Inc., a technology giant. Examining Apple's balance sheet reveals its massive cash reserves and significant investments in research and development.

Its income statement highlights its consistent revenue growth and strong profitability, driven by sales of iPhones, Macs, and other products and services. (Source: Apple's SEC filings).

Analyzing both statements together reveals a company with a strong financial position and a proven track record of profitability.

Expert Insights and Perspectives

According to Dr. Emily Carter, an accounting professor at State University, "Understanding the relationship between the balance sheet and the income statement is fundamental to financial analysis. They are two sides of the same coin."

John Davis, a certified public accountant, emphasizes the importance of analyzing trends over time. "Looking at multiple balance sheets and income statements allows you to identify patterns and assess the sustainability of a company's performance."

Looking Ahead: The Future of Financial Reporting

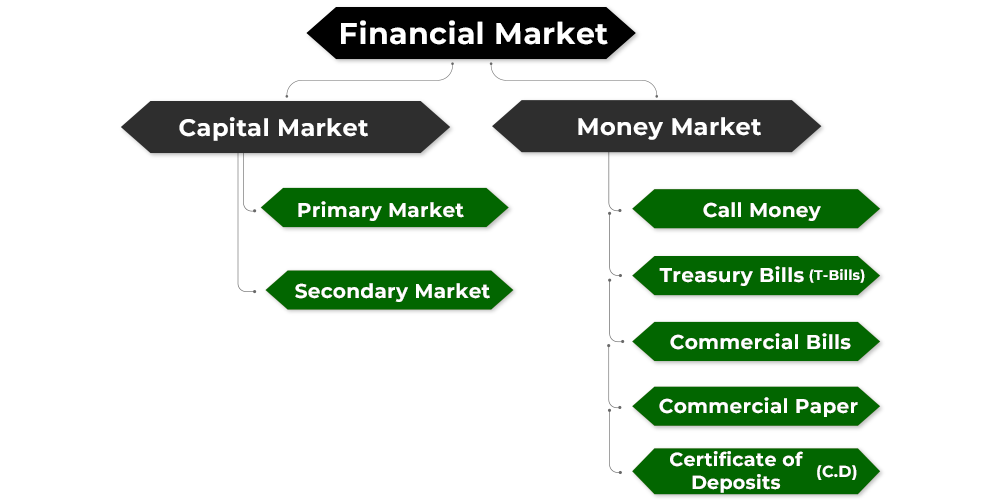

The future of financial reporting is likely to be shaped by technological advancements and increasing demands for transparency. The rise of XBRL (Extensible Business Reporting Language) is making financial data more accessible and comparable.

Integrated reporting, which combines financial and non-financial information, is gaining traction as companies seek to provide a more holistic view of their performance. Investors are increasingly demanding information about a company's environmental, social, and governance (ESG) practices.

Ultimately, understanding the fundamental principles of financial reporting, including the roles of the balance sheet and the income statement, will remain crucial for navigating the evolving financial landscape.

In conclusion, the balance sheet and the income statement are indispensable tools for understanding a company's financial health. By understanding their distinct purposes and complementary roles, stakeholders can make more informed decisions and navigate the complexities of the financial world with greater confidence.