The Types Of Accounts Which Affect Retained Earnings Are

Retained earnings, a critical component of a company’s equity, represent the cumulative profits accumulated over time, less any dividends paid out to shareholders. Understanding the various accounts that directly influence this figure is paramount for investors, analysts, and anyone seeking to gauge a company's financial health and future prospects. This article will delve into the key accounts that impact retained earnings, offering a comprehensive overview of their roles and significance.

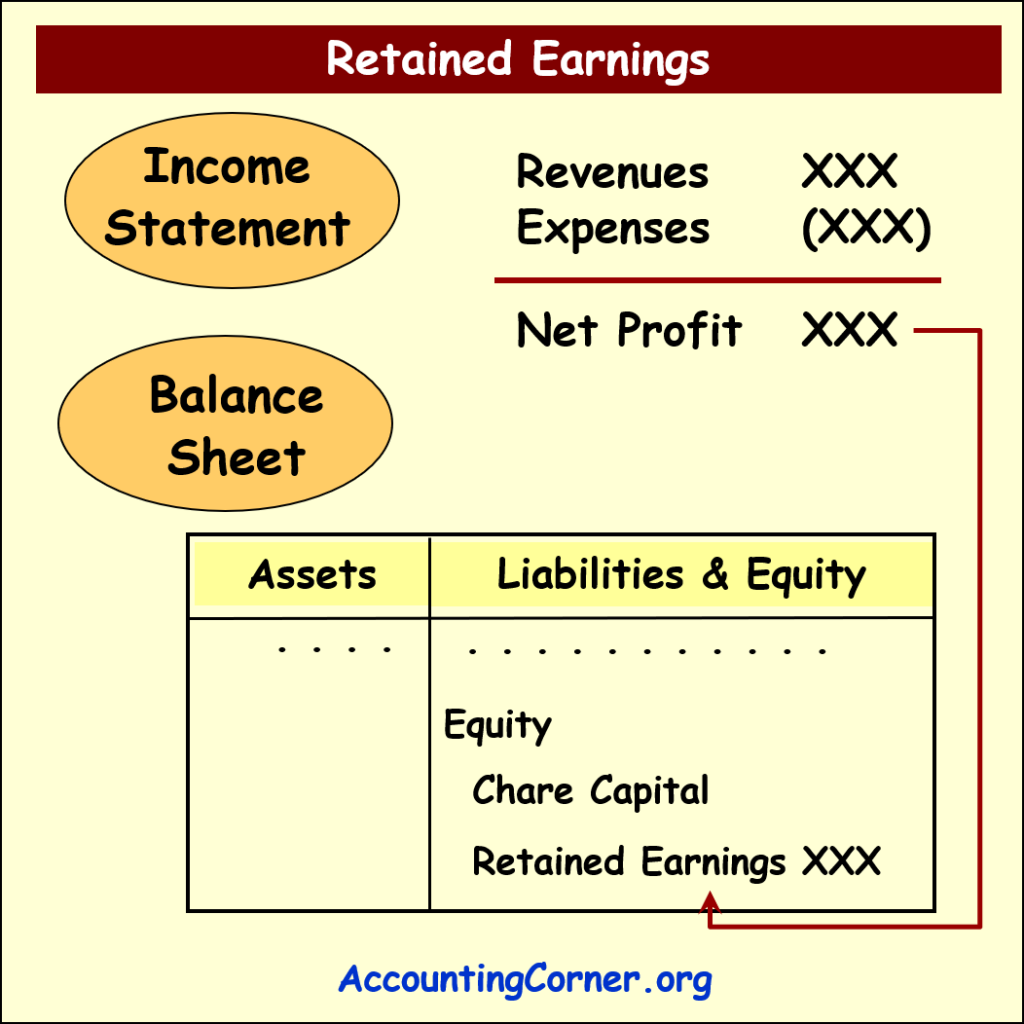

At its core, retained earnings serve as a barometer of a company's profitability and its ability to reinvest in its operations. Changes in retained earnings reflect a company's successes and setbacks in generating profits and managing its resources. These changes are influenced by a carefully managed set of financial transactions that ultimately paint a picture of the enterprise's fiscal performance.

Net Income: The Primary Driver

The most significant factor impacting retained earnings is net income. Net income, found at the bottom of the income statement, is what's left after subtracting all expenses, including the cost of goods sold, operating expenses, interest, and taxes, from total revenues.

A higher net income directly translates to a larger increase in retained earnings, signaling strong financial performance and profitability. Conversely, a net loss will decrease retained earnings, reflecting a period of financial strain.

Dividends: Distributing Profits to Shareholders

While net income adds to retained earnings, dividends represent the distribution of profits to shareholders. Dividends are cash payments or stock distributions made to investors as a return on their investment in the company.

Paying out dividends reduces the amount of earnings retained by the company, as cash or shares are being distributed instead of being reinvested. The decision on how much to distribute as dividends significantly impacts the retained earnings balance and the company's capacity to fuel future growth.

Prior Period Adjustments: Rectifying Past Errors

Prior period adjustments are corrections made to previously issued financial statements to rectify errors discovered in prior reporting periods. These adjustments directly impact the retained earnings balance, as they adjust previously reported profits or losses.

These adjustments are relatively rare but can occur due to accounting errors, such as miscalculations of depreciation or incorrect application of accounting standards. Correcting these errors ensures that the retained earnings accurately reflects the company's true financial position.

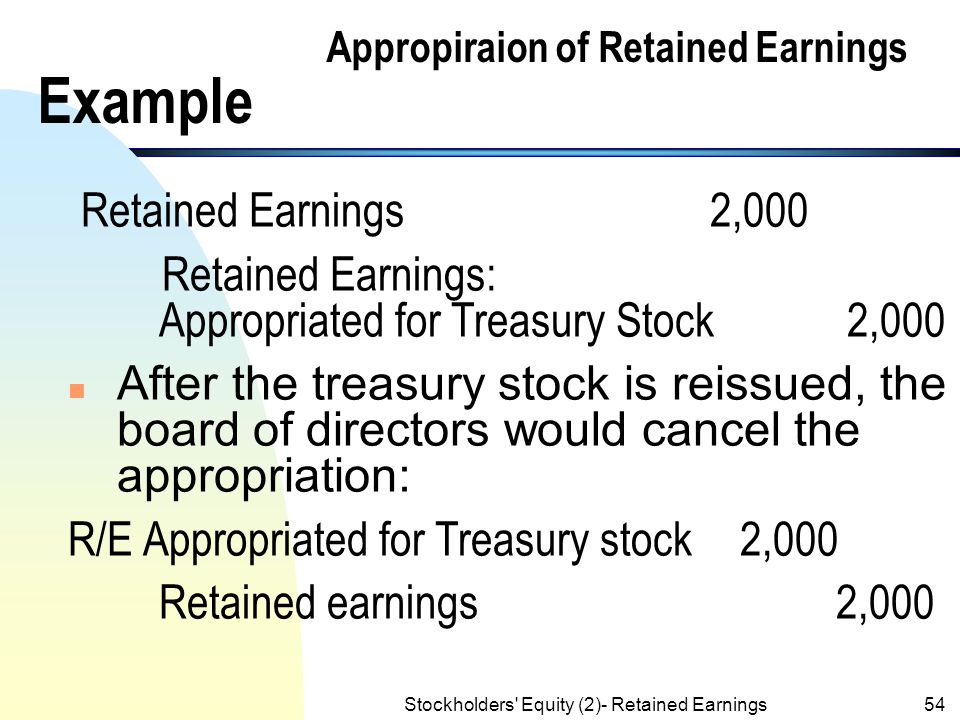

Accounting Changes: Implementing New Standards

Changes in accounting principles or accounting standards can also affect retained earnings. When a company adopts a new accounting standard, it may be required to retrospectively apply the new standard to previous periods, leading to adjustments in retained earnings.

For example, if a company adopts a new revenue recognition standard, it may need to restate its prior-period revenues, which would subsequently impact retained earnings. These changes ensure consistency and transparency in financial reporting, potentially reshaping the understanding of a company's historical performance.

Gains and Losses on Investments: Fluctuations in Value

Companies often hold investments in other entities, and the gains or losses realized from these investments can directly influence retained earnings. The accounting treatment depends on the nature of the investment and the accounting standards in place.

For example, under certain accounting standards, unrealized gains or losses on available-for-sale securities are recognized in other comprehensive income, which then flows into accumulated other comprehensive income, a component of equity that affects retained earnings indirectly over time.

Impact on Stakeholders

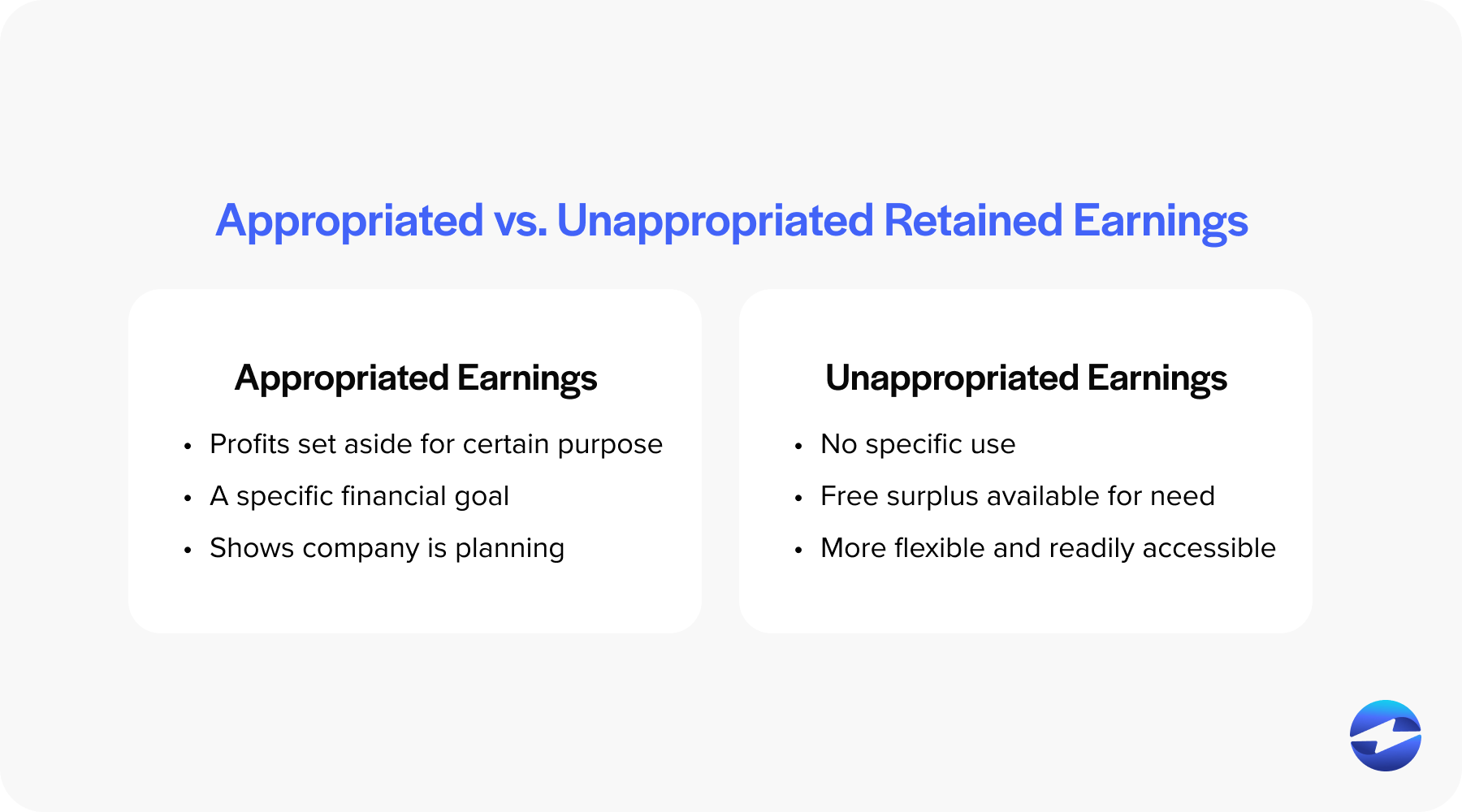

The level of retained earnings offers insights into a company’s ability to fund future projects without incurring debt or issuing new equity. High retained earnings can signal financial stability and the capacity to support growth initiatives.

Conversely, low or negative retained earnings may raise concerns about a company's financial health and its reliance on external funding. Investors often consider retained earnings when assessing a company's long-term value and its ability to generate future returns.

Real-World Implications

Consider a hypothetical technology company, TechForward Inc., which reported substantial net income due to a successful product launch. This increase in net income directly boosts TechForward's retained earnings, showcasing its profitability.

However, the company also declared a significant dividend to reward shareholders for their loyalty. This dividend payment reduces the retained earnings balance, reflecting the company's decision to share its profits. The final retained earnings figure provides a net result of the company's profitable operations offset by its dividend distribution.

Understanding the accounts that influence retained earnings provides valuable insights into a company's financial management and long-term sustainability. By monitoring these components, stakeholders can make informed decisions and gain a deeper understanding of a company's economic trajectory. This understanding empowers investors and analysts alike.

.jpg)