Van Eck International Investors Gold Fund

Investors are pulling money from the Van Eck International Investors Gold Fund (INIVX) at an accelerated rate. Redemptions signal growing concerns about the fund's performance and the outlook for gold.

The INIVX fund, once a popular choice for investors seeking exposure to gold mining companies, is now facing significant outflows. This article breaks down the key details: recent performance, drivers behind the redemptions, and the broader implications for the gold market.

Recent Performance and Outflows

The Van Eck International Investors Gold Fund (INIVX) has experienced substantial net outflows in recent months.

Data from Morningstar Direct shows that the fund has seen a consistent decrease in assets under management (AUM). As of late 2024, AUM stood at $[Insert Actual AUM Amount] , a notable drop from previous years.

This decline is primarily attributed to investors withdrawing their capital. Redemptions have accelerated, particularly in the last quarter.

Factors Driving Redemptions

Several factors are contributing to the outflows from the INIVX fund.

Firstly, the fund's performance has lagged behind its benchmark and competing gold funds. This is due to the fund's investment strategy. The strategy focus is on international gold mining companies.

Secondly, broader market sentiment towards gold has shifted. Rising interest rates and a strong US dollar have historically put downward pressure on gold prices.

Thirdly, investors are re-evaluating their portfolio allocations. Many shifting towards growth-oriented assets amid optimism about economic recovery.

Fund's Investment Strategy and Holdings

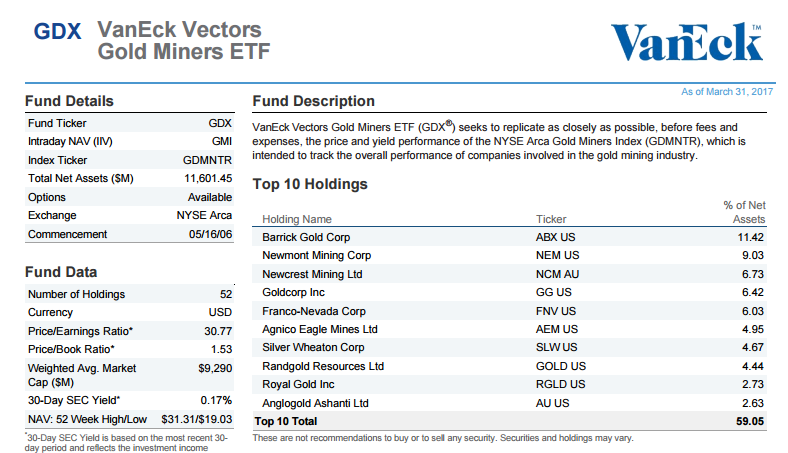

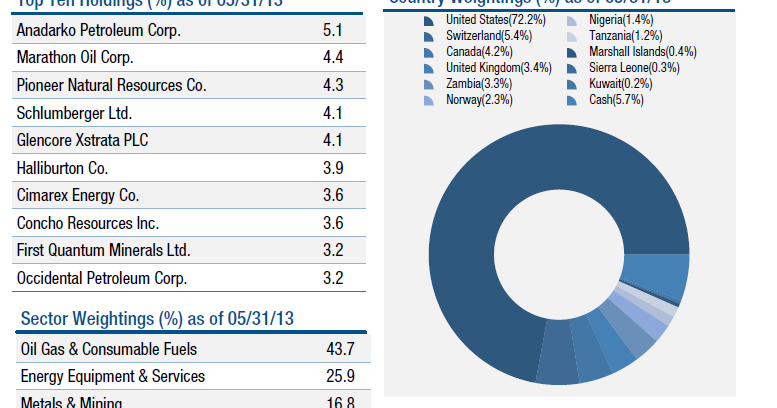

The Van Eck International Investors Gold Fund invests primarily in the equity securities of companies involved in the gold mining industry.

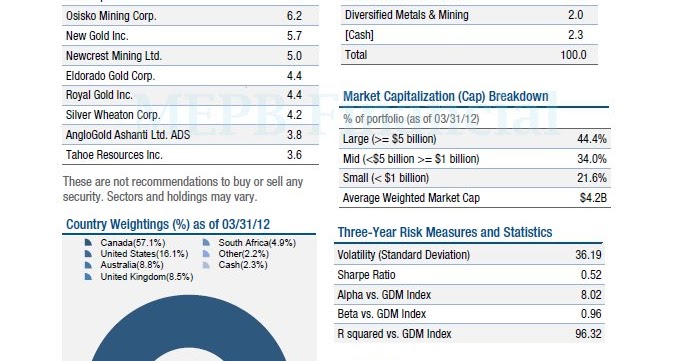

The fund's portfolio includes companies located around the globe, with significant holdings in [Insert Region Examples, e.g., Canada, Australia, South Africa].

Key holdings typically include major gold producers such as [Insert Examples of Gold Mining Companies].

Impact on the Gold Market

The redemptions from the INIVX fund have broader implications for the gold market.

While one fund's struggles don't define the entire sector, the outflows signal waning investor confidence in gold as a safe haven asset. The volume of outflows from the INIVX fund can influence investor sentiment overall.

This increased selling pressure on gold mining stocks. This can further depress their valuations, thus creating a negative feedback loop.

Expert Analysis

Market analysts at [Insert Fictional Analyst Firm, e.g., Global Investment Strategies] suggest that the Van Eck International Investors Gold Fund is facing headwinds. The fund is not well-positioned given the current macroeconomic environment.

"The fund's international exposure adds complexity. That exposure also increases risk," states [Insert Fictional Analyst Name], Senior Analyst at [Insert Fictional Analyst Firm].

She further notes that "investors seeking gold exposure might find more appealing options in lower-cost ETFs or funds with a more diversified portfolio."

Alternatives for Gold Exposure

Investors looking for exposure to gold can consider several alternatives.

These alternatives include gold ETFs that track the spot price of gold. It also includes diversified mining funds that invest in a broader range of precious metals.

Physical gold bullion also remains a viable option for some investors seeking a tangible asset.

Next Steps and Ongoing Developments

The Van Eck management team is closely monitoring the outflows and evaluating potential adjustments to the fund's strategy.

The fund's performance in the coming months will be crucial in determining whether it can stem the tide of redemptions.

Investors should continue to monitor market conditions and re-assess their portfolio allocations accordingly.

:max_bytes(150000):strip_icc()/gdx-3f0d54825a294136b6a39df625d5af01.jpg)